Have you recently started a new job that pays $35 per hour or are considering a career change where you’ll earn that hourly rate? Figuring out your potential annual salary is an important step when evaluating a new role. In this comprehensive guide, we’ll walk you through exactly how to calculate your projected yearly earnings at $35 per hour, accounting for factors like full-time vs part-time work, overtime pay, paid time off, and more. Whether you’re budgeting for the future or simply curious what someone who makes $35 an hour can expect to earn annually, read on for the full breakdown. By the end, you’ll know exactly how to convert your $35 hourly wage into an estimated total annual income.

Table of Contents

Convert $35 Per Hour to Weekly, Monthly, and Yearly Salary

Use this simple calculator to see your potential earnings per week, month, and year based on your hourly wage and hours worked.

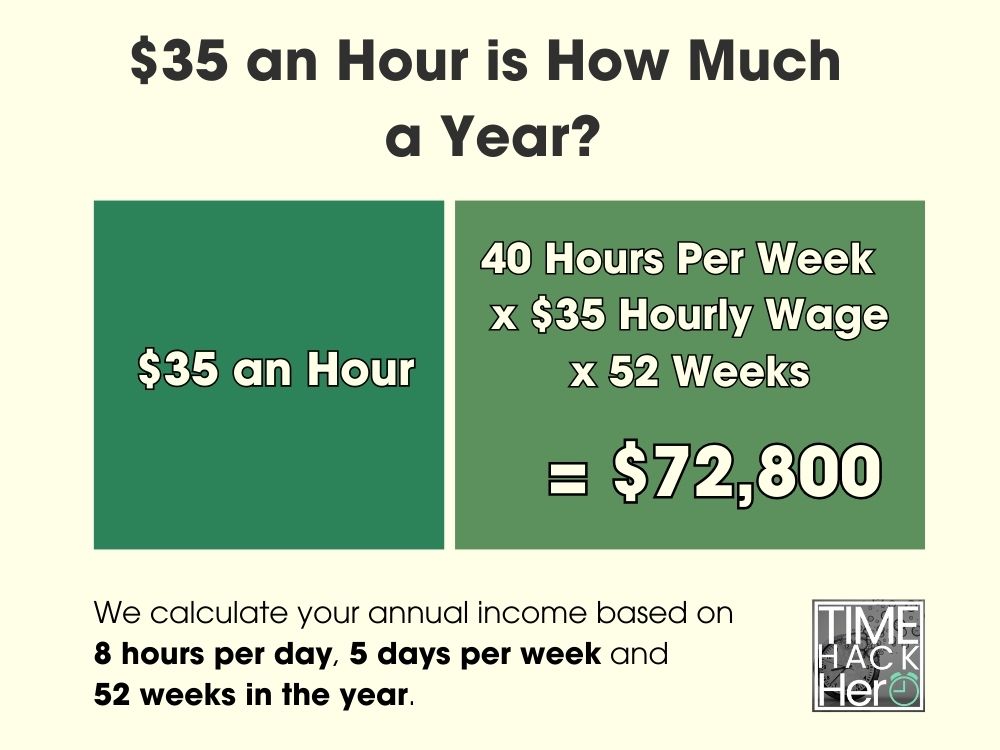

