Knowing how to convert an hourly wage into an annual salary is important for financial planning and setting savings goals. In this article, we’ll break down the potential yearly earnings from $50 per hour based on standard full-time and part-time schedules.

We’ll calculate the total pre-tax income that can be earned annually from $50/hour. We’ll also look at how overtime pay can significantly increase total yearly pay at this high hourly rate. Since unpaid time off is common, we’ll factor in how it reduces actual annual salary.

In addition, we’ll determine the after-tax income you can expect to take home from $50/hour after deductions. Understanding your net pay is crucial.

We’ll also discuss whether $50/hour provides a comfortable or even lavish lifestyle in different parts of the country. With high inflation lately, we’ll look at ways to possibly boost earnings beyond $50/hour.

Knowing exactly how much annual salary you could earn from $50 an hour is important knowledge for financial planning. Let’s take a detailed look at this question.

Table of Contents

Convert $50 Per Hour to Weekly, Monthly, and Yearly Salary

Input your wage and hours per week to see how much you’ll make monthly, yearly and more.

$50 an Hour is How Much a Year?

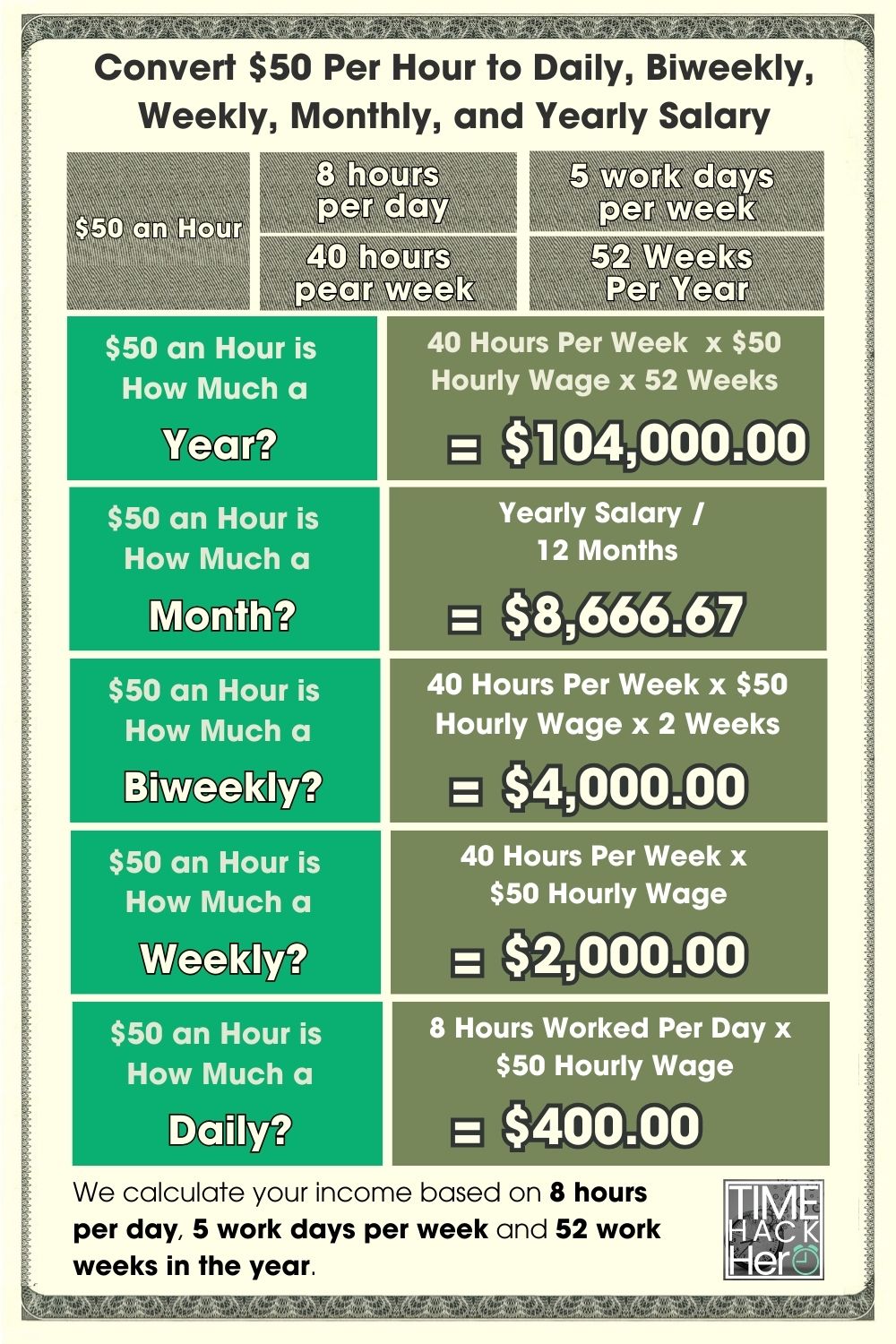

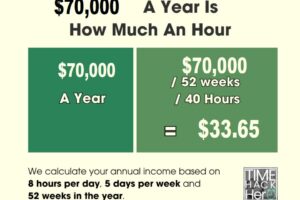

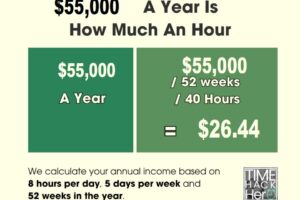

If you make $50 an hour, your yearly salary would be $104,000. We calculate your annual income based on 8 hours per day, 5 days per week and 52 weeks in the year.

Hours worked per week (40) x Hourly wage($50) x Weeks worked per year(52) = $104,000

$50 an Hour is How Much a Month?

If you make $50 an hour, your monthly salary would be $8,666.67. We calculated this number by dividing your annual income by 12 months.

Hours worked per week (40) x Hourly wage($50) x Weeks worked per year(52) / Months per Year(12) = $8,666.67

$50 an Hour is How Much a Biweekly?

If you make $50 an hour, your biweekly salary would be $4,000.

Hours worked per week (40) x Hourly wage($50) x 2 = $4,000

$50 an Hour is How Much a Week?

If you make $50 an hour, your weekly salary would be $2,000. Calculating based on 5 days per week and 8 hours each day.

Hours worked per week (40) x Hourly wage($50) = $2,000

$50 an Hour is How Much a Day?

If you make $50 an hour, your daily salary would be $400. We calculated your daily income based on 8 hours per day.

Hours worked per day (8) x Hourly wage($50) = $400

$50 an Hour is How Much a Year?

The basic formula to calculate your annual salary from an hourly wage is:

Hourly Rate x Hours Worked per Week x Number of Weeks Worked per Year = Annual Salary

