A $600000 annual income represents an elite salary level accessible to only the top few percent of earners.

This article will break down exactly how much $600000 annually equals on an hourly, weekly, monthly and biweekly basis. We will calculate estimated after-tax wages to understand take-home pay. Additionally, we will compare $600000 to average U.S. salaries and examine whether it is considered a good salary based on location, household size and lifestyle factors.

Table of Contents

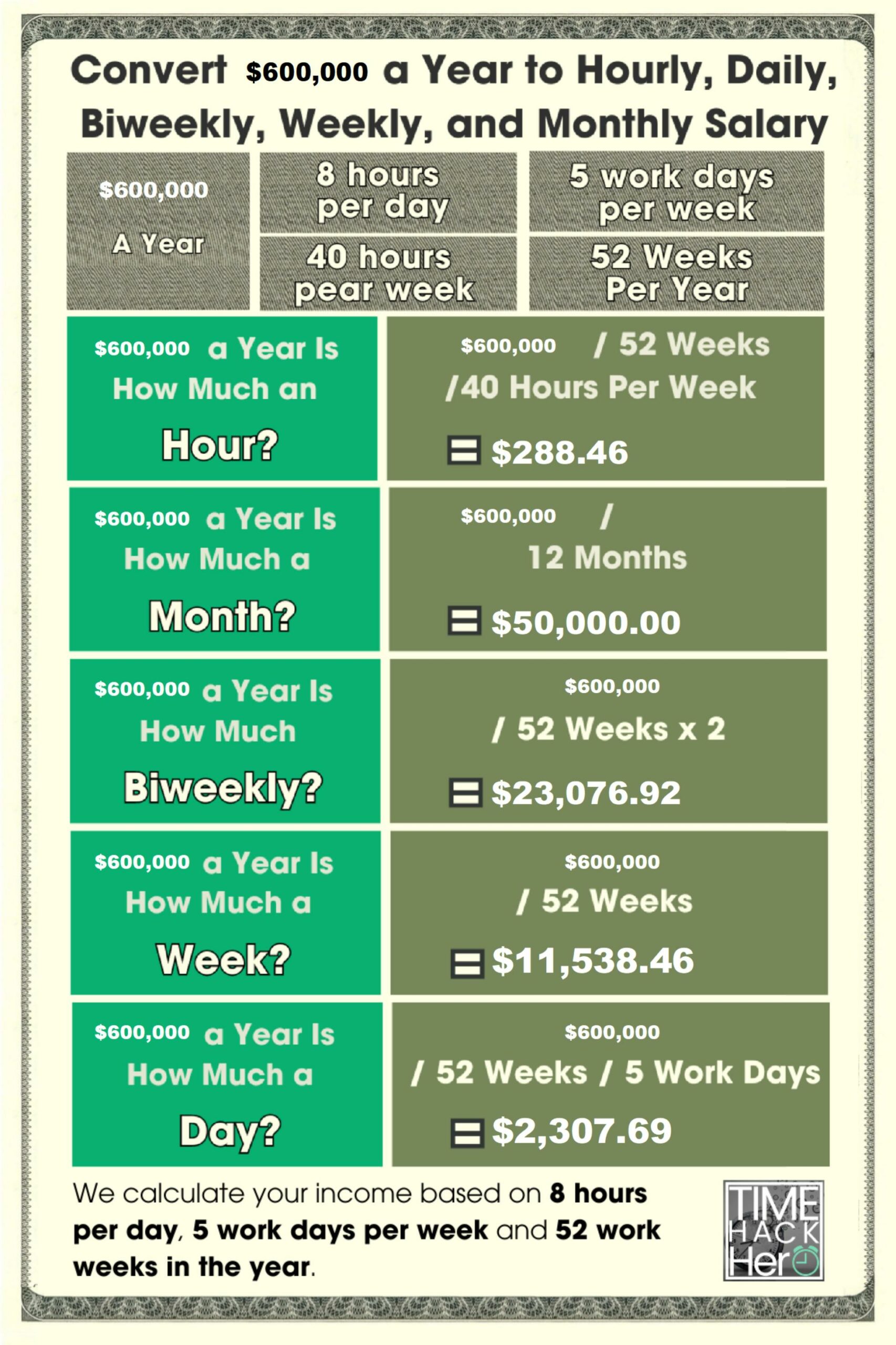

How Much is $600000 a Year Per Hour?

