An hourly wage of $46 can provide a comfortable living in many areas, but what does this equate to over the course of a year? In this article, we’ll break down the annual, monthly, biweekly, and weekly pay for jobs paying $46 per hour. We’ll look at how factors like taxes, overtime, and unpaid time off impact the actual yearly earnings from a $46 hourly wage. Additionally, we’ll evaluate whether $46 an hour is considered a good salary, highlight typical jobs that pay this rate, and discuss what kind of lifestyle is possible on this income. With proper budgeting and money management, $46 an hour can be enough to afford major purchases like cars and homes in some parts of the country. However, the costs of housing, healthcare, and other essentials vary widely across regions. Understanding the full yearly earnings potential of $46 an hour can help individuals better plan their finances and career trajectories.

Table of Contents

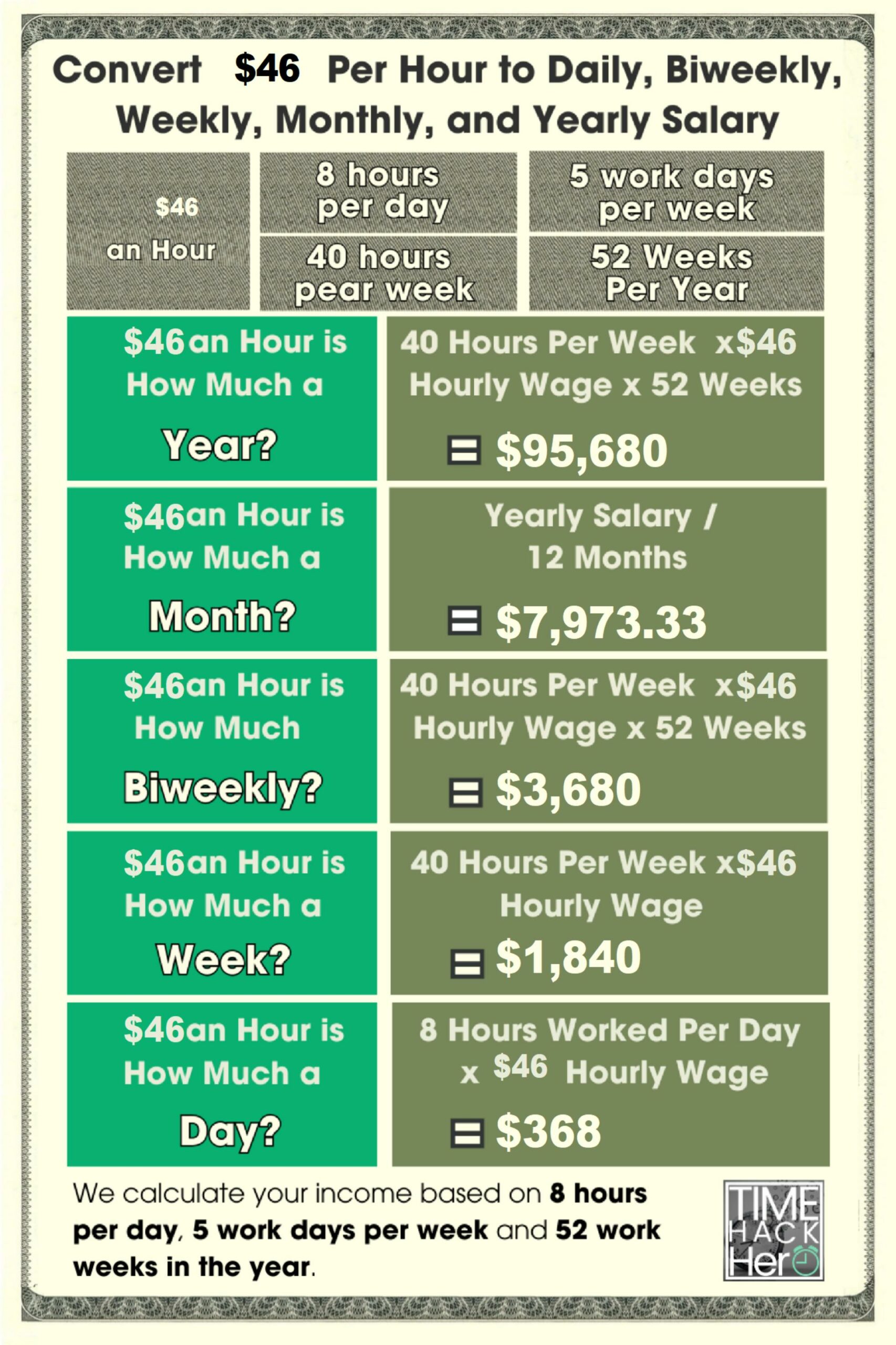

Convert $46 Per Hour to Weekly, Monthly, and Yearly Salary

Input your wage and hours per week to see how much you’ll make monthly, yearly and more.

