When earning an hourly wage, it’s useful to calculate your potential annual salary. At $25 per hour, your yearly earnings depend on the number of hours worked per week and weeks per year. Factors like overtime, holidays, and taxes also impact your actual take-home pay.

This article explains how to estimate your annual income if you make $25 an hour. We’ll walk through the calculations based on full-time and part-time work schedules. You’ll also learn how overtime pay and time off affect your total yearly earnings.

Follow along to find out the answer to: $25 an hour is how much a year?

Table of Contents

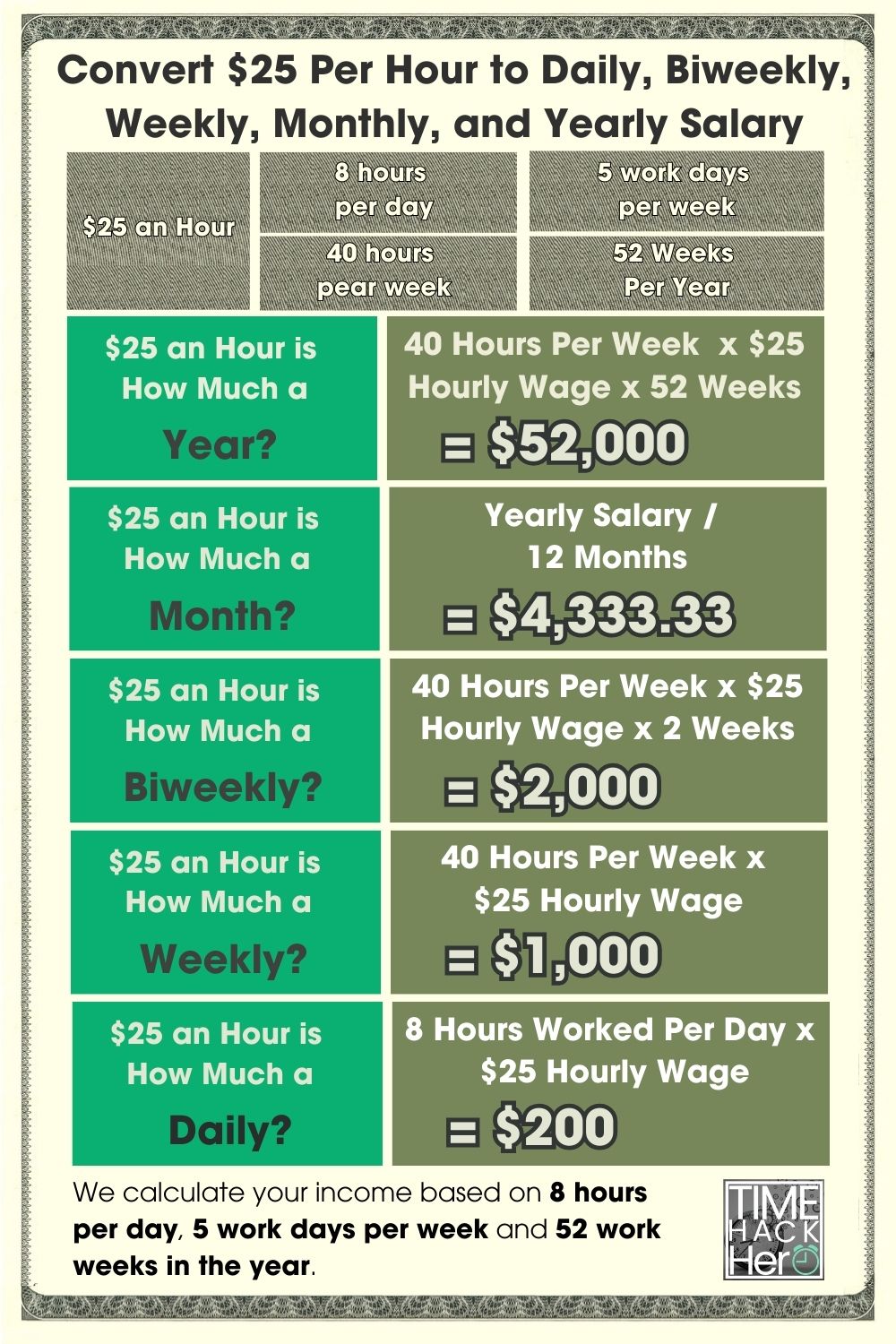

Convert $25 Per Hour to Weekly, Monthly, and Yearly Salary

Input your wage and hours per week to see how much you’ll make monthly, yearly and more.

$25 an Hour Equals How Much Annually?