The most basic way to calculate your hourly rate from an annual salary is to:

- Take your annual salary – in this case, $600000

- Divide it by the typical number of working hours in a year:

Annual working hours = 52 weeks x 5 work days x 8 working hours per day = 2,080 hours

- Take your annual salary and divide it by 2,080 hours

Following this formula:

$600000 (annual salary) / 2,080 (working hours per year) = $288.46 per hour

So an annual salary of $600000 breaks down to $288.46 per hour.

This is the most straightforward way to derive an hourly wage from a known annual salary amount. However, there are some additional factors around paid time off, benefits, and hourly versus salaried pay status that can impact your exact hourly earnings.

Adjusting for Paid Time Off

The 2,080 working hour figure excludes any paid time off or holidays. Most full-time employees receive some amount of paid time off each year, which reduces the actual number of hours worked.

For example, if you receive 2 weeks (10 working days) of paid vacation annually, this is 80 hours less you have to work out of the year. Subtracting 80 hours from 2,080 yields 2,000 total hours worked.

If we adjust our $600000 annual salary for 2 weeks paid time off, the hourly rate increases slightly:

$600000 divided by 2,000 hours = $300 per hour

Here’s a table summarizing how your hourly rate change depending on paid time off or holidays:

| Yearly Salary | Paid vacation annually | Hourly Rate |

| $600000 | 0 weeks | $288.46 |

| $600000 | 1 weeks | $294.12 |

| $600000 | 2 weeks | $300 |

| $600000 | 3 weeks | $306.12 |

| $600000 | 4 weeks | $312.50 |

| $600000 | 5 weeks | $319.15 |

Convert $600000 a Year to Hourly, Daily, Biweekly, Weekly, and Monthly Salary

$600000 a year is How Much a Month?

Converting an annual salary to monthly income simply involves dividing the annual amount by 12 months.

$600000 Annual Salary / 12 Months = $50000 Monthly Income

So an annual salary of $600000 equals $50000 per month.

$600000 a year is How Much Biweekly?

Divide the annual salary by 26 to determine the biweekly gross pay. Most employers issue 26 paychecks per year.

$600000 annual salary / 26 pay periods = $23076.92 biweekly gross pay

$600000 a year is How Much a Week?

Take your annual salary amount, Divide it by 52 weeks (the number of weeks in a year)

$600000 / 52 weeks = $11538.46

$600000 a year is How Much a Day?

Divide the annual salary by the number of working days in a year. The average number of working days for full-time employees in the US is 260 days(52 weeks x 5 days per week).

$600000 / 260 days = $2307.69 per working day

$600000 a Year is How Much an Hour After Taxes?

When you’re paid hourly, determining your after-tax hourly wage based on your gross annual income is important for understanding your net pay. We’ll calculate how much per hour someone would make after taxes on a $600000 salary, explore the key taxes that impact hourly workers, and provide tables to estimate your take-home hourly pay.

Calculating After-Tax Hourly Pay from a $600000 Yearly Salary

Let’s walk through the steps to determine the after-tax hourly wage from a $600000 annual salary:

1. Convert the annual salary to a gross hourly wage.

- $600000 per year

- Working 40 hours per week, 52 weeks per year = 2,080 hours

- $600000 / 2,080 hours = $288.46 per hour gross pay

2. Identify the main taxes that are deducted from each paycheck, and typical tax rates:

- Federal income tax: 10% to 37%

- Social Security tax: 6.2%

- Medicare tax: 1.45%

- State income tax: 0-13% approx.

- An average combined tax rate is around 25%

3. Calculate the estimated annual tax amount:

- Annual salary: $600000

- 25% estimated tax rate

- $600000 x 0.25 = $150000 in annual taxes

4. Determine the after-tax hourly wage:

- Gross hourly pay: $288.46/hour

- Annual taxes on gross salary: $150,000

- Net annual salary: $600000 – $150000 = $450000

- $450000 / 2,080 hours = $216.35 per hour after taxes

Based on this estimate, a $600000 annual salary equates to approximately $216.35 per hour after taxes.

This means this employee gets around $72.11 less per hour after accounting for taxes. Let’s take a closer look at how taxes impact your net hourly pay.

