With inflation on the rise, more and more Americans are looking closely at their hourly wages and salaries to determine if they can maintain their standard of living. An hourly rate of $36 per hour may sound high at first glance, but how much does this translate to when calculated as a weekly, monthly, or yearly salary? And how much could someone reasonably expect to take home after accounting for taxes and benefits?

In this article, we will calculate $36 per hour as a weekly, monthly, and yearly salary both before and after typical taxes and deductions. We will also look at whether $36 an hour is considered a good salary in today’s economy and what kind of lifestyle it could afford. To do this, we will create sample budgets to see if $36 an hour is enough to live comfortably, buy a car, or purchase a home. With the right planning, even an hourly wage can go a long way. Understanding exactly how an hourly or salaried pay structure works is key to making informed decisions about your career and finances.

Table of Contents

Convert $36 Per Hour to Weekly, Monthly, and Yearly Salary

Input your wage and hours per week to see how much you’ll make monthly, yearly and more.

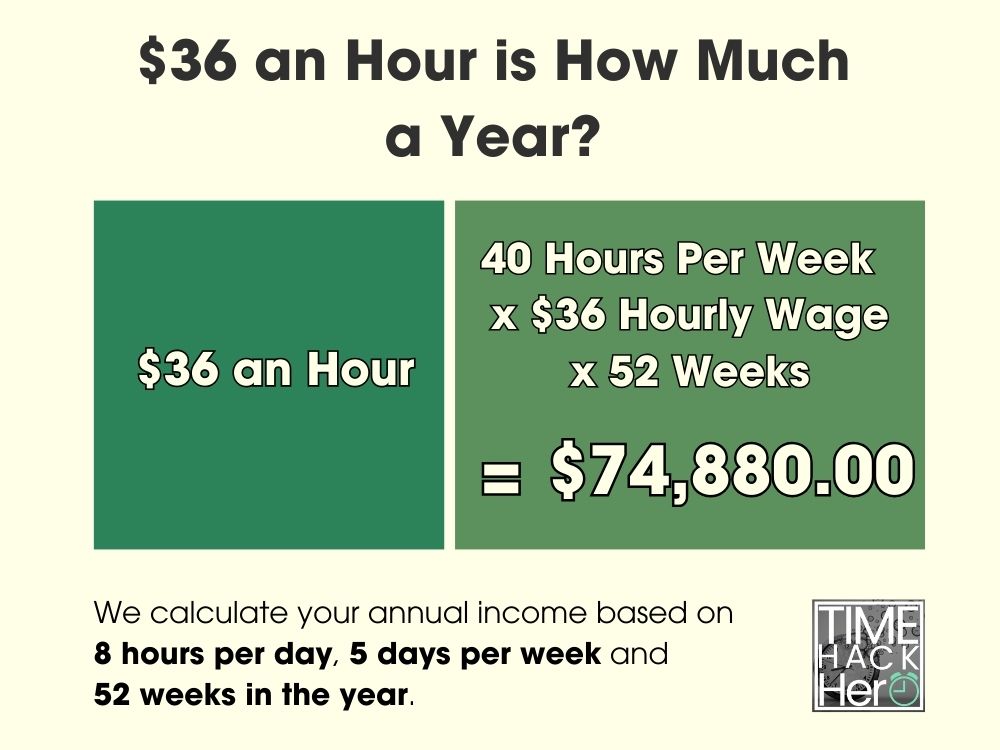

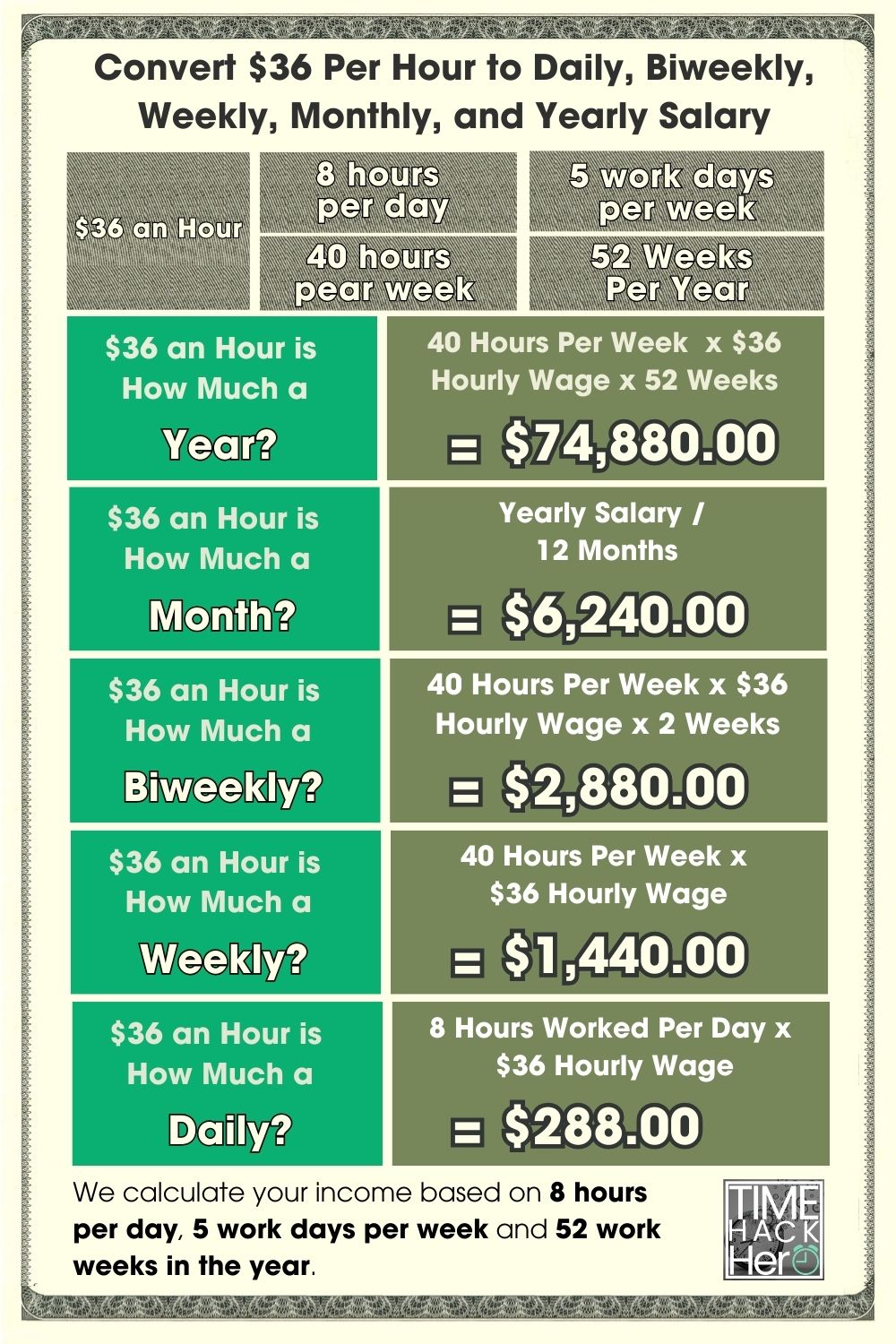

$36 an Hour is How Much a Year?

If you make $36 an hour, your yearly salary would be $74,880. We calculate your annual income based on 8 hours per day, 5 days per week and 52 weeks in the year.

Hours worked per week (40) x Hourly wage($36) x Weeks worked per year(52) = $74,880

$36 an Hour is How Much a Month?

If you make $36 an hour, your monthly salary would be $6,240. We calculated this number by dividing your annual income by 12 months.

Hours worked per week (40) x Hourly wage($36) x Weeks worked per year(52) / Months per Year(12) = $6,240

$36 an Hour is How Much a Biweekly?

If you make $36 an hour, your biweekly salary would be $2,880.

