When getting paid hourly, calculating your total annual earnings can be tricky. The hours you work each week and take off affect your income. In this article, we’ll break down the math to find out how much you can earn annually when making $30 per hour.

Table of Contents

Convert $30 Per Hour to Weekly, Monthly, and Yearly Salary

Input your $30 hourly wage and hours per week to calculate your monthly, yearly, and other earnings.

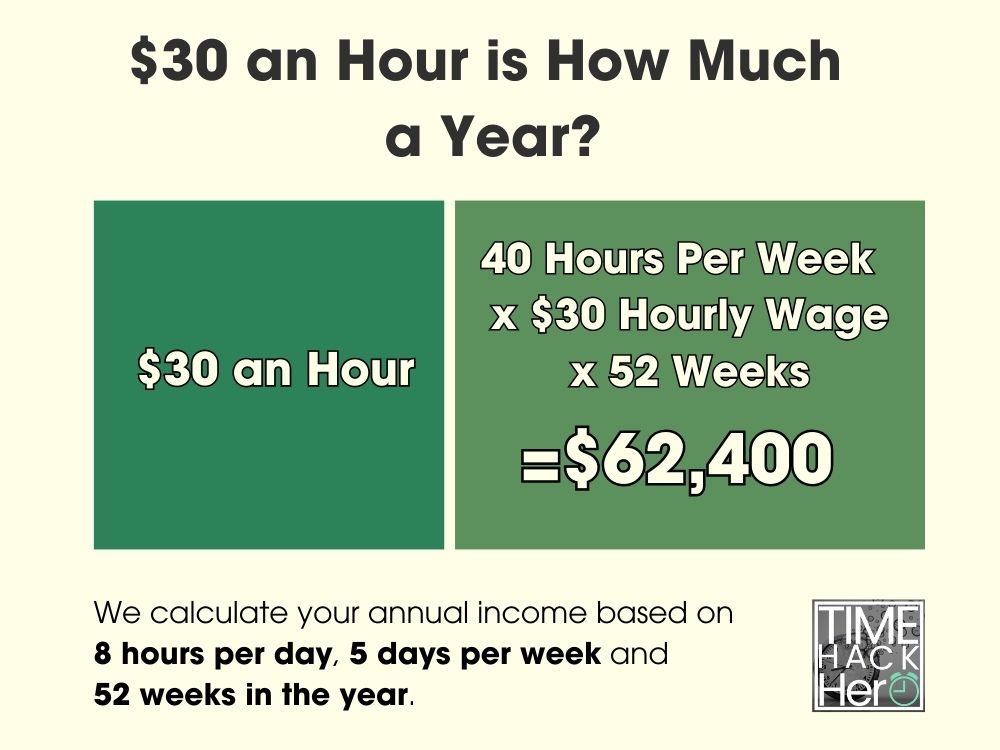

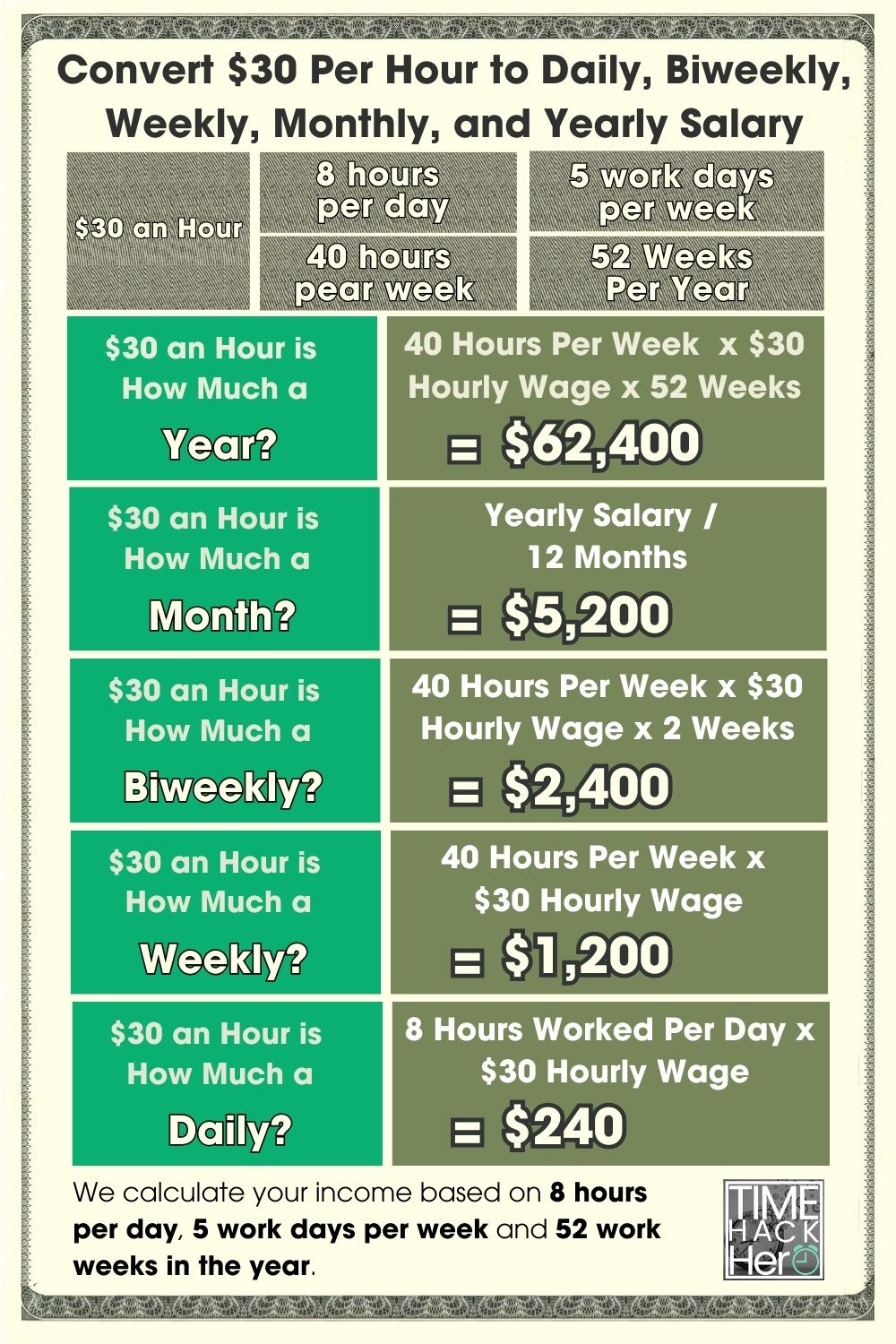

$30 an Hour is How Much a Year?

Working $30 an hour at 40 hours per week for 52 weeks equals $62,400 per year. We based this on 8 hour days, 5 day workweeks.

Hours worked per week (40) x Hourly wage ($30) x Weeks per year (52) = $62,400

$30 an Hour is How Much a Month?

Dividing the $62,400 annual salary by 12 months results in $5,200 per month at $30 an hour.

Hours per week (40) x Hourly pay ($30) x Weeks per year (52) / Months (12) = $5,200

$30 an Hour is How Much Biweekly?

You would earn $2,400 biweekly when making $30 an hour.

Hours per week (40) x Hourly wage ($30) x 2 = $2,400

$30 an Hour is How Much a Week?

At 40 hours per week, $30 an hour equals $1,200 per week.

Hours per week (40) x Hourly pay ($30) = $1,200

$30 an Hour is How Much a Day?

Based on 8 hours daily, you would make $240 per day at $30 per hour.

Hours per day (8) x Hourly wage ($30) = $240

$30 an Hour is How Much a Year?

To find a yearly salary from an hourly wage:

Hourly Rate x Hours Per Week x Weeks Per Year = Annual Salary

For $30 per hour:

$30 per hour x 40 hours per week x 52 weeks per year = $62,400

However, this assumes:

- Working 40 hours every week

- No paid time off

So it’s earnings without any vacation, holidays, or sick days.

