With rising inflation, an hourly wage of $41 may provide a comfortable living for some but barely get by for others. This article will break down exactly how much annual income you can expect at $41 per hour based on full-time and part-time schedules. We will calculate gross yearly pay and net salary after taxes. You’ll also learn how unpaid time off impacts actual annual earnings, and whether $41 per hour provides a livable wage. If you currently earn $41 an hour or aspire to, read on to see the yearly, monthly, biweekly, and weekly pay $41 per hour equals before and after taxes. We will look at jobs paying $41 hourly, examine inflation’s impact, provide tips to increase earnings, and evaluate sample budgets to determine if home or car buying is feasible. The goal is to give you a complete financial picture of what $41 an hour truly means.

Table of Contents

Convert $41 Per Hour to Weekly, Monthly, and Yearly Salary

Input your wage and hours per week to see how much you’ll make monthly, yearly and more.

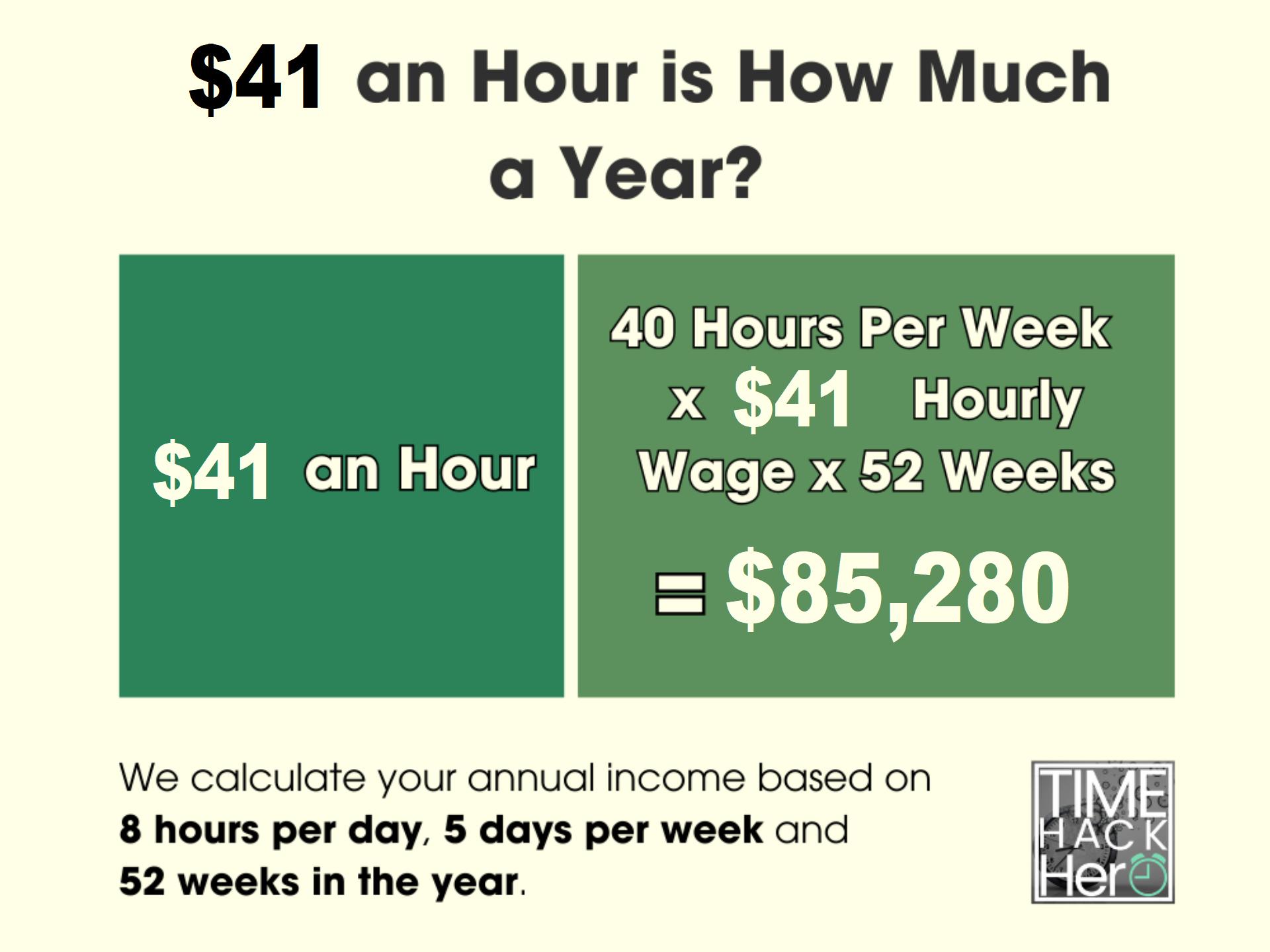

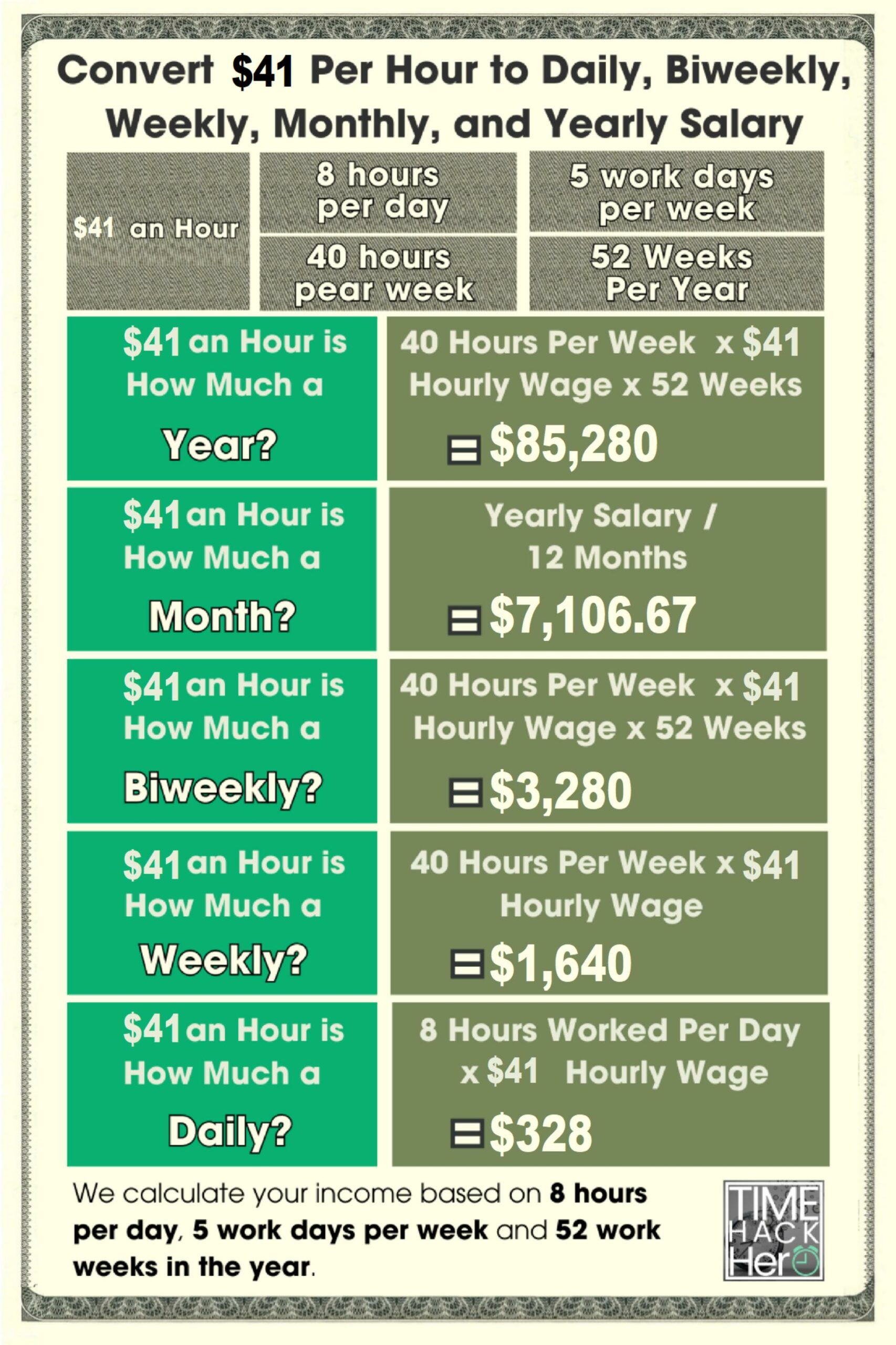

$41 an Hour is How Much a Year?

If you make $41 an hour, your yearly salary would be $85,280. We calculate your annual income based on 8 hours per day, 5 days per week and 52 weeks in the year.

Hours worked per week (40) x Hourly wage($41) x Weeks worked per year(52) = $85,280

$41 an Hour is How Much a Month?

If you make $41 an hour, your monthly salary would be $7,106.67. We calculated this number by dividing your annual income by 12 months.

Hours worked per week (40) x Hourly wage($41) x Weeks worked per year(52) / Months per Year(12) = $7,106.67

$41 an Hour is How Much a Biweekly?

If you make $41 an hour, your biweekly salary would be $3,280.

Hours worked per week (40) x Hourly wage($41) x 2 = $3,280

$41 an Hour is How Much a Week?

If you make $41 an hour, your weekly salary would be $1,640. Calculating based on 5 days per week and 8 hours each day.

Hours worked per week (40) x Hourly wage($41) = $1,640

$41 an Hour is How Much a Day?