Hours worked per week (40) x Hourly wage($36) x 2 = $2,880

$36 an Hour is How Much a Week?

If you make $36 an hour, your weekly salary would be $1,440. Calculating based on 5 days per week and 8 hours each day.

Hours worked per week (40) x Hourly wage($36) = $1,440

$36 an Hour is How Much a Day?

If you make $36 an hour, your daily salary would be $288. We calculated your daily income based on 8 hours per day.

Hours worked per day (8) x Hourly wage($36) = $288

$36 an Hour is How Much a Year?

The basic formula to calculate your annual salary from an hourly wage is:

Hourly Rate x Hours Worked per Week x Number of Weeks Worked per Year = Annual Salary

So for a $20 per hour job:

$36 per hour x 40 hours per week x 52 weeks per year = $74,880

However, this simple calculation makes some assumptions:

- You will work 40 hours every week of the year

- You will not get any paid time off

Therefore, it represents your earnings if you worked every week of the year, without any vacation, holidays, or sick days.

Accounting for Paid Time Off

The $74,880 base salary does not yet factor in paid time off (PTO). Let’s assume the job provides:

- 2 weeks (10 days) paid vacation

- 6 paid holidays

- 3 paid sick days

This totals 19 paid days off, or nearly 4 weeks of PTO.

Importantly, this paid time off should not be deducted from the annual salary, since you still get paid for those days.

So with 4 weeks PTO, the annual salary would remain $74,880 .

Part time $36 an hour is How Much a Year?

Your annual income changes significantly if you work part-time and not full-time.

For example, let’s say you work 30 hours per week instead of 40. Here’s how you calculate your new yearly total:

$36 per hour x 30 hours per week x 52 weeks per year = $56,160

By working 10 fewer hours per week (30 instead of 40), your annual earnings at $36 an hour drop from $74,880 to $56,160.