Accounting for Paid Time Off

The base $62,400 doesn’t include paid time off (PTO). If your job has:

- 2 weeks (10 days) vacation

- 6 holidays

- 3 sick days

That’s 19 paid days off, or about 4 weeks PTO.

Importantly, paid time off isn’t deducted from salary, since you still get paid.

So with 4 weeks PTO, the annual salary remains $62,400.

Part Time $30 an Hour is How Much a Year?

Going part-time significantly impacts your annual pay.

For example, 30 hours per week instead of 40 gives:

$30 per hour x 30 hours per week x 52 weeks = $46,800

By working 10 fewer hours weekly, earnings at $30 an hour drop from $62,400 to $46,800.

That’s a $15,600 difference per year due to part-time hours!

Here’s how annual salary changes by hours per week at $30 an hour:

| Hours Per Week | Earnings Per Week | Annual Earnings |

|---|---|---|

| 40 | $1,200 | $62,400 |

| 35 | $1,050 | $54,600 |

| 30 | $900 | $46,800 |

| 25 | $750 | $39,000 |

| 20 | $600 | $31,200 |

More weekly hours means higher annual pay when the hourly rate is fixed at $30.

While benefits and work-life balance matter, hours significantly influence total yearly income.

$30 an Hour With Overtime is How Much a Year?

Overtime boosts annual earnings.

Overtime usually starts after 40 hours per week. You’ll typically earn 1.5x your regular pay for overtime hours.

So at $30 per hour normally, overtime would be $45 per hour.

If you work 45 hours in a week:

- 40 regular hours at $30 per hour = $1,200

- 5 overtime hours at $45 per hour = $225

- Total for week = $1,200 + $225 = $1,425

Working 45 hours per week year-round results in:

$1,425 per week x 52 weeks = $74,100

That’s $11,700 more per year than not working overtime.

Overtime can significantly increase total yearly pay. But also consider higher tax withholding from extra hourly wages.

$30 an Hour With Unpaid Time Off is How Much a Year?

The last factor affecting annual earnings is unpaid time off.

So far, we assumed 52 paid weeks per year.

If you take unpaid time off for holidays, illness, etc, your total annual pay decreases.

For example:

- 2 weeks unpaid time off

- Leaves 50 paid weeks instead of 52

At a 40 hour per week job earning $1,200 weekly, 2 unpaid weeks off leads to:

$1,200 per week x 50 paid weeks = $60,000

That’s $2,400 less than working 52 paid weeks.

More unpaid time off lowers your total yearly income. Account for holidays, sick days, and vacation when estimating annual salary from an hourly wage.

In Summary

The main factors determining annual earnings from an hourly wage are:

- Hours worked weekly

- Hourly rate

- Overtime pay

- Unpaid time off

Here’s how $30 an hour changes yearly income for full-time versus part-time:

| Weeks Worked | Hours Per Week | Annual Earnings | |

|---|---|---|---|

| Full-Time | 52 | 40 | $62,400 |

| Part-Time | 52 | 30 | $46,800 |

| Overtime | 52 | 45 | $74,100 |

| Unpaid Time Off | 50 | 40 | $60,000 |

Annual income from an hourly wage can vary substantially based on hours and overtime. But it’s straightforward to calculate with the key inputs!

Is $30 an Hour a Good Salary?

Whether or not $30 an hour is considered a good salary depends largely on where you live and your overall household expenses. In lower cost-of-living rural areas, $30 an hour would be considered an excellent wage by most. But those living in high-cost urban areas may struggle to get by on that amount.