If you make $41 an hour, your daily salary would be $328. We calculated your daily income based on 8 hours per day.

Hours worked per day (8) x Hourly wage($41) = $328

$41 an Hour is How Much a Year?

The basic formula to calculate your annual salary from an hourly wage is:

Hourly Rate x Hours Worked per Week x Number of Weeks Worked per Year = Annual Salary

So for a $20 per hour job:

$41 per hour x 40 hours per week x 52 weeks per year = $85,280

However, this simple calculation makes some assumptions:

- You will work 40 hours every week of the year

- You will not get any paid time off

Therefore, it represents your earnings if you worked every week of the year, without any vacation, holidays, or sick days.

Accounting for Paid Time Off

The $85,280 base salary does not yet factor in paid time off (PTO). Let’s assume the job provides:

- 2 weeks (10 days) paid vacation

- 6 paid holidays

- 3 paid sick days

This totals 19 paid days off, or nearly 4 weeks of PTO.

Importantly, this paid time off should not be deducted from the annual salary, since you still get paid for those days.

So with 4 weeks PTO, the annual salary would remain $85,280 .

Part time $41 an hour is How Much a Year?

Your annual income changes significantly if you work part-time and not full-time.

For example, let’s say you work 25 hours per week instead of 40. Here’s how you calculate your new yearly total:

$41 per hour x 25 hours per week x 52 weeks per year = $53,300

By working 15 fewer hours per week (25 instead of 40), your annual earnings at $41 an hour drop from $85,280 to $53,300.

That’s a $31,980 per year difference just by working part-time!

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $41 an hour:

| Hours Per Week | Earnings Per Week | Annual Earnings |

|---|---|---|

| 40 | $1,640 | $85,280 |

| 35 | $1,435 | $74,620 |

| 30 | $1,230 | $63,960 |

| 25 | $1,025 | $53,300 |

| 20 | $820 | $42,640 |

| 15 | $615 | $31,980 |

The more hours per week, the higher your total yearly earnings. But part-time work allows for more life balance if you don’t need the full salary.

$41 an Hour With Overtime is How Much a Year?

Now let’s look at how overtime can increase your annual earnings.

Overtime kicks in once you work more than 40 hours in a week. Typically, you earn 1.5x your regular hourly wage for overtime hours.

So if you make $41 per hour normally, you would make $61.50 per hour for any hours over 40 in a week.

Here’s an example:

- You work 45 hours in a Week

- 40 regular hours paid at $41 per hour = $1,640

- 5 overtime hours paid at $61.50 per hour = $307.50

- Your total one Week earnings =$1,640 + $307.50 = $1,947.50

If you worked 45 hours each week for 52 weeks, here’s how your annual earnings increase thanks to overtime pay:

$1,947.50 per week x 52 weeks per year = $101,270

That’s $15,990 more than you’d earn working just 40 hours per week at $41 an hour.

Overtime can add up! But also consider taxes and work-life balance when deciding on extra hours.

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $41 an hour:

| Overtime hours per work day | Hours Per Week | Earnings Per Week | Annual Earnings |

| 0 | 40 | $1,640 | $85,280 |

| 1 | 45 | $1,947.50 | $101,270 |

| 2 | 50 | $2,255 | $117,260 |

| 3 | 55 | $2,562.50 | $133,250 |

| 4 | 60 | $2,870 | $149,240 |

| 5 | 65 | $3,177.50 | $165,230 |

| 6 | 70 | $3,485 | $181,220 |

| 7 | 75 | $3,792.50 | $197,210 |

How Unpaid Time Off Impacts $41/Hour Yearly Earnings

So far we’ve assumed you work 52 paid weeks per year. Any unpaid time off will reduce your total income.

For example, let’s say you take 2 weeks of unpaid leave. That brings your paid weeks down to 50:

Hours worked per week (40) x Hourly wage($41) x Weeks worked per year(50) = $82,000 annual salary

With 2 weeks unpaid time off, your annual earnings at $41/hour would drop by $3,280.

The table below summarizes how your annual income changes depending on the number of weeks of unpaid leave.

| Weeks of unpaid leave | Paid weeks per year | Earnings Per Week | Annual Earnings |

| 0 | 52 | $1,640 | $85,280 |

| 1 | 51 | $1,640 | $83,640 |

| 2 | 50 | $1,640 | $82,000 |

| 3 | 49 | $1,640 | $80,360 |

| 4 | 48 | $1,640 | $78,720 |

| 5 | 47 | $1,640 | $77,080 |

| 6 | 46 | $1,640 | $75,440 |

| 7 | 45 | $1,640 | $73,800 |

Key Takeaways for $41 Hourly Wage

In summary, here are some key points on annual earnings when making $41 per hour:

- At 40 hours per week, you’ll earn $85,280 per year.

- Part-time of 30 hours/week results in $63,960 annual salary.