So for a $20 per hour job:

$50 per hour x 40 hours per week x 52 weeks per year = $104,000

However, this simple calculation makes some assumptions:

- You will work 40 hours every week of the year

- You will not get any paid time off

Therefore, it represents your earnings if you worked every week of the year, without any vacation, holidays, or sick days.

Accounting for Paid Time Off

The $104,000 base salary does not yet factor in paid time off (PTO). Let’s assume the job provides:

- 2 weeks (10 days) paid vacation

- 6 paid holidays

- 3 paid sick days

This totals 19 paid days off, or nearly 4 weeks of PTO.

Importantly, this paid time off should not be deducted from the annual salary, since you still get paid for those days.

So with 4 weeks PTO, the annual salary would remain $104,000 .

Part time $50 an hour is How Much a Year?

Your annual income changes significantly if you work part-time and not full-time.

For example, let’s say you work 25 hours per week instead of 40. Here’s how you calculate your new yearly total:

$50 per hour x 25 hours per week x 52 weeks per year = $65,000

By working 15 fewer hours per week (25 instead of 40), your annual earnings at $50 an hour drop from $104,000 to $65,000.

That’s a $39,000 per year difference just by working part-time!

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $50 an hour:

| Hours Per Week | Earnings Per Week | Annual Earnings |

|---|---|---|

| 40 | $2,000 | $104,000 |

| 35 | $1,750 | $91,000 |

| 30 | $1,500 | $78,000 |

| 25 | $1,250 | $65,000 |

| 20 | $1,000 | $52,000 |

| 15 | $750 | $39,000 |

The more hours per week, the higher your total yearly earnings. But part-time work allows for more life balance if you don’t need the full salary.

$50 an Hour With Overtime is How Much a Year?

Now let’s look at how overtime can increase your annual earnings.

Overtime kicks in once you work more than 40 hours in a week. Typically, you earn 1.5x your regular hourly wage for overtime hours.

So if you make $50 per hour normally, you would make $75 per hour for any hours over 40 in a week.

Here’s an example:

- You work 45 hours in a Week

- 40 regular hours paid at $50 per hour = $2,000

- 5 overtime hours paid at $75 per hour = $375

- Your total one Week earnings =$2,000 + $375 = $2,375

If you worked 45 hours each week for 52 weeks, here’s how your annual earnings increase thanks to overtime pay:

$2,375 per week x 52 weeks per year = $123,500

That’s $19,500 more than you’d earn working just 40 hours per week at $50 an hour.

Overtime can add up! But also consider taxes and work-life balance when deciding on extra hours.