$46 an Hour is How Much a Year?

If you make $46 an hour, your yearly salary would be $95,680. We calculate your annual income based on 8 hours per day, 5 days per week and 52 weeks in the year.

Hours worked per week (40) x Hourly wage($46) x Weeks worked per year(52) = $95,680

$46 an Hour is How Much a Month?

If you make $46 an hour, your monthly salary would be $7,973.33. We calculated this number by dividing your annual income by 12 months.

Hours worked per week (40) x Hourly wage($46) x Weeks worked per year(52) / Months per Year(12) = $7,973.33

$46 an Hour is How Much Biweekly?

If you make $46 an hour, your biweekly salary would be $3,680.

Hours worked per week (40) x Hourly wage($46) x 2 = $3,680

$46 an Hour is How Much a Week?

If you make $46 an hour, your weekly salary would be $1,840. Calculating based on 5 days per week and 8 hours each day.

Hours worked per week (40) x Hourly wage($46) = $1,840

$46 an Hour is How Much a Day?

If you make $46 an hour, your daily salary would be $368. We calculated your daily income based on 8 hours per day.

Hours worked per day (8) x Hourly wage($46) = $368

$46 an Hour is How Much a Year?

The basic formula to calculate your annual salary from an hourly wage is:

Hourly Rate x Hours Worked per Week x Number of Weeks Worked per Year = Annual Salary

So for a $20 per hour job:

$46 per hour x 40 hours per week x 52 weeks per year = $95,680

However, this simple calculation makes some assumptions:

- You will work 40 hours every week of the year

- You will not get any paid time off

Therefore, it represents your earnings if you worked every week of the year, without any vacation, holidays, or sick days.

Accounting for Paid Time Off

The $95,680 base salary does not yet factor in paid time off (PTO). Let’s assume the job provides:

- 2 weeks (10 days) paid vacation

- 6 paid holidays

- 3 paid sick days

This totals 19 paid days off, or nearly 4 weeks of PTO.

Importantly, this paid time off should not be deducted from the annual salary, since you still get paid for those days.

So with 4 weeks PTO, the annual salary would remain $95,680 .

Part time $46 an hour is How Much a Year?

Your annual income changes significantly if you work part-time and not full-time.

For example, let’s say you work 30 hours per week instead of 40. Here’s how you calculate your new yearly total:

$46 per hour x 30 hours per week x 52 weeks per year = $71,760

By working 10 fewer hours per week (30 instead of 40), your annual earnings at $46 an hour drop from $95,680 to $71,760.

That’s a $23,920 per year difference just by working part-time!

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $46 an hour:

| Hours Per Week | Earnings Per Week | Annual Earnings |

|---|---|---|

| 40 | $1,840 | $95,680 |

| 35 | $1,610 | $83,720 |

| 30 | $1,380 | $71,760 |

| 25 | $1,150 | $59,800 |

| 20 | $920 | $47,840 |

| 15 | $690 | $35,880 |

The more hours per week, the higher your total yearly earnings. But part-time work allows for more life balance if you don’t need the full salary.

$46 an Hour With Overtime is How Much a Year?

Now let’s look at how overtime can increase your annual earnings.

Overtime kicks in once you work more than 40 hours in a week. Typically, you earn 1.5x your regular hourly wage for overtime hours.

So if you make $46 per hour normally, you would make $69 per hour for any hours over 40 in a week.

Here’s an example:

- You work 45 hours in a Week

- 40 regular hours paid at $46 per hour = $1,840

- 5 overtime hours paid at $69 per hour = $345

- Your total one Week earnings =$1,840 + $345 = $2,185

If you worked 45 hours each week for 52 weeks, here’s how your annual earnings increase thanks to overtime pay:

$2,185 per week x 52 weeks per year = $113,620

That’s $17,940 more than you’d earn working just 40 hours per week at $46 an hour.

Overtime can add up! But also consider taxes and work-life balance when deciding on extra hours.