That’s a $18,720 per year difference just by working part-time!

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $36 an hour:

| Hours Per Week | Earnings Per Week | Annual Earnings |

|---|---|---|

| 40 | $1,440 | $74,880 |

| 35 | $1,260 | $65,520 |

| 30 | $1,080 | $56,160 |

| 25 | $900 | $46,800 |

| 20 | $720 | $37,440 |

| 15 | $540 | $28,080 |

The more hours per week, the higher your total yearly earnings. But part-time work allows for more life balance if you don’t need the full salary.

$36 an Hour With Overtime is How Much a Year?

Now let’s look at how overtime can increase your annual earnings.

Overtime kicks in once you work more than 40 hours in a week. Typically, you earn 1.5x your regular hourly wage for overtime hours.

So if you make $36 per hour normally, you would make $54 per hour for any hours over 40 in a week.

Here’s an example:

- You work 45 hours in a Week

- 40 regular hours paid at $36 per hour = $1,440

- 5 overtime hours paid at $54 per hour = $270

- Your total one Week earnings =$1,440 + $270 = $1,710

If you worked 45 hours each week for 52 weeks, here’s how your annual earnings increase thanks to overtime pay:

$1,710 per week x 52 weeks per year = $88,920

That’s $14,040 more than you’d earn working just 40 hours per week at $36 an hour.

Overtime can add up! But also consider taxes and work-life balance when deciding on extra hours.

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $36 an hour:

| Overtime hours per work day | Hours Per Week | Earnings Per Week | Annual Earnings |

| 0 | 40 | $1,440 | $74,880 |

| 1 | 45 | $1,710 | $88,920 |

| 2 | 50 | $1,980 | $102,960 |

| 3 | 55 | $2,250 | $117,000 |

| 4 | 60 | $2,520 | $131,040 |

| 5 | 65 | $2,790 | $145,080 |

| 6 | 70 | $3,060 | $159,120 |

| 7 | 75 | $3,330 | $173,160 |

How Unpaid Time Off Impacts $36/Hour Yearly Earnings

So far we’ve assumed you work 52 paid weeks per year. Any unpaid time off will reduce your total income.

For example, let’s say you take 2 weeks of unpaid leave. That brings your paid weeks down to 50:

Hours worked per week (40) x Hourly wage($36) x Weeks worked per year(50) = $72,000 annual salary

With 2 weeks unpaid time off, your annual earnings at $36/hour would drop by $2,880.

The table below summarizes how your annual income changes depending on the number of weeks of unpaid leave.

| Weeks of unpaid leave | Paid weeks per year | Earnings Per Week | Annual Earnings |

| 0 | 52 | $1,440 | $74,880 |

| 1 | 51 | $1,440 | $73,440 |

| 2 | 50 | $1,440 | $72,000 |

| 3 | 49 | $1,440 | $70,560 |

| 4 | 48 | $1,440 | $69,120 |

| 5 | 47 | $1,440 | $67,680 |

| 6 | 46 | $1,440 | $66,240 |

| 7 | 45 | $1,440 | $64,800 |

Key Takeaways for $36 Hourly Wage

In summary, here are some key points on annual earnings when making $36 per hour:

- At 40 hours per week, you’ll earn $74,880 per year.

- Part-time of 30 hours/week results in $56,160 annual salary.

- Overtime pay can boost yearly earnings, e.g. $14,040 extra at 45 hours/week.

- Unpaid time off reduces your total income, around $2,880 less per 2 weeks off.

- Your specific situation and location impacts taxes and PTO.

Knowing your approximate annual salary and factors impacting it makes it easier to budget and plan your finances. The next step is calculating take-home pay after deductions like taxes.

$36 An Hour Is How Much A Year After Taxes

Figuring out your actual annual earnings based on an hourly wage can be complicated once taxes are taken into account. In addition to federal, state, and local income taxes, 7.65% of your gross pay also goes to Social Security and Medicare through FICA payroll taxes. So how much does $36 an hour equal per year after FICA and income taxes are deducted from your gross pay?

Below we’ll walk through the steps to calculate your annual net take home pay if you make $36 per hour. This will factor in estimated federal, FICA, state, and local taxes so you know exactly what to expect.

Factoring in Federal Income Tax

Your federal income tax will be a big chunk out of your gross pay. Federal tax rates range from 10% to 37%, depending on your tax bracket.

To estimate your federal income tax rate and liability:

Look up your federal income tax bracket based on your gross pay.