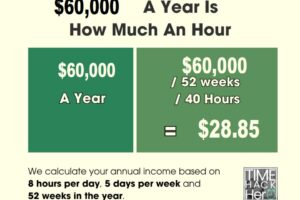

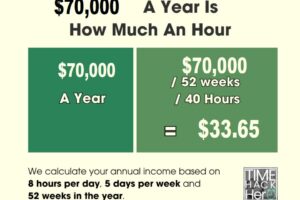

As a general rule, $30 an hour full-time (40 hours a week) equates to an annual salary of around $62,400. That puts it well above the median personal income in the United States, which was $41,535 in 2021 according to the U.S. Census Bureau. So in that sense, yes $30 an hour is a good wage compared to typical incomes.

However, the cost of living varies tremendously across different parts of the country. According to MIT’s Living Wage Calculator, here is an estimate of the hourly living wage for several U.S. cities:

| City | 1 Adult | 1 Adult + 1 Child |

|---|---|---|

| New York City | $22.24 | $49.26 |

| San Francisco | $22.63 | $49.85 |

| Seattle | $19.36 | $42.12 |

| Chicago | $17.24 | $38.36 |

| Houston | $16.31 | $33.46 |

| Detroit | $17.07 | $32.31 |

| Indianapolis | $15.37 | $29.42 |

| Memphis | $15.52 | $29.65 |

As you can see, $30 an hour reaches or exceeds the living wage for a single adult in all of those cities. But for a single parent with one child, it falls short in higher cost areas like NYC and San Francisco.

So while $30/hour is well above minimum wage, whether or not it’s considered a “good” salary depends largely on location and household size. For single adults with no children in medium or low cost areas, it provides a comfortable standard of living. Those with families to support or living in expensive metro areas may still find it difficult to afford basics like housing, childcare, and healthcare at that wage level.

Jobs that pay $30 an hour

While $30 an hour is a great wage target, not many jobs pay exactly that amount. But there are plenty of careers with average hourly pay in the $25-$35 per hour range:

- Registered Nurse – Average Hourly Pay: $35.24

- Web Developer – Average Hourly Pay: $31.29

- Electrical Technician – Average Hourly Pay: $27.01

- Paralegal – Average Hourly Pay: $25.28

- Mechanical Drafter – Average Hourly Pay: $24.36

- Massage Therapist – Average Hourly Pay: $24.09

- Dental Hygienist – Average Hourly Pay: $33.69

- Diagnostic Medical Sonographer – Average Hourly Pay: $31.73

- Radiologic Technologist – Average Hourly Pay: $30.15

- Respiratory Therapist – Average Hourly Pay: $29.17

- Court Reporter – Average Hourly Pay: $25.32

- Physical Therapist Assistant – Average Hourly Pay: $28.71

- Occupational Therapy Assistant – Average Hourly Pay: $30.19

- Plumber – Average Hourly Pay: $28.34

- Electrician – Average Hourly Pay: $27.01

Most of these positions require some level of training and certification beyond a high school diploma but less than a bachelor’s degree. Healthcare roles, trades like plumbing or electrical, and tech jobs tend to pay above average hourly wages after a fairly short education period.

Government websites like the Bureau of Labor Statistics Occupational Outlook Handbook provide detailed salary data for hundreds of different careers. That can help you find jobs aligning with your interests that also provide $30+ hourly pay.

Can You Live Off $30 An Hour?

Whether or not $30 an hour provides a livable wage depends largely on your location, household size, and spending habits. For a single person or dual-income couple without kids in a relatively low cost of living area, $30 an hour can provide a solid middle-class lifestyle. But for larger families in expensive cities, it may mean scraping by.

To determine if $30/hour is livable for your situation, it helps to create a monthly budget tallying up typical costs:

Housing – The standard recommendation is to spend no more than 30% of your income on housing. At $30 an hour full time, that’s around $930 per month. In many parts of the country that won’t cover rent, let alone a mortgage. In lower cost areas though, it’s possible to keep housing below that threshold.

Transportation – Owning a car costs on average $7000-9000 per year according to AAA, or $583-$750 monthly. Even relying on public transportation adds $100+ a month. Budget 10-15% of income for transportation costs.

Food – Grocery bills for a family average $360 per month. Eating out adds considerably more. Plan on $400+ monthly for food per household.

