Knowing how to convert an hourly wage into an annual salary is key for financial planning and determining your income potential. In this article, we’ll break down the yearly earnings from $26 per hour based on standard full-time and part-time schedules.

We’ll calculate the total pre-tax income that can be earned annually from $26/hour. We’ll also look at how overtime pay can boost total yearly earnings. Since unpaid time off is common, we’ll factor in how it reduces actual annual pay.

In addition, we’ll determine the after-tax salary you can expect to take home from $26/hour after deductions. Understanding your net income is vital.

We’ll also evaluate if $26/hour provides a comfortable standard of living in different areas of the country. With high inflation lately, we’ll discuss ways to increase earnings beyond $26/hour.

Knowing exactly how much annual pay you could earn from $26 an hour is important knowledge for financial planning. Let’s explore this question in detail.

Table of Contents

Convert $26 Per Hour to Weekly, Monthly, and Yearly Salary

Input your wage and hours per week to see how much you’ll make monthly, yearly and more.

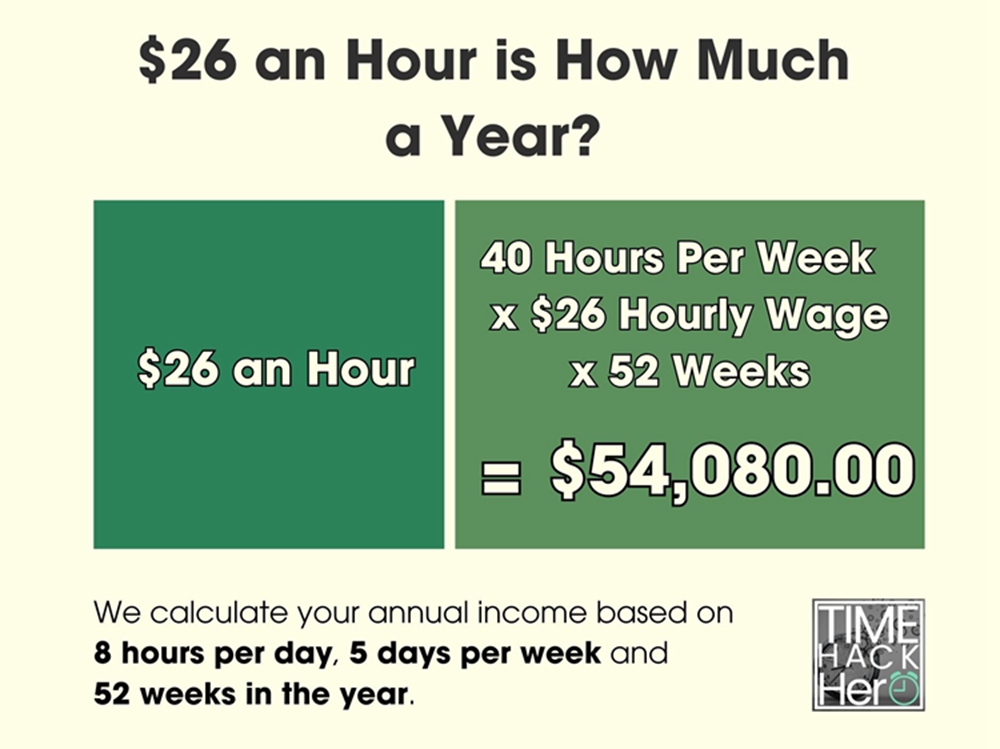

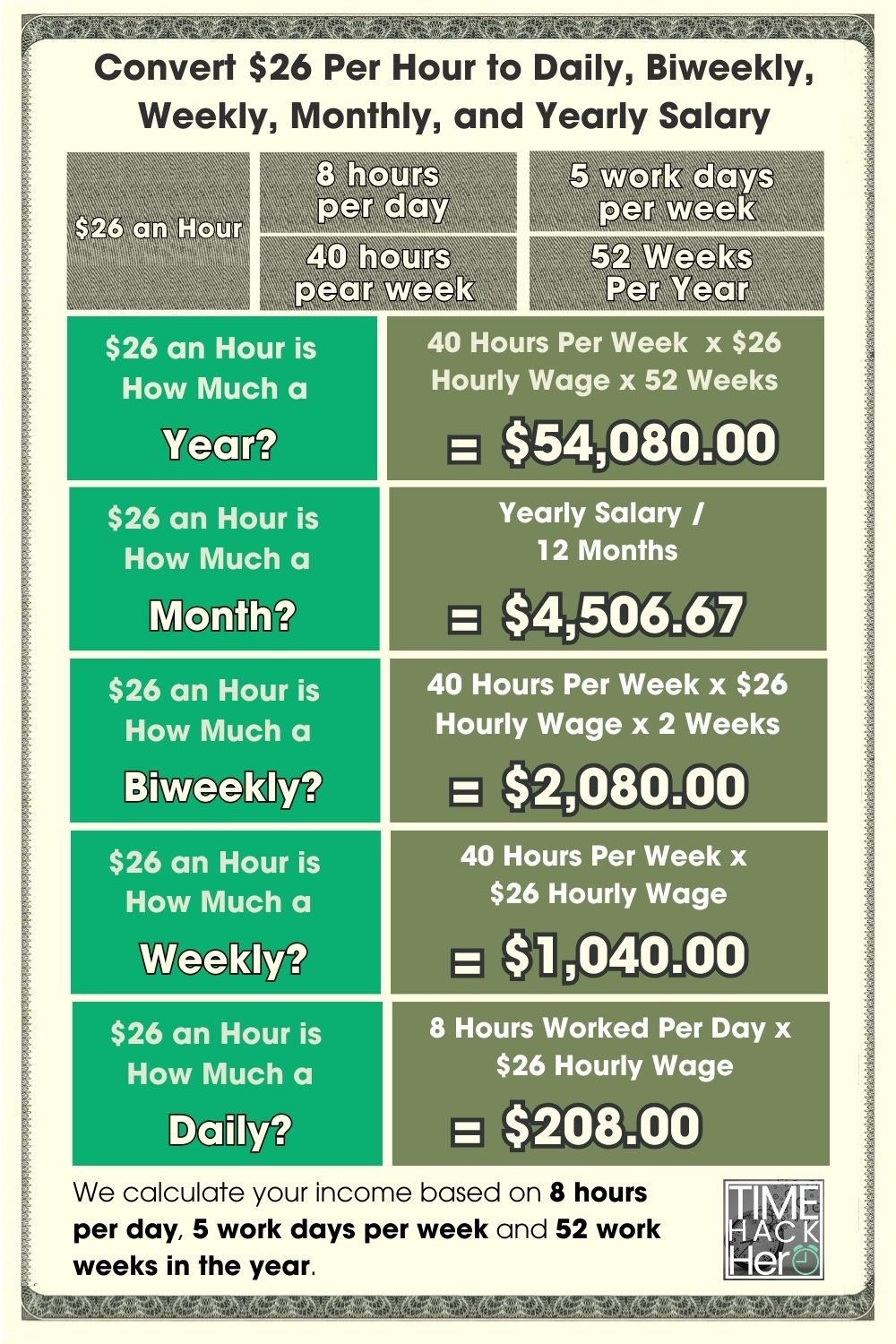

$26 an Hour is How Much a Year?

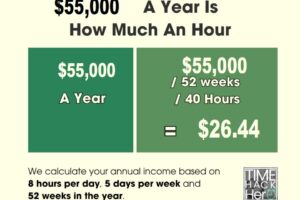

If you make $26 an hour, your yearly salary would be $54,080. We calculate your annual income based on 8 hours per day, 5 days per week and 52 weeks in the year.

Hours worked per week (40) x Hourly wage($26) x Weeks worked per year(52) = $54,080

$26 an Hour is How Much a Month?