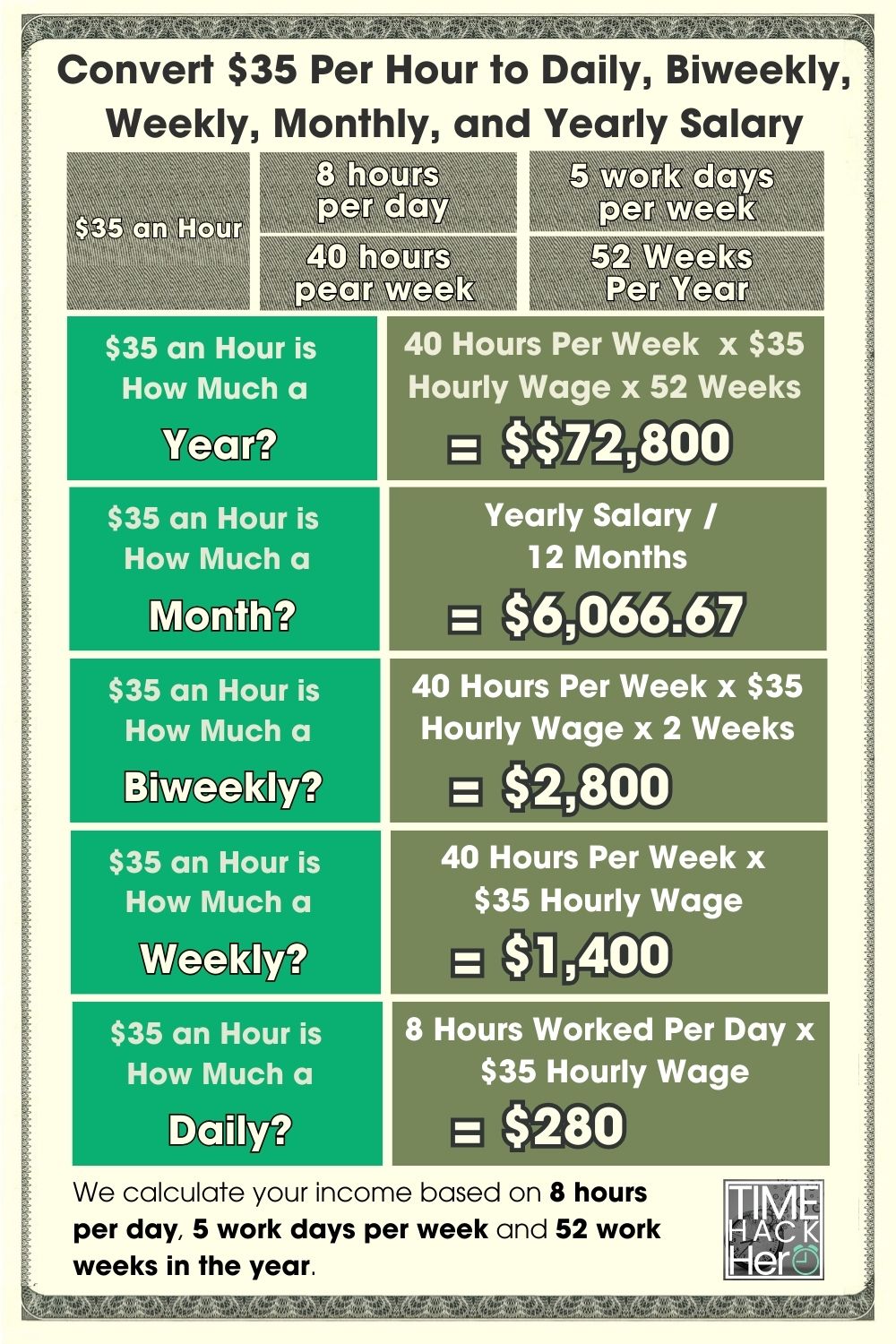

$35 an Hour is How Much a Year?

If you make $35 an hour and work full-time (40 hours per week), your estimated yearly salary would be $72,800. This is calculated based on working all 52 weeks of the year at your hourly rate.

Here is the math:

Hours worked per week (40) x Hourly wage ($35) x Weeks worked per year (52) = $72,800

$35 an Hour is How Much a Month?

Making $35 an hour at a full-time 40 hour per week job equals approximately $6,066.67 per month. This is your yearly salary divided evenly by 12 months.

Here is the calculation:

Hours worked per week (40) x Hourly wage ($35) x Weeks worked per year (52) / Months per year (12) = $6,066.67

$35 an Hour is How Much a Biweekly?

At $35 an hour and 40 hours per week, your biweekly (every two weeks) earnings would be $2,800.

The math is:

Hours worked per week (40) x Hourly wage ($35) x 2 = $2,800

$35 an Hour is How Much a Week?