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $50 an hour:

| Overtime hours per work day | Hours Per Week | Earnings Per Week | Annual Earnings |

| 0 | 40 | $2,000 | $104,000 |

| 1 | 45 | $2,375 | $123,500 |

| 2 | 50 | $2,750 | $143,000 |

| 3 | 55 | $3,125 | $162,500 |

| 4 | 60 | $3,500 | $182,000 |

| 5 | 65 | $3,875 | $201,500 |

| 6 | 70 | $4,250 | $221,000 |

| 7 | 75 | $4,625 | $240,500 |

How Unpaid Time Off Impacts $50/Hour Yearly Earnings

So far we’ve assumed you work 52 paid weeks per year. Any unpaid time off will reduce your total income.

For example, let’s say you take 2 weeks of unpaid leave. That brings your paid weeks down to 50:

Hours worked per week (40) x Hourly wage($50) x Weeks worked per year(50) = $100,000 annual salary

With 2 weeks unpaid time off, your annual earnings at $50/hour would drop by $4,000.

The table below summarizes how your annual income changes depending on the number of weeks of unpaid leave.

| Weeks of unpaid leave | Paid weeks per year | Earnings Per Week | Annual Earnings |

| 0 | 52 | $2,000 | $104,000 |

| 1 | 51 | $2,000 | $102,000 |

| 2 | 50 | $2,000 | $100,000 |

| 3 | 49 | $2,000 | $98,000 |

| 4 | 48 | $2,000 | $96,000 |

| 5 | 47 | $2,000 | $94,000 |

| 6 | 46 | $2,000 | $92,000 |

| 7 | 45 | $2,000 | $90,000 |

Key Takeaways for $50 Hourly Wage

In summary, here are some key points on annual earnings when making $50 per hour:

- At 40 hours per week, you’ll earn $104,000 per year.

- Part-time of 30 hours/week results in $78,000 annual salary.

- Overtime pay can boost yearly earnings, e.g. $19,500 extra at 45 hours/week.

- Unpaid time off reduces your total income, around $4,000 less per 2 weeks off.

- Your specific situation and location impacts taxes and PTO.

Knowing your approximate annual salary and factors impacting it makes it easier to budget and plan your finances. The next step is calculating take-home pay after deductions like taxes.

$50 An Hour Is How Much A Year After Taxes

Figuring out your actual annual earnings based on an hourly wage can be complicated once taxes are taken into account. In addition to federal, state, and local income taxes, 7.65% of your gross pay also goes to Social Security and Medicare through FICA payroll taxes. So how much does $50 an hour equal per year after FICA and income taxes are deducted from your gross pay?

Below we’ll walk through the steps to calculate your annual net take home pay if you make $50 per hour. This will factor in estimated federal, FICA, state, and local taxes so you know exactly what to expect.

Factoring in Federal Income Tax

Your federal income tax will be a big chunk out of your gross pay. Federal tax rates range from 10% to 37%, depending on your tax bracket.

To estimate your federal income tax rate and liability:

Look up your federal income tax bracket based on your gross pay.

2023 tax brackets: single filers

| Tax rate | Taxable income bracket | Tax owed |

|---|---|---|

| 10% | $0 to $11,000. | 10% of taxable income. |

| 12% | $11,001 to $44,725. | $1,100 plus 12% of the amount over $11,000. |

| 22% | $44,726 to $95,375. | $5,147 plus 22% of the amount over $44,725. |

| 24% | $95,376 to $182,100. | $16,290 plus 24% of the amount over $95,375. |

| 32% | $182,101 to $231,250. | $37,104 plus 32% of the amount over $182,100. |

| 35% | $231,251 to $578,125. | $52,832 plus 35% of the amount over $231,250. |

| 37% | $578,126 or more. | $174,238.25 plus 37% of the amount over $578,125. |

For example, if you are single with $104,000 gross annual pay, your federal tax bracket is 24%.

Your estimated federal tax would be:

$16,290 + ($104,000 – $95,376) x 24% = $18,359.76

So at $50/hour with $104,000 gross pay, you would owe about $18,359.76 in federal income taxes.

Considering State Income Tax

In addition to federal tax, most states also charge a state income tax. State income tax rates range from about 1% to 13%, with most falling between 4% and 6%.

Key Takeaways

-

- California, Hawaii, New York, New Jersey, and Oregon have some of the highest state income tax rates.

- Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming don’t impose an income tax at all.

- Another 10 U.S states have a flat tax rate—everyone pays the same percentage regardless of how much they earn.