Utilities – Electricity, water, gas, phone/internet bills tally up quickly. Budget 5-10% of income, or around $310-$620 at $30 an hour full time.

Insurance – Health insurance premiums for an individual average $500 per month. Car insurance adds another $100 or more. Allocate 10-15% for insurance.

Debt – Student loan, credit card, and other debt payments can range from $200 to $1000+ per month depending on balances.

Entertainment – Movies, concerts, hobbies, trips etc. These discretionary costs still impact total savings ability. Keep entertainment costs below 5%.

Adding it all up, fixed monthly expenses for a single person or couple could easily reach $2500-$3500 per month, leaving little room for savings at a $30 an hour full-time salary. Those with kids, debt, or living in high cost areas may not even cover necessities without taking on additional work.

The impact of inflation on the value of $30 an hour

While a $30 an hour wage sounds solid on the surface, inflation steadily erodes its real value over time. The chart below shows the purchasing power of $30 an hour since 2000:

| Year | Value of $30/hour |

|---|---|

| 2000 | $574.97 |

| 2005 | $527.84 |

| 2010 | $487.76 |

| 2015 | $452.56 |

| 2020 | $421.90 |

| 2023 | $367.68 |

Over the past two decades, inflation has reduced the actual purchasing power of $30 per hour by over 35%. Items that cost $500 in 2000 would cost around $800 today. This hidden drop in real wages is an important factor when considering jobs paying a fixed hourly rate.

Even with mild 2-3% annual inflation, the value of a fixed wage diminishes each year. Getting periodic pay raises to keep up with the rising cost of living is key to maintaining purchasing power. Cost of living adjustments or annual raises help offset inflation erosion.

When negotiating a job offer or deciding whether a $30 per hour wage is adequate, be sure to factor in the impacts of long term inflation. Instead of focusing on the hourly rate alone, look at overall compensation growth opportunities. Jobs with regular raises built in will do better at keeping pace with inflation over the years.

5 Ways To Increase Your Hourly Wage

If you’re currently earning less than $30 per hour, there are several potential strategies to boost your earnings:

- Ask for a Raise – If you’ve been at a company for a year or more and have a good performance record, requesting a pay bump is reasonable. Come prepared with market data and a case for why you deserve higher pay.

- Get an Advanced Degree – Gaining additional education and skills can qualify you for higher paying roles. An associate’s, bachelor’s, or master’s degree may open doors to over $30 per hour jobs.

- Switch Companies – Changing employers every few years is the fastest way to score major pay increases nowadays. Don’t get too comfortable staying put at below market wages.

- Pick up Side Gigs – Driving for Uber or Lyft, bartending, tutoring, and selling handmade goods on Etsy are examples of popular side hustles to supplement income from a main job.

- Negotiate Salary at Hire – When starting a new job, don’t automatically accept the initial salary offer. Research market rates and make a case for why you deserve higher pay.

Taking action to increase your earnings makes a $30 an hour wage attainable. Combining higher pay at your day job with side income streams can get you there even faster.

Buying a car on $30 an hour

Buying a car is a major expenditure. Is it affordable if you make $30 an hour? Well, that depends on a few factors:

- Total monthly vehicle budget – As a general rule, limit auto expenses including your car payment, insurance, gas and maintenance to 10-15% of your gross monthly income. At $30/hour full-time, that’s a max budget of around $620-$930.

- Down payment amount – The more you can put down upfront, the lower your monthly payment will be. Save up a 20% down payment if possible. On a $20,000 car, that’s $4,000.

- Loan terms – The longer the loan repayment period, the lower the monthly payment. But you end up paying more interest over time. Aim for a 36 month loan term.

- Credit score – Good credit (690+ score) qualifies you for lower interest rates on a car loan, saving money each month.