- Overtime pay can boost yearly earnings, e.g. $15,990 extra at 45 hours/week.

- Unpaid time off reduces your total income, around $3,280 less per 2 weeks off.

- Your specific situation and location impacts taxes and PTO.

Knowing your approximate annual salary and factors impacting it makes it easier to budget and plan your finances. The next step is calculating take-home pay after deductions like taxes.

$41 An Hour Is How Much A Year After Taxes

Figuring out your actual annual earnings based on an hourly wage can be complicated once taxes are taken into account. In addition to federal, state, and local income taxes, 7.65% of your gross pay also goes to Social Security and Medicare through FICA payroll taxes. So how much does $41 an hour equal per year after FICA and income taxes are deducted from your gross pay?

Below we’ll walk through the steps to calculate your annual net take home pay if you make $41 per hour. This will factor in estimated federal, FICA, state, and local taxes so you know exactly what to expect.

Factoring in Federal Income Tax

Your federal income tax will be a big chunk out of your gross pay. Federal tax rates range from 10% to 37%, depending on your tax bracket.

To estimate your federal income tax rate and liability:

Look up your federal income tax bracket based on your gross pay.

2023 tax brackets: single filers

| Tax rate | Taxable income bracket | Tax owed |

|---|---|---|

| 10% | $0 to $11,000. | 10% of taxable income. |

| 12% | $11,001 to $44,725. | $1,100 plus 12% of the amount over $11,000. |

| 22% | $44,726 to $95,375. | $5,147 plus 22% of the amount over $44,725. |

| 24% | $95,376 to $182,100. | $16,290 plus 24% of the amount over $95,375. |

| 32% | $182,101 to $231,250. | $37,104 plus 32% of the amount over $182,100. |

| 35% | $231,251 to $578,125. | $52,832 plus 35% of the amount over $231,250. |

| 37% | $578,126 or more. | $174,238.25 plus 37% of the amount over $578,125. |

For example, if you are single with $85,280 gross annual pay, your federal tax bracket is 22%.

Your estimated federal tax would be:

$5,147 + ($85,280 – $44,726) x 22% = $14,068.88

So at $41/hour with $85,280 gross pay, you would owe about $14,068.88 in federal income taxes.

Considering State Income Tax

In addition to federal tax, most states also charge a state income tax. State income tax rates range from about 1% to 13%, with most falling between 4% and 6%.

Key Takeaways

-

- California, Hawaii, New York, New Jersey, and Oregon have some of the highest state income tax rates.

- Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming don’t impose an income tax at all.

- Another 10 U.S states have a flat tax rate—everyone pays the same percentage regardless of how much they earn.

