Have you started a new job that pays an attractive hourly rate of $40? Or are you exploring different career options and want to understand the earning potential of a $40 per hour wage? Calculating your approximate annual salary from an hourly pay rate is straightforward, but requires accounting for important factors like hours worked, paid time off, and overtime.

In this comprehensive guide, we’ll walk through the key steps for estimating your total yearly earnings if you make $40 per hour. Whether you’re an experienced professional considering a role change or just starting your career, read on to find out the answer to the big question: How much annual income can I expect if I make $40/hour?

Table of Contents

Convert $40 Per Hour to Estimated Weekly, Monthly, and Yearly Totals

Use this calculator to estimate your weekly, monthly and annual earnings based on $40 per hour and your typical hours.

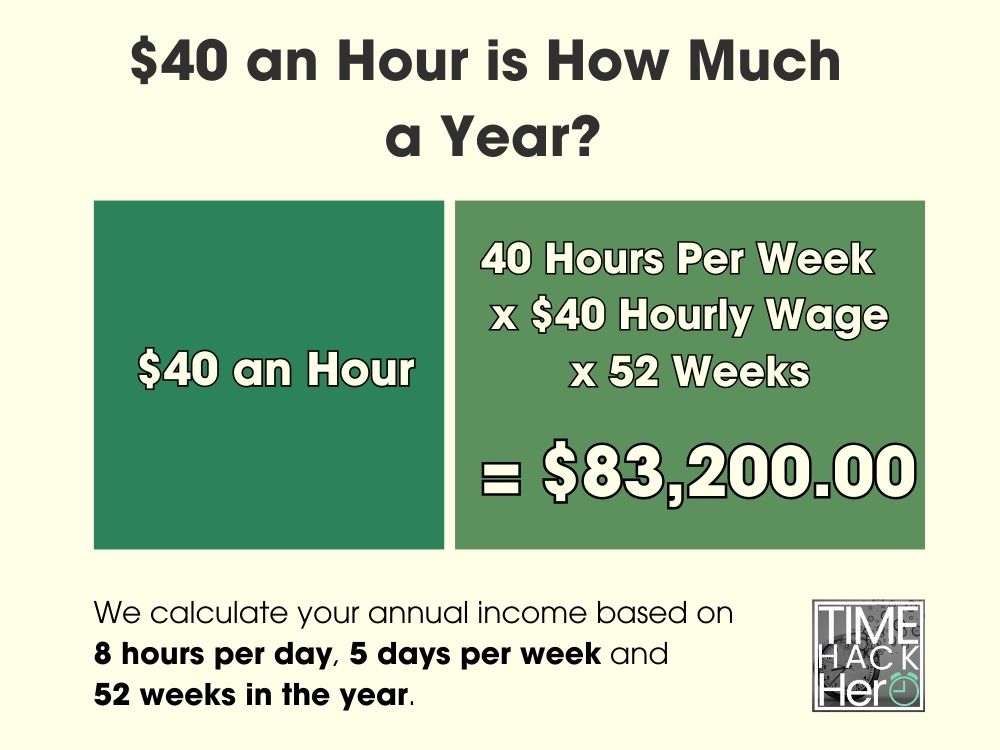

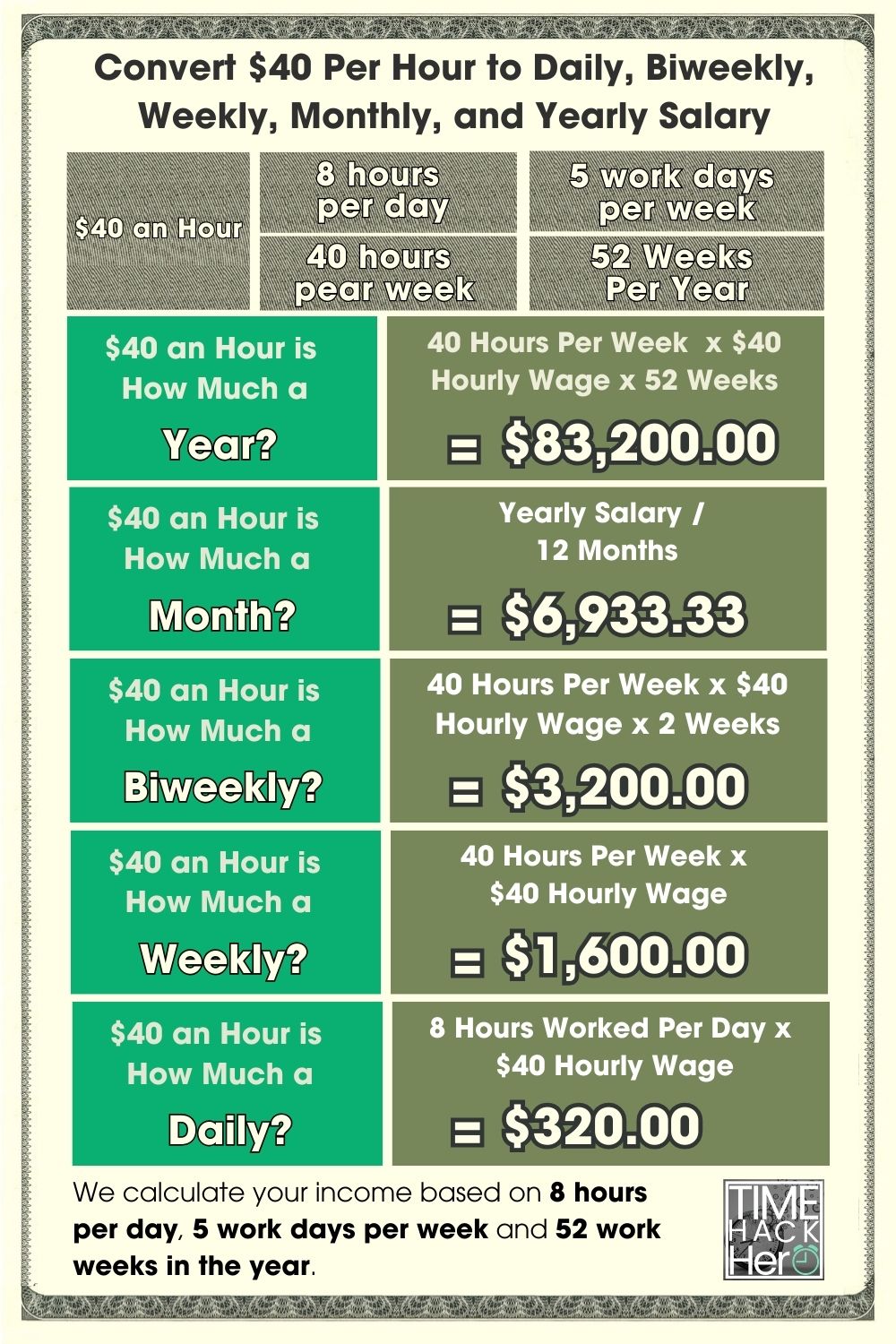

$40 an Hour is How Much Per Year?

Working 40 hours per week year-round, your estimated annual earnings at $40/hour would be $83,200.

This is calculated as:

Hourly wage ($40) x Hours per week (40) x Weeks per year (52) = $83,200

$40 an Hour is How Much Per Month?

Assuming 40 hour weeks, your estimated monthly income at $40/hour is $6,933.33.

This is your annual salary divided by 12 months:

$83,200 / 12 months = $6,933.33

$40 an Hour is How Much Biweekly?

If paid biweekly, you would earn $3,200 per biweekly period at $40/hour.

Hourly wage ($40) x Biweekly hours (80) = $3,200

$40 an Hour is How Much Per Week?