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $46 an hour:

| Overtime hours per work day | Hours Per Week | Earnings Per Week | Annual Earnings |

| 0 | 40 | $1,840 | $95,680 |

| 1 | 45 | $2,185 | $113,620 |

| 2 | 50 | $2,530 | $131,560 |

| 3 | 55 | $2,875 | $149,500 |

| 4 | 60 | $3,220 | $167,440 |

| 5 | 65 | $3,565 | $185,380 |

| 6 | 70 | $3,910 | $203,320 |

| 7 | 75 | $4,255 | $221,260 |

How Unpaid Time Off Impacts $46/Hour Yearly Earnings

So far we’ve assumed you work 52 paid weeks per year. Any unpaid time off will reduce your total income.

For example, let’s say you take 2 weeks of unpaid leave. That brings your paid weeks down to 50:

Hours worked per week (40) x Hourly wage($46) x Weeks worked per year(50) = $92,000 annual salary

With 2 weeks unpaid time off, your annual earnings at $46/hour would drop by $3,680.

The table below summarizes how your annual income changes depending on the number of weeks of unpaid leave.

| Weeks of unpaid leave | Paid weeks per year | Earnings Per Week | Annual Earnings |

| 0 | 52 | $1,840 | $95,680 |

| 1 | 51 | $1,840 | $93,840 |

| 2 | 50 | $1,840 | $92,000 |

| 3 | 49 | $1,840 | $90,160 |

| 4 | 48 | $1,840 | $88,320 |

| 5 | 47 | $1,840 | $86,480 |

| 6 | 46 | $1,840 | $84,640 |

| 7 | 45 | $1,840 | $82,800 |

Key Takeaways for $46 Hourly Wage

In summary, here are some key points on annual earnings when making $46 per hour:

- At 40 hours per week, you’ll earn $95,680 per year.

- Part-time of 30 hours/week results in $71,760 annual salary.

- Overtime pay can boost yearly earnings, e.g. $17,940 extra at 45 hours/week.

- Unpaid time off reduces your total income, around $3,680 less per 2 weeks off.

- Your specific situation and location impacts taxes and PTO.

Knowing your approximate annual salary and factors impacting it makes it easier to budget and plan your finances. The next step is calculating take-home pay after deductions like taxes.

$46 An Hour Is How Much A Year After Taxes

Figuring out your actual annual earnings based on an hourly wage can be complicated once taxes are taken into account. In addition to federal, state, and local income taxes, 7.65% of your gross pay also goes to Social Security and Medicare through FICA payroll taxes. So how much does $46 an hour equal per year after FICA and income taxes are deducted from your gross pay?

Below we’ll walk through the steps to calculate your annual net take home pay if you make $46 per hour. This will factor in estimated federal, FICA, state, and local taxes so you know exactly what to expect.

Factoring in Federal Income Tax

Your federal income tax will be a big chunk out of your gross pay. Federal tax rates range from 10% to 37%, depending on your tax bracket.

To estimate your federal income tax rate and liability:

Look up your federal income tax bracket based on your gross pay.

2023 tax brackets: single filers

| Tax rate | Taxable income bracket | Tax owed |

|---|---|---|

| 10% | $0 to $11,000. | 10% of taxable income. |

| 12% | $11,001 to $44,725. | $1,100 plus 12% of the amount over $11,000. |

| 22% | $44,726 to $95,375. | $5,147 plus 22% of the amount over $44,725. |

| 24% | $95,376 to $182,100. | $16,290 plus 24% of the amount over $95,375. |

| 32% | $182,101 to $231,250. | $37,104 plus 32% of the amount over $182,100. |

| 35% | $231,251 to $578,125. | $52,832 plus 35% of the amount over $231,250. |

| 37% | $578,126 or more. | $174,238.25 plus 37% of the amount over $578,125. |

For example, if you are single with $95,680 gross annual pay, your federal tax bracket is 24%.

Your estimated federal tax would be:

$16,290 + ($95,680 – $95,376) x 24% = $16,362.96

So at $46/hour with $95,680 gross pay, you would owe about $16,362.96 in federal income taxes.

Considering State Income Tax

In addition to federal tax, most states also charge a state income tax. State income tax rates range from about 1% to 13%, with most falling between 4% and 6%.

Key Takeaways

-

- California, Hawaii, New York, New Jersey, and Oregon have some of the highest state income tax rates.

- Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming don’t impose an income tax at all.

- Another 10 U.S states have a flat tax rate—everyone pays the same percentage regardless of how much they earn.