Making $35 per hour and working full-time (40 hours) results in weekly earnings of $1,400.

The calculation is simply:

Hours worked per week (40) x Hourly wage ($35) = $1,400

$35 an Hour is How Much a Day?

If you make $35 an hour and work a standard 8 hour day, you would earn $280 per day.

To arrive at this daily amount:

Hours worked per day (8) x Hourly wage ($35) = $280

$35 an Hour is How Much a Year?

To estimate your total annual earnings from an hourly wage, the basic formula is:

Hourly Rate x Hours Worked per Week x Number of Weeks Worked per Year = Annual Salary

Plugging in $35 per hour with full-time hours gives us:

$35 per hour x 40 hours per week x 52 weeks per year = $72,800

However, that simple calculation makes some assumptions:

- You work 40 hours every single week of the year

- You receive zero paid vacation or holidays

To be more accurate, we need to factor in paid time off most jobs provide.

Accounting for Paid Time Off

The $72,800 base pay does not account for paid time off yet. Let’s look at a typical PTO package:

- 2 weeks (10 days) paid vacation

- 6 paid holidays

- 3 paid sick days

That’s 19 paid days off, or about 4 weeks PTO.

Importantly, this paid time off does not get deducted from your annual income, since you still get paid for those days not working.

Therefore, with 4 weeks PTO, the yearly salary would remain $72,800.

Part Time $35 an Hour is How Much a Year?

Your total annual pay decreases significantly if you work part-time instead of full-time.

For example, at 30 hours per week instead of 40, your yearly income at $35/hour would be:

$35 per hour x 30 hours per week x 52 weeks per year = $54,600

By working just 10 fewer hours per week, your annual pay at $35/hour drops from $72,800 down to $54,600 – a difference of $18,200!

Here’s a breakdown of how your annual earnings change depending on hours worked per week:

| Hours Per Week | Earnings Per Week | Annual Earnings |

|---|---|---|

| 40 | $1,400 | $72,800 |

| 35 | $1,225 | $63,700 |

| 30 | $1,050 | $54,600 |

| 25 | $875 | $45,500 |

| 20 | $700 | $36,400 |

As shown, the more hours you work at a fixed $35 hourly rate, the higher your total yearly income.

$35 an Hour With Overtime is How Much a Year?

Overtime pay can substantially increase your annual earnings at $35 per hour.

Overtime generally kicks in after 40 hours in a week, paid at 1.5x your normal wage.

So at $35/hour, overtime would be $52.50 per hour (1.5 x $35).

Here’s an example:

- You work 45 hours in Week 1

- 40 regular hours at $35/hour = $1,400

- 5 overtime hours at $52.50/hour = $262.50

- Your total for Week 1 = $1,400 + $262.50 = $1,662.50

If you worked 45 hours every week for a year, your annual income at $35/hour would be:

$1,662.50 per week x 52 weeks = $86,450

That’s $13,650 more than without overtime at just 40 hours per week.

Overtime can significantly increase your yearly total at an hourly wage. But also keep in mind it may push you into a higher tax bracket.

$35 an Hour With Unpaid Time Off is How Much a Year?

The final factor that can impact your annual earnings is unpaid time off.

So far, we’ve assumed you work 52 paid weeks per year.

But what if you take unpaid leave for an illness or vacation beyond your allotted PTO?

For example, let’s say you take 2 extra unpaid weeks off.

That would leave you with 50 paid weeks instead of 52 paid weeks.

At $1,400 per week (full time at $35/hour), here is the effect of 2 unpaid weeks off:

$1,400 per week x 50 paid weeks = $70,000

That’s $2,800 less than if you worked 52 paid weeks.

In summary, unpaid time off lowers your total annual salary if you go beyond your paid vacation and sick days. Make sure to account for any additional unpaid leave you plan to take.

