Converting an hourly wage into potential annual earnings is key for financial planning and setting savings goals. In this article, we’ll break down the yearly income that can be earned from $21 per hour based on standard full-time and part-time schedules.

We’ll calculate the total pre-tax salary per year that $21/hour provides. We’ll also look at how overtime can boost annual earnings. Since unpaid time off is common, we’ll factor in how it reduces actual yearly pay.

In addition, we’ll determine the after-tax income you can expect to take home annually from $21/hour after deductions. Understanding your net pay is vital.

We’ll also assess whether $21/hour allows for a comfortable lifestyle in different areas of the country. With high inflation lately, we’ll discuss ways to potentially increase earnings beyond $21/hour.

Knowing exactly how much salary you could earn per year from $21 an hour is valuable knowledge for your financial plans. Let’s explore this question in detail.

Table of Contents

Convert $21 Per Hour to Weekly, Monthly, and Yearly Salary

Input your wage and hours per week to see how much you’ll make monthly, yearly and more.

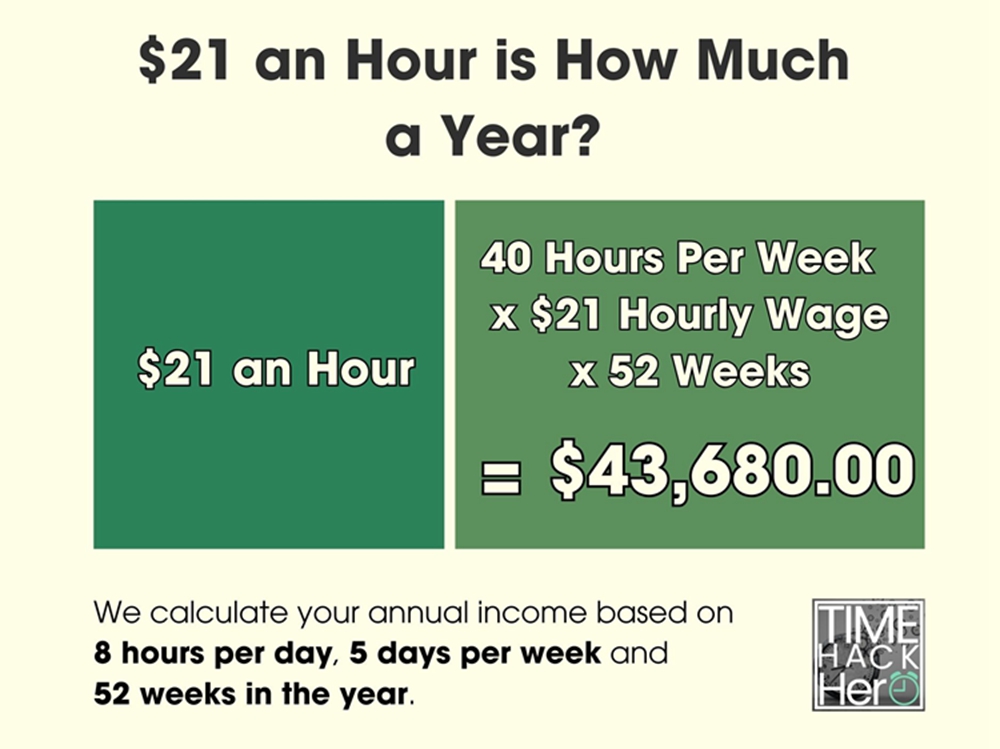

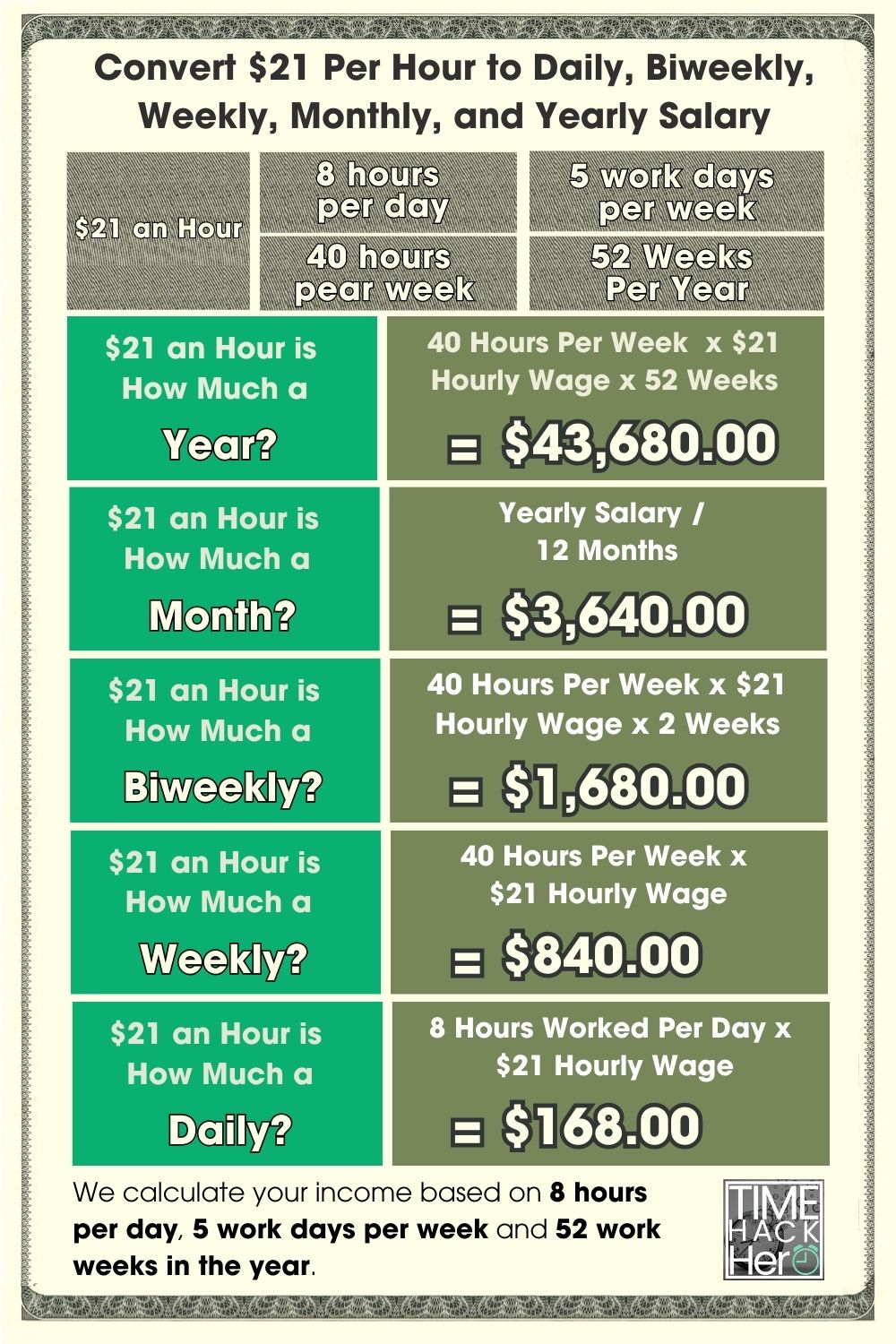

$21 an Hour is How Much a Year?

If you make $21 an hour, your yearly salary would be $43,680. We calculate your annual income based on 8 hours per day, 5 days per week and 52 weeks in the year.

Hours worked per week (40) x Hourly wage($21) x Weeks worked per year(52) = $43,680

$21 an Hour is How Much a Month?