A State-by-State Comparison of Income Tax Rates

| STATE | TAX RATES | LOWEST AND HIGHEST INCOME BRACKETS |

|---|---|---|

| Alaska | 0% | None |

| Florida | 0% | None |

| Nevada | 0% | None |

| South Dakota | 0% | None |

| Tennessee | 0% | None |

| Texas | 0% | None |

| Washington | 0% | None |

| Wyoming | 0% | None |

| Colorado | 4.55% | Flat rate applies to all incomes |

| Illinois | 4.95% | Flat rate applies to all incomes |

| Indiana | 3.23% | Flat rate applies to all incomes |

| Kentucky | 5% | Flat rate applies to all incomes |

| Massachusetts | 5% | Flat rate applies to all incomes |

| New Hampshire | 5% | Flat rate on interest and dividend income only |

| North Carolina | 4.99% | Flat rate applies to all incomes |

| Pennsylvania | 3.07% | Flat rate applies to all incomes |

| Utah | 4.95% | Flat rate applies to all incomes |

| Michigan | 4.25% | Flat rate applies to all incomes |

| Arizona | 2.59% to 4.5% | $27,806 and $166,843 |

| Arkansas | 2% to 5.5% | $4,300 and $8,501 |

| California | 1% to 13.3% | $9,325 and $1 million |

| Connecticut | 3% to 6.99% | $10,000 and $500,000 |

| Delaware | 0% to 6.6% | $2,000 and $60,001 |

| Alabama | 2% to 5% | $500 and $3,001 |

| Georgia | 1% to 5.75% | $750 and $7,001 |

| Hawaii | 1.4% to 11% | $2,400 and $200,000 |

| Idaho | 1.125% to 6.5% | $1,568 and $7,939 |

| Iowa | 0.33% to 8.53% | $1,743 and $78,435 |

| Kansas | 3.1% to 5.7% | $15,000 and $30,000 |

| Louisiana | 1.85% to 4.25% | $12,500 and $50,001 |

| Maine | 5.8% to 7.15% | $23,000 and $54,450 |

| Maryland | 2% to 5.75% | $1,000 and $250,000 |

| Minnesota | 5.35% to 9.85% | $28,080 and $171,221 |

| Mississippi | 0% to 5% | $5,000 and $10,001 |

| Missouri | 1.5% to 5.3% | $1,121 and $8,968 |

| Montana | 1% to 6.75% | $2,900and $17,400 |

| Nebraska | 2.46% to 6.84% | $3,340 and $32,210 |

| New Jersey | 1.4% to 10.75% | $20,000 and $1 million |

| New Mexico | 1.7% to 5.9% | $5,500 and $210,000 |

| New York | 4% to 10.9% | $8,500 and $25 million |

| North Dakota | 1.1% to 2.9% | $41,775 and $458,350 |

| Ohio | 0% to 3.99% | $25,000 and $110,650 |

| Oklahoma | 0.25% to 4.75% | $1,000 and $7,200 |

| Oregon | 4.75% to 9.9% | $3,750 and $125,000 |

| Rhode Island | 3.75% to 5.99% | $68,200 and $155,050 |

| South Carolina | 0% to 7% | $3,110 and $15,560 |

| Vermont | 3.35% to 8.75% | $42,150 and $213,150 |

| Virginia | 2% to 5.75% | $3,000 and $17,001 |

| Washington, D.C. | 4% to 9.75% | $10,000 and $1 million |

| West Virginia | 3% to 6.5% | $10,000 and $60,000 |

| Wisconsin | 3.54% to 7.65% | $12,760 and $280,950 |

To estimate your state income tax:

Look up your state income tax rate based on your gross pay and filing status.

Multiply your gross annual pay by the state tax rate.

For example, if you live in Pennsylvania which has a flat 3.07% tax rate, your estimated state tax would be:

$95,680 gross pay x 3.07% PA tax rate = $2,937.38 estimated state income tax

So with $95,680 gross annual income, you would owe around in $2,937.38 Pennsylvania state income tax. Verify your specific state’s income tax rates.

Factoring in Local Taxes

Some cities and counties levy local income taxes ranging from 1-3% of taxable income.

To estimate potential local taxes you may owe:

- Check if your city or county charges a local income tax.

- If yes, look up the local income tax rate.

- Multiply your gross annual pay by the local tax rate.