If you make $26 an hour, your monthly salary would be $4,506.67. We calculated this number by dividing your annual income by 12 months.

Hours worked per week (40) x Hourly wage($26) x Weeks worked per year(52) / Months per Year(12) = $4,506.67

$26 an Hour is How Much a Biweekly?

If you make $26 an hour, your biweekly salary would be $2,080.

Hours worked per week (40) x Hourly wage($26) x 2 = $2,080

$26 an Hour is How Much a Week?

If you make $26 an hour, your weekly salary would be $1,040. Calculating based on 5 days per week and 8 hours each day.

Hours worked per week (40) x Hourly wage($26) = $1,040

$26 an Hour is How Much a Day?

If you make $26 an hour, your daily salary would be $208. We calculated your daily income based on 8 hours per day.

Hours worked per day (8) x Hourly wage($26) = $208

$26 an Hour is How Much a Year?

The basic formula to calculate your annual salary from an hourly wage is:

Hourly Rate x Hours Worked per Week x Number of Weeks Worked per Year = Annual Salary

So for a $20 per hour job:

$26 per hour x 40 hours per week x 52 weeks per year = $54,080

However, this simple calculation makes some assumptions:

- You will work 40 hours every week of the year

- You will not get any paid time off

Therefore, it represents your earnings if you worked every week of the year, without any vacation, holidays, or sick days.

Accounting for Paid Time Off

The $54,080 base salary does not yet factor in paid time off (PTO). Let’s assume the job provides:

- 2 weeks (10 days) paid vacation

- 6 paid holidays

- 3 paid sick days

This totals 19 paid days off, or nearly 4 weeks of PTO.