Your weekly earnings at $40/hour for 40 hours would be $1,600.

Hourly wage ($40) x Hours per week (40) = $1,600

$40 an Hour is How Much Per Day?

For a standard 8 hour workday, your estimated daily earnings at $40/hour are $320.

Hourly wage ($40) x Hours per day (8) = $320

$40 an Hour is How Much Per Year?

The basic formula for calculating annual salary from an hourly wage is:

Hourly Rate x Hours Worked per Week x Number of Weeks Worked per Year = Annual Salary

For $40 per hour:

$40/hour x 40 hours/week x 52 weeks/year = $83,200

However, this assumes you work 40 hour weeks year-round with no time off. Let’s factor in paid time off and other variables.

Accounting for Paid Time Off

The base calculation doesn’t yet include paid holidays, vacation, sick time, etc. Let’s assume you get:

- 2 weeks (10 days) paid vacation

- 6 paid holidays

- 3 paid sick days

That’s 19 paid days off, equal to nearly 4 weeks PTO.

Importantly, this paid time off does not decrease your annual pay, since you still get paid for those days.

So with 4 weeks PTO, your annual salary at $40/hour remains $83,200.

Part Time $40 an Hour is How Much Per Year?

If you work part-time instead of 40 hours full-time, your annual pay at $40/hour drops significantly.

For example, at 30 hours per week:

$40/hour x 30 hours/week x 52 weeks/year = $62,400

That’s over $20,000 less annually than working 40 hour weeks.

Here’s how your annual pay changes at $40/hour based on hours worked:

| Hours Per Week | Annual Earnings |

|---|---|

| 40 | $83,200 |

| 35 | $72,800 |

| 30 | $62,400 |

| 25 | $52,000 |

| 20 | $41,600 |

When your hourly wage is fixed, total annual compensation depends heavily on hours worked.

$40 an Hour With Overtime is How Much Per Year?

Next let’s examine how overtime can increase your annual earnings.

Overtime kicks in after 40 hours in a week, typically paid at 1.5x your regular wage.

For example:

- You work 45 hours in Week 1

- 40 regular hours at $40/hour = $1,600

- 5 overtime hours at 1.5 x $40 = $300

- Your total Week 1 earnings = $1,600 + $300 = $1,900

If you worked 45 overtime hours every week for a year at 1.5x pay, your estimated annual earnings would be:

$1,900 per week x 52 weeks = $98,800

That’s over $15,000 more per year compared to no overtime pay.

Overtime can significantly boost your annual income, but may push you into a higher tax bracket.

$40 an Hour With Unpaid Time Off is How Much Per Year?

The last factor that can reduce your annual pay is unpaid time off.

Let’s say you take 2 weeks off without pay, leaving you with 50 paid weeks instead of 52.

At $1,600 per 40-hour week, 2 weeks unpaid time off would reduce your annual earnings to:

$1,600 per week x 50 paid weeks = $80,000

That’s $3,200 less than if you worked 52 paid weeks.

In general, more unpaid time off means lower total annual compensation at a fixed hourly wage.

Putting It All Together

To summarize, the key factors determining your annual pay at an hourly rate are:

- Hours worked per week

- Hourly wage

- Overtime pay

- Unpaid time off

Here’s how your annual earnings would vary at $40/hour based on full-time vs part-time status:

| Weeks Worked | Hours Per Week | Annual Earnings | |

|---|---|---|---|

| Full-Time | 52 | 40 | $83,200 |

| Part-Time | 52 | 30 | $62,400 |

| Overtime | 52 | 45 | $98,800 |

| Unpaid Time Off | 50 | 40 | $80,000 |

In conclusion, estimating your potential annual compensation from an hourly wage requires factoring in key variables like hours, PTO, and overtime. This guide provides an easy framework for calculating your approximate yearly earnings at various hourly rates based on your specific work situation. Whether you are exploring a new job opportunity or planning future career moves, use these examples to help forecast your income potential from an hourly wage.