A State-by-State Comparison of Income Tax Rates

| STATE | TAX RATES | LOWEST AND HIGHEST INCOME BRACKETS |

|---|---|---|

| Alaska | 0% | None |

| Florida | 0% | None |

| Nevada | 0% | None |

| South Dakota | 0% | None |

| Tennessee | 0% | None |

| Texas | 0% | None |

| Washington | 0% | None |

| Wyoming | 0% | None |

| Colorado | 4.55% | Flat rate applies to all incomes |

| Illinois | 4.95% | Flat rate applies to all incomes |

| Indiana | 3.23% | Flat rate applies to all incomes |

| Kentucky | 5% | Flat rate applies to all incomes |

| Massachusetts | 5% | Flat rate applies to all incomes |

| New Hampshire | 5% | Flat rate on interest and dividend income only |

| North Carolina | 4.99% | Flat rate applies to all incomes |

| Pennsylvania | 3.07% | Flat rate applies to all incomes |

| Utah | 4.95% | Flat rate applies to all incomes |

| Michigan | 4.25% | Flat rate applies to all incomes |

| Arizona | 2.59% to 4.5% | $27,806 and $166,843 |

| Arkansas | 2% to 5.5% | $4,300 and $8,501 |

| California | 1% to 13.3% | $9,325 and $1 million |

| Connecticut | 3% to 6.99% | $10,000 and $500,000 |

| Delaware | 0% to 6.6% | $2,000 and $60,001 |

| Alabama | 2% to 5% | $500 and $3,001 |

| Georgia | 1% to 5.75% | $750 and $7,001 |

| Hawaii | 1.4% to 11% | $2,400 and $200,000 |

| Idaho | 1.125% to 6.5% | $1,568 and $7,939 |

| Iowa | 0.33% to 8.53% | $1,743 and $78,435 |

| Kansas | 3.1% to 5.7% | $15,000 and $30,000 |

| Louisiana | 1.85% to 4.25% | $12,500 and $50,001 |

| Maine | 5.8% to 7.15% | $23,000 and $54,450 |

| Maryland | 2% to 5.75% | $1,000 and $250,000 |

| Minnesota | 5.35% to 9.85% | $28,080 and $171,221 |

| Mississippi | 0% to 5% | $5,000 and $10,001 |

| Missouri | 1.5% to 5.3% | $1,121 and $8,968 |

| Montana | 1% to 6.75% | $2,900and $17,400 |

| Nebraska | 2.46% to 6.84% | $3,340 and $32,210 |

| New Jersey | 1.4% to 10.75% | $20,000 and $1 million |

| New Mexico | 1.7% to 5.9% | $5,500 and $210,000 |

| New York | 4% to 10.9% | $8,500 and $25 million |

| North Dakota | 1.1% to 2.9% | $41,775 and $458,350 |

| Ohio | 0% to 3.99% | $25,000 and $110,650 |

| Oklahoma | 0.25% to 4.75% | $1,000 and $7,200 |

| Oregon | 4.75% to 9.9% | $3,750 and $125,000 |

| Rhode Island | 3.75% to 5.99% | $68,200 and $155,050 |

| South Carolina | 0% to 7% | $3,110 and $15,560 |

| Vermont | 3.35% to 8.75% | $42,150 and $213,150 |

| Virginia | 2% to 5.75% | $3,000 and $17,001 |

| Washington, D.C. | 4% to 9.75% | $10,000 and $1 million |

| West Virginia | 3% to 6.5% | $10,000 and $60,000 |

| Wisconsin | 3.54% to 7.65% | $12,760 and $280,950 |

To estimate your state income tax:

Look up your state income tax rate based on your gross pay and filing status.

Multiply your gross annual pay by the state tax rate.

For example, if you live in Pennsylvania which has a flat 3.07% tax rate, your estimated state tax would be:

$85,280 gross pay x 3.07% PA tax rate = $2,618.10 estimated state income tax

So with $85,280 gross annual income, you would owe around in $2,618.10 Pennsylvania state income tax. Verify your specific state’s income tax rates.

Factoring in Local Taxes

Some cities and counties levy local income taxes ranging from 1-3% of taxable income.

To estimate potential local taxes you may owe:

- Check if your city or county charges a local income tax.

- If yes, look up the local income tax rate.

- Multiply your gross annual pay by the local tax rate.

For example, say you live in Columbus, OH which has a 2.5% local income tax. Your estimated local tax would be:

$85,280 gross pay x 2.5% local tax rate = $2,132 estimated local tax

So with $85,280 in gross earnings, you may owe around $2,132 in Columbus local income taxes. Verify rates for your own city/county.

Accounting for FICA Taxes (Social Security & Medicare)

FICA taxes are a combination of Social Security and Medicare taxes that equal 15.3% of your earnings. You are responsible for half of the total bill (7.65%), which includes a 6.2% Social Security tax and 1.45% Medicare tax on your earnings.

In 2023, only the first $160,200 of your earnings are subject to the Social Security tax

There is an additional 0.9% surtax on top of the standard 1.45% Medicare tax for those who earn over $200,000 (single filers) or $250,000 (joint filers).

To estimate your FICA tax payment:

$85,280 x 6.2% + $85,280 x 1.45% = $6,523.92

So you can expect to pay about $6,523.92 in Social Security and Medicare taxes out of your gross $85,280 in earnings.

Total Estimated Tax Payments

Based on the examples above, your total estimated tax payments would be:

Federal tax: $14,068.88

State tax: $2,618.10

Local tax: $2,132

FICA tax: $6,523.92

Total Estimated Tax: $25,342.90

Calculating Your Take Home Pay

To calculate your annual take home pay at $41 /hour:

1. Take your gross pay

2. Subtract your estimated total tax payments

$85,280 gross pay – $25,342.90 Total Estimated Tax = $59,937.10 Your Take Home Pay

n summary, if you make $41 per hour and work full-time, you would take home around $59,937.10 per year after federal, state, local , FICA taxes.

Your actual net income may vary depending on your specific tax situation. But this gives you a general idea of what to expect.

Convert $41 Per Hour to Yearly, Monthly, Biweekly, and Weekly Salary After Taxes

If you make $41 an hour and work full-time (40 hours per week), your estimated yearly salary would be $85,280 .

The $85,280 per year salary does not account for taxes. Federal, state, and local taxes will reduce your take-home pay. The amount withheld depends on your location, filing status, dependents, and other factors.

Just now during our calculation of $41 An Hour Is How Much A Year After Taxes, we assumed the following conditions:

- You are single with $85,280 gross annual pay, your federal tax bracket is 22 %.

- You live in Pennsylvania which has a flat 3.07% tax rate

- You live in Columbus, OH which has a 2.5% local income tax.

In the end, we calculated your Total Estimated Tax is $25,342.90 , Your Take Home Pay is $59,937.10 , Total tax rate is 29.72%.

So next we’ll use 29.72% as the estimated tax rate to calculate your weekly, biweekly, and monthly after-tax income.