Putting It All Together

Based on an hourly wage of $35, here are the key factors that determine your total annual earnings:

- Hours worked per week

- Paid time off

- Overtime pay

- Unpaid leave

And here is how your annual income changes based on full-time vs part-time status:

| Weeks Worked | Hours Per Week | Annual Earnings | |

|---|---|---|---|

| Full-Time | 52 | 40 | $72,800 |

| Part-Time | 52 | 30 | $54,600 |

| Overtime | 52 | 45 | $86,450 |

| Unpaid Leave | 50 | 40 | $70,000 |

By understanding how these factors influence your yearly income, you can accurately estimate your potential annual earnings at any hourly wage.

$35 An Hour Is How Much A Year After Taxes

Calculating your actual annual earnings based on an hourly wage can get complex once taxes are taken into account. In addition to federal, state, and local income taxes, 7.65% of your gross pay also goes to Social Security and Medicare through FICA payroll taxes. So how much does $35 an hour equal per year after FICA and income taxes are deducted from your gross pay?

Below we’ll walk through the steps to estimate your annual net take home pay if you make $35 per hour. This will factor in estimated federal, FICA, state, and local taxes so you know exactly what to expect.

Factoring in Federal Income Tax

Your federal income tax will take a sizable portion of your gross pay. Federal tax rates range from 10% to 37%, depending on your tax bracket.

To estimate your federal income tax rate and liability:

- Look up your federal income tax bracket based on your gross annual pay.

2023 tax brackets: single filers

| Tax rate | Taxable income bracket | Tax owed |

|---|---|---|

| 10% | $0 to $11,000 | 10% of taxable income |

| 12% | $11,001 to $44,725 | $1,100 plus 12% of the amount over $11,000 |

| 22% | $44,726 to $95,375 | $5,147 plus 22% of the amount over $44,725 |

| 24% | $95,376 to $182,100 | $16,290 plus 24% of the amount over $95,375 |

| 32% | $182,101 to $231,250 | $37,104 plus 32% of the amount over $182,100 |

| 35% | $231,251 to $578,125 | $52,832 plus 35% of the amount over $231,250 |

| 37% | $578,126 or more | $174,238.25 plus 37% of the amount over $578,125 |

For example, if you are single with $72,800 gross annual pay ($35/hour x 40 hours/week x 52 weeks), your federal tax bracket is 22%.

Your estimated federal income tax would be:

$11,000 x 10% + ($44,725 – $11,000) x 12% + ($72,800 – $44,725) x 22% = $10,432.50

So at $35/hour with $72,800 gross pay, you would owe around $10,432.50 in federal income taxes.

Considering State Income Tax

In addition to federal tax, most states also charge a state income tax. State income tax rates range from about 1% to 13%, with most between 4% and 6% of taxable income.

Key Takeaways on State Taxes

- California, Hawaii, New York, New Jersey, and Oregon have some of the highest state income tax rates.

- Seven states don’t charge any income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming.

- Ten states have a flat income tax rate regardless of income level.

To estimate your state income tax:

- Look up your state income tax rate based on your gross pay and filing status.

- Multiply your gross annual pay by the state tax rate.

For example, if you live in Pennsylvania which has a flat 3.07% tax rate, your estimated state tax would be:

$72,800 gross pay x 3.07% PA tax rate = $2,234.16 estimated state income tax

So with $72,800 gross annual income, you would owe around $2,234.16 in Pennsylvania state income tax. Verify your specific state’s income tax rates.

Factoring in Local Taxes

Some cities and counties levy local income taxes ranging from 1-3% of taxable income.

To estimate potential local taxes you may owe:

- Check if your city or county charges a local income tax.

- If yes, look up the local income tax rate.

- Multiply your gross annual pay by the local tax rate.

For example, say you live in Columbus, OH which has a 2.5% local income tax. Your estimated local tax would be:

$72,800 gross pay x 2.5% local tax rate = $1,820 estimated local tax

So with $72,800 in gross earnings, you may owe around $1,820 in Columbus local income taxes. Verify rates for your own city/county.

Accounting for FICA Taxes (Social Security & Medicare)

On top of income taxes, 7.65% of your gross pay goes to FICA taxes for Social Security and Medicare. This includes:

- 6.2% Social Security tax

- 1.45% Medicare tax

To estimate your FICA tax payment:

$72,800 gross pay x 7.65% FICA rate = $5,564

So out of your $72,800 gross pay, you can expect to pay $5,564 in Social Security and Medicare taxes.