$40 An Hour Is How Much A Year After Taxes

Figuring out your real yearly earnings based on an hourly wage gets tricky once taxes enter the equation. In addition to federal, state, and local income taxes, 7.65% of your gross pay goes to Social Security and Medicare through FICA payroll taxes. So how much does $40 per hour equal annually after FICA and income taxes are deducted from your gross income?

Below we’ll go through the steps to estimate your annual net take home pay if you make $40 per hour. This factors in approximated federal, FICA, state, and local taxes so you know exactly what to expect.

Factoring in Federal Income Tax

Your federal income tax will take a large portion of your gross pay. Federal tax rates range from 10% to 37%, depending on your tax bracket.

To estimate your federal income tax rate and liability:

- Look up your federal income tax bracket based on your gross income.

2023 tax brackets for single filers:

| Tax Rate | Taxable Income Bracket | Tax Owed |

|---|---|---|

| 10% | $0 to $11,000 | 10% of taxable income |

| 12% | $11,001 to $44,725 | $1,100 plus 12% of the amount over $11,000 |

| 22% | $44,726 to $95,375 | $5,147 plus 22% of the amount over $44,725 |

| 24% | $95,376 to $182,100 | $16,290 plus 24% of the amount over $95,375 |

| 32% | $182,101 to $231,250 | $37,104 plus 32% of the amount over $182,100 |

| 35% | $231,251 to $578,125 | $52,832 plus 35% of the amount over $231,250 |

| 37% | $578,126 or more | $174,238.25 plus 37% of the amount over $578,125 |

For example, if your gross annual income is $83,200 as a single filer, your federal tax bracket is 22%.

Your estimated federal tax would be:

$11,000 x 10% + ($44,725 – $11,000) x 12% + ($83,200 – $44,725) x 22% = $13611.5

So at $40/hour with $83,200 gross income, you would owe about $13611.5 in federal income taxes.

Considering State Income Tax

In addition to federal tax, most states charge state income tax. State income tax rates range from about 1% to 13%, with most between 4% to 6%.

Key Points

- California, Hawaii, New York, New Jersey, and Oregon have some of the highest state income tax rates.

- Seven U.S. states have no income tax.

- Ten other states have a flat tax rate, meaning everyone pays the same percentage regardless of income.

Look up your state income tax rate based on your gross income and filing status.

Multiply your gross pay by the state tax rate to get your estimated state tax amount.

For example, if you live in Pennsylvania with a 3.07% flat tax rate, your estimated state tax would be:

$83,200 gross income x 3.07% state tax rate = $2,554.24 estimated state tax

So with $83,200 gross annual income, you would owe about $2,554.24 in Pennsylvania state income tax. Verify rates for your particular state.

Considering Local Taxes

Some cities and counties charge local income taxes ranging from 1% to 3% of gross income generally.

To estimate potential local taxes:

- Check if your city/county has a local income tax.

- If yes, look up the local income tax rate.

- Multiply your gross income by the local tax rate to estimate local tax.

For example, say you live in Columbus, OH which has a 2.5% local tax rate. Your estimated local tax would be:

$83,200 gross income x 2.5% local tax rate = $2,080 estimated local tax

So you may owe around $2,080 in Columbus local taxes. Verify rates for your specific area.

Accounting for FICA Taxes (Social Security & Medicare)

On top of income taxes, 7.65% of your gross pay goes to FICA taxes for Social Security and Medicare:

- 6.2% for Social Security

- 1.45% for Medicare

To estimate FICA taxes:

$83,200 gross income x 7.65% FICA rate = $6,365.80

So expect to pay about $6,365.80 in Social Security and Medicare taxes from your $83,200 gross earnings.