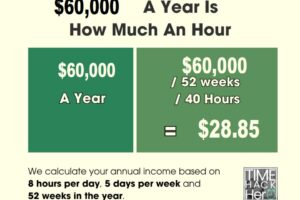

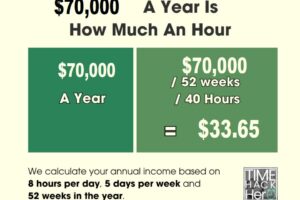

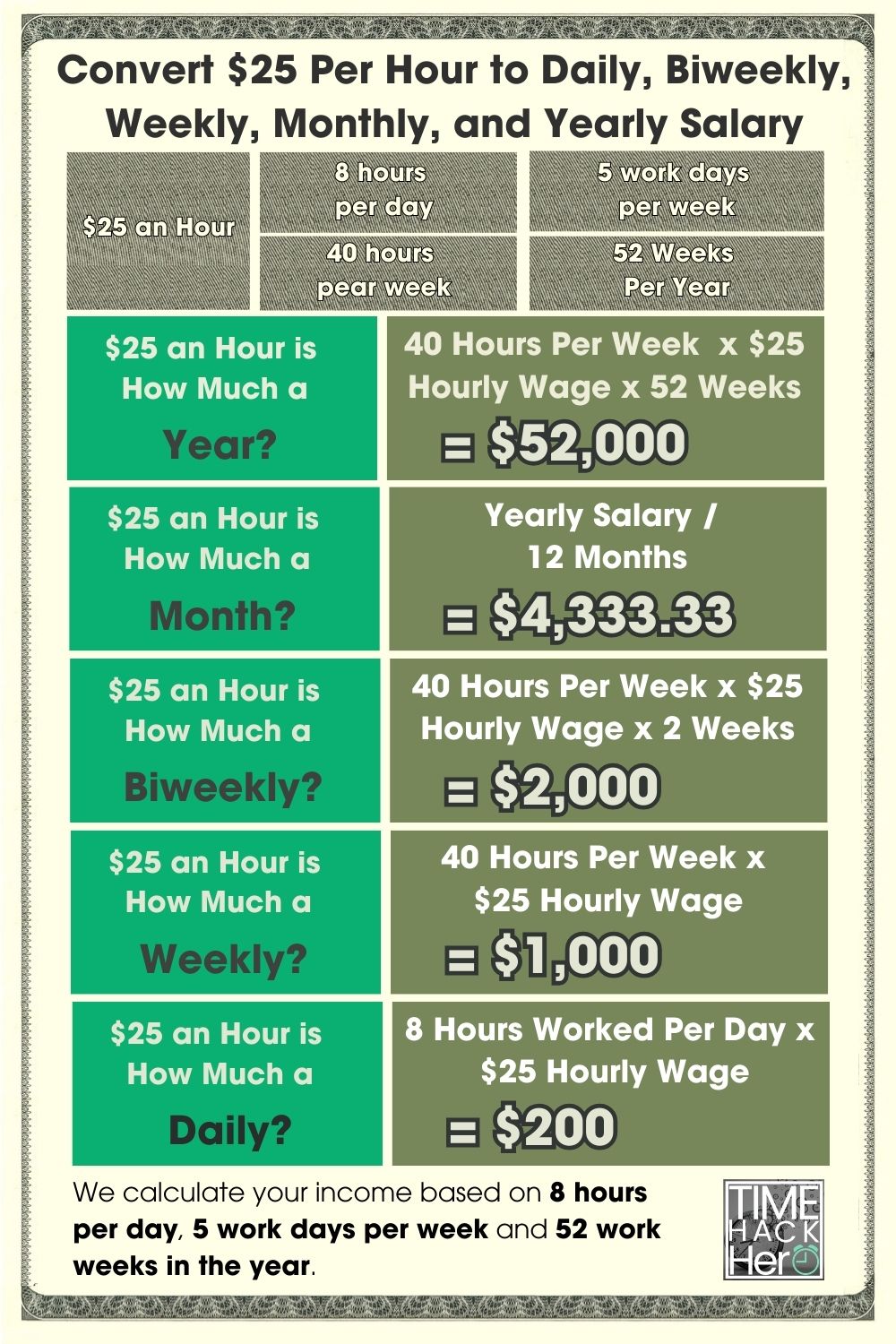

If you earn $25 per hour and work full-time (40 hours/week) for all 52 weeks, your annual salary would be $52,000.

$25 per hour x 40 hours per week x 52 weeks per year = $52,000

This assumes a standard 40 hour work week with no overtime or unpaid time off.

$25 an Hour is How Much Per Month?

Making $25 an hour equals $4,333.33 per month when working full-time. This is calculated by dividing the annual salary of $52,000 by 12 months.

$52,000 annual salary / 12 months = $4,333.33 monthly income

$25 an Hour is How Much a Week?

If you make $25 an hour, your weekly salary would be $1,000. Calculating based on 5 days per week and 8 hours each day.

Hours worked per week (40) x Hourly wage($25) =$1,000

$25 an Hour is How Much a Day?

If you make $25 an hour, your daily salary would be $200. We calculated your daily income based on 8 hours per day.

Hours worked per day (8) x Hourly wage($25) =$200

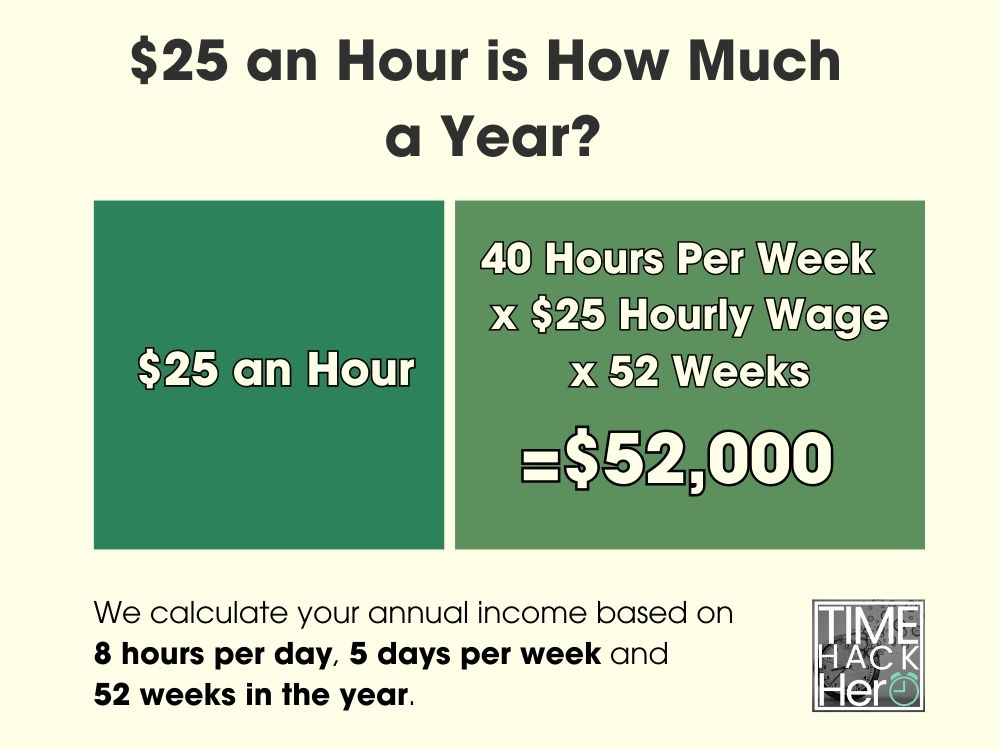

$25 an Hour is How Much a Year?

The basic formula to calculate your annual salary from an hourly wage is:

Hourly Rate x Hours Worked per Week x Number of Weeks Worked per Year = Annual Salary

So for a $25 per hour job:

$25 per hour x 40 hours per week x 52 weeks per year = $52,000

However, this simple calculation makes some assumptions:

- You will work 40 hours every week of the year

- You will not get any paid time off

Therefore, it represents your earnings if you worked every week of the year, without any vacation, holidays, or sick days.

Accounting for Paid Time Off

The $52,000 base salary does not yet factor in paid time off (PTO). Let’s assume the job provides:

- 2 weeks (10 days) paid vacation

- 6 paid holidays

- 3 paid sick days

This totals 19 paid days off, or nearly 4 weeks of PTO.

Importantly, this paid time off should not be deducted from the annual salary, since you still get paid for those days.

So with 4 weeks PTO, the annual salary would remain $52,000.

Part Time $25 an Hour Equals How Much a Year?

Working part-time results in a lower yearly salary compared to full-time hours.

For example, if you work 30 hours per week at $25/hour:

$25 per hour x 30 hours per week x 52 weeks per year = $39,000

That’s $13,000 less per year than working 40 hour weeks.

Here’s a table summarizing annual salaries at $25/hour for different part-time schedules:

| Hours Per Week | Earnings Per Week | Annual Salary |

|---|---|---|

| 40 | $1,000 | $52,000 |

| 35 | $875 | $45,500 |

| 30 | $750 | $39,000 |

| 25 | $625 | $32,500 |

| 20 | $500 | $26,000 |

The more hours per week, the higher your total yearly earnings. But part-time work allows for more life balance if you don’t need the full salary.

Overtime Pay Raises Your $25/Hour Yearly Total

Hourly workers often get overtime pay for working more than 40 hours in a week. Overtime is typically 1.5 times your regular hourly wage.

So at $25 per hour normal pay, overtime would be $37.50 per hour.

Here’s an example:

- You work 45 hours in Week 1

- 40 regular hours at $25/hour = $1,000

- 5 overtime hours at $37.50/hour = $187.50

- Your total for Week 1 = $1,187.50

If you worked 45 hours every week of the year, your annual salary would increase thanks to overtime pay:

$1,187.50 per week x 52 weeks = $61,750 annual salary

That’s $9,750 more than you’d earn working just 40 hours per week at $25 an hour.

Overtime can add up! But also consider taxes and work-life balance when deciding on extra hours.

How Unpaid Time Off Impacts $25/Hour Yearly Earnings

So far we’ve assumed you work 52 paid weeks per year. Any unpaid time off will reduce your total income.

For example, let’s say you take 2 weeks of unpaid leave. That brings your paid weeks down to 50:

$1,000 per week x 50 paid weeks = $50,000 annual salary

With 2 weeks unpaid time off, your annual earnings at $25/hour would drop by $2,000.

Always account for estimated unpaid time when calculating your anticipated salary from an hourly wage.

Key Takeaways for $25 Hourly Wage

In summary, here are some key points on annual earnings when making $25 per hour:

- At 40 hours per week, you’ll earn $52,000 per year.

- Part-time of 30 hours/week results in $39,000 annual salary.

- Overtime pay can boost yearly earnings, e.g. $9,750 extra at 45 hours/week.

- Unpaid time off reduces your total income, around $2,000 less per 2 weeks off.

- Your specific situation and location impacts taxes and PTO.

- Use these formulas to estimate your yearly pay at $25/hour.

Knowing your approximate annual salary and factors impacting it makes it easier to budget and plan your finances. The next step is calculating take-home pay after deductions like taxes.

$25 An Hour Is How Much A Year After Taxes

Figuring out your actual annual earnings based on an hourly wage can be complicated once taxes are taken into account. In addition to federal, state, and local income taxes, 7.65% of your gross pay also goes to Social Security and Medicare through FICA payroll taxes. So how much does $25 an hour equal per year after FICA and income taxes are deducted from your gross pay?

Below we’ll walk through the steps to calculate your annual net take home pay if you make $25 per hour. This will factor in estimated federal, FICA, state, and local taxes so you know exactly what to expect.

Factoring in Federal Income Tax

Your federal income tax will be a big chunk out of your gross pay. Federal tax rates range from 10% to 37%, depending on your tax bracket.

To estimate your federal income tax rate and liability:

Look up your federal income tax bracket based on your gross pay.

2023 tax brackets: single filers

|

Tax rate |

Taxable income bracket |

Tax owed |

|---|---|---|

|

10% |

$0 to $11,000. |

10% of taxable income. |

|

12% |

$11,001 to $44,725. |

$1,100 plus 12% of the amount over $11,000. |

|

22% |

$44,726 to $95,375. |

$5,147 plus 22% of the amount over $44,725. |

|

24% |

$95,376 to $182,100. |

$16,290 plus 24% of the amount over $95,375. |

|

32% |

$182,101 to $231,250. |

$37,104 plus 32% of the amount over $182,100. |

|

35% |

$231,251 to $578,125. |

$52,832 plus 35% of the amount over $231,250. |

|

37% |

$578,126 or more. |

$174,238.25 plus 37% of the amount over $578,125. |

For example, if you are single with $52,000 gross annual pay, your federal tax bracket is 22%.

Your estimated federal tax would be:

$11,000 x 10% +($44,725 – $11,000) x 12% + ($52,000 – $44,725) x 22%= $6,747.5

So at $25/hour with $52,000 gross pay, you would owe about $6,747.5 in federal income taxes.

Considering State Income Tax

In addition to federal tax, most states also charge a state income tax. State income tax rates range from about 1% to 13%, with most falling between 4% and 6%.

Key Takeaways

- California, Hawaii, New York, New Jersey, and Oregon have some of the highest state income tax rates in the country.

- Seven U.S. states charge no tax on earned income at all.

- Another 10 U.S states have a flat tax rate—everyone pays the same percentage regardless of how much they earn.

Look up your state income tax rate based on your gross income and filing status.

Top Income Tax Rates by State

Below, you’ll find the top 10 states with the highest income tax

| STATE | TOP INCOME TAX RATE |

|---|---|

| California | 13.3% |

| Hawaii | 11% |

| New York | 10.9% |

| New Jersey | 10.75% |

| Oregon | 9.9% |

| Minnesota | 9.85% |

| District of Columbia | 9.75% |

| Vermont | 8.75% |

| Iowa | 8.53% |

| Wisconsin | 7.65% |

Multiply your gross pay by your state tax rate. This gives your estimated state tax.

For example, say you live in North Carolina which has a 4.99% flat tax rate. Your estimated state income tax would be:

$52,000 gross pay x 4.99% state tax rate = $2,594.80 estimated state income tax

So with $52,000 gross annual pay, you would owe around $2,594.80 in North Carolina state income tax. Make sure to check your specific state’s rates.

Considering Local Taxes

Some cities and counties also charge local income taxes. These generally range from 1% to 3% of gross pay.

To estimate your potential local tax:

- See if your city or county charges a local income tax.

- If yes, look up the local income tax rate.

- Multiply your gross pay by the local tax rate to get your estimated local tax.

For example, if you lived in Columbus, Ohio which has a 2.5% local income tax, your estimated local tax would be:

$52,000 gross pay x 2.5% local tax rate = $1,300 estimated local income tax

So you may owe around $1,300 in local taxes in Columbus. Remember to check rates for your own city/county.

Accounting for FICA Taxes (Social Security & Medicare)

On top of income taxes, 7.65% of your gross pay will go to FICA taxes to fund Social Security and Medicare. This includes:

- 6.2% for Social Security

- 1.45% for Medicare

To estimate your FICA tax payment:

$52,000 gross pay x 7.65% FICA tax rate = $3,900

So you can expect to pay about $3,900 in Social Security and Medicare taxes out of your gross $52,000 in earnings.

Total Estimated Tax Payments

Based on the examples above, your total estimated tax payments would be:

Federal tax: $6,747.5

State tax: $2,594.80

Local tax: $1,300

FICA tax: $3,900

Total Estimated Tax: $14,542.3

Your total estimated tax payments would be around $14,542.3 per year.

Calculating Your Take Home Pay

To calculate your annual take home pay at $25/hour:

- Take your gross pay

- Subtract your estimated total tax payments

$52,000 gross pay – $14,542.3 Total Estimated Tax = $37,457.7 Your Take Home Pay

In summary, if you make $25 per hour and work full-time, you would take home around $37,457.7 per year after federal, state, local , FICA taxes.

Your actual net income may vary depending on your specific tax situation. But this gives you a general idea of what to expect.

What Is the Average Hourly Wage in the US?

Last Updated: Sep 1 2023

US Average Hourly Earnings is at a current level of $33.82, up from 33.74 last month and up from 32.43 one year ago. This is a change of 0.24% from last month and 4.29% from one year ago.

Average Hourly Earnings is the average dollars that a private employee makes per hour in the US. This metric is a part of one of the most important releases every month which includes unemployment numbers as well. This is normally released on the first Friday of every month. This metric is released by the Bureau of Labor Statistics (BLS).

What is the average salary in the U.S.?

Last Updated: July 18, 2023

The U.S. Bureau of Labor Statistics uses median salary data rather than averages to avoid skewed numbers from outlying high and low numbers. Median weekly earnings of the nation's 121.5 million full-time wage and salary workers were $1,100 in the second quarter of 2023, the U.S.

If a person works 52 weeks in the year, then this represents a national annual salary of $57,200.

Is $25 an Hour a Good Salary?

Earning $25 an hour amounts to an annual salary of around $52,000, assuming a 40-hour work week. For many Americans, this represents a comfortable middle-class income that allows for financial stability. However, whether $25 an hour is considered a “good” salary depends largely on factors like location, household size, and personal lifestyle.

Key Factors That Determine if $25/Hour is a Good Salary

Several key factors should be considered when evaluating if $25 an hour is a sufficient income:

Cost of Living

The cost of living varies tremendously across the United States. While $25 an hour goes far in some rural areas, it may barely cover basic expenses in high cost metro regions like San Francisco or New York City. Always compare potential salaries to local costs.

Household Size and Dependents

A single person can live comfortably on $25 an hour. However, supporting a family significantly increases costs for housing, healthcare, education, childcare, and other expenses. More dependents mean a higher salary is needed.

Personal Lifestyle Expectations

Salary expectations should align with lifestyle goals. An individual focused on aggressive saving for retirement or who wants extra disposable income for travel and leisure may view $25 an hour as inadequate. However, someone with more modest expectations could be perfectly content.

Career Stage

Early career salaries tend to start low and gradually increase with experience. At the start of one’s career, $25 an hour may be an excellent income. Later in one’s career, expectations for a higher salary tend to grow.

Benefits Package Value

Some employers provide excellent health insurance, retirement plans, and other benefits that can add significant value to total compensation. Strong overall benefits at $25 an hour can make the salary more appealing.

Opportunity for Advancement

If the position provides ample opportunity for rapid salary growth through promotions, $25 an hour may be reasonable for a short period before quickly rising. However, fewer advancement prospects make the salary less adequate.

By weighing all these factors, individuals can decide if $25 an hour meets their needs and expectations both now and in the future. The salary provides a middle-class lifestyle in many areas, but it’s not ideal for all situations.

Can You Live Off $25 An Hour?

Living off $25 an hour is feasible in many parts of the country, but budgeting is crucial. Avoiding overspending and debt requires smart money management. Here are some key considerations:

Monthly Budget Overview

With an annual salary of approximately $52,000, the monthly gross pay equals around $4,333. After accounting for taxes, benefits deductions, and other payroll factors, the monthly take-home pay typically drops to roughly $3,200.

From this, housing costs usually claim the biggest portion of the budget for most people. Assuming $1,000 in rent for a modest 1-bedroom apartment, that leaves $2,200 to cover other essential expenses.

Here’s one possible budget breakdown:

| Expense | Cost |

|---|---|

| Rent | $1,000 |

| Groceries | $300 |

| Car Payment | $300 |

| Car Insurance | $100 |

| Gasoline | $100 |

| Utilities | $200 |

| Entertainment | $100 |

| Clothing | $50 |

| Savings Contribution | $200 |

| Total | $2,350 |

This leaves $850 as a buffer for unanticipated expenses and addition.

Overall, maintaining a decent but modest middle-class lifestyle is possible on $25 an hour. But it requires carefully tracking expenses and has some financial constraints.

Can You Buy a House on $25 An Hour?

While buying a house on $25 an hour is not impossible, it can be quite difficult in today’s real estate market. Home ownership requires disciplined savings, small down payments, low-cost areas, and creative financing options.

Saving for a Down Payment

The biggest barrier for buyers earning around $25 an hour is saving enough for a down payment. Conventional mortgages usually require at least 5-10% down to avoid expensive private mortgage insurance (PMI). On a median U.S. home price of $355,000, 5% down is $17,750 – a substantial amount for this income level. Getting to 10-20% down often takes years of diligent saving.

Low Down Payment Programs

One option is an FHA loan, which allows down payments as low as 3.5%. There are also some state and local programs providing down payment assistance grants to qualifying buyers. These options ease the savings requirements.

Purchasing a Lower-Cost Home

Those earning $25 an hour increase affordability by targeting less expensive properties. While still challenging in hot markets like California or New York, reasonably priced homes exist in many metro areas and small towns, especially in the Midwest and South.

Managing Other Costs

In addition to the down payment, buyers need cash reserves for closing costs and moving expenses. Ongoing mortgage payments, insurance, taxes, and maintenance costs must also fit the monthly budget. This further limits purchasing power on $25 an hour, making lower-cost markets a necessity.

While clearly difficult in today’s market, home ownership is possible on this salary by utilizing savings diligently, programs with low down payments, and focusing on lower-cost areas and properties. But budgets will be tight, and the process will take time.

Summary

- At around $52,000 annually, $25 an hour provides a middle-class income that can support a decent lifestyle. However, whether it’s “good” depends on individual circumstances like location, household size, expectations, career stage, and benefits.

- Many occupations typically pay $25 an hour or more, including registered nurses, software developers, accountants, engineers, and technical writers.

- Living on $25 an hour requires carefully budgeting to cover basic expenses, with some financial constraints. Achieving major goals like home ownership is challenging but possible with disciplined savings.

Overall, $25 an hour is a reasonable income that allows for financial independence in many parts of the country. But it may fall short of expectations for more affluent lifestyles or in high-cost regions. With smart money management, however, a secure middle-class life is certainly attainable on this salary.

What’s next, remember to save our diagram to your Pinterest board for further checking.