For example, say you live in Columbus, OH which has a 2.5% local income tax. Your estimated local tax would be:

$95,680 gross pay x 2.5% local tax rate = $2,392 estimated local tax

So with $95,680 in gross earnings, you may owe around $2,392 in Columbus local income taxes. Verify rates for your own city/county.

Accounting for FICA Taxes (Social Security & Medicare)

FICA taxes are a combination of Social Security and Medicare taxes that equal 15.3% of your earnings. You are responsible for half of the total bill (7.65%), which includes a 6.2% Social Security tax and 1.45% Medicare tax on your earnings.

In 2023, only the first $160,200 of your earnings are subject to the Social Security tax

There is an additional 0.9% surtax on top of the standard 1.45% Medicare tax for those who earn over $200,000 (single filers) or $250,000 (joint filers).

To estimate your FICA tax payment:

$95,680 x 6.2% + $95,680 x 1.45% = $7,319.52

So you can expect to pay about $7,319.52 in Social Security and Medicare taxes out of your gross $95,680 in earnings.

Total Estimated Tax Payments

Based on the examples above, your total estimated tax payments would be:

Federal tax: $16,362.96

State tax: $2,937.38

Local tax: $2,392

FICA tax: $7,319.52

Total Estimated Tax: $29,011.86

Calculating Your Take Home Pay

To calculate your annual take home pay at $46 /hour:

1. Take your gross pay

2. Subtract your estimated total tax payments

$95,680 gross pay – $29,011.86 Total Estimated Tax = $66,668.14 Your Take Home Pay

n summary, if you make $46 per hour and work full-time, you would take home around $66,668.14 per year after federal, state, local , FICA taxes.

Your actual net income may vary depending on your specific tax situation. But this gives you a general idea of what to expect.

Convert $46 Per Hour to Yearly, Monthly, Biweekly, and Weekly Salary After Taxes

If you make $46 an hour and work full-time (40 hours per week), your estimated yearly salary would be $95,680 .

The $95,680 per year salary does not account for taxes. Federal, state, and local taxes will reduce your take-home pay. The amount withheld depends on your location, filing status, dependents, and other factors.

Just now during our calculation of $46 An Hour Is How Much A Year After Taxes, we assumed the following conditions:

- You are single with $95,680 gross annual pay, your federal tax bracket is 24 %.

- You live in Pennsylvania which has a flat 3.07% tax rate

- You live in Columbus, OH which has a 2.5% local income tax.

In the end, we calculated your Total Estimated Tax is $29,011.86 , Your Take Home Pay is $66,668.14 , Total tax rate is 30.32%.

So next we’ll use 30.32% as the estimated tax rate to calculate your weekly, biweekly, and monthly after-tax income.

$46 Per Hour to Yearly, Monthly, Biweekly, Weekly,and Week Salary After Taxes Table

| Income before taxes | Estimated Tax Rate | Income Taxes | After Tax Income | |

| Yearly Salary | $95,680 | 30.32% | $29,011.86 | $66,668.14 |

| Monthly Salary | $7,973.33 | 30.32% | $2,417.65 | $5,555.68 |

| BiWeekly Salary | $3,680 | 30.32% | $1,115.84 | $2,564.16 |

| Weekly Salary | $1,840 | 30.32% | $557.92 | $1,282.08 |

$46 an hour is how much a year after taxes

Here is the adjusted yearly salary after a 30.32% tax reduction:

-

- Yearly salary before taxes: $95,680

- Estimated tax rate: 30.32%

- Taxes owed (30.32% * $95,680 )= $29,011.86

- Yearly salary after taxes: $66,668.14

| Hourly Wage | Hours Worked Per Week | Weeks Worked Per Year | Total Yearly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Yearly Salary |

|---|---|---|---|---|---|---|

| $46 | 40 | 52 | $95,680 | 30.32% | $29,011.86 | $66,668.14 |

$46 an hour is how much a month after taxes

To calculate the monthly salary based on an hourly wage, you first need the yearly salary amount. Then divide by 12 months.

-

-

- Yearly salary before taxes at $46 per hour: $95,680

- Divided by 12 months per year: $95,680 / 12 = $7,973.33 per month

-

The monthly salary based on a 40 hour work week at $46 per hour is $7,973.33 before taxes.