$41 Per Hour to Yearly, Monthly, Biweekly, Weekly,and Week Salary After Taxes Table

| Income before taxes | Estimated Tax Rate | Income Taxes | After Tax Income | |

| Yearly Salary | $85,280 | 29.72% | $25,342.90 | $59,937.10 |

| Monthly Salary | $7,106.67 | 29.72% | $2,111.91 | $4,994.76 |

| BiWeekly Salary | $3,280 | 29.72% | $974.73 | $2,305.27 |

| Weekly Salary | $1,640 | 29.72% | $487.36 | $1,152.64 |

$41 an hour is how much a year after taxes

Here is the adjusted yearly salary after a 29.72% tax reduction:

-

- Yearly salary before taxes: $85,280

- Estimated tax rate: 29.72%

- Taxes owed (29.72% * $85,280 )= $25,342.90

- Yearly salary after taxes: $59,937.10

| Hourly Wage | Hours Worked Per Week | Weeks Worked Per Year | Total Yearly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Yearly Salary |

|---|---|---|---|---|---|---|

| $41 | 40 | 52 | $85,280 | 29.72% | $25,342.90 | $59,937.10 |

$41 an hour is how much a month after taxes

To calculate the monthly salary based on an hourly wage, you first need the yearly salary amount. Then divide by 12 months.

-

-

- Yearly salary before taxes at $41 per hour: $85,280

- Divided by 12 months per year: $85,280 / 12 = $7,106.67 per month

-

The monthly salary based on a 40 hour work week at $41 per hour is $7,106.67 before taxes.

After applying the estimated 29.72% tax rate, the monthly after-tax salary would be:

-

- Monthly before-tax salary: $7,106.67

- Estimated tax rate: 29.72%

- Taxes owed (29.72% * $7,106.67 )= $2,111.91

- Monthly after-tax salary: $4,994.76

Monthly Salary Based on $41 Per Hour

| Hourly Wage | Yearly Salary | Months Per Year | Before-Tax Monthly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Monthly Salary |

|---|---|---|---|---|---|---|

| $41 | $85,280 | 12 | $7,106.67 | 29.72% | $2,111.91 | $4,994.76 |

$41 an hour is how much biweekly after taxes

Many people are paid biweekly, meaning every other week. To calculate the biweekly pay at $41 per hour:

- Hourly wage: $41

- Hours worked per week: 40

- Weeks per biweekly pay period: 2

- $41 * 40 hours * 2 weeks = $3,280 biweekly

Applying the 29.72%estimated tax rate:

- Biweekly before-tax salary: $3,280

- Estimated tax rate: 29.72%

- Taxes owed (29.72% * $3,280 )= $974.73

- Biweekly after-tax salary: $2,305.27

Biweekly Salary at $41 Per Hour

| Hourly Wage | Hours Worked Per Week | Weeks Per Pay Period | Before-Tax Biweekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Biweekly Salary |

|---|---|---|---|---|---|---|

| $41 | 40 | 2 | $3,280 | 29.72% | $974.73 | $2,305.27 |

$41 an hour is how much weekly after taxes

To find the weekly salary based on an hourly wage, you need to know the number of hours worked per week. At 40 hours per week, the calculation is:

- Hourly wage: $41

- Hours worked per week: 40

- $41 * 40 hours = $1,640 per week

Accounting for the estimated 29.72% tax rate:

- Weekly before-tax salary: $1,640

- Estimated tax rate: 29.72%

- Taxes owed (29.72% * $1,640 )= $487.36

- Weekly after-tax salary: $1,152.64

Weekly Salary at $41 Per Hour

| Hourly Wage | Hours Worked Per Week | Before-Tax Weekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Weekly Salary |

|---|---|---|---|---|---|

| $41 | 40 | $1,640 | 29.72% | $487.36 | $1,152.64 |

Key Takeaways

- An hourly wage of $41 per hour equals a yearly salary of $85,280 before taxes, assuming a 40 hour work week.

- After accounting for an estimated 29.72% tax rate, the yearly after-tax salary is approximately $59,937.10 .

- On a monthly basis before taxes, $41 per hour equals $7,106.67 per month. After estimated taxes, the monthly take-home pay is about $4,994.76 .

- The before-tax weekly salary at $41 per hour is $1,640 . After taxes, the weekly take-home pay is approximately $1,152.64 .

- For biweekly pay, the pre-tax salary at $41 per hour is $3,280 . After estimated taxes, the biweekly take-home pay is around $2,305.27 .

Understanding annual, monthly, weekly, and biweekly salary equivalents based on an hourly wage is useful when budgeting and financial planning. Taxes make a significant difference in take-home pay, so be sure to account for them when making income conversions. Use this guide as a reference when making salary calculations.

What Is the Average Hourly Wage in the US?

Last Updated: Sep 1 2023

US Average Hourly Earnings is at a current level of $33.82, up from 33.74 last month and up from 32.43 one year ago. This is a change of 0.24% from last month and 4.29% from one year ago.