Key Taxes on Hourly Earnings

When you’re paid hourly, there are several taxes withheld from each paycheck that affect your net hourly wage. The main taxes that impact your take-home hourly pay include:

Federal Income Tax

- Levied on all taxable income based on IRS tax brackets

- Progressive rates from 10% to 37% based on income level

- Higher incomes are taxed at higher rates

Social Security Tax

- 6.2% tax on first $147,000 earned in 2023

- Funds Social Security retirement benefits

Medicare Tax

- 1.45% on all earned income

- Extra 0.9% tax on income over $200,000

- Helps fund Medicare health insurance program

State Income Tax

- Rates range from 0% to over 10% depending on state

- Only 43 states levy a state income tax

Local Taxes

- Cities and counties may charge local taxes of 1-4%

- Helps fund regional transportation, infrastructure, schools

When added together, these taxes can reach 25-30% of earned income. State and local taxes in particular vary widely based on where you live and work.

Understanding typical tax rates helps estimate hourly workers’ after-tax wages.

Next let’s look at some sample hourly wage calculations after taxes.

After-Tax Hourly Wage Examples

Below are examples of estimating after-tax hourly pay at different gross wage levels:

$15/hour Gross Wage

- Gross hourly wage: $15

- 25% estimated tax rate

- $15 x 0.25 = $3.75 in tax withholding per hour

- Net hourly wage: $15 – $3.75 = $11.25/hour

$23/hour Gross Wage

- Gross hourly wage: $23

- 25% estimated tax rate

- $23 x 0.25 = $5.75 in tax withholding per hour

- Net hourly wage: $23 – $5.75 = $17.25/hour

$29/hour Gross Wage

- Gross hourly wage: $29

- 25% estimated tax rate

- $29 x 0.25 = $7.25 in tax withholding per hour

- Net hourly wage: $29 – $7.25 = $21.75/hour

Higher gross hourly wages result in more taxes withheld and a larger difference between gross and net pay.

$600000 a year is How Much a Month After Taxes?

Based on the average combined tax rate of 25%, we will directly calculate your after-tax monthly salary.

Your Monthy Salary Before Taxes: $50000

Your Monthy Salary After Taxes: $50000 – $50000 * 25% = $37500

$600000 a year is How Much Biweekly After Taxes?

Based on the average combined tax rate of 25%, we will directly calculate your after-tax biweekly salary.

Your Biweekly Salary Before Taxes: $23076.92

Your Biweekly Salary After Taxes: $23076.92 – $23,076.92 * 25% = $17307.69

$600000 a year is How Much a Week After Taxes?

Based on the average combined tax rate of 25%, we will directly calculate your after-tax weekly salary.

Your Weekly Salary Before Taxes: $11538.46

Your Weekly Salary After Taxes: $11538.46 – $11,538.46 * 25% = $8653.85

$600000 a year is How Much a Day After Taxes?

Based on the average combined tax rate of 25%, we will directly calculate your after-tax daily salary.

Your Daily Salary Before Taxes: $2307.69

Your Daily Salary After Taxes: $2307.69 – $2,307.69 * 25% = $1730.77

$600000 Salary vs Average U.S. Salary

Last Updated: July 18, 2023

The U.S. Bureau of Labor Statistics uses median salary data rather than averages to avoid skewed numbers from outlying high and low numbers. Median weekly earnings of the nation's 121.5 million full-time wage and salary workers were $1,100 in the second quarter of 2023, the U.S.

If a person works 52 weeks in the year, then this represents a national annual salary of $57,200.

As can be seen, the annual salary of $600000 is higher than the average wage in the United States.

$600000 A Year Budget Example

The 50/30/20 budget is a simple, effective approach to managing your household finances on an annual salary of $600000. This budget method divides spending into three main categories: 50% on needs, 30% on wants, and 20% to savings and debt repayment.

Below, we will provide an example 50/30/20 monthly budget template for a $600000 income, discuss the key categories, and share tips on making this budget work for your lifestyle.

Overview of 50/30/20 Budgeting Method

The 50/30/20 budget allocates:

- 50% to Necessities?- Housing, utilities, transportation, food, insurance, minimum debt payments

- 30% to Lifestyle Spending?- Dining, entertainment, shopping, hobbies, vacations

- 20% to Savings and Debt Repayment?- Emergency fund, retirement, extra debt payments

This creates a simple spending blueprint for any income level. Let’s look at how to apply it to a $600000 annual salary.