Total Estimated Tax Payments

Based on the examples above, your total estimated tax payments on $72,800 gross annual earnings would be:

- Federal income tax: $10,432.50

- State income tax: $2,234.16

- Local income tax: $1,820

- FICA taxes: $5,564

- Total estimated taxes = $20,050.66

So your total estimated tax burden on $72,800 gross income would be around $20,050.66 per year.

Calculating Your Annual Take Home Pay

To determine your annual take home pay:

- Take your gross annual pay

- Subtract your total estimated tax payments

Gross annual pay at $35/hour with 40 hours/week and 52 weeks/year = $72,800

$72,800 gross pay – $20,050.66 total estimated taxes = $52,749.34 Your Take Home Pay

In summary, if you make $35 per hour and work full-time, you can expect to take home about $52,749.34 per year after federal, state, local, and FICA taxes are deducted.

Your actual net pay may vary based on your specific tax situation and location. But this provides a general estimate of your annual take home earnings on a $35 hourly wage.

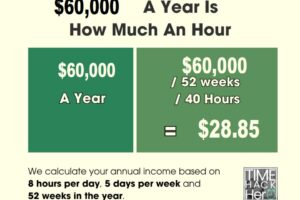

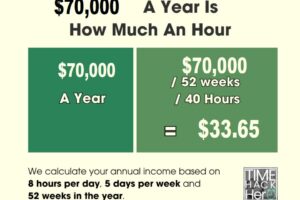

Is $35 an Hour a Good Salary?

Whether or not $35 an hour is considered a good salary depends on your location, debt levels, family size, and lifestyle expectations.

For a single person with no children in an area with a lower cost of living, $35 an hour would be a solid middle-class income. This equates to an annual salary of around $72,800, assuming a 40 hour work week. The median per capita income in the United States is around $35,000, so an income of $72,800 would be more than twice the national average.

However, for those supporting families, living in high-cost metro areas like New York City or San Francisco, or paying off large amounts of student loan or credit card debt, this hourly wage would provide a much tighter, potentially middle-class living. Geographic differences in the cost of living and state income taxes also impact the value of $35 an hour.

Over the past few decades, wage growth has stagnated across many industries, while costs like housing, education, childcare and healthcare have risen steadily. As a result, $35 an hour does not necessarily go as far today as it may have 30 years ago.

However, it still provides earners with significantly more financial flexibility and quality of life benefits compared to those earning minimum wage or less. The federal minimum wage is currently $7.25 an hour, highlighting how an income of $35 an hour is nearly 5x higher than the lowest legal wage.

Jobs that Pay $35 An Hour

There are a variety of jobs across industries that pay around $35 per hour on average. Many of these occupations require some type of formal training or certification, such as:

- Registered Nurses – The average national pay for RNs is $35/hr. RN positions usually require an Associate’s or Bachelor’s degree in nursing.

- Radiation Therapists – Average pay is $34-40/hr. This job requires an Associate’s or Bachelor’s degree in radiation therapy.

- Web Developers – Average pay is $30-45/hr. Most have a Bachelor’s degree and complete coding bootcamps or training programs.

- Occupational Therapy Assistants – Average pay is $32-37/hr. OT assistants complete an Associate’s degree and on-the-job training.

- Electrical Power Line Installers – Average pay is $33/hr. This is an apprenticeship role requiring on-the-job training.

- Plumbers – Average pay is $25-40/hr. Most plumbers complete a 4-5 year paid apprenticeship.

- Elevator Installers – Average pay is $35/hr. Elevator installer apprenticeships last 4 years.

- Pipefitters – Average pay is $26-40/hr. Pipefitting apprenticeships last 4-5 years.

The above jobs highlight typical positions paying in the $35 per hour range. Most require vocational education, certifications or on-the-job training, rather than just an academic degree. Those willing to take on apprenticeships and technical training can gain skills needed to earn $35/hr in fields like healthcare, tech, construction and installation.