Average Hourly Earnings is the average dollars that a private employee makes per hour in the US. This metric is a part of one of the most important releases every month which includes unemployment numbers as well. This is normally released on the first Friday of every month. This metric is released by the Bureau of Labor Statistics (BLS).

What is the average salary in the U.S.?

Last Updated: July 18, 2023

The U.S. Bureau of Labor Statistics uses median salary data rather than averages to avoid skewed numbers from outlying high and low numbers. Median weekly earnings of the nation's 121.5 million full-time wage and salary workers were $1,100 in the second quarter of 2023, the U.S.

If a person works 52 weeks in the year, then this represents a national annual salary of $57,200.

Is $41 an Hour a Good Salary?

Whether $41 per hour is a good wage depends largely on where you live and your lifestyle. In many parts of the country, $41 an hour translates to an annual salary of around $85,000 if working full-time. This puts you solidly in the upper-middle class.

However, in high cost-of-living areas like New York City or San Francisco, this hourly rate affords a more middle-class lifestyle. It may allow you to afford a comfortable but modest home, regular vacations, and decent savings. Healthcare, childcare, and education costs will still strain your budget.

Overall, $41 an hour provides a good standard of living compared to median wages. The median hourly wage in the U.S. is around $20. But earning $41 an hour doesn’t make you rich, especially with the rising costs of housing, food, gas, and other expenses. You’ll need to budget wisely and limit luxuries to live comfortably.

Jobs that Pay $41 An Hour

Certain careers reliably pay around $41 per hour or more. Here are some common professions that offer this earnings potential:

- Registered Nurse – The average RN makes $35-$50 per hour, depending on specialization and location. Those working in hospitals, emergency rooms, or private practices earn towards the higher end.

- Electrical Engineer – Experienced electrical engineers can make $40-$60 per hour. Those with in-demand skills like circuit design or software integration sit at the top of the pay scale.

- Software Developer – Tech talent is highly valued, with software developers earning $30-$60 per hour. Expertise in languages like Java or Python boosts income potential.

- Plumber – Licensed plumbers average $45-$65 per hour. Master plumbers with several years of experience charge rates at the higher end.

- Elevator Mechanic – Elevator installers and repairers can bring in $35 to $55 per hour with overtime pay possibilities.

- Electrician – Licensed electricians typically make $25-$50 per hour. Those working union commercial jobs tend to earn towards the top end.

- Mechanical Engineer – Experienced mechanical engineers make $35-$55 per hour in fields like product design or robotics.

- Accountant – CPAs or accountants with senior titles can bill $40-$65 per hour at major firms. Taxes and auditing specialists are most lucrative.

The jobs above demonstrate the mix of trade skills, healthcare roles, and professional services that pay around $41 or more per hour. Experience level impacts earnings, but these careers offer the potential for this salary.

Can You Live Off $41 An Hour?

Living solely on $41 an hour requires carefully budgeting to cover not just basic expenses but also savings goals, medical bills, emergencies, and more. It can be done, but you’ll need to prioritize keeping housing, food, and transportation costs in check. Building an emergency fund is also essential.

With $41 an hour, a single person should be able to afford:

- A 1-bedroom apartment priced at around $1,350 per month

- A used car payment of $250 per month

- A grocery budget of $350 per month

- Utilities like electric, internet, and cell phone for $200

- Car insurance, gas, and maintenance of $140

- Retirement savings of 10-15% of income

- Budget for medical copays, prescriptions, clothing, entertainment, etc.

This budget would require sticking to economical housing, cooking at home frequently, and limiting costs like takeout or travel. But it allows saving for retirement, vacations, and goals while covering essential expenses.

For a family budget on $41 per hour, costs obviously increase. Housing, insurance, food, childcare, and other expenses for two or more will quickly add up. Minutes medical issues or large bills can also drain savings quickly. However, this income makes a reasonable middle-class family budget possible with very careful planning and spending.

The Impact of Inflation on $41 An Hour

With inflation recently reaching 40-year highs, incomes like $41 an hour have declining purchasing power. Essential costs like food, rent, electricity, and gasoline have rapidly increased, while wages fail to keep up.

For example, since January 2021:

- Food costs have risen over 10% due to factors like supply chain disruptions, labor shortages, and the war in Ukraine.

- Gas prices have spiked over 50% to record levels above $5 per gallon before retreating. Further volatility is expected.

- Electric bills are up 10-20% across many states as fuel prices rise.

- Rent has increased 12-15% nationally as demand outpaces supply. Prices in desirable areas have skyrocketed.

This rampant inflation erodes the value of $41 per hour significantly. Cost of living was over 8% higher in July 2022 than a year prior. So an hourly wage of $41 today purchases less than an equivalent salary in 2021. Salary demands must keep pace with inflation to maintain real earning power.