Importantly, this paid time off should not be deducted from the annual salary, since you still get paid for those days.

So with 4 weeks PTO, the annual salary would remain $54,080 .

Part time $26 an hour is How Much a Year?

Your annual income changes significantly if you work part-time and not full-time.

For example, let’s say you work 35 hours per week instead of 40. Here’s how you calculate your new yearly total:

$26 per hour x 35 hours per week x 52 weeks per year = $47,320

By working 5 fewer hours per week (35 instead of 40), your annual earnings at $26 an hour drop from $54,080 to $47,320.

That’s a $6,760 per year difference just by working part-time!

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $26 an hour:

| Hours Per Week | Earnings Per Week | Annual Earnings |

|---|---|---|

| 40 | $1,040 | $54,080 |

| 35 | $910 | $47,320 |

| 30 | $780 | $40,560 |

| 25 | $650 | $33,800 |

| 20 | $520 | $27,040 |

| 15 | $390 | $20,280 |

The more hours per week, the higher your total yearly earnings. But part-time work allows for more life balance if you don’t need the full salary.

$26 an Hour With Overtime is How Much a Year?

Now let’s look at how overtime can increase your annual earnings.

Overtime kicks in once you work more than 40 hours in a week. Typically, you earn 1.5x your regular hourly wage for overtime hours.

So if you make $26 per hour normally, you would make $39 per hour for any hours over 40 in a week.

Here’s an example:

- You work 45 hours in a Week

- 40 regular hours paid at $26 per hour = $1,040

- 5 overtime hours paid at $39 per hour = $195

- Your total one Week earnings =$1,040 + $195 = $1,235

If you worked 45 hours each week for 52 weeks, here’s how your annual earnings increase thanks to overtime pay:

$1,235 per week x 52 weeks per year = $64,220

That’s $10,140 more than you’d earn working just 40 hours per week at $26 an hour.

Overtime can add up! But also consider taxes and work-life balance when deciding on extra hours.

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $26 an hour:

| Overtime hours per work day | Hours Per Week | Earnings Per Week | Annual Earnings |

| 0 | 40 | $1,040 | $54,080 |

| 1 | 45 | $1,235 | $64,220 |

| 2 | 50 | $1,430 | $74,360 |

| 3 | 55 | $1,625 | $84,500 |

| 4 | 60 | $1,820 | $94,640 |

| 5 | 65 | $2,015 | $104,780 |

| 6 | 70 | $2,210 | $114,920 |

| 7 | 75 | $2,405 | $125,060 |

How Unpaid Time Off Impacts $26/Hour Yearly Earnings

So far we’ve assumed you work 52 paid weeks per year. Any unpaid time off will reduce your total income.

For example, let’s say you take 2 weeks of unpaid leave. That brings your paid weeks down to 50:

Hours worked per week (40) x Hourly wage($26) x Weeks worked per year(50) = $52,000 annual salary

With 2 weeks unpaid time off, your annual earnings at $26/hour would drop by $2,080.

The table below summarizes how your annual income changes depending on the number of weeks of unpaid leave.

| Weeks of unpaid leave | Paid weeks per year | Earnings Per Week | Annual Earnings |

| 0 | 52 | $1,040 | $54,080 |

| 1 | 51 | $1,040 | $53,040 |

| 2 | 50 | $1,040 | $52,000 |

| 3 | 49 | $1,040 | $50,960 |

| 4 | 48 | $1,040 | $49,920 |

| 5 | 47 | $1,040 | $48,880 |

| 6 | 46 | $1,040 | $47,840 |

| 7 | 45 | $1,040 | $46,800 |

Key Takeaways for $26 Hourly Wage

In summary, here are some key points on annual earnings when making $26 per hour:

- At 40 hours per week, you’ll earn $54,080 per year.

- Part-time of 30 hours/week results in $40,560 annual salary.

- Overtime pay can boost yearly earnings, e.g. $10,140 extra at 45 hours/week.

- Unpaid time off reduces your total income, around $2,080 less per 2 weeks off.

- Your specific situation and location impacts taxes and PTO.

Knowing your approximate annual salary and factors impacting it makes it easier to budget and plan your finances. The next step is calculating take-home pay after deductions like taxes.

$26 An Hour Is How Much A Year After Taxes

Figuring out your actual annual earnings based on an hourly wage can be complicated once taxes are taken into account. In addition to federal, state, and local income taxes, 7.65% of your gross pay also goes to Social Security and Medicare through FICA payroll taxes. So how much does $26 an hour equal per year after FICA and income taxes are deducted from your gross pay?

Below we’ll walk through the steps to calculate your annual net take home pay if you make $26 per hour. This will factor in estimated federal, FICA, state, and local taxes so you know exactly what to expect.