Here’s an example auto affordability estimate for someone earning $30 an hour:

| Vehicle Price | Down Payment | Loan Amount | Loan Terms | Monthly Payment |

|---|---|---|---|---|

| $20,000 | $4,000 | $16,000 | 36 months | $465 |

With a solid down payment and good credit, buying a reliable used car in the $15,000-$20,000 range is manageable on $30 an hour. Just be diligent about keeping other expenses in check to account for the car payment and related costs.

Can You Buy a House on $30 An Hour?

Owning a home is a common dream, but is it achievable on $30 an hour? The salary needed to buy a house depends primarily on three factors:

Home Price – In expensive housing markets like Los Angeles or New York City, even higher wages struggle to afford property. In lower cost areas of the Midwest and South though, meeting the salary needed is more feasible.

Down Payment – The more you can put as a down payment, the lower your mortgage. Shoot for 20% if possible. On a $200,000 home, that’s $40,000 – a stretch for many buyers.

Debt Obligations – Lenders look at your total monthly debts – car loans, student loans, credit cards etc. Too much existing debt hurts mortgage eligibility.

As a rough guideline, plan to spend no more than 3x your gross annual income on a home purchase. At $30 an hour full-time, that’s around $187,200. Here’s an example first-time home buyer scenario:

| Home Price | Down Payment (20%) | Loan Amount | Est. Monthly Payment | Annual Salary Needed |

|---|---|---|---|---|

| $200,000 | $40,000 | $160,000 | $990 | $60,000 |

While doable in some areas, buying a house on a single $30/hour income would be very difficult, unless you have significant savings from past higher earnings. Being part of a dual-income couple helps tremendously with affording major purchases like homes.

Example Budget For $30 Per Hour

Creating a realistic budget is key to managing your paycheck. Here is an example monthly budget for an individual earning $30 per hour full-time:

| Expense | Amount | % of Income |

|---|---|---|

| Gross Monthly Income | $5,200 | 100% |

| Federal Taxes (12%) | $624 | 12% |

| State Taxes (5%) | $260 | 5% |

| Net Take Home Pay | $4,316 | 83% |

| Housing (rent) | $1,200 | 23% |

| Car Payment | $465 | 9% |

| Car Insurance | $100 | 2% |

| Utilities | $300 | 6% |

| Groceries | $350 | 7% |

| Dining Out | $200 | 4% |

| Health Insurance | $400 | 8% |

| Gas/Parking/Public Transportation | $130 | 2% |

| Phone/Internet/Subscriptions | $150 | 3% |

| Entertainment/Self Care | $200 | 4% |

| Total Monthly Expenses | $3,495 | 67% |

| Remaining for Debt/Savings | $821 | 16% |

This leaves $821 per month that could go towards student loans, credit card debt, or ideally savings. Building an emergency fund should be a top priority when starting a new job.

Everyone’s expenses vary based on location, household size, and lifestyle. But keeping housing under 30% of your income and total expenses below 70% is a good target. Adjust categories as needed to align with your actual spending habits.

In Summary

A wage of $30 per hour equates to approximately $62,000 annually assuming full-time hours. While not considered a high wage, it exceeds median personal incomes in the U.S. However, the livability of $30 an hour depends largely on where you live and household expenses.

For single adults without children living in relatively low cost of living areas, $30 an hour provides a moderate or comfortable middle-class lifestyle. But for larger families in expensive cities, it may mean barely scraping by even for necessities. Those supporting families on a single income would likely struggle in many areas.

People early in their careers should view $30/hour as a reasonable minimum target wage for financial stability. However, recognize that inflation slowly erodes purchasing power over time. Cost of living adjustments or periodic pay raises are necessary to maintain a decent standard of living.

With proper budgeting, individuals or dual-income couples earning $30 an hour can afford basic necessities and modest entertainment. Home ownership may be possible depending on housing prices in the local market. However, buying a house is likely out of reach for single earners at this wage level in many cities.

Overall, $30 per hour provides a livable though not lavish income for childless couples or single adults able to keep expenses low. Certain careers in healthcare, tech, trades, and government offer hourly pay in the $25-$35 range. But covering larger households or living comfortably in high-cost areas will be challenging without additional income.