After applying the estimated 30.32% tax rate, the monthly after-tax salary would be:

-

- Monthly before-tax salary: $7,973.33

- Estimated tax rate: 30.32%

- Taxes owed (30.32% * $7,973.33 )= $2,417.65

- Monthly after-tax salary: $5,555.68

Monthly Salary Based on $46 Per Hour

| Hourly Wage | Yearly Salary | Months Per Year | Before-Tax Monthly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Monthly Salary |

|---|---|---|---|---|---|---|

| $46 | $95,680 | 12 | $7,973.33 | 30.32% | $2,417.65 | $5,555.68 |

$46 an hour is how much biweekly after taxes

Many people are paid biweekly, meaning every other week. To calculate the biweekly pay at $46 per hour:

- Hourly wage: $46

- Hours worked per week: 40

- Weeks per biweekly pay period: 2

- $46 * 40 hours * 2 weeks = $3,680 biweekly

Applying the 30.32%estimated tax rate:

- Biweekly before-tax salary: $3,680

- Estimated tax rate: 30.32%

- Taxes owed (30.32% * $3,680 )= $1,115.84

- Biweekly after-tax salary: $2,564.16

Biweekly Salary at $46 Per Hour

| Hourly Wage | Hours Worked Per Week | Weeks Per Pay Period | Before-Tax Biweekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Biweekly Salary |

|---|---|---|---|---|---|---|

| $46 | 40 | 2 | $3,680 | 30.32% | $1,115.84 | $2,564.16 |

$46 an hour is how much weekly after taxes

To find the weekly salary based on an hourly wage, you need to know the number of hours worked per week. At 40 hours per week, the calculation is:

- Hourly wage: $46

- Hours worked per week: 40

- $46 * 40 hours = $1,840 per week

Accounting for the estimated 30.32% tax rate:

- Weekly before-tax salary: $1,840

- Estimated tax rate: 30.32%

- Taxes owed (30.32% * $1,840 )= $557.92

- Weekly after-tax salary: $1,282.08

Weekly Salary at $46 Per Hour

| Hourly Wage | Hours Worked Per Week | Before-Tax Weekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Weekly Salary |

|---|---|---|---|---|---|

| $46 | 40 | $1,840 | 30.32% | $557.92 | $1,282.08 |

Key Takeaways

- An hourly wage of $46 per hour equals a yearly salary of $95,680 before taxes, assuming a 40 hour work week.

- After accounting for an estimated 30.32% tax rate, the yearly after-tax salary is approximately $66,668.14 .

- On a monthly basis before taxes, $46 per hour equals $7,973.33 per month. After estimated taxes, the monthly take-home pay is about $5,555.68 .

- The before-tax weekly salary at $46 per hour is $1,840 . After taxes, the weekly take-home pay is approximately $1,282.08 .

- For biweekly pay, the pre-tax salary at $46 per hour is $3,680 . After estimated taxes, the biweekly take-home pay is around $2,564.16 .

Understanding annual, monthly, weekly, and biweekly salary equivalents based on an hourly wage is useful when budgeting and financial planning. Taxes make a significant difference in take-home pay, so be sure to account for them when making income conversions. Use this guide as a reference when making salary calculations.

What Is the Average Hourly Wage in the US?

Last Updated: Sep 1 2023

US Average Hourly Earnings is at a current level of $33.82, up from 33.74 last month and up from 32.43 one year ago. This is a change of 0.24% from last month and 4.29% from one year ago.

Average Hourly Earnings is the average dollars that a private employee makes per hour in the US. This metric is a part of one of the most important releases every month which includes unemployment numbers as well. This is normally released on the first Friday of every month. This metric is released by the Bureau of Labor Statistics (BLS).

What is the average salary in the U.S.?

Last Updated: July 18, 2023

The U.S. Bureau of Labor Statistics uses median salary data rather than averages to avoid skewed numbers from outlying high and low numbers. Median weekly earnings of the nation's 121.5 million full-time wage and salary workers were $1,100 in the second quarter of 2023, the U.S.

If a person works 52 weeks in the year, then this represents a national annual salary of $57,200.

Is $46 an Hour a Good Salary?

Whether $46 an hour is considered a good salary depends largely on where you live and your lifestyle. In lower cost-of-living rural areas, $46 an hour would be well above average and provide a comfortable living. However, in expensive metropolitan areas like New York City or San Francisco, that wage would make it much harder to afford basics like housing.

The national median hourly wage in the U.S. is around $20 per hour. So at $46 an hour, you’re making over twice the median income. However, as of August 2022, the living wage for a single adult with no children in the U.S. is $21.54 per hour. That accounts for basic necessities like food, housing, transportation, etc. Given inflation and rising prices, an argument could be made that $46 per hour is simply a moderately good salary right now depending on where you live.