Factoring in Federal Income Tax

Your federal income tax will be a big chunk out of your gross pay. Federal tax rates range from 10% to 37%, depending on your tax bracket.

To estimate your federal income tax rate and liability:

Look up your federal income tax bracket based on your gross pay.

2023 tax brackets: single filers

| Tax rate | Taxable income bracket | Tax owed |

|---|---|---|

| 10% | $0 to $11,000. | 10% of taxable income. |

| 12% | $11,001 to $44,725. | $1,100 plus 12% of the amount over $11,000. |

| 22% | $44,726 to $95,375. | $5,147 plus 22% of the amount over $44,725. |

| 24% | $95,376 to $182,100. | $16,290 plus 24% of the amount over $95,375. |

| 32% | $182,101 to $231,250. | $37,104 plus 32% of the amount over $182,100. |

| 35% | $231,251 to $578,125. | $52,832 plus 35% of the amount over $231,250. |

| 37% | $578,126 or more. | $174,238.25 plus 37% of the amount over $578,125. |

For example, if you are single with $54,080 gross annual pay, your federal tax bracket is 22%.

Your estimated federal tax would be:

$5,147 + ($54,080 – $44,726) x 22% = $7,204.88

So at $26/hour with $54,080 gross pay, you would owe about $7,204.88 in federal income taxes.

Considering State Income Tax

In addition to federal tax, most states also charge a state income tax. State income tax rates range from about 1% to 13%, with most falling between 4% and 6%.

Key Takeaways

-

- California, Hawaii, New York, New Jersey, and Oregon have some of the highest state income tax rates.

- Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming don’t impose an income tax at all.

- Another 10 U.S states have a flat tax rate—everyone pays the same percentage regardless of how much they earn.

A State-by-State Comparison of Income Tax Rates

| STATE | TAX RATES | LOWEST AND HIGHEST INCOME BRACKETS |

|---|---|---|

| Alaska | 0% | None |

| Florida | 0% | None |

| Nevada | 0% | None |

| South Dakota | 0% | None |

| Tennessee | 0% | None |

| Texas | 0% | None |

| Washington | 0% | None |

| Wyoming | 0% | None |

| Colorado | 4.55% | Flat rate applies to all incomes |

| Illinois | 4.95% | Flat rate applies to all incomes |

| Indiana | 3.23% | Flat rate applies to all incomes |

| Kentucky | 5% | Flat rate applies to all incomes |

| Massachusetts | 5% | Flat rate applies to all incomes |

| New Hampshire | 5% | Flat rate on interest and dividend income only |

| North Carolina | 4.99% | Flat rate applies to all incomes |

| Pennsylvania | 3.07% | Flat rate applies to all incomes |

| Utah | 4.95% | Flat rate applies to all incomes |

| Michigan | 4.25% | Flat rate applies to all incomes |

| Arizona | 2.59% to 4.5% | $27,806 and $166,843 |

| Arkansas | 2% to 5.5% | $4,300 and $8,501 |

| California | 1% to 13.3% | $9,325 and $1 million |

| Connecticut | 3% to 6.99% | $10,000 and $500,000 |

| Delaware | 0% to 6.6% | $2,000 and $60,001 |

| Alabama | 2% to 5% | $500 and $3,001 |

| Georgia | 1% to 5.75% | $750 and $7,001 |

| Hawaii | 1.4% to 11% | $2,400 and $200,000 |

| Idaho | 1.125% to 6.5% | $1,568 and $7,939 |

| Iowa | 0.33% to 8.53% | $1,743 and $78,435 |

| Kansas | 3.1% to 5.7% | $15,000 and $30,000 |

| Louisiana | 1.85% to 4.25% | $12,500 and $50,001 |

| Maine | 5.8% to 7.15% | $23,000 and $54,450 |

| Maryland | 2% to 5.75% | $1,000 and $250,000 |

| Minnesota | 5.35% to 9.85% | $28,080 and $171,221 |

| Mississippi | 0% to 5% | $5,000 and $10,001 |

| Missouri | 1.5% to 5.3% | $1,121 and $8,968 |

| Montana | 1% to 6.75% | $2,900and $17,400 |

| Nebraska | 2.46% to 6.84% | $3,340 and $32,210 |

| New Jersey | 1.4% to 10.75% | $20,000 and $1 million |

| New Mexico | 1.7% to 5.9% | $5,500 and $210,000 |

| New York | 4% to 10.9% | $8,500 and $25 million |

| North Dakota | 1.1% to 2.9% | $41,775 and $458,350 |

| Ohio | 0% to 3.99% | $25,000 and $110,650 |

| Oklahoma | 0.25% to 4.75% | $1,000 and $7,200 |

| Oregon | 4.75% to 9.9% | $3,750 and $125,000 |

| Rhode Island | 3.75% to 5.99% | $68,200 and $155,050 |

| South Carolina | 0% to 7% | $3,110 and $15,560 |

| Vermont | 3.35% to 8.75% | $42,150 and $213,150 |

| Virginia | 2% to 5.75% | $3,000 and $17,001 |

| Washington, D.C. | 4% to 9.75% | $10,000 and $1 million |

| West Virginia | 3% to 6.5% | $10,000 and $60,000 |

| Wisconsin | 3.54% to 7.65% | $12,760 and $280,950 |

To estimate your state income tax:

Look up your state income tax rate based on your gross pay and filing status.

Multiply your gross annual pay by the state tax rate.

For example, if you live in Pennsylvania which has a flat 3.07% tax rate, your estimated state tax would be:

$54,080 gross pay x 3.07% PA tax rate = $1,660.26 estimated state income tax

So with $54,080 gross annual income, you would owe around in $1,660.26 Pennsylvania state income tax. Verify your specific state’s income tax rates.

Factoring in Local Taxes

Some cities and counties levy local income taxes ranging from 1-3% of taxable income.

To estimate potential local taxes you may owe:

- Check if your city or county charges a local income tax.

- If yes, look up the local income tax rate.

- Multiply your gross annual pay by the local tax rate.

For example, say you live in Columbus, OH which has a 2.5% local income tax. Your estimated local tax would be:

$54,080 gross pay x 2.5% local tax rate = $1,352 estimated local tax

So with $54,080 in gross earnings, you may owe around $1,352 in Columbus local income taxes. Verify rates for your own city/county.

Accounting for FICA Taxes (Social Security & Medicare)

FICA taxes are a combination of Social Security and Medicare taxes that equal 15.3% of your earnings. You are responsible for half of the total bill (7.65%), which includes a 6.2% Social Security tax and 1.45% Medicare tax on your earnings.

In 2023, only the first $160,200 of your earnings are subject to the Social Security tax

There is an additional 0.9% surtax on top of the standard 1.45% Medicare tax for those who earn over $200,000 (single filers) or $250,000 (joint filers).

To estimate your FICA tax payment:

$54,080 x 6.2% + $54,080 x 1.45% = $4,137.12

So you can expect to pay about $4,137.12 in Social Security and Medicare taxes out of your gross $54,080 in earnings.

Total Estimated Tax Payments

Based on the examples above, your total estimated tax payments would be:

Federal tax: $7,204.88

State tax: $1,660.26

Local tax: $1,352

FICA tax: $4,137.12

Total Estimated Tax: $14,354.26

Calculating Your Take Home Pay

To calculate your annual take home pay at $26 /hour:

1. Take your gross pay

2. Subtract your estimated total tax payments

$54,080 gross pay – $14,354.26 Total Estimated Tax = $39,725.74 Your Take Home Pay

n summary, if you make $26 per hour and work full-time, you would take home around $39,725.74 per year after federal, state, local , FICA taxes.

Your actual net income may vary depending on your specific tax situation. But this gives you a general idea of what to expect.

Convert $26 Per Hour to Yearly, Monthly, Biweekly, and Weekly Salary After Taxes

If you make $26 an hour and work full-time (40 hours per week), your estimated yearly salary would be $54,080 .

The $54,080 per year salary does not account for taxes. Federal, state, and local taxes will reduce your take-home pay. The amount withheld depends on your location, filing status, dependents, and other factors.

Just now during our calculation of $26 An Hour Is How Much A Year After Taxes, we assumed the following conditions:

- You are single with $54,080 gross annual pay, your federal tax bracket is 22 %.

- You live in Pennsylvania which has a flat 3.07% tax rate

- You live in Columbus, OH which has a 2.5% local income tax.

In the end, we calculated your Total Estimated Tax is $14,354.26 , Your Take Home Pay is $39,725.74 , Total tax rate is 26.54%.

So next we’ll use 26.54% as the estimated tax rate to calculate your weekly, biweekly, and monthly after-tax income.