2023 tax brackets: single filers

| Tax rate | Taxable income bracket | Tax owed |

|---|---|---|

| 10% | $0 to $11,000. | 10% of taxable income. |

| 12% | $11,001 to $44,725. | $1,100 plus 12% of the amount over $11,000. |

| 22% | $44,726 to $95,375. | $5,147 plus 22% of the amount over $44,725. |

| 24% | $95,376 to $182,100. | $16,290 plus 24% of the amount over $95,375. |

| 32% | $182,101 to $231,250. | $37,104 plus 32% of the amount over $182,100. |

| 35% | $231,251 to $578,125. | $52,832 plus 35% of the amount over $231,250. |

| 37% | $578,126 or more. | $174,238.25 plus 37% of the amount over $578,125. |

For example, if you are single with $74,880 gross annual pay, your federal tax bracket is 22%.

Your estimated federal tax would be:

$5,147 + ($74,880 – $44,726) x 22% = $11,780.88

So at $36/hour with $74,880 gross pay, you would owe about $11,780.88 in federal income taxes.

Considering State Income Tax

In addition to federal tax, most states also charge a state income tax. State income tax rates range from about 1% to 13%, with most falling between 4% and 6%.

Key Takeaways

-

- California, Hawaii, New York, New Jersey, and Oregon have some of the highest state income tax rates.

- Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming don’t impose an income tax at all.

- Another 10 U.S states have a flat tax rate—everyone pays the same percentage regardless of how much they earn.

A State-by-State Comparison of Income Tax Rates

| STATE | TAX RATES | LOWEST AND HIGHEST INCOME BRACKETS |

|---|---|---|

| Alaska | 0% | None |

| Florida | 0% | None |

| Nevada | 0% | None |

| South Dakota | 0% | None |

| Tennessee | 0% | None |

| Texas | 0% | None |

| Washington | 0% | None |

| Wyoming | 0% | None |

| Colorado | 4.55% | Flat rate applies to all incomes |

| Illinois | 4.95% | Flat rate applies to all incomes |

| Indiana | 3.23% | Flat rate applies to all incomes |

| Kentucky | 5% | Flat rate applies to all incomes |

| Massachusetts | 5% | Flat rate applies to all incomes |

| New Hampshire | 5% | Flat rate on interest and dividend income only |

| North Carolina | 4.99% | Flat rate applies to all incomes |

| Pennsylvania | 3.07% | Flat rate applies to all incomes |

| Utah | 4.95% | Flat rate applies to all incomes |

| Michigan | 4.25% | Flat rate applies to all incomes |

| Arizona | 2.59% to 4.5% | $27,806 and $166,843 |

| Arkansas | 2% to 5.5% | $4,300 and $8,501 |

| California | 1% to 13.3% | $9,325 and $1 million |

| Connecticut | 3% to 6.99% | $10,000 and $500,000 |

| Delaware | 0% to 6.6% | $2,000 and $60,001 |

| Alabama | 2% to 5% | $500 and $3,001 |

| Georgia | 1% to 5.75% | $750 and $7,001 |

| Hawaii | 1.4% to 11% | $2,400 and $200,000 |

| Idaho | 1.125% to 6.5% | $1,568 and $7,939 |

| Iowa | 0.33% to 8.53% | $1,743 and $78,435 |

| Kansas | 3.1% to 5.7% | $15,000 and $30,000 |

| Louisiana | 1.85% to 4.25% | $12,500 and $50,001 |

| Maine | 5.8% to 7.15% | $23,000 and $54,450 |

| Maryland | 2% to 5.75% | $1,000 and $250,000 |

| Minnesota | 5.35% to 9.85% | $28,080 and $171,221 |

| Mississippi | 0% to 5% | $5,000 and $10,001 |

| Missouri | 1.5% to 5.3% | $1,121 and $8,968 |

| Montana | 1% to 6.75% | $2,900and $17,400 |

| Nebraska | 2.46% to 6.84% | $3,340 and $32,210 |

| New Jersey | 1.4% to 10.75% | $20,000 and $1 million |

| New Mexico | 1.7% to 5.9% | $5,500 and $210,000 |

| New York | 4% to 10.9% | $8,500 and $25 million |

| North Dakota | 1.1% to 2.9% | $41,775 and $458,350 |

| Ohio | 0% to 3.99% | $25,000 and $110,650 |

| Oklahoma | 0.25% to 4.75% | $1,000 and $7,200 |

| Oregon | 4.75% to 9.9% | $3,750 and $125,000 |

| Rhode Island | 3.75% to 5.99% | $68,200 and $155,050 |

| South Carolina | 0% to 7% | $3,110 and $15,560 |

| Vermont | 3.35% to 8.75% | $42,150 and $213,150 |

| Virginia | 2% to 5.75% | $3,000 and $17,001 |

| Washington, D.C. | 4% to 9.75% | $10,000 and $1 million |

| West Virginia | 3% to 6.5% | $10,000 and $60,000 |

| Wisconsin | 3.54% to 7.65% | $12,760 and $280,950 |

To estimate your state income tax:

Look up your state income tax rate based on your gross pay and filing status.

Multiply your gross annual pay by the state tax rate.