If you make $21 an hour, your monthly salary would be $3,640. We calculated this number by dividing your annual income by 12 months.

Hours worked per week (40) x Hourly wage($21) x Weeks worked per year(52) / Months per Year(12) = $3,640

$21 an Hour is How Much a Biweekly?

If you make $21 an hour, your biweekly salary would be $1,680.

Hours worked per week (40) x Hourly wage($21) x 2 = $1,680

$21 an Hour is How Much a Week?

If you make $21 an hour, your weekly salary would be $840. Calculating based on 5 days per week and 8 hours each day.

Hours worked per week (40) x Hourly wage($21) = $840

$21 an Hour is How Much a Day?

If you make $21 an hour, your daily salary would be $168. We calculated your daily income based on 8 hours per day.

Hours worked per day (8) x Hourly wage($21) = $168

$21 an Hour is How Much a Year?

The basic formula to calculate your annual salary from an hourly wage is:

Hourly Rate x Hours Worked per Week x Number of Weeks Worked per Year = Annual Salary

So for a $20 per hour job:

$21 per hour x 40 hours per week x 52 weeks per year = $43,680

However, this simple calculation makes some assumptions:

- You will work 40 hours every week of the year

- You will not get any paid time off

Therefore, it represents your earnings if you worked every week of the year, without any vacation, holidays, or sick days.

Accounting for Paid Time Off

The $43,680 base salary does not yet factor in paid time off (PTO). Let’s assume the job provides:

- 2 weeks (10 days) paid vacation

- 6 paid holidays

- 3 paid sick days

This totals 19 paid days off, or nearly 4 weeks of PTO.