$26 Per Hour to Yearly, Monthly, Biweekly, Weekly,and Week Salary After Taxes Table

| Income before taxes | Estimated Tax Rate | Income Taxes | After Tax Income | |

| Yearly Salary | $54,080 | 26.54% | $14,354.26 | $39,725.74 |

| Monthly Salary | $4,506.67 | 26.54% | $1,196.19 | $3,310.48 |

| BiWeekly Salary | $2,080 | 26.54% | $552.09 | $1,527.91 |

| Weekly Salary | $1,040 | 26.54% | $276.04 | $763.96 |

$26 an hour is how much a year after taxes

Here is the adjusted yearly salary after a 26.54% tax reduction:

-

- Yearly salary before taxes: $54,080

- Estimated tax rate: 26.54%

- Taxes owed (26.54% * $54,080 )= $14,354.26

- Yearly salary after taxes: $39,725.74

| Hourly Wage | Hours Worked Per Week | Weeks Worked Per Year | Total Yearly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Yearly Salary |

|---|---|---|---|---|---|---|

| $26 | 40 | 52 | $54,080 | 26.54% | $14,354.26 | $39,725.74 |

$26 an hour is how much a month after taxes

To calculate the monthly salary based on an hourly wage, you first need the yearly salary amount. Then divide by 12 months.

-

-

- Yearly salary before taxes at $26 per hour: $54,080

- Divided by 12 months per year: $54,080 / 12 = $4,506.67 per month

-

The monthly salary based on a 40 hour work week at $26 per hour is $4,506.67 before taxes.

After applying the estimated 26.54% tax rate, the monthly after-tax salary would be:

-

- Monthly before-tax salary: $4,506.67

- Estimated tax rate: 26.54%

- Taxes owed (26.54% * $4,506.67 )= $1,196.19

- Monthly after-tax salary: $3,310.48

Monthly Salary Based on $26 Per Hour

| Hourly Wage | Yearly Salary | Months Per Year | Before-Tax Monthly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Monthly Salary |

|---|---|---|---|---|---|---|

| $26 | $54,080 | 12 | $4,506.67 | 26.54% | $1,196.19 | $3,310.48 |

$26 an hour is how much biweekly after taxes

Many people are paid biweekly, meaning every other week. To calculate the biweekly pay at $26 per hour:

- Hourly wage: $26

- Hours worked per week: 40

- Weeks per biweekly pay period: 2

- $26 * 40 hours * 2 weeks = $2,080 biweekly

Applying the 26.54%estimated tax rate:

- Biweekly before-tax salary: $2,080

- Estimated tax rate: 26.54%

- Taxes owed (26.54% * $2,080 )= $552.09

- Biweekly after-tax salary: $1,527.91

Biweekly Salary at $26 Per Hour

| Hourly Wage | Hours Worked Per Week | Weeks Per Pay Period | Before-Tax Biweekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Biweekly Salary |

|---|---|---|---|---|---|---|

| $26 | 40 | 2 | $2,080 | 26.54% | $552.09 | $1,527.91 |

$26 an hour is how much weekly after taxes

To find the weekly salary based on an hourly wage, you need to know the number of hours worked per week. At 40 hours per week, the calculation is:

- Hourly wage: $26

- Hours worked per week: 40

- $26 * 40 hours = $1,040 per week

Accounting for the estimated 26.54% tax rate:

- Weekly before-tax salary: $1,040

- Estimated tax rate: 26.54%

- Taxes owed (26.54% * $1,040 )= $276.04

- Weekly after-tax salary: $763.96

Weekly Salary at $26 Per Hour

| Hourly Wage | Hours Worked Per Week | Before-Tax Weekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Weekly Salary |

|---|---|---|---|---|---|

| $26 | 40 | $1,040 | 26.54% | $276.04 | $763.96 |

Key Takeaways

- An hourly wage of $26 per hour equals a yearly salary of $54,080 before taxes, assuming a 40 hour work week.

- After accounting for an estimated 26.54% tax rate, the yearly after-tax salary is approximately $39,725.74 .

- On a monthly basis before taxes, $26 per hour equals $4,506.67 per month. After estimated taxes, the monthly take-home pay is about $3,310.48 .

- The before-tax weekly salary at $26 per hour is $1,040 . After taxes, the weekly take-home pay is approximately $763.96 .

- For biweekly pay, the pre-tax salary at $26 per hour is $2,080 . After estimated taxes, the biweekly take-home pay is around $1,527.91 .

Understanding annual, monthly, weekly, and biweekly salary equivalents based on an hourly wage is useful when budgeting and financial planning. Taxes make a significant difference in take-home pay, so be sure to account for them when making income conversions. Use this guide as a reference when making salary calculations.

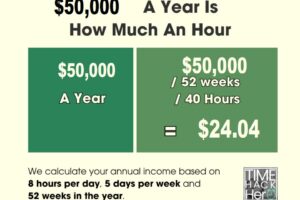

What Is the Average Hourly Wage in the US?

Last Updated: Sep 1 2023

US Average Hourly Earnings is at a current level of $33.82, up from 33.74 last month and up from 32.43 one year ago. This is a change of 0.24% from last month and 4.29% from one year ago.

Average Hourly Earnings is the average dollars that a private employee makes per hour in the US. This metric is a part of one of the most important releases every month which includes unemployment numbers as well. This is normally released on the first Friday of every month. This metric is released by the Bureau of Labor Statistics (BLS).