Total Estimated Tax Payments

Based on the examples above, your total estimated tax payments would be:

- Federal tax: $13611.5

- State tax: $2,554.24

- Local tax: $2,080

- FICA tax: $6,365.80

Total Estimated Tax: 24,611.54

Your total estimated tax payments come out to around $24,611.54 per year.

Calculating Your Take Home Pay

To get your annual take home pay at $40/hour:

- Take your gross income

- Subtract your estimated total tax payments

$83,200 gross income – $24,611.54 Total Estimated Tax = $58,588.46 Your Take Home Pay

In summary, if you make $40 per hour and work full-time, you would take home about $58,588.46 per year after federal, state, local, and FICA taxes.

Your actual net income may vary based on your tax situation. But this provides a general estimate of what to expect annually.

Is $40 an Hour a Good Salary?

In most parts of the country, $40 an hour would be considered an excellent wage and provide a comfortable middle-class income. It is nearly 3x higher than the federal minimum wage of $7.25 per hour.

However, for skilled workers in high cost-of-living cities like San Francisco and New York, $40 an hour may only equate to a moderate middle-class income. The key factors determining whether $40/hour is a good salary include:

- Geographic location – Cost of living in your city heavily impacts salary needs. $40/hour goes much further in Ohio vs. California.

- Housing costs – Big monthly rent or mortgage payments eat up income quickly. Managing housing costs is key.

- Family size – Single/dual income households can live well on $40/hour. But supporting a family multiplies expenses quickly.

- Career field – Some fields like finance, tech, medicine pay higher, so $40 may be on the low end for experienced workers.

- Debt obligations – Student loans, credit cards, auto loans drain available income. Keeping debt low is important.

- Health benefits – Quality medical insurance saves substantially on healthcare costs.

Considering these factors, $40/hour provides a comfortable middle-class income for individuals and smaller households in average- or low-cost areas. But for larger families in expensive cities, $40/hour may only provide more basic needs.

Jobs that pay $40 an hour

There are a variety of professional careers, skilled trades, and technical roles that typically pay around $40 per hour:

- Registered Nurses

- Web Developers

- Accountants

- Electricians

- HVAC Technicians

- Software Developers

- Massage Therapists

- Paralegals

- Radiologic Technologists

- Diagnostic Medical Sonographers

- Commercial Pilots

- Court Reporters

- Respiratory Therapists

- Occupational Therapy Assistants

- Insurance Sales Agents

- Police Officers

- Real Estate Agents

- Plumbers

- Machinists

- Architectural Drafters

- Claims Adjusters

Many of these occupations require specialized licenses, training, or certifications. Roles in healthcare, tech, accounting, and the skilled trades commonly pay around $40/hour. Sales jobs and self-employed work like real estate also average $40/hour but depend heavily on commissions and market conditions.

Here is a summary of the typical entry-level education and training requirements for jobs paying approximately $40/hour:

| Job Title | Typical Education/Training |

|---|---|

| Registered Nurse | Bachelor’s Degree in Nursing |

| Accountant | Bachelor’s Degree in Accounting |

| Web Developer | Bachelor’s Degree in CS |

| Electrician | Apprenticeship/On-the-job Training |

| HVAC Tech | Postsecondary Certificate/Apprenticeship |

| Software Developer | Bachelor’s in Computer Science |

| Massage Therapist | Postsecondary Certificate/Diploma |

| Paralegal | Associate’s Degree |

| Radiologic Tech | Associate’s Degree |

| Diagnostic Medical Sonographer | Associate’s Degree |

| Respiratory Therapist | Associate’s Degree |

| Police Officer | HS Diploma + Police Academy |

| Claims Adjuster | HS Diploma + On-the-job Training |

Can You Live Off $40 An Hour?

Whether or not $40 an hour provides an adequate income depends heavily on your location, household size, and expenses.

For example, a single person or child-free couple could live very comfortably on $40/hour in most Midwest, South, or Southwest cities. However, for a family of four in New York City or San Francisco, expenses could quickly exceed income at this pay rate.