Jobs that pay $46 an hour

There are a variety of jobs that pay around $46 per hour or more. Here are some examples:

- Registered Nurse – The average RN makes $41/hr, but experienced RNs in specialized units or states/cities with high demand can make over $46/hr.

- Software Developer – The average software developer earns around $50/hr, with senior developers earning well over $46/hr. High-paid developers work at major tech companies.

- Electrical Engineer – Experienced electrical engineers can make $45-$60 per hour once they move beyond entry-level positions. Those with sought-after skills command the highest salaries.

- Accountant – CPAs and accountants with specialized certifications can make $46/hr and up at mid-size and large corporate firms. Public accountants and auditors also earn salaries in this range.

- Data Scientist – As demand for data analytics grows, experienced data scientists now earn $45-$60/hr at major companies. Those with advanced credentials tend to earn towards the higher end.

- Plumber – Licensed plumbers and pipefitters charge around $70-$120 per hour for their services, earning a median of $55 per hour.

- Electrician – Similarly, licensed electricians can charge $50-$100 for hourly service calls, earning around $46 per hour.

- Freelance Consultant – Independent management consultants, financial consultants, and IT consultants often charge between $60-$150 per hour, delivering a healthy hourly rate.

Can You Live Off $46 An Hour?

Whether $46 an hour provides a livable wage depends largely on where you live and your lifestyle. For context, someone earning $46 an hour and working 40 hour weeks would earn around $95,000 per year. Here’s a look at how far that salary could go in different circumstances:

For a single person living in a smaller town or rural area in the Midwest or South, $95,000 would provide a very comfortable, livable wage. You could afford a nice apartment or even a small house, decent car, healthcare, entertainment, and savings on that salary alone. However, in a high-cost city like San Francisco or New York, you’d find it much harder to get by on $95,000 annually as a single resident. While doable, you’d likely need roommates, would struggle to buy property, and would have less disposable income.

For a family with kids, $95,000 provides a solid middle-class lifestyle in most regions of the country. While not enough to be considered wealthy, that income allows for a nice suburban house, 1-2 family cars, regular vacations, and decent savings. But in major coastal cities, supporting a family on that salary alone would require careful budgeting and living further from the urban core. Costs like childcare could also consume more of the budget.

The bottom line is that $46 an hour is certainly a livable wage for a single person or family in many areas, but not necessarily in high-cost major metro regions. Location, lifestyle factors, and number of household earners play a big role. But that income provides a level of comfort and financial flexibility not available to lower wage earners.

The impact of inflation on the value of $46 an hour

With U.S. inflation recently reaching 40-year highs above 9%, the value of $46 an hour has been negatively impacted. Higher inflation drives up prices for necessities like food, housing, transportation, and healthcare. This means your paycheck doesn’t go as far at the grocery store or gas pump as it used to.

Over the past year alone, inflation has significantly reduced real wages and consumers’ purchasing power. While an hourly wage of $46 provides a decent standard of living in normal economic conditions, sky-high inflation right now is stretching budgets thin. Everything is considerably more expensive than it was just 2 years ago before the pandemic.

If the inflation rate averages 7% per year going forward, the real value of $46 an hour would decline considerably over the next decade. Your paycheck would likely increase slightly each year to help keep pace with some inflation. But the actual purchasing power would still be much less in 5-10 years if inflation remains high.

To maintain the same standard of living, your hourly earnings would need to increase each year by at least the rate of inflation. If not, your wage will slowly lose value in real terms. The impact of inflation really highlights the importance of periodically reassessing your salary and negotiating pay raises above inflation to maintain your financial wellbeing.

5 Ways To Increase Your Hourly Wage

For those currently earning less than $46 per hour, here are some steps that could help boost your wages:

- Ask for a raise – If you’ve been succeeding in your current role for some time, build a case for why you deserve higher pay and schedule a meeting with your manager. Come prepared with benchmark data on typical pay for your position and highlight your contributions.

- Find a higher paying job – Explore job listings in your field paying $45/hr and up and consider switching employers. More lucrative opportunities may exist at other companies.

- Develop specialized skills – Take classes to gain expertise in high-demand areas in your field. For example, accountants can take certification courses to become a CPA. Specialized skills lead to higher pay.

- Negotiate freelance work – Many skilled professionals earn $50-100+ per hour doing freelance consulting, coaching, or advising work outside their regular job.