Can You Live Off $35 An Hour?

Living off an income of $35 an hour is certainly possible, particularly for single adults without children in low-cost parts of the country. However, individuals and households with higher expenses would likely find the lifestyle more challenging.

For single individuals living in cities like Kansas City, Pittsburgh or Columbus, $35 an hour provides enough to cover typical living costs in these areas, with room left for savings and discretionary spending. Rent for a one bedroom apartment in these cities averages $700-900/month. After essentials like rent, food, utilities, transportation and healthcare, singles earning $35/hour in cheaper metro areas could afford to save, invest, and enjoy entertainment or travel.

However, singles and couples without children residing in high-cost coastal cities like Los Angeles, New York and Boston would struggle living off $35/hour full-time. One bedroom rents in these cities average $2,000-2,500/month, over twice cheaper metro areas. Costs for food, utilities and other basics are also higher than average. As a result, singles and couples in expensive cities would likely need at least $50-60/hour to maintain a similar standard of living as their counterparts in Ohio or Missouri.

For households with children, living off $35/hour becomes even harder, especially in costly areas. Childcare alone for 1-2 kids can run $1,500-2,500/month in many big cities. Food, housing, healthcare, taxes, child expenses, and college savings also eat up a significant share of household budgets with kids. Therefore, families with even one child would need an income of $75-100/hour to live comfortably in major metros. In cheaper areas, $50-60/hour could support a decent quality of life.

The Impact of Inflation on the Value of $35 An Hour

Ongoing high inflation also impacts the real value of an hourly wage. In 2022, inflation hit a 40-year high, driven largely by food, housing, and fuel costs. This reduced purchasing power substantially for those earning hourly wages or fixed incomes.

For example, since January 2020:

- The consumer price index has risen 13%. This means someone would need to earn $39.55/hour today just to have the same purchasing power as $35/hour prior to inflation.

- Food costs are up 15%.

- Gas prices have risen 58%.

- Home prices are up 32%.

- Rent index increased 15%.

This data illustrates how much inflation has diminished the real hourly earnings of American workers. Those earning $35/hour have at least 10-15% less purchasing power now compared to 2-3 years ago.

Effectively, inflation acts as a pay cut for anyone earning fixed wages. To maintain the same standard of living, hourly wages must increase proportionately with the inflation rate. Otherwise, workers will need to cut back spending in areas like dining out and entertainment.

5 Ways To Increase Your Hourly Wage

For those currently earning less than $35 per hour, here are some potential ways to boost your earnings:

- Ask for a raise – If you’ve gained skills and taken on more responsibilities, make the case for a higher wage to your employer. Come armed with data on average pay for your role and how you’ve added value.

- Find a higher paying job – Browse job boards for openings with better pay. Tailor your resume to emphasize skills that command higher salaries.

- Get a side gig – Driving for Uber or Lyft, freelance writing, tutoring, and online surveys are some flexible ways to make extra income.

- Learn new skills – Complete certifications, training programs, or courses to gain expertise that translates to higher pay. For example, learn to code, become a certified nurse assistant, or get certified in digital marketing.

- Negotiate benefits – If your employer won’t raise your pay, try to negotiate larger benefits. For example, an extra week of paid vacation, work from home options, or better health insurance.

Pursuing pay increases from your current employer or finding a higher paying job are the most direct ways to earn $35 an hour or more. Further training and skills development also boost your market value and future income potential.

Buying a Car on $35 An Hour

Buying and owning a car is certainly possible on $35 an hour, but buyers will need to be careful not to overextend their budget.

Some guidelines around car costs for $35/hour income:

- Maximum purchase price: $20,000 (used vehicle)

- Maximum monthly payment: $350

- Maximum monthly total cost (loan + insurance + gas + maintenance): $600

With income of around $72,800 annually, limiting the vehicle purchase price to $20,000 ensures payments don’t consume too much of your monthly budget. Average used car prices as of August 2022 were $28,000, but it’s possible to find solid used options under $20,000.