Importantly, this paid time off should not be deducted from the annual salary, since you still get paid for those days.

So with 4 weeks PTO, the annual salary would remain $43,680 .

Part time $21 an hour is How Much a Year?

Your annual income changes significantly if you work part-time and not full-time.

For example, let’s say you work 25 hours per week instead of 40. Here’s how you calculate your new yearly total:

$21 per hour x 25 hours per week x 52 weeks per year = $27,300

By working 15 fewer hours per week (25 instead of 40), your annual earnings at $21 an hour drop from $43,680 to $27,300.

That’s a $16,380 per year difference just by working part-time!

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $21 an hour:

| Hours Per Week | Earnings Per Week | Annual Earnings |

|---|---|---|

| 40 | $840 | $43,680 |

| 35 | $735 | $38,220 |

| 30 | $630 | $32,760 |

| 25 | $525 | $27,300 |

| 20 | $420 | $21,840 |

| 15 | $315 | $16,380 |

The more hours per week, the higher your total yearly earnings. But part-time work allows for more life balance if you don’t need the full salary.

$21 an Hour With Overtime is How Much a Year?

Now let’s look at how overtime can increase your annual earnings.

Overtime kicks in once you work more than 40 hours in a week. Typically, you earn 1.5x your regular hourly wage for overtime hours.

So if you make $21 per hour normally, you would make $31.50 per hour for any hours over 40 in a week.

Here’s an example:

- You work 45 hours in a Week

- 40 regular hours paid at $21 per hour = $840

- 5 overtime hours paid at $31.50 per hour = $157.50

- Your total one Week earnings =$840 + $157.50 = $997.50

If you worked 45 hours each week for 52 weeks, here’s how your annual earnings increase thanks to overtime pay:

$997.50 per week x 52 weeks per year = $51,870

That’s $8,190 more than you’d earn working just 40 hours per week at $21 an hour.

Overtime can add up! But also consider taxes and work-life balance when deciding on extra hours.

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $21 an hour:

| Overtime hours per work day | Hours Per Week | Earnings Per Week | Annual Earnings |

| 0 | 40 | $840 | $43,680 |

| 1 | 45 | $997.50 | $51,870 |

| 2 | 50 | $1,155 | $60,060 |

| 3 | 55 | $1,312.50 | $68,250 |

| 4 | 60 | $1,470 | $76,440 |

| 5 | 65 | $1,627.50 | $84,630 |

| 6 | 70 | $1,785 | $92,820 |

| 7 | 75 | $1,942.50 | $101,010 |

How Unpaid Time Off Impacts $21/Hour Yearly Earnings

So far we’ve assumed you work 52 paid weeks per year. Any unpaid time off will reduce your total income.

For example, let’s say you take 2 weeks of unpaid leave. That brings your paid weeks down to 50:

Hours worked per week (40) x Hourly wage($21) x Weeks worked per year(50) = $42,000 annual salary

With 2 weeks unpaid time off, your annual earnings at $21/hour would drop by $1,680.

The table below summarizes how your annual income changes depending on the number of weeks of unpaid leave.

| Weeks of unpaid leave | Paid weeks per year | Earnings Per Week | Annual Earnings |

| 0 | 52 | $840 | $43,680 |

| 1 | 51 | $840 | $42,840 |

| 2 | 50 | $840 | $42,000 |

| 3 | 49 | $840 | $41,160 |

| 4 | 48 | $840 | $40,320 |

| 5 | 47 | $840 | $39,480 |

| 6 | 46 | $840 | $38,640 |

| 7 | 45 | $840 | $37,800 |

Key Takeaways for $21 Hourly Wage

In summary, here are some key points on annual earnings when making $21 per hour:

- At 40 hours per week, you’ll earn $43,680 per year.

- Part-time of 30 hours/week results in $32,760 annual salary.

- Overtime pay can boost yearly earnings, e.g. $8,190 extra at 45 hours/week.

- Unpaid time off reduces your total income, around $1,680 less per 2 weeks off.

- Your specific situation and location impacts taxes and PTO.

Knowing your approximate annual salary and factors impacting it makes it easier to budget and plan your finances. The next step is calculating take-home pay after deductions like taxes.

$21 An Hour Is How Much A Year After Taxes

Figuring out your actual annual earnings based on an hourly wage can be complicated once taxes are taken into account. In addition to federal, state, and local income taxes, 7.65% of your gross pay also goes to Social Security and Medicare through FICA payroll taxes. So how much does $21 an hour equal per year after FICA and income taxes are deducted from your gross pay?