A State-by-State Comparison of Income Tax Rates

| STATE | TAX RATES | LOWEST AND HIGHEST INCOME BRACKETS |

|---|---|---|

| Alaska | 0% | None |

| Florida | 0% | None |

| Nevada | 0% | None |

| South Dakota | 0% | None |

| Tennessee | 0% | None |

| Texas | 0% | None |

| Washington | 0% | None |

| Wyoming | 0% | None |

| Colorado | 4.55% | Flat rate applies to all incomes |

| Illinois | 4.95% | Flat rate applies to all incomes |

| Indiana | 3.23% | Flat rate applies to all incomes |

| Kentucky | 5% | Flat rate applies to all incomes |

| Massachusetts | 5% | Flat rate applies to all incomes |

| New Hampshire | 5% | Flat rate on interest and dividend income only |

| North Carolina | 4.99% | Flat rate applies to all incomes |

| Pennsylvania | 3.07% | Flat rate applies to all incomes |

| Utah | 4.95% | Flat rate applies to all incomes |

| Michigan | 4.25% | Flat rate applies to all incomes |

| Arizona | 2.59% to 4.5% | $27,806 and $166,843 |

| Arkansas | 2% to 5.5% | $4,300 and $8,501 |

| California | 1% to 13.3% | $9,325 and $1 million |

| Connecticut | 3% to 6.99% | $10,000 and $500,000 |

| Delaware | 0% to 6.6% | $2,000 and $60,001 |

| Alabama | 2% to 5% | $500 and $3,001 |

| Georgia | 1% to 5.75% | $750 and $7,001 |

| Hawaii | 1.4% to 11% | $2,400 and $200,000 |

| Idaho | 1.125% to 6.5% | $1,568 and $7,939 |

| Iowa | 0.33% to 8.53% | $1,743 and $78,435 |

| Kansas | 3.1% to 5.7% | $15,000 and $30,000 |

| Louisiana | 1.85% to 4.25% | $12,500 and $50,001 |

| Maine | 5.8% to 7.15% | $23,000 and $54,450 |

| Maryland | 2% to 5.75% | $1,000 and $250,000 |

| Minnesota | 5.35% to 9.85% | $28,080 and $171,221 |

| Mississippi | 0% to 5% | $5,000 and $10,001 |

| Missouri | 1.5% to 5.3% | $1,121 and $8,968 |

| Montana | 1% to 6.75% | $2,900and $17,400 |

| Nebraska | 2.46% to 6.84% | $3,340 and $32,210 |

| New Jersey | 1.4% to 10.75% | $20,000 and $1 million |

| New Mexico | 1.7% to 5.9% | $5,500 and $210,000 |

| New York | 4% to 10.9% | $8,500 and $25 million |

| North Dakota | 1.1% to 2.9% | $41,775 and $458,350 |

| Ohio | 0% to 3.99% | $25,000 and $110,650 |

| Oklahoma | 0.25% to 4.75% | $1,000 and $7,200 |

| Oregon | 4.75% to 9.9% | $3,750 and $125,000 |

| Rhode Island | 3.75% to 5.99% | $68,200 and $155,050 |

| South Carolina | 0% to 7% | $3,110 and $15,560 |

| Vermont | 3.35% to 8.75% | $42,150 and $213,150 |

| Virginia | 2% to 5.75% | $3,000 and $17,001 |

| Washington, D.C. | 4% to 9.75% | $10,000 and $1 million |

| West Virginia | 3% to 6.5% | $10,000 and $60,000 |

| Wisconsin | 3.54% to 7.65% | $12,760 and $280,950 |

To estimate your state income tax:

Look up your state income tax rate based on your gross pay and filing status.

Multiply your gross annual pay by the state tax rate.

For example, if you live in Pennsylvania which has a flat 3.07% tax rate, your estimated state tax would be:

$104,000 gross pay x 3.07% PA tax rate = $3,192.80 estimated state income tax

So with $104,000 gross annual income, you would owe around in $3,192.80 Pennsylvania state income tax. Verify your specific state’s income tax rates.

Factoring in Local Taxes

Some cities and counties levy local income taxes ranging from 1-3% of taxable income.

To estimate potential local taxes you may owe:

- Check if your city or county charges a local income tax.

- If yes, look up the local income tax rate.

- Multiply your gross annual pay by the local tax rate.

For example, say you live in Columbus, OH which has a 2.5% local income tax. Your estimated local tax would be:

$104,000 gross pay x 2.5% local tax rate = $2,600 estimated local tax

So with $104,000 in gross earnings, you may owe around $2,600 in Columbus local income taxes. Verify rates for your own city/county.

Accounting for FICA Taxes (Social Security & Medicare)

FICA taxes are a combination of Social Security and Medicare taxes that equal 15.3% of your earnings. You are responsible for half of the total bill (7.65%), which includes a 6.2% Social Security tax and 1.45% Medicare tax on your earnings.

In 2023, only the first $160,200 of your earnings are subject to the Social Security tax

There is an additional 0.9% surtax on top of the standard 1.45% Medicare tax for those who earn over $200,000 (single filers) or $250,000 (joint filers).

To estimate your FICA tax payment:

$104,000 x 6.2% + $104,000 x 1.45% = $7,956

So you can expect to pay about $7,956 in Social Security and Medicare taxes out of your gross $104,000 in earnings.

Total Estimated Tax Payments

Based on the examples above, your total estimated tax payments would be:

Federal tax: $18,359.76

State tax: $3,192.80

Local tax: $2,600

FICA tax: $7,956

Total Estimated Tax: $32,108.56

Calculating Your Take Home Pay

To calculate your annual take home pay at $50 /hour:

1. Take your gross pay

2. Subtract your estimated total tax payments

$104,000 gross pay – $32,108.56 Total Estimated Tax = $71,891.44 Your Take Home Pay

n summary, if you make $50 per hour and work full-time, you would take home around $71,891.44 per year after federal, state, local , FICA taxes.

Your actual net income may vary depending on your specific tax situation. But this gives you a general idea of what to expect.

Convert $50 Per Hour to Yearly, Monthly, Biweekly, and Weekly Salary After Taxes

If you make $50 an hour and work full-time (40 hours per week), your estimated yearly salary would be $104,000 .

The $104,000 per year salary does not account for taxes. Federal, state, and local taxes will reduce your take-home pay. The amount withheld depends on your location, filing status, dependents, and other factors.

Just now during our calculation of $50 An Hour Is How Much A Year After Taxes, we assumed the following conditions:

- You are single with $104,000 gross annual pay, your federal tax bracket is 24 %.

- You live in Pennsylvania which has a flat 3.07% tax rate

- You live in Columbus, OH which has a 2.5% local income tax.

In the end, we calculated your Total Estimated Tax is $32,108.56 , Your Take Home Pay is $71,891.44 , Total tax rate is 30.87%.

So next we’ll use 30.87% as the estimated tax rate to calculate your weekly, biweekly, and monthly after-tax income.

$50 Per Hour to Yearly, Monthly, Biweekly, Weekly,and Week Salary After Taxes Table

| Income before taxes | Estimated Tax Rate | Income Taxes | After Tax Income | |

| Yearly Salary | $104,000 | 30.87% | $32,108.56 | $71,891.44 |

| Monthly Salary | $8,666.67 | 30.87% | $2,675.71 | $5,990.95 |

| BiWeekly Salary | $4,000 | 30.87% | $1,234.94 | $2,765.06 |

| Weekly Salary | $2,000 | 30.87% | $617.47 | $1,382.53 |

$50 an hour is how much a year after taxes

Here is the adjusted yearly salary after a 30.87% tax reduction:

-

- Yearly salary before taxes: $104,000

- Estimated tax rate: 30.87%

- Taxes owed (30.87% * $104,000 )= $32,108.56

- Yearly salary after taxes: $71,891.44

| Hourly Wage | Hours Worked Per Week | Weeks Worked Per Year | Total Yearly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Yearly Salary |

|---|---|---|---|---|---|---|

| $50 | 40 | 52 | $104,000 | 30.87% | $32,108.56 | $71,891.44 |

$50 an hour is how much a month after taxes

To calculate the monthly salary based on an hourly wage, you first need the yearly salary amount. Then divide by 12 months.

-

-

- Yearly salary before taxes at $50 per hour: $104,000

- Divided by 12 months per year: $104,000 / 12 = $8,666.67 per month

-

The monthly salary based on a 40 hour work week at $50 per hour is $8,666.67 before taxes.

After applying the estimated 30.87% tax rate, the monthly after-tax salary would be:

-

- Monthly before-tax salary: $8,666.67

- Estimated tax rate: 30.87%

- Taxes owed (30.87% * $8,666.67 )= $2,675.71

- Monthly after-tax salary: $5,990.95

Monthly Salary Based on $50 Per Hour

| Hourly Wage | Yearly Salary | Months Per Year | Before-Tax Monthly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Monthly Salary |

|---|---|---|---|---|---|---|

| $50 | $104,000 | 12 | $8,666.67 | 30.87% | $2,675.71 | $5,990.95 |

$50 an hour is how much biweekly after taxes

Many people are paid biweekly, meaning every other week. To calculate the biweekly pay at $50 per hour:

- Hourly wage: $50

- Hours worked per week: 40

- Weeks per biweekly pay period: 2

- $50 * 40 hours * 2 weeks = $4,000 biweekly

Applying the 30.87%estimated tax rate:

- Biweekly before-tax salary: $4,000

- Estimated tax rate: 30.87%

- Taxes owed (30.87% * $4,000 )= $1,234.94

- Biweekly after-tax salary: $2,765.06

Biweekly Salary at $50 Per Hour

| Hourly Wage | Hours Worked Per Week | Weeks Per Pay Period | Before-Tax Biweekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Biweekly Salary |

|---|---|---|---|---|---|---|

| $50 | 40 | 2 | $4,000 | 30.87% | $1,234.94 | $2,765.06 |

$50 an hour is how much weekly after taxes

To find the weekly salary based on an hourly wage, you need to know the number of hours worked per week. At 40 hours per week, the calculation is:

- Hourly wage: $50

- Hours worked per week: 40

- $50 * 40 hours = $2,000 per week

Accounting for the estimated 30.87% tax rate:

- Weekly before-tax salary: $2,000

- Estimated tax rate: 30.87%

- Taxes owed (30.87% * $2,000 )= $617.47

- Weekly after-tax salary: $1,382.53

Weekly Salary at $50 Per Hour

| Hourly Wage | Hours Worked Per Week | Before-Tax Weekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Weekly Salary |

|---|---|---|---|---|---|

| $50 | 40 | $2,000 | 30.87% | $617.47 | $1,382.53 |

Key Takeaways

- An hourly wage of $50 per hour equals a yearly salary of $104,000 before taxes, assuming a 40 hour work week.

- After accounting for an estimated 30.87% tax rate, the yearly after-tax salary is approximately $71,891.44 .

- On a monthly basis before taxes, $50 per hour equals $8,666.67 per month. After estimated taxes, the monthly take-home pay is about $5,990.95 .

- The before-tax weekly salary at $50 per hour is $2,000 . After taxes, the weekly take-home pay is approximately $1,382.53 .

- For biweekly pay, the pre-tax salary at $50 per hour is $4,000 . After estimated taxes, the biweekly take-home pay is around $2,765.06 .

Understanding annual, monthly, weekly, and biweekly salary equivalents based on an hourly wage is useful when budgeting and financial planning. Taxes make a significant difference in take-home pay, so be sure to account for them when making income conversions. Use this guide as a reference when making salary calculations.

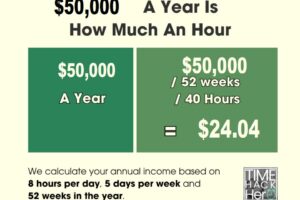

What Is the Average Hourly Wage in the US?

Last Updated: Sep 1 2023

US Average Hourly Earnings is at a current level of $33.82, up from 33.74 last month and up from 32.43 one year ago. This is a change of 0.24% from last month and 4.29% from one year ago.

Average Hourly Earnings is the average dollars that a private employee makes per hour in the US. This metric is a part of one of the most important releases every month which includes unemployment numbers as well. This is normally released on the first Friday of every month. This metric is released by the Bureau of Labor Statistics (BLS).

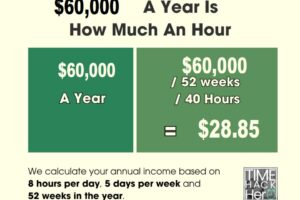

What is the average salary in the U.S.?

Last Updated: July 18, 2023

The U.S. Bureau of Labor Statistics uses median salary data rather than averages to avoid skewed numbers from outlying high and low numbers. Median weekly earnings of the nation's 121.5 million full-time wage and salary workers were $1,100 in the second quarter of 2023, the U.S.

If a person works 52 weeks in the year, then this represents a national annual salary of $57,200.

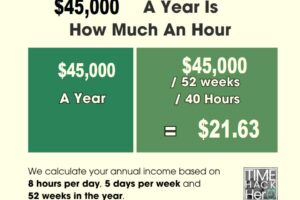

Is $50 an Hour a Good Salary?

For many individuals and families, $50 per hour provides a comfortable income. Assuming 40 hour work weeks for 52 weeks annually, this rate translates to an average gross pay of $104,000 a year. Compared to the 2020 median personal income of $35,805 in the U.S., $50 an hour is nearly triple the typical American wage.

However, simply looking at hourly and yearly earnings doesn’t provide the full picture. First, $50 an hour is a pre-tax income. After federal, state, and local taxes, your net take-home pay will be reduced significantly. How much you specifically pay in taxes will vary based on your location, filing status, dependents, and other factors. Typically though, you can expect to pay at least 20-30% in taxes on a salary of $100k.

Second, the cost of living based on your geographic location makes a major impact. If you live in a low cost midwestern town, $50 an hour goes much further than if you live in an exorbitant housing market like San Francisco or New York City. You’ll have to look at typical rents, home prices, bills, and other expenses for your area to determine if this wage allows you to live comfortably.

Finally, your individual circumstances like family size, health, debts, and lifestyle preferences factor into whether $50 an hour meets your needs. For a single person renting an apartment, $50 an hour may provide a solid middle class lifestyle. But supporting a family of four on this income could be more challenging.

Overall, $50 per hour certainly qualifies as a good wage. But determining whether it’s an excellent or just adequate salary requires looking at your specific situation. In high cost areas or for larger families, $50 an hour may be a more modest income.

Jobs that pay $50 an hour

Very few jobs pay an hourly wage of $50 or more. According to the Bureau of Labor Statistics, the median hourly wage across all occupations in the U.S. is $20.17. Jobs paying $50 per hour or higher tend to require advanced expertise, skills, education, certifications, security clearances, and training. Here are some of the most common professions that pay $50 per hour or more:

- Pilots – Pilots earn a median wage of $50.13 per hour, translating to $104,270 annually. Commercial airline pilots require significant training and flight hours and must pass rigorous exams to obtain FAA licensure.

- Nuclear engineers – Those working in the nuclear power industry average $50.25 per hour or $104,520 per year. A bachelor’s degree in nuclear engineering along with extensive on the job training is required.

- Physicians – Doctors earn an average of $50.50 per hour according to BLS data, though this varies by specialty. Becoming a physician requires a bachelor’s degree, four years of medical school, and a multi-year residency program.

- Dentists – General dentists earn approximately $50.83 per hour or $105,720 annually on average. Aspiring dentists must complete a Doctor of Dental Surgery (DDS) or Doctor of Dental Medicine (DMD) program after college.

- Information security analysts – Information security analysts earn a median pay rate of $51.35 per hour or $106,810 per year. Breaking into this field generally requires a bachelor’s degree in cybersecurity or computer science along with professional certifications.

- Pharmacists – The average hourly wage for pharmacists is $51.87, equivalent to $107,890 annually. Becoming a pharmacist requires completing a 4 year Doctor of Pharmacy (PharmD) program after undergrad studies.

- Attorneys – Lawyers earn approximately $53.80 per hour or $111,910 on average according to BLS data. Attorneys need to hold a bachelor’s degree, complete three years of law school, and pass the bar exam.

These are just a few examples of professions that pay $50 per hour or more on average. However, salaries can vary widely based on factors like geographic location, years of experience, level of education, and employer. The highest paying jobs tend to require extensive training and credentials.

Can You Live Off $50 An Hour?

Whether or not $50 an hour provides a livable income depends largely on where you live and your household size.

For a single person or couple without children living in an average cost area, $50 an hour can absolutely provide a comfortable lifestyle. Two earners making $50 per hour combined have an annual pre-tax household income of over $200,000. This puts them solidly in the upper-middle class bracket for most U.S. locations.

However, for larger families supporting multiple children or single parents providing solo, the costs add up quickly. Childcare, healthcare, housing, food, transportation, and other kid-related expenses can eat up $50 an hour quickly. Living solely on this salary while raising a family would likely require careful budgeting, particularly in high cost metro regions.

Those living in very high cost of living cities like San Francisco, New York City, Honolulu, or Los Angeles may also find $50 an hour insufficient to cover basic expenses. In these pricey real estate markets where rents for a simple apartment can easily exceed $4,000 per month, salaries need to be significantly higher to compensate. Unless you have two earners both making $50+ per hour, living off a single $50 per hour income in a big coastal city will be challenging.

But for individuals or working couples based in mid-tier cities or less populated regions, $50 per hour goes much further. Places like Raleigh, Dallas, Houston, Atlanta, Phoenix, Nashville, Charlotte, and Austin all offer reasonable costs of housing, groceries, and transportation relative to this $100k+ salary. Living comfortably on $50 an hour is certainly feasible in these metro areas, even for families.

Ultimately, the standard of living $50 per hour affords depends entirely on the big three factors of household size, location, and lifestyle. For a single person or DINK couple (dual income, no kids) in an average cost area that lives modestly, $50 an hour provides comfortable earnings. Families or high cost cities will require more income to sustain the same standard of living.

The impact of inflation on the value of $50 an hour

With inflation recently reaching levels not seen in 40 years, the costs of consumer goods, housing, medical care, and other living expenses have risen substantially. This means the purchasing power and value of an hourly wage can decrease over time.

For example, $50 per hour in 2022 has significantly less buying power than $50 per hour did in 2000. Things that cost $100 back then may now cost $200 or more, meaning your earnings don’t stretch as far. This is why cost of living adjustments (COLAs) and annual raises are necessary just to maintain the status quo purchasing ability.

In the near and medium term future, inflation is expected to continue eroding the value of fixed incomes. The Federal Reserve anticipates inflation running well above its 2% target, likely in the 3-4% range over the next few years. What this means is that $50 an hour will likely buy you less goods and services in 2025 than it does in 2022.

To counteract inflation, Americans need to advocate for raises and search for better paying job opportunities over time. Earning $50 per hour may provide a solid standard of living right now. But in five or ten years, you will likely need to be making $55 or $60 an hour just to have the same purchasing power, depending on inflation.

The key takeaway is that inflation constantly eats away at the real value of a fixed wage. Even if your hourly rate or salary stays stagnant over many years, its actual buying power declines steadily. This is why seeking opportunities to increase your earnings over time is so important.

5 Ways To Increase Your Hourly Wage

If you currently make less than $50 per hour, here are some potential ways to boost your earnings:

- Ask for a raise – If you’ve been at a company 1-2 years with positive performance, request a salary bump citing your experience and value. Even a 5% raise can significantly boost hourly pay over time.

- Seek promotions – Moving up to higher roles with greater responsibility tends to come with higher compensation. Make yourself indispensable and seek internal mobility.

- Switch companies – Changing employers every few years is one of the fastest ways to secure major pay increases. Don’t get too comfortable staying put.

- Pick up overtime – Working extra hours is an easy way to immediately boost your overall compensation. Aim for time-and-a-half overtime.

- Learn new skills – Gain certifications, training, or education that allows you to command higher pay based on expanded expertise.

Persistence, hard work, and continually bettering yourself are key to moving up the hourly wage ladder. With the right combination of promotions, job moves, skills, and overtime, you can significantly increase earnings over a career.

Buying a car on $50 an hour

Making $50 per hour certainly provides enough income to afford a nice car. But you’ll need to stick to a reasonable budget relative to your total earnings and expenses.

As a general rule, you should aim to spend no more than 10-15% of your total take-home pay on a car payment. On this salary, that means keeping the payment under $500 per month is wise. This allows room in your budget for other costs like housing, food, utilities, healthcare, gas, and savings.

Given today’s auto prices and interest rates, sticking to this budget would allow you to comfortably afford a new car in the $25,000 to $35,000 range or a used car under $20,000. While you may be able to afford higher priced vehicles, it’s prudent to buy below your means and maintain financial flexibility.

Going above this car budget while making $50 an hour would make affording your other monthly expenses and goals difficult. Always run the numbers for the total monthly payment including tax, title, license, and interest before committing to any auto purchase. And search for optimal financing terms to keep the payment on a new or used car under $500.

Can You Buy a House on $50 An Hour?

Buying and affording a house on an income of $50 per hour comes down first and foremost to location.

In lower cost real estate markets in the Midwest, South, and Southwest, buying a home is very feasible on this salary. The median home price in metros like St. Louis, Cincinnati, Indianapolis, Atlanta, Austin, Dallas, and Phoenix tend to be around 3X your gross annual income or less.

That means on $100k per year, purchasing a home valued between $250,000 and $350,000 is affordable based on typical lender standards. This price range would allow a 20% down payment while keeping mortgage repayments around 25% of your monthly take-home income. With today’s interest rates, you’d be looking at a monthly mortgage payment of $1,500 or less on a $300k house.

However, in ultra-high cost areas like the Bay Area, New York, Boston, Seattle, or Los Angeles, affording a home on $50 an hour may be out of reach. The median home price is $1 million+ in many of these West Coast and Northeast metros.

Without a second income from a partner, buying even a condo on a single $50 per hour salary in hyper-expensive cities is extremely challenging. You’ll either need two solid earners or to relocate to more reasonably priced housing markets to buy on this income.

The key factors are your total income, savings for a down payment, debt levels, and targeting metro areas with average home prices near 3X your annual earnings. For most parts of the country outside major coastal tech hubs, $50 an hour provides sufficient income to buy a modest starter home or condo.

Example Budget For $50 Per Hour

To determine if you can live comfortably on $50 per hour, mapping out a monthly budget is key. Here is an example budget for this salary:

- Gross Monthly Income ($50/hour x 40 hours/week x 52 weeks / 12 months): $8,667

- Taxes and Deductions at 25%: $2,167

- Take-Home Pay: $6,500

- Housing (rent/mortgage): $1,500

- Utilities: $250

- Car Payment: $450

- Car Insurance: $100

- Gas: $200

- Groceries and Household Items: $400

- Dining Out: $200

- Health Insurance: $400

- Prescriptions and Medical Copays: $50

- Cell Phone: $100

- Internet and Cable: $150

- Entertainment/Recreation: $200

- Retirement Savings: $500

- Emergency Savings: $400

- Total Monthly Expenses: $5,400

- Remaining for Additional Savings or Spending: $1,100

This leaves $1,100 per month for extra savings, travel, or other discretionary spending. This budget would allow comfortable middle class living in most areas of the country. In higher cost cities like NYC or San Francisco, expenses would need to be reduced significantly.

Overall though, this breakdown demonstrates that $50 an hour can absolutely provide a livable wage and nice standard of living, especially for individuals or dual income couples without kids.

In Summary

An hourly wage of $50 equates to over $100k annually, placing income earners solidly in the upper middle class. However, factors like where you live, household size, and lifestyle preferences determine exactly what sort of lifestyle this salary affords.

For single earners or working couples residing in average cost of living regions, $50 per hour provides a comfortable living with room for savings and discretionary spending. But families or those living in high cost urban coastal cities may struggle without dual incomes at this level.

It’s important to carefully budget and understand exactly what $50 an hour enables in the context of your specific circumstances. But for many Americans, this hourly rate is sufficient to sustain a nice middle class standard of living, especially when two partners earn this level of income. With the right money management, living on $50 an hour is readily achievable for individuals, couples, and even families in reasonably priced metro regions.