Absent meaningful wage growth, inflation will continue to hit Americans relying on fixed incomes from wages, retirement, or social security. With experts projecting elevated inflation for years, this remains concerning for $41 per hour earners trying to meet expenses.

5 Ways to Increase Your Hourly Wage

For those currently earning less than $41 per hour, several strategies can boost your earnings:

- Get trained – Complete certifications or advanced degrees related to high-paying fields like technology, healthcare, finance, or engineering. Specialized skills raise earnings potential.

- Switch industries – Look at salaries in thriving sectors like tech or construction vs. your current field. Changing careers could be lucrative.

- Ask for raises – If you’ve gained major experience, request a salary bump from your employer. Come armed with data on average pay rates.

- Find a higher paying job – Polish your resume and look for roles at different companies that offer better compensation.

- Negotiate hourly pay – When offered a position, negotiate the hourly or salary rate if below market averages.

Remember that with inflation, hourly wages must increase over time just to have the same buying power. Don’t remain stagnant at one pay rate for too long. Look for ways to boost earnings by $3-5 per hour over years through raises, job changes, promotions, or education. This steady progress can help you eventually earn $41 per hour or more.

Buying a Car on $41 An Hour

Making $41 per hour allows buying a fairly nice used car or economical new car. Experts recommend limiting auto loans to 20-30% of take home income, so aim for payments under $425 monthly on this salary.

For a used car priced around $12,000, expect financing payments of $250-275 per month for 4-5 years on average. This fits easily in a $41 per hour budget. Prioritize certified pre-owned models for reliability and warranty coverage.

If buying new, compact sedans or hatchbacks often sell for $18,000-$26,000. At 0-5% financing over 5-6 years, payments on a $22,000 car would be around $350 monthly. While manageable, opt for base models to save costs.

No matter your income, avoid stretching for luxury cars or models above your needs. Interest, insurance, gas, and repairs will strain your budget. Buy based on reliability, fuel economy, and total cost – not just monthly payment.

And if possible, purchase used cars with cash from your savings. That lets you avoid finance charges while keeping flexibility in your monthly budget. At $41 an hour, aim to pay cash for cars costing $7,000-$12,000.

Can You Buy a House on $41 An Hour?

Owning a home is challenging but possible on $41 an hour, depending on housing costs in your area. A good rule of thumb is to limit housing expenses to 30% of income. On $41 per hour, that equates to:

- Mortgage payment – Around $1,300 per month on a house.

- Down payment – At least 10-20% down, so $15,000-$20,000 saved up.

This allows purchasing a modest home for $170,000-$220,000 in most markets, while avoiding excessive mortgage debt. In high-cost areas like California or New York, condos or townhomes near $400,000 are more realistic.

Getting approved for a mortgage requires good credit and steady employment history. Lenders like to see minimal existing debts beyond the home loan.

Owning also involves taxes, insurance, maintenance and utilities, so budget $450-$850 monthly beyond just the mortgage payment. And make sure to also save separately for other goals.

Home ownership is challenging but possible on $41 an hour with the right expectations. Opt for affordable, smaller homes to start building equity rather than stretching beyond your budget.

Example Budget for $41 Per Hour

Here is a sample monthly budget for living reasonably on $41 an hour:

Housing:

- Rent: $1,300

- Utilities: $175

- Internet: $50

Transportation:

- Used car payment: $250

- Insurance: $85

- Gas: $130

Food:

- Groceries: $350

- Dining out: $125

Debt payments:

- Student loan: $200

- Credit card: $100

Entertainment:

- Streaming services: $40

- Other entertainment: $100

Miscellaneous:

- Cell phone: $80

- Clothing: $75

- Medical copays: $30

- Personal care: $50

- Pet care: $50

Savings:

- Retirement account: $410

- Emergency fund: $300

Total monthly expenses: $4,100

This allows saving nearly $900 per month while meeting needs and allowing some flexibility in the budget. Keep variable costs like dining out controlled, and aim to pay off debts quickly.

Everyone’s expenses differ, but this demonstrates maintaining a solid middle-class lifestyle on $41 an hour. Track your actual spending to create a realistic budget.

In Summary

Working for $41 per hour provides a relatively comfortable income compared to median wages. However, in today’s economy with high inflation, this pay rate does not make you wealthy. Living solely on $41 an hour requires carefully budgeting and limiting expenses, especially in high-cost regions.

With the right lifestyle choices, this income allows covering basic needs, saving for retirement, and affording occasional luxuries. Home ownership is achievable but often requires sacrifices. Cars must be economical and housing modest to avoid overextending your budget.

Boosting your earnings beyond $41 an hour involves pursuing education and new job opportunities. Especially as costs of living rise, aim for steady pay growth throughout your career. But an hourly salary of $41 puts you on solid ground financially compared to many Americans if spent wisely. Setting budgets and financial goals helps stretch your income effectively.