Below we’ll walk through the steps to calculate your annual net take home pay if you make $21 per hour. This will factor in estimated federal, FICA, state, and local taxes so you know exactly what to expect.

Factoring in Federal Income Tax

Your federal income tax will be a big chunk out of your gross pay. Federal tax rates range from 10% to 37%, depending on your tax bracket.

To estimate your federal income tax rate and liability:

Look up your federal income tax bracket based on your gross pay.

2023 tax brackets: single filers

| Tax rate | Taxable income bracket | Tax owed |

|---|---|---|

| 10% | $0 to $11,000. | 10% of taxable income. |

| 12% | $11,001 to $44,725. | $1,100 plus 12% of the amount over $11,000. |

| 22% | $44,726 to $95,375. | $5,147 plus 22% of the amount over $44,725. |

| 24% | $95,376 to $182,100. | $16,290 plus 24% of the amount over $95,375. |

| 32% | $182,101 to $231,250. | $37,104 plus 32% of the amount over $182,100. |

| 35% | $231,251 to $578,125. | $52,832 plus 35% of the amount over $231,250. |

| 37% | $578,126 or more. | $174,238.25 plus 37% of the amount over $578,125. |

For example, if you are single with $43,680 gross annual pay, your federal tax bracket is 12%.

Your estimated federal tax would be:

$1,100 + ($43,680 – $11,000) x 12% = $5,021.60

So at $21/hour with $43,680 gross pay, you would owe about $5,021.60 in federal income taxes.

Considering State Income Tax

In addition to federal tax, most states also charge a state income tax. State income tax rates range from about 1% to 13%, with most falling between 4% and 6%.

Key Takeaways

-

- California, Hawaii, New York, New Jersey, and Oregon have some of the highest state income tax rates.

- Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming don’t impose an income tax at all.

- Another 10 U.S states have a flat tax rate—everyone pays the same percentage regardless of how much they earn.