Here are some key factors impacting the livability of $40/hour:

- Housing Costs – Paying a mortgage or rent is often people’s largest monthly bill. Managing housing expenses is key to controlling costs. Living close to work can save substantially on transportation expenses as well.

- Debt Obligations – Student loans, credit cards, auto loans, and high interest debt drain disposable income. Aggressively paying down debt improves cash flow.

- Family Size – Single people or couples can more easily live on $40/hour. But childcare, education, food, healthcare, etc. costs add up fast for larger families.

- Savings – Building up emergency savings and contributing to retirement accounts every month helps build financial security. But saving is difficult at lower income levels.

- Medical Costs – Quality insurance through an employer helps manage healthcare costs. Out-of-pocket medical bills can devastate budgets.

Overall, $40/hour provides a comfortable middle-class income for individuals or couples, especially if living in a lower cost area. But for families with kids in a high COL metro, $40/hour would require diligent budgeting and most likely supplemental income.

The impact of inflation on the value of $40 an hour

Inflation reduces the purchasing power and real earnings value of a fixed wage like $40 per hour over time. As the costs of goods and services rise, $40 buys fewer and fewer hours of labor.

Here is how inflation has diminished the real value of $40/hour over the past two decades:

- In 2000, $40/hour equaled $66.98 per hour in 2022 dollars adjusted for inflation.

- In 2010, $40/hour equaled $50.95 per hour in 2022 dollars.

- In 2015, $40/hour equaled $46.36 per hour in 2022 dollars.

This demonstrates how inflation steadily eats into incomes. What felt like a solid middle-class salary decades ago may only equate to a lower-middle-class life today.

The average inflation rate over the past 10 years has been approximately 2% annually. But in June 2022, inflation hit 9.1% representing the highest increase since 1981. At sustained elevated inflation rates, the value of wages drops quickly.

If we assume 8% inflation next year, $40/hour today will only equate to around $36.80/hour of purchasing power next year. That’s why seeking cost of living or inflation-adjusted raises is important to maintain a consistent standard of living.

Overall, inflation has a large negative impact on fixed wage earners over time. Finding ways to increase income is crucial to counteract the effects of rising prices.

5 Ways To Increase Your Hourly Wage?

While $40 per hour represents a healthy income, inflation will erode its value over the long-run. Here are 5 potential strategies for boosting your earnings over time:

- Ask for raises/promotions – If you’re a strong performer, negotiate a raise every 12-24 months to outpace inflation. Shoot for 5-10% increase.

- Change jobs/companies – Leverage competitive job offers to increase your salary. Job switching often results in higher pay.

- Finish additional education – Complete a college degree or earn a job-relevant master’s degree to quality for higher salaries.

- Gain specialty certifications – Obtain advanced certifications that are valued in your field to command higher compensation.

- Start a side business – Start freelancing, consulting, or launch a small business to generate supplemental income.

- Relocate to lower cost area – $40/hour goes much further in Ohio or Texas than in NYC for example. Changing geography can stretch your dollars.

- Negotiate remote work – Relocating while keeping big city salary boosts income value substantially.

- Lower living costs – Get roommates, downsize housing, limit eating out and discretionary purchases.

Pursuing raises, education, certifications, side income, and managing costs are great ways to boost income and purchasing power over the course of your career.

Buying a car on $40 an hour

Is buying a car realistic if you make $40 per hour? The answer depends on factors like:

- Cost of vehicle

- Down payment amount

- Interest rate on auto loan

- Length of loan term

- Insurance costs

- Gas, maintenance, and repair costs

As a rule of thumb, limit auto loan payments to 10-15% of take-home pay. At $40/hour full-time, plan to spend $550-$800 per month maximum on a car payment plus insurance.