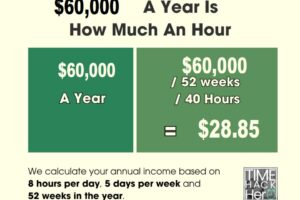

What is the average salary in the U.S.?

Last Updated: July 18, 2023

The U.S. Bureau of Labor Statistics uses median salary data rather than averages to avoid skewed numbers from outlying high and low numbers. Median weekly earnings of the nation's 121.5 million full-time wage and salary workers were $1,100 in the second quarter of 2023, the U.S.

If a person works 52 weeks in the year, then this represents a national annual salary of $57,200.

Is $26 an Hour a Good Salary?

Whether or not $26 per hour is considered a “good” wage depends heavily on where you live, household size, lifestyle expectations, and other factors.

For a single person without children living in a small or mid-sized city, $26 an hour can certainly provide a comfortable middle-class lifestyle. However, for larger metropolitan areas like Los Angeles, New York City, Chicago, Seattle, Miami, and others, this hourly wage would require some budgetary prudence.

Let’s examine some data from the MIT Living Wage Calculator:

- New York City: $26.62 per hour

- Chicago: $19.04 per hour

- Houston: $17.68 per hour

- Billings, MT: $15.77 per hour

- Columbus, OH: $15.80 per hour

So in more rural and suburban areas, $26 an hour exceeds living wage estimates rather comfortably. But for costly urban cities, it falls slightly below the minimum comfortable standard, especially for families.

For larger households with 2+ children, a sole earner making $26 per hour would find it challenging to support all expenses without supplemental income. As family size grows, making ends meet becomes harder.

Jobs that pay $26 an hour

There are a variety of professional and skilled trade occupations that typically pay around $26 per hour:

- Registered nurses – Provide medical care and patient education in hospitals, doctor’s offices, nursing homes, and other healthcare facilities. Requires at least an associate’s degree in nursing (ADN).

- Respiratory therapists – Assess and treat patients with heart and lung conditions under physician supervision. Need an associate’s degree to qualify.

- Radiologic technologists – Take x-rays and administer nonradioactive materials into patients’ bloodstreams for diagnostic imaging. Requires an associate’s degree and certification.

- Electrical powerline installers – Install and maintain the power grid including power lines, transformers and pole hardware. Requires technical school training plus an apprenticeship.

- Elevator installers – Assemble, install, and repair elevators, escalators, chairlifts and moving walkways. Must complete a 4-year paid apprenticeship program.

- Web developers – Create and maintain websites and web applications. Most positions require a bachelor’s degree in web design, computer science or related field.

- Mechanical drafters – Prepare technical drawings, schematics, diagrams and models to specify mechanical systems and components. Typically need an associate’s degree.

These examples demonstrate the range of stable skilled trade, technical and professional roles that pay in the $24 – $28 per hour range. Education requirements vary.

Can You Live Off $26 An Hour?

Whether living comfortably is achievable on $26 an hour largely depends on where you live and your overall budget and lifestyle factors. For dual income households without children or single individuals in reasonably priced regions, this wage can absolutely enable a high quality of life. However, families with multiple dependents or those in high cost cities may require supplemental income.

To determine if $26/hour meets your needs, outline your monthly expenses:

- Housing (mortgage/rent, insurance, taxes, utilities)

- Transportation (car payment, insurance, gas, repairs)

- Food

- Healthcare (insurance, prescriptions, co-pays)

- Debt obligations

- Leisure and entertainment

- Miscellaneous expenses

Experts recommend spending no more than 30% of pretax income on housing. At $26/hour or ~$4,493 monthly before taxes, that’s roughly $1,348 toward housing costs. This is reasonable for most areas outside major metros.

Overall, maintaining a detailed budget, minimizing unnecessary costs, and keeping housing affordable is key to living comfortably on $26 per hour. Avoiding lifestyle inflation also helps. With proper planning, this income can absolutely enable thriving financially.

The impact of inflation on the value of $26 an hour

With inflation recently hitting multi-decade highs, the real value of $26 an hour has decreased substantially. While nominal wage growth has somewhat kept pace over the past couple years, accounting for 8-9% annual inflation shows most workers have experienced a decline in real wages.

In 2021, $26 an hour provided an annual income of around $54,080. But with high inflation, real wages have dropped by 6-8 percentage points when adjusted for huge rises in cost of living.

This means employees are able to purchase fewer goods and services with their earnings compared to prior years. From housing and food costs to transportation, healthcare, and education, expenses have increased considerably across the board.