50/30/20 Budget Template for $600000 Income

Here is an example 50/30/20 monthly budget template for earnings of $600000 per year:

Monthly Income

- Monthly Salary: $50000

- Taxes and Deductions: $12500

- Net Monthly Income: $37500

Recommended Budget Percentages Based On $600000 A Year Salary:

| Yearly Salary | $600000 | ||

| Monthly Salary | $50000 | ||

| Taxes and Deductions | $12500 | ||

| Net Monthly Income | $37500 | ||

| Category |

Ideal Percentages |

Sample Monthly Budget | |

| Necessities (50%) $18750 | Housing: | 25% | $9375 |

| Utilities: | 4% | $1500 | |

| Food: | 12% | $34500 | |

| Transportation: | 3% | $1125 | |

| Insurance: | 4% | $1500 | |

| Minimum Debt Payment: | 2% | $750 | |

| Lifestyle (30%) $11250 | Dining Out: | 8% | $3000 |

| Entertainment: | 6% | $2250 | |

| Shopping: | 4% | $1500 | |

| Hobbies: | 4% | $1500 | |

| Vacation: | 8% | $3000 | |

| Savings and Extra Debt (20%): $7500 | Emergency Savings | 10% | $3750 |

| Extra Debt Payment | 6% | $2250 | |

| Retirement Savings | 4% | $1500 | |

This sample budget allows you to cover needs, enjoy lifestyle spending, and build savings on an annual $600000 salary.

Is $600000 a Good Salary?

Earning a $600,000 annual salary definitely puts you in the top income bracket. According to the IRS, only the top 0.001% of tax filers in the US report an adjusted gross income of $600,000 or more.

So yes, a $600,000 salary is an extremely high income compared to average salaries. The median personal income in the US is only around $35,805 per year according to 2021 data from the US Census Bureau.

Here are some key points to consider about a $600,000 salary:

- It is more than 15 times the median US income.

- It puts you in the top 0.1% of income earners.

- Less than 1 in 1000 Americans earn this much.

- You are making over $50,000 per month.

- It is a high income even for lucrative fields like medicine, law, and finance.

- You will be in one of the highest tax brackets.

- It provides tremendous financial security and flexibility.

While middle class in some parts of the country might be around $100,000, a $600,000 salary is firmly in the upper class without a doubt.

Strategies to Increase a $600,000 Salary

Even though $600,000 is already an extremely high salary, some individuals may want to increase it even further. Here are some tips:

- Get promotions at your company to move into higher paying leadership roles.

- Start a side business that can generate additional income.

- Monetize a passion project like writing a book or creating an online course.

- Invest aggressively to grow your net worth – this increases job flexibility.

- Network and make influential connections to open up new high paying job opportunities.

- Consider moving into consulting which can offer very high wages.

- Change industries and make strategic moves into ultra high paying sectors like finance, technology, medicine.

- Negotiate higher pay when changing jobs by demonstrating your value and achievements.

- Get advanced certifications to increase your skills and justify higher pay.

- Move to a lower cost area – $600,000 goes further in Texas than New York for instance.

- Get equity stakes in a successful business venture on top of salary.

| Strategy | How it Works | Risk Level |

|---|---|---|

| Promotions | Climb the ladder in your current organization | Low |

| Side Business | Start a business for extra income | Moderate |

| Monetize Passion | Profit from books, courses, YouTube | Low |

| Aggressive Investing | Grow wealth rapidly with stocks & real estate | High |

| Connections | Network into new high paying roles | Low |

| Consulting | Offer your expertise as a consultant | Moderate |

| Industry Change | Move into banking, tech, medicine | High |

| Negotiation | Advocate for yourself when changing jobs | Low |

| Certifications | Get credentials to justify higher pay | Low |

| Move Locations | Leverage pay differences across regions | High |

| Equity | Get ownership stake in a business | Very High |

As you can see there are many options, each with different risk and reward profiles. Combining multiple strategies can help highly motivated individuals push their salaries even higher.

How to Live on $600000 Per Year Salary?