A State-by-State Comparison of Income Tax Rates

| STATE | TAX RATES | LOWEST AND HIGHEST INCOME BRACKETS |

|---|---|---|

| Alaska | 0% | None |

| Florida | 0% | None |

| Nevada | 0% | None |

| South Dakota | 0% | None |

| Tennessee | 0% | None |

| Texas | 0% | None |

| Washington | 0% | None |

| Wyoming | 0% | None |

| Colorado | 4.55% | Flat rate applies to all incomes |

| Illinois | 4.95% | Flat rate applies to all incomes |

| Indiana | 3.23% | Flat rate applies to all incomes |

| Kentucky | 5% | Flat rate applies to all incomes |

| Massachusetts | 5% | Flat rate applies to all incomes |

| New Hampshire | 5% | Flat rate on interest and dividend income only |

| North Carolina | 4.99% | Flat rate applies to all incomes |

| Pennsylvania | 3.07% | Flat rate applies to all incomes |

| Utah | 4.95% | Flat rate applies to all incomes |

| Michigan | 4.25% | Flat rate applies to all incomes |

| Arizona | 2.59% to 4.5% | $27,806 and $166,843 |

| Arkansas | 2% to 5.5% | $4,300 and $8,501 |

| California | 1% to 13.3% | $9,325 and $1 million |

| Connecticut | 3% to 6.99% | $10,000 and $500,000 |

| Delaware | 0% to 6.6% | $2,000 and $60,001 |

| Alabama | 2% to 5% | $500 and $3,001 |

| Georgia | 1% to 5.75% | $750 and $7,001 |

| Hawaii | 1.4% to 11% | $2,400 and $200,000 |

| Idaho | 1.125% to 6.5% | $1,568 and $7,939 |

| Iowa | 0.33% to 8.53% | $1,743 and $78,435 |

| Kansas | 3.1% to 5.7% | $15,000 and $30,000 |

| Louisiana | 1.85% to 4.25% | $12,500 and $50,001 |

| Maine | 5.8% to 7.15% | $23,000 and $54,450 |

| Maryland | 2% to 5.75% | $1,000 and $250,000 |

| Minnesota | 5.35% to 9.85% | $28,080 and $171,221 |

| Mississippi | 0% to 5% | $5,000 and $10,001 |

| Missouri | 1.5% to 5.3% | $1,121 and $8,968 |

| Montana | 1% to 6.75% | $2,900and $17,400 |

| Nebraska | 2.46% to 6.84% | $3,340 and $32,210 |

| New Jersey | 1.4% to 10.75% | $20,000 and $1 million |

| New Mexico | 1.7% to 5.9% | $5,500 and $210,000 |

| New York | 4% to 10.9% | $8,500 and $25 million |

| North Dakota | 1.1% to 2.9% | $41,775 and $458,350 |

| Ohio | 0% to 3.99% | $25,000 and $110,650 |

| Oklahoma | 0.25% to 4.75% | $1,000 and $7,200 |

| Oregon | 4.75% to 9.9% | $3,750 and $125,000 |

| Rhode Island | 3.75% to 5.99% | $68,200 and $155,050 |

| South Carolina | 0% to 7% | $3,110 and $15,560 |

| Vermont | 3.35% to 8.75% | $42,150 and $213,150 |

| Virginia | 2% to 5.75% | $3,000 and $17,001 |

| Washington, D.C. | 4% to 9.75% | $10,000 and $1 million |

| West Virginia | 3% to 6.5% | $10,000 and $60,000 |

| Wisconsin | 3.54% to 7.65% | $12,760 and $280,950 |

To estimate your state income tax:

Look up your state income tax rate based on your gross pay and filing status.

Multiply your gross annual pay by the state tax rate.

For example, if you live in Pennsylvania which has a flat 3.07% tax rate, your estimated state tax would be:

$43,680 gross pay x 3.07% PA tax rate = $1,340.98 estimated state income tax

So with $43,680 gross annual income, you would owe around in $1,340.98 Pennsylvania state income tax. Verify your specific state’s income tax rates.

Factoring in Local Taxes

Some cities and counties levy local income taxes ranging from 1-3% of taxable income.

To estimate potential local taxes you may owe:

- Check if your city or county charges a local income tax.

- If yes, look up the local income tax rate.

- Multiply your gross annual pay by the local tax rate.

For example, say you live in Columbus, OH which has a 2.5% local income tax. Your estimated local tax would be:

$43,680 gross pay x 2.5% local tax rate = $1,092 estimated local tax

So with $43,680 in gross earnings, you may owe around $1,092 in Columbus local income taxes. Verify rates for your own city/county.

Accounting for FICA Taxes (Social Security & Medicare)

FICA taxes are a combination of Social Security and Medicare taxes that equal 15.3% of your earnings. You are responsible for half of the total bill (7.65%), which includes a 6.2% Social Security tax and 1.45% Medicare tax on your earnings.

In 2023, only the first $160,200 of your earnings are subject to the Social Security tax

There is an additional 0.9% surtax on top of the standard 1.45% Medicare tax for those who earn over $200,000 (single filers) or $250,000 (joint filers).

To estimate your FICA tax payment:

$43,680 x 6.2% + $43,680 x 1.45% = $3,341.52

So you can expect to pay about $3,341.52 in Social Security and Medicare taxes out of your gross $43,680 in earnings.

Total Estimated Tax Payments

Based on the examples above, your total estimated tax payments would be:

Federal tax: $5,021.60

State tax: $1,340.98

Local tax: $1,092

FICA tax: $3,341.52

Total Estimated Tax: $10,796.10

Calculating Your Take Home Pay

To calculate your annual take home pay at $21 /hour:

1. Take your gross pay

2. Subtract your estimated total tax payments

$43,680 gross pay – $10,796.10 Total Estimated Tax = $32,883.90 Your Take Home Pay

n summary, if you make $21 per hour and work full-time, you would take home around $32,883.90 per year after federal, state, local , FICA taxes.

Your actual net income may vary depending on your specific tax situation. But this gives you a general idea of what to expect.

Convert $21 Per Hour to Yearly, Monthly, Biweekly, and Weekly Salary After Taxes

If you make $21 an hour and work full-time (40 hours per week), your estimated yearly salary would be $43,680 .

The $43,680 per year salary does not account for taxes. Federal, state, and local taxes will reduce your take-home pay. The amount withheld depends on your location, filing status, dependents, and other factors.

Just now during our calculation of $21 An Hour Is How Much A Year After Taxes, we assumed the following conditions:

- You are single with $43,680 gross annual pay, your federal tax bracket is 12 %.

- You live in Pennsylvania which has a flat 3.07% tax rate

- You live in Columbus, OH which has a 2.5% local income tax.

In the end, we calculated your Total Estimated Tax is $10,796.10 , Your Take Home Pay is $32,883.90 , Total tax rate is 24.72%.

So next we’ll use 24.72% as the estimated tax rate to calculate your weekly, biweekly, and monthly after-tax income.

$21 Per Hour to Yearly, Monthly, Biweekly, Weekly,and Week Salary After Taxes Table

| Income before taxes | Estimated Tax Rate | Income Taxes | After Tax Income | |

| Yearly Salary | $43,680 