For example, if you live in Pennsylvania which has a flat 3.07% tax rate, your estimated state tax would be:

$74,880 gross pay x 3.07% PA tax rate = $2,298.82 estimated state income tax

So with $74,880 gross annual income, you would owe around in $2,298.82 Pennsylvania state income tax. Verify your specific state’s income tax rates.

Factoring in Local Taxes

Some cities and counties levy local income taxes ranging from 1-3% of taxable income.

To estimate potential local taxes you may owe:

- Check if your city or county charges a local income tax.

- If yes, look up the local income tax rate.

- Multiply your gross annual pay by the local tax rate.

For example, say you live in Columbus, OH which has a 2.5% local income tax. Your estimated local tax would be:

$74,880 gross pay x 2.5% local tax rate = $1,872 estimated local tax

So with $74,880 in gross earnings, you may owe around $1,872 in Columbus local income taxes. Verify rates for your own city/county.

Accounting for FICA Taxes (Social Security & Medicare)

FICA taxes are a combination of Social Security and Medicare taxes that equal 15.3% of your earnings. You are responsible for half of the total bill (7.65%), which includes a 6.2% Social Security tax and 1.45% Medicare tax on your earnings.

In 2023, only the first $160,200 of your earnings are subject to the Social Security tax

There is an additional 0.9% surtax on top of the standard 1.45% Medicare tax for those who earn over $200,000 (single filers) or $250,000 (joint filers).

To estimate your FICA tax payment:

$74,880 x 6.2% + $74,880 x 1.45% = $5,728.32

So you can expect to pay about $5,728.32 in Social Security and Medicare taxes out of your gross $74,880 in earnings.

Total Estimated Tax Payments

Based on the examples above, your total estimated tax payments would be:

Federal tax: $11,780.88

State tax: $2,298.82

Local tax: $1,872

FICA tax: $5,728.32

Total Estimated Tax: $21,680.02

Calculating Your Take Home Pay

To calculate your annual take home pay at $36 /hour:

1. Take your gross pay

2. Subtract your estimated total tax payments

$74,880 gross pay – $21,680.02 Total Estimated Tax = $53,199.98 Your Take Home Pay

n summary, if you make $36 per hour and work full-time, you would take home around $53,199.98 per year after federal, state, local , FICA taxes.

Your actual net income may vary depending on your specific tax situation. But this gives you a general idea of what to expect.

Convert $36 Per Hour to Yearly, Monthly, Biweekly, and Weekly Salary After Taxes

If you make $36 an hour and work full-time (40 hours per week), your estimated yearly salary would be $74,880 .

The $74,880 per year salary does not account for taxes. Federal, state, and local taxes will reduce your take-home pay. The amount withheld depends on your location, filing status, dependents, and other factors.

Just now during our calculation of $36 An Hour Is How Much A Year After Taxes, we assumed the following conditions:

- You are single with $74,880 gross annual pay, your federal tax bracket is 22 %.

- You live in Pennsylvania which has a flat 3.07% tax rate

- You live in Columbus, OH which has a 2.5% local income tax.

In the end, we calculated your Total Estimated Tax is $21,680.02 , Your Take Home Pay is $53,199.98 , Total tax rate is 28.95%.

So next we’ll use 28.95% as the estimated tax rate to calculate your weekly, biweekly, and monthly after-tax income.

$36 Per Hour to Yearly, Monthly, Biweekly, Weekly,and Week Salary After Taxes Table

| Income before taxes | Estimated Tax Rate | Income Taxes | After Tax Income | |

| Yearly Salary | $74,880 | 28.95% | $21,680.02 | $53,199.98 |

| Monthly Salary | $6,240 | 28.95% | $1,806.67 | $4,433.33 |

| BiWeekly Salary | $2,880 | 28.95% | $833.85 | $2,046.15 |

| Weekly Salary | $1,440 | 28.95% | $416.92 | $1,023.08 |

$36 an hour is how much a year after taxes

Here is the adjusted yearly salary after a 28.95% tax reduction:

-

- Yearly salary before taxes: $74,880

- Estimated tax rate: 28.95%

- Taxes owed (28.95% * $74,880 )= $21,680.02

- Yearly salary after taxes: $53,199.98

| Hourly Wage | Hours Worked Per Week | Weeks Worked Per Year | Total Yearly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Yearly Salary |

|---|---|---|---|---|---|---|

| $36 | 40 | 52 | $74,880 | 28.95% | $21,680.02 | $53,199.98 |

$36 an hour is how much a month after taxes

To calculate the monthly salary based on an hourly wage, you first need the yearly salary amount. Then divide by 12 months.

-

-

- Yearly salary before taxes at $36 per hour: $74,880

- Divided by 12 months per year: $74,880 / 12 = $6,240 per month

-

The monthly salary based on a 40 hour work week at $36 per hour is $6,240 before taxes.