Unless wages start increasing faster than inflation, this decline in real incomes will persist and economic pressures on middle class households will intensify. Careful budgeting and spending optimization becomes critical.

5 Ways To Increase Your Hourly Wage

If you currently earn around $26 per hour but want to boost your earnings, here are some options:

- Ask for a raise – If you’ve been with your company a while and have a strong performance history, request a pay increase to keep pace with rising costs.

- Find a higher paying job – Browse job boards and professional contacts to uncover new roles that better compensate your experience.

- Develop new skills – Take classes, online courses, or training programs to gain skills that qualify you for higher-paying jobs.

- Freelance or consult – Use your expertise to provide freelance services or consulting in your off hours to generate income.

- Start a side business – Offer services like bookkeeping, web design, tutoring, or sell products online to earn supplemental income.

- Adjust tax withholding – Claim fewer allowances to reduce tax withholding and increase your regular take-home pay. (But avoid underpaying to prevent penalties!)

Pursuing a combination of these avenues can help maximize your earnings potential beyond $26 per hour.

Buying a car on $26 an hour

Reliable transportation is an essential need for most working professionals. But does making $26 an hour provide enough income to comfortably afford a car?

The short answer – yes, absolutely. The average monthly new car payment sits around $600. For someone earning $26 an hour or ~$4,493 monthly pre-tax, this equates to just 13% of gross income – well below the recommended 15% maximum budget allocation.

Here are some tips for buying a car when making $26 per hour:

- Shop new or used – With a healthy income, you likely can afford payments for a new or used model. Evaluate all costs.

- Get pre-approved – Secure pre-approval first so you know your budget ceiling before shopping around. This allows you to target options in your affordable price range.

- Compare loan terms – Weigh loan lengths (48 months, 60 months, etc.) and interest rates to find the optimal monthly payment for your budget.

- Make a large down payment – Putting 20% down or more keeps your monthly payments lower and saves substantially on interest over the loan duration.

- Investigate leasing – For some situations and based on factors like annual mileage, leasing may provide more financial benefit than buying.

With a $26 hourly wage, you have great flexibility in choosing a vehicle while keeping payments comfortable and affordable.

Can You Buy a House on $26 An Hour?

One major benefit of earning $26 an hour is having an income level that provides a path to affordable home ownership in many real estate markets. While prices and specific budgets will vary greatly by location, this salary range positions most people well to buy and pay for a home.

Here are some tips for buying a house when you make around $26 per hour:

- Determine your budget – Factor in likely mortgage payments, taxes, insurance, maintenance, and homeowner fees given prices in areas you’re considering.

- Save for a downpayment – Shoot for 20% down to avoid PMI and get better rates. This may take a few years to build up through disciplined saving.

- Check first-time homebuyer programs – If it’s your first home purchase, look into special programs that provide grants, loans, and tax credits to assist buyers.

- Compare mortgage options – Weigh pros and cons of conventional, FHA, VA, and ARM loans to find the best rates and terms for your situation.

- Prioritize must-have features – To keep purchase costs down, consider sacrificing nice-to-have amenities and focus on necessities.

- Consider hiring a buyer’s agent – They provide invaluable expertise to help you assess home values, negotiate, and navigate the buying process.

While not easy, home ownership is very achievable on $26 an hour with proper planning, realistic expectations, and strategic home selection. This income level provides a great foundation.

Example Budget For $26 Per Hour

Here is an example budget for an individual earning $26 an hour or $4,493 per month before taxes:

Income

- Monthly Take Home Pay: $3,500

- Partner’s Take Home Pay: $2,800

- Total: $6,300

Housing

- Mortgage Payment: $1,600

- Home Insurance: $125

- Utilities: $390

Transportation

- Car Payment: $400

- Insurance: $140

- Gas: $240

Other Costs

- Groceries: $550

- Dining Out: $250

- Entertainment: $200

- Medical: $250

- Miscellaneous: $320

Total Expenses: $4,465

Remaining Each Month:

- $1,835

This comfortable budget allows for retirement contributions, building an emergency fund, and discretionary spending while building home equity. A $26 hourly wage can absolutely support living very well for most individuals and households.

Of course, circumstances like high cost-of-living cities, large families, and substantial debts would require financial adjustments. But in general, this income level provides a great middle class lifestyle in most regions.

In Summary

For individuals, dual income households, and small families living in reasonably priced areas, $26 per hour enables a very comfortable, stable middle-class lifestyle. But for larger families or those in major metros, expenses may necessitate supplemental income.

Strict budgeting and smart financial choices are key to offsetting the inflationary erosion of real wages. With proper planning, $26 an hour provides most people the means to not just get by, but potentially thrive financially and build assets like home ownership. It’s a solid income, but also requires avoiding unnecessary lifestyle inflation.