- Relocate to a higher paying region – Major metro areas like San Francisco and New York often pay more for the same work. If your field pays better in a different city, consider relocating.

Putting in the effort to proactively increase your skillset and marketability can help substantially boost your earnings over time. Periodically evaluating your income relative to industry norms is also important. An incremental series of steps over many years is often needed to reach an hourly rate of $46.

Buying a car on $46 an hour

Making $46 an hour certainly provides enough income to afford a nice, new car should you choose to buy one. But experts typically recommend spending no more than 15% of your annual gross pay on a car purchase.

For someone earning $95,000 annually, 15% of gross pay is around $14,250. So with $46 an hour income, you can comfortably afford a car in the range of $14,000-$18,000. This provides plenty of options for a reliable used car in good condition, or a modest new car with basic features.

However, luxury vehicles or loaded SUVs over $40,000 would generally not be advisable on this salary despite being technically affordable with financing. Interest charges, insurance, maintenance and fuel costs make owning a luxury car a strain on $95k income.

When evaluating vehicles to buy on $46/hour wages, it’s important to consider:

- Affordability – Focus on prices 15% of your gross annual income or below

- Insurance/fuel costs – Opt for a car with lower operating costs

- Maintenance – Prioritize reliable models with lower maintenance needs

- Your needs – Choose a car size and features aligned with your lifestyle

With $46 an hour income, you can certainly buy a very nice car. But holding off on luxury vehicles and purchasing a capable used or basic new car is generally the smarter financial move. Avoid over-extending your budget and give yourself financial flexibility.

Can You Buy a House on $46 An Hour?

On an income of $46 an hour, or approximately $95,000 per year, buying a house is certainly possible depending on where you live and housing costs in your local market. Home prices and required down payments vary widely across the country.

As a rough guideline, you can afford to spend up to 3 times your gross annual income on a home purchase. So on $95k annual income from $46/hr wages, your maximum home buying budget would be around $285,000. Here are some examples of what’s feasible:

- In many Midwest, South, and Southwest markets, you can find nice starter homes for $200k-$280k that are affordable on this income. The mortgage with 10-20% down would be manageable.

- In moderate cost of living states like Texas or Georgia, you may be able to buy a larger suburban home for $250k-$350k with a 20% down payment.

- In very high cost markets like California and New York, buying a condo or townhome under $350k may be possible with sufficient savings. But single family homes are often unaffordable.

While buying a house is achievable in your region, it’s important to consider:

- Total home prices and whether they fit your budget

- Local home price appreciation rates

- Interest rates on mortgages

- Having at least 10-20% saved for a downpayment

- Closing costs and fees

- Property taxes and insurance costs

Overall, $46 an hour income allows you to buy a home in many real estate markets. But the specific type and price range of home will depend on your local prices and how much you have saved upfront.

Example Budget For $46 Per Hour

Here is an example monthly budget for someone earning $46 per hour while working 40 hours per week in a moderately priced region:

- Gross Monthly Income – $8,000

- Taxes (~25%) – $2,000

- 401k (10% pre-tax) – $800

Take Home Pay – $5,200

- Rent – $1,200

- Utilities – $200

- Car Payment – $300

- Car Insurance – $100

- Gas – $150

- Groceries – $450

- Eating Out – $250

- Entertainment/Hobbies – $200

- Health Insurance – $350

- Life Insurance – $80

- Cell Phone – $100

- Internet/Cable – $150

- Gym Membership – $50

Total Expenses – $3,580

Remaining Income – $1,620

Savings – $800

In this scenario, you’d be able to cover all basic living expenses, entertainment, insurance premiums, retirement savings, and still have $800 left over to put into savings or other goals each month. This allows building an emergency fund, saving for a down payment, paying off debt faster, or investing.

Of course expenses and budgets vary greatly by individual and region. Housing costs and taxes make the biggest impact. But in many areas, an hourly income of $46 provides the ability to live comfortably as a single person. While not enough to splurge constantly or become wealthy, this income affords you some financial flexibility.

In Summary

Making $46 an hour translates to an annual salary that can certainly support a decent standard of living in many parts of the country. While not riches, that level of pay allows you to cover costs, save money each month, buy a suitable home and car, and live comfortably in most regions. However, to maintain your purchasing power and financial wellbeing, monitoring inflation and seeking pay increases is crucial. An income that seems ample today might not feel as substantial in 5-10 years if living costs continue rising rapidly.