Here are some examples of affordable vehicle options on $40/hour:

- New compact sedan ($22,000), 20% down ($4,400), 5-year loan at 4% interest = $360 monthly payment

- Used SUV ($18,000), 10% down ($1,800), 5-year loan at 6% interest = $315 monthly payment

- Allow $100-$150 for insurance and $150-$200 for gas monthly

Aim for used vehicles priced below $20,000 that have good gas mileage. Shop interest rates at banks/credit unions. Remember to factor in higher maintenance costs of older used cars.

Overall, buying a nice used car in the $15,000 to $22,000 range is a realistic goal on $40 an hour as long as you budget accordingly.

Can You Buy a House on $40 An Hour?

Is buying a house possible on a salary of $40/hour? The answer depends primarily on four factors:

1. Down payment savings – Most lenders require 10-20% down to qualify for a mortgage with a reasonable interest rate. At $40/hour you should be able to save $15k-$30k over time for a down payment on a modest home.

2. Housing prices in your area – In expensive markets like San Francisco or NYC, median home prices exceed $1 million. At $40/hour your budget will only support a lower priced suburban home or condo/townhome. Look for average prices between $250k-$400k.

3. Debt levels – The more existing debt you have (student loans, credit cards, auto loans, etc), the harder qualifying for a large mortgage may be. Keep debt low.

4. Credit score – You’ll want a credit score of at least 720 to get the best mortgage interest rates. Make all credit and loan payments on time.

Here’s a sample monthly budget for buying a $300,000 home at $40/hour:

- Mortgage payment (20% down, 4% rate) = $1,150

- Property tax (1.5%) = $375

- Home insurance = $100

- Total housing costs = ~$1,625

This is just under 30% of gross monthly income from $40/hour full-time. Generally you want total housing expenses below 30% of income.

So home ownership on $40/hour is very feasible with proper budgeting, saving for a down payment, controlling other debts, and establishing excellent credit.

Example Budget For $40 Per Hour

Below is an example monthly budget for an individual earning $40 per hour while living in Texas:

| Expense | Amount |

|---|---|

| Gross Monthly Income | $6,920 |

| Federal Taxes | $831 |

| FICA Taxes | $529 |

| State/Local Taxes | $208 |

| Total Taxes | $1,568 |

| Take Home Pay | $5,352 |

| Rent | $1,200 |

| Groceries / Dining Out | $600 |

| Utilities | $200 |

| Car Payment | $375 |

| Auto Insurance | $125 |

| Gasoline | $150 |

| Entertainment | $200 |

| Clothing / Personal Care | $100 |

| Internet/Cell Phone | $125 |

| Gym membership | $50 |

| Total Expenses | $3,175 |

| Remaining Income | $2,087 |

The $2,087 leftover each month could be used for goals like:

- Increasing emergency fund savings

- Paying down debts

- Retirement account contributions

- Vacation savings

- Additional mortgage principal payments

This budget would provide a very comfortable lifestyle for an individual or couple living in Texas or another area with low cost of living. There is ample opportunity for both short and long-term savings.

Someone supporting a whole family on $40/hour would likely need to supplement with additional income via a spouse/partner in order to maintain this standard of living, depending on family size. Overall this income provides a nice middle-class lifestyle.

In Summary

At $40 per hour full time, a single person or smaller household can live very comfortably in most areas of the country with proper budgeting and money management. Those supporting larger families or living in high cost-of-living cities may find $40/hour more challenging but still livable with care taken to control housing/living costs.

The key takeaways are:

- Location makes a huge impact on livability primarily due to housing costs.

- Keeping fixed monthly costs like rent, auto loans, and other debts within a limited budget percentage.

- Maintaining excellent credit scores to qualify for the best loan rates.

- Investing in education, training, and skills development to increase income over time.

- Monitoring spending diligently and limiting lifestyle inflation.

While inflation will always gradually reduce purchasing power, $40 an hour still provides a very nice middle-class salary in most of the country that allows workers to live well and build financial security if they manage their money wisely.