After applying the estimated 28.95% tax rate, the monthly after-tax salary would be:

-

- Monthly before-tax salary: $6,240

- Estimated tax rate: 28.95%

- Taxes owed (28.95% * $6,240 )= $1,806.67

- Monthly after-tax salary: $4,433.33

Monthly Salary Based on $36 Per Hour

| Hourly Wage | Yearly Salary | Months Per Year | Before-Tax Monthly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Monthly Salary |

|---|---|---|---|---|---|---|

| $36 | $74,880 | 12 | $6,240 | 28.95% | $1,806.67 | $4,433.33 |

$36 an hour is how much biweekly after taxes

Many people are paid biweekly, meaning every other week. To calculate the biweekly pay at $36 per hour:

- Hourly wage: $36

- Hours worked per week: 40

- Weeks per biweekly pay period: 2

- $36 * 40 hours * 2 weeks = $2,880 biweekly

Applying the 28.95%estimated tax rate:

- Biweekly before-tax salary: $2,880

- Estimated tax rate: 28.95%

- Taxes owed (28.95% * $2,880 )= $833.85

- Biweekly after-tax salary: $2,046.15

Biweekly Salary at $36 Per Hour

| Hourly Wage | Hours Worked Per Week | Weeks Per Pay Period | Before-Tax Biweekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Biweekly Salary |

|---|---|---|---|---|---|---|

| $36 | 40 | 2 | $2,880 | 28.95% | $833.85 | $2,046.15 |

$36 an hour is how much weekly after taxes

To find the weekly salary based on an hourly wage, you need to know the number of hours worked per week. At 40 hours per week, the calculation is:

- Hourly wage: $36

- Hours worked per week: 40

- $36 * 40 hours = $1,440 per week

Accounting for the estimated 28.95% tax rate:

- Weekly before-tax salary: $1,440

- Estimated tax rate: 28.95%

- Taxes owed (28.95% * $1,440 )= $416.92

- Weekly after-tax salary: $1,023.08

Weekly Salary at $36 Per Hour

| Hourly Wage | Hours Worked Per Week | Before-Tax Weekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Weekly Salary |

|---|---|---|---|---|---|

| $36 | 40 | $1,440 | 28.95% | $416.92 | $1,023.08 |

Key Takeaways

- An hourly wage of $36 per hour equals a yearly salary of $74,880 before taxes, assuming a 40 hour work week.

- After accounting for an estimated 28.95% tax rate, the yearly after-tax salary is approximately $53,199.98 .

- On a monthly basis before taxes, $36 per hour equals $6,240 per month. After estimated taxes, the monthly take-home pay is about $4,433.33 .

- The before-tax weekly salary at $36 per hour is $1,440 . After taxes, the weekly take-home pay is approximately $1,023.08 .

- For biweekly pay, the pre-tax salary at $36 per hour is $2,880 . After estimated taxes, the biweekly take-home pay is around $2,046.15 .

Understanding annual, monthly, weekly, and biweekly salary equivalents based on an hourly wage is useful when budgeting and financial planning. Taxes make a significant difference in take-home pay, so be sure to account for them when making income conversions. Use this guide as a reference when making salary calculations.

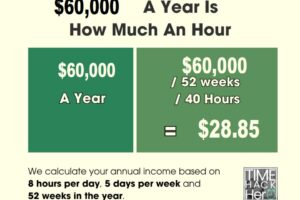

What Is the Average Hourly Wage in the US?

Last Updated: Sep 1 2023

US Average Hourly Earnings is at a current level of $33.82, up from 33.74 last month and up from 32.43 one year ago. This is a change of 0.24% from last month and 4.29% from one year ago.

Average Hourly Earnings is the average dollars that a private employee makes per hour in the US. This metric is a part of one of the most important releases every month which includes unemployment numbers as well. This is normally released on the first Friday of every month. This metric is released by the Bureau of Labor Statistics (BLS).

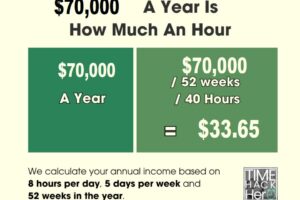

What is the average salary in the U.S.?

Last Updated: July 18, 2023

The U.S. Bureau of Labor Statistics uses median salary data rather than averages to avoid skewed numbers from outlying high and low numbers. Median weekly earnings of the nation's 121.5 million full-time wage and salary workers were $1,100 in the second quarter of 2023, the U.S.

If a person works 52 weeks in the year, then this represents a national annual salary of $57,200.

Is $36 an Hour a Good Salary?

Whether or not $36 an hour is considered a good salary depends on your location, expenses, debt, and career aspirations. Based on a 40 hour work week, $36 an hour equates to an annual salary of $74,880. The average annual salary in the United States is around $56,310, so $36 an hour is well above what the typical American worker earns.