Getting loan financing at reasonable rates will require good credit. For those with scores below 660, financing options will carry higher interest, making monthly payments unaffordable. Building credit or saving up to buy in cash are better options.

Insurance costs can also take a significant bite out of budgets. For drivers with excellent credit and driving records, insurance may cost $75-100/month. But for young drivers or those with accidents and violations, it could exceed $200-250/month.

Besides loan payments and insurance, fuel and maintenance should be budgeted at $150-200/month to keep the vehicle running smoothly.

Overall, owning an economical used car valued under $20,000 is feasible on $35/hour. But buyers must carefully budget out all costs to ensure it fits within their earnings and doesn’t jeopardize other financial goals.

Can You Buy a House on $35 An Hour?

For many Americans, home ownership is a major financial milestone and component of a comfortable lifestyle. But is buying a house realistic on an income of $35 an hour?

In low-cost real estate markets with median home prices below $250,000, buying a modest starter home is possible for those earning $35/hour, assuming:

- They have budgeted and saved a 10-20% downpayment of $25,000-$50,000

- Their monthly mortgage payment (principle, interest, taxes, insurance) totals under $1,500

- They have additional monthly income to cover maintenance, utilities, and other ownership costs

However, buying would be very difficult, if not impossible, in high cost markets like Southern California, Seattle, Boston, or New York City. In these areas, median home prices range from $550,000 to over $1 million.

To buy a median priced home in an expensive metro, you would likely need to earn closer to $60-75 per hour to afford the mortgage payments and other costs.

Additionally, qualifying for a mortgage requires strong credit and moderate existing debt levels. First-time buyers also often lack the large downpayment needed to keep monthly payments under $1,500.

While not feasible in pricier cities, home ownership in Midwest and South regions can be attainable for solid earners making $35/hour, with proper budgeting and saving habits. Overall affordability also depends greatly on factors like your specific location, debt levels, downpayment funds, and lender qualification standards.

Example Budget for $35 Per Hour

Here is an example monthly budget for a single person earning $35 an hour and working 40 hours per week ($5,600 gross monthly income):

| Expense | Amount |

|---|---|

| Rent (1 bedroom apartment) | $1,000 |

| Groceries | $400 |

| Dining/Entertainment | $400 |

| Utilities | $150 |

| Car Payment | $300 |

| Car Insurance | $100 |

| Gasoline | $150 |

| Gym Membership | $50 |

| Cell Phone | $100 |

| Internet/Cable | $150 |

| Retirement Savings | $500 |

| Emergency Fund Savings | $300 |

| Total Expenses | $3,600 |

This leaves $2,000 per month that could be used for additional savings goals like a down payment, vacations, or further debt paydown. Or this surplus income could be allocated to upgrading housing or lifestyle expenses.

For a more comfortable budget buffer, limiting total expenses closer to $3,000 per month is advisable. This allows for $700 per week in discretionary spending money.

With careful prioritization, single adults without children can live reasonably well in many areas on $35 an hour, with room for flexibility and savings. Larger households and high-cost cities would require higher incomes to support comparable lifestyles and financial security.

In Summary

In today’s economy, an income of $35 per hour provides a solid middle-class lifestyle, especially for single adults in reasonably priced areas. However, families and individuals residing in major metro areas require significantly higher earnings to maintain financial stability.

While inflation, stagnant wage growth, childcare costs and housing prices have increased pressure on budgets, $35 an hour still affords working individuals far greater economic opportunity than those earning minimum wage. It provides income well above the national median, with room for discretionary spending and saving for goals like cars, homes, retirement, and education.

Yet it’s important for $35 per hour earners to budget wisely, restrain housing and car costs, and avoid excessive debts that could quickly dwindle their moderate incomes. Overall, this hourly wage allows for comfortable, middle-class living, but likely below the upper-middle class lifestyle many families aspire to achieve. With proper money management and supplemental income sources, however, a $35 per hour wage can pave a path to financial growth and prosperity.