Although a $600,000 salary provides tremendous income, you still need financial discipline to live within your means. Here are some tips:

- Track your spending using a budgeting app or spreadsheet to understand where the money goes each month. Look for wasteful spending.

- Limit housing costs to a sensible portion of your income – consider 20-30% max. Live below your means.

- Avoid buying status symbols like fancy cars or watches just to show off wealth. Focus spending on assets and appreciate over time or add value to your life.

- Invest aggressively – max out retirement accounts, utilize other investing strategies. Compounding growth is powerful with high savings.

- Consider hiring a financial advisor to help prudently manage your substantial wealth and taxes.

- Be thoughtful before having kids – they dramatically increase costs. Model out expenses beforehand.

- Set up a trust fund or 529 plan to save for kids’ college education if you have a family.

- Automate payments for bills to avoid late fees or interest charges. Automation helps manage complex finances.

- Pay down debts quickly with your high income rather than accumulate interest payments.

- Buy used luxury vehicles to balance pragmatism and indulgence. You can get great deals on used high-end cars.

- Take advantage of business tax deductions if you are self-employed. Write off eligible expenses.

- Watch out for lifestyle inflation – resist pressure to overspend just because you earn a lot.

With some discipline, you can comfortably live a great lifestyle on $600,000 without going into debt or running out of money. The key is developing smart financial habits.

Tips to Manage $600000 Salary for Singles

Being single with a $600,000 salary provides great freedom and flexibility with your finances. Here are some money management tips:

- Don’t feel pressured to overspend on housing. As a single person you likely don’t need a massive house. Keep housing costs reasonable.

- Build an emergency fund with 3-6 months of living expenses. This provides a buffer for unexpected expenses.

- Contribute to retirement accounts like a 401(k) or IRA. Max these out each year to build wealth.

- Develop streams of passive income with your excess capital through investing in dividend stocks, rental properties, or starting a business.

- Travel extensively while you are young and single with few obligations. This is the perfect time to experience the world.

- Consider hiring a house cleaner so you can spend time on hobbies instead of chores. Outsource tasks you don’t enjoy.

- Go back to school for an advanced degree to enhance your skills while you don’t have kids. This can unlock higher earning potential.

- Help out family members who may be struggling financially. You can change lives with generosity.

- Splurge on yourself occasionally on something reasonable that adds value to your life – like first class plane tickets for special trips.

- Save for retirement aggressively to retire early if you wish. Max out accounts and use other strategies.

- Don’t feel pressured to buy fancy status symbols like exotic cars. Make prudent financial decisions.

Tips to Manage $600000 Salary for Families

Having a $600,000 household income with a family requires some extra planning but provides a very comfortable lifestyle. Here are some tips:

- Live in a good school district so you don’t have to pay for private school. This saves tens of thousands per year.

- Drive family friendly vehicles that can accommodate kids, carpools, sports equipment, etc. Avoid flashy cars.

- Start saving and investing for kids’ college as soon as possible. College costs escalate rapidly.

- Hire a cleaner, landscaper and other domestic help. Your time is short with kids. Outsource tasks where prudent.

- Take family vacations while the kids are young. Travel becomes harder as they grow older.

- Pack kids’ lunches and avoid buying lunch at school. Small savings add up.

- Buy quality but affordable kids’ clothes. Children outgrow clothes rapidly. Think practical.

- Set limits on kids’ birthday parties. Over the top parties set bad expectations.

- Agree with your spouse on financial goals and budget tradeoffs. Get aligned on priorities.

- Look for kid tax credits like the child tax credit when filing your taxes. Maximizing these can save thousands.

- Save in a 529 plan for college expenses to avoid student loans. Take advantage of tax benefits.

- Insure yourself adequately with life and disability coverage in case the unforeseen happens.

Raising kids is expensive, but the costs can be managed wisely. Set expectations early and focus spending on items that really matter for your family.

Conclusion

In summary, a $600,000 annual salary is firmly in the top income percentiles. It provides tremendous financial opportunities if managed prudently.

The key is developing smart financial habits like tracking your spending, monitoring lifestyle inflation, and investing excess income wisely. Consider the tips in this article based on your individual circumstances to make the most of a high salary while avoiding unnecessary excess.

With some planning, discipline and perspective, a $600,000 a year income can set you and your family up for long-term financial success.