For a single person with minimal expenses and debt, $36 an hour can provide a relatively comfortable lifestyle in most areas of the country. However, for someone with a family to support or a lot of existing debt, this hourly wage may still mean living paycheck to paycheck. Those residing in high cost-of-living cities like New York and San Francisco will also find $36 an hour to be just getting by.

Ultimately, $36 an hour is a decent wage compared to the national average and minimum wage jobs. Yet for many positions requiring a college degree or specialized skills, it may not be considered an exceptionally high salary. Each person’s financial situation is unique, so $36 an hour could be a dream come true for some, while barely making ends meet for others.

Jobs that pay $36 an hour

There are a variety of occupations that typically pay around $36 per hour. Here are some examples:

- Registered Nurse – The average RN makes $36.22 per hour, according to the Bureau of Labor Statistics. Nursing is projected to be one of the fastest growing occupations over the next decade.

- Web Developer – Experienced web developers can earn $35-$45 per hour on average. Programming skills are highly desired in today’s digital economy.

- Electrician – Licensed electricians charge an average hourly rate of $36, but overtime and premium pay can push that even higher. Trade skills like electrical work are in demand.

- Plumber – Similar to electricians, plumbers average around $36 per hour but can make more including overtime pay. Plumbing expertise will be needed as infrastructure continues to age.

- Real Estate Agent – Successful real estate agents can easily earn over $36 an hour, but income is commissioned based. The top 10% make $112,000 annually.

- Massage Therapist – Those with experience and regular clients can make $35-$45 per hour, including tips. Healthcare and wellness services are a growing field.

- Financial Analyst – Analysts with financial modeling skills and expertise can bill $35 to $50 per hour as self-employed consultants. A degree in finance or accounting is typically required.

The jobs listed offer the earning potential of $36 an hour or more. However, higher wages often come with extensive education, training, and expertise. Those willing to invest in their skills can access higher paying roles.

Can You Live Off $36 An Hour?

Whether or not $36 an hour is enough to live on depends largely on the cost of living in your city and your personal lifestyle. For a single person without children in a relatively low cost area, $36 an hour can provide a comfortable standard of living. However, for those with families to support or living in major metropolitan areas, this wage may mean cutting things close each month.

To determine if you can realistically live on $36 an hour, consider these factors:

- Housing – Housing costs like rent or a mortgage payment typically make up the largest portion of one’s budget. Do local housing prices align with what you would make on $36 an hour?

- Debt obligations – What existing debts like student loans, car payments and credit cards do you need to factor into your budget? High debt payments can constrain a budget.

- Healthcare – Are you getting employer provided health insurance? Without it, you’ll have to account for premiums and out-of-pocket costs in your budget.

- Family size – More children means higher expenses. You’ll need to account for costs like childcare, food, clothing, etc.

- Location – How far does your paycheck go in your city? $36 an hour does not take you as far in NYC as it would in Boise, Idaho.

Carefully look at your unique financial situation and lifestyle needs. For those with minimal obligations, $36 an hour can absolutely be enough. But for larger families or those with lots of existing debt, it may be tough to get by in higher cost areas. Perform a detailed analysis of your income versus expenses.

The impact of inflation on the value of $36 an hour

With historically high inflation in 2022, the real value of hourly wages like $36 an hour has decreased. High inflation leads to an increase in overall prices for things like food, rent, clothing, and other living expenses.

If inflation runs at 7% annually, a $36 per hour wage one year would only have the same purchasing power as $33.48 the next year. While you would still earn the numerical wage of $36 an hour, you wouldn’t be able to buy as much with it due to inflation eating away at the real value.

Accounting for even moderate 3-4% annual inflation means a $36 hourly wage slowly declines in actual purchasing power year after year. For example, after five straight years of 4% inflation, the buying power of $36 an hour drops to $31.26.

This illustrates why most workers desire a cost of living increase that matches or exceeds the inflation rate each year. Otherwise, inflation silently erodes what you can actually buy with your supposedly fixed wage.

Those earning $36 an hour feel this inflation impact directly at the grocery store and gas pump. If hourly pay fails to keep pace with rising prices, a tight budget gets even tighter. Looking forward, focus on acquiring skills to merit pay increases greater than inflation.

5 Ways To Increase Your Hourly Wage

While $36 an hour is a respectable wage, you may aspire to earn even more. Here are 5 potential ways to increase your hourly pay:

1. Ask for a raise – If you’re doing great work for your employer, build a case for why you deserve a raise and schedule a meeting with your manager. Come prepared with market data and examples of your contributions. Timing it well with company budgets can help.

2. Seek a promotion – Rather than just asking for a raise, look for ways to be promoted into roles with more responsibility and higher pay grades. Take on leadership projects and skills to grow within your company.

3. Build new skills – Look for skills that are valuable yet underutilized in your industry, and work on developing them. Specialized skills in high demand can garner higher pay. Consider taking classes or getting certified.

4. Freelance or consult – Look for side projects to take on as a freelancer or consultant. Having another stream of income from billable hours is a fast way to increase your overall hourly earnings.

5. Switch companies – Research what companies are paying for your role in the job market. Leverage offers from other employers as negotiating power. Be willing to switch jobs for substantially higher pay.

The more competitive and in-demand your skills, the more bargaining power you have to increase your hourly wage. Ramp up efforts in professional development, networking, and researching higher paying job opportunities. With the right skills and strategy, you can realistically increase your earnings over time.

Buying a car on $36 an hour

Is it feasible to buy a car when you make $36 an hour? The answer largely depends on the type of car you purchase, any downpayment amount, and the financing terms available.

For example, if you purchase an economy car like a Honda Civic for $25,000 with a 10% downpayment of $2,500, your loan amount would be $22,500. Assuming you qualify for a 4% interest rate on a 5 year loan, your monthly car payment would be around $400.

Accounting for costs like car insurance, gas, maintenance and repairs, your total monthly vehicle expenses would likely range from $600 – $700. That’s a sizable portion of your monthly take home pay from a $36 an hour job, but may be manageable if you budget accordingly.

However, if you wish to purchase a more expensive luxury vehicle, the monthly payments and overall costs will be much higher. A $50,000 car with 10% down would equal a $667 monthly payment, along with substantially higher insurance rates. In addition, repairs and maintenance are typically more costly on high-end import vehicles.

The bottom line is that buying a modestly priced economy car on $36 an hour is feasible for most single individuals. But aiming for a luxury vehicle that’s double the price would likely stretch your budget beyond comfort. Focus on buying a reliable used car that meets your needs without breaking the bank. Maintain a moderate monthly vehicle expense as part of a balanced budget.

Can You Buy a House on $36 An Hour?

On an hourly wage of $36, buying a house is possible depending on the home price and your existing debts and expenses. With smart budgeting and moderate expectations on home size, those earning $36 an hour can achieve home ownership.

Some key considerations when buying a home on $36 an hour:

- Focus on more affordable locations or smaller metro areas where home prices are lower relative to incomes. Avoid pricier big cities.

- Have a substantial downpayment saved up, ideally 20% or more of the purchase price. The larger the downpayment, the lower your monthly mortgage cost will be.

- Opt for a fixed rate 15 or 30 year mortgage, not an adjustable ARM loan. This locks in your principal and interest for the long haul.

- Prioritize low to moderate cost homes in the $175,000 to $300,000 range. Condos, townhomes, or detached homes at this price are affordable.

- Ensure your total debts (mortgage, car loan, student loan, credit cards) are at a manageable level relative to your income. Don’t over-extend yourself.

- Have an emergency fund to cover unforeseen costs that accompany home ownership like repairs or temporary job loss.

Assuming you purchase a moderately priced home you can afford, pay a sizable downpayment of 20% or more, and have reasonable other debts, home ownership on $36 an hour is a realistic goal. Just be sure to run the numbers for your specific situation before committing to such a major purchase.

Example Budget For $36 Per Hour

Creating a monthly budget provides visibility into whether or not you can realistically live on an hourly wage of $36. Here is an example budget for someone making $36 per hour while working full time:

Monthly Net (After Tax) Pay – $5,120

- This assumes 160 hours worked at $36 per hour, subtracting 30% in combined federal, state, and local taxes. Your exact take home pay may vary.

Housing Costs: $1,500

- Includes $1,300 per month in rent for a 1 bedroom apartment plus $200 toward utilities like electricity, gas, water, etc.

Transportation Costs: $500

- $350 for a car payment, $100 for gas and $50 for insurance.

Food Costs: $550

- Includes groceries, dining out and other food purchases.

Personal Costs: $625

- $100 for cell phone, $125 for health insurance premiums, $400 for discretionary personal spending money

Debt Payments: $250

- $250 per month total for credit card, student loan, or other required debt payments

Emergency Savings: $500

- $500 per month contribution to emergency fund

Retirement Savings: $400

- $400 monthly contribution to 401(k) or other retirement savings

Total Monthly Expenses: $4,325

That leaves $795 of wiggle room in the budget each month. So based on this example, a single person could feasibly live on $36 an hour while working full time. Carefully manage housing costs and discretionary expenses, and you can live comfortably on this hourly wage.

In Summary

While $36 an hour can provide a decent living in some areas, it also means carefully budgeting and monitoring expenses depending on your specific situation. Focus on maintaining housing costs around 25% of take home pay or lower. Minimize debt obligations whenever possible. And continue developing skills and income streams to hedge against inflationary impacts over time.

If costs like housing and childcare are reasonable relative to income, a $36 hourly wage allows a comfortable, middle class lifestyle for individuals or families who practice sound budgeting and financial habits. But the feasibility is also highly dependent on your geographic location and personal obligations. Evaluate your entire financial picture when determining if $36 an hour is a livable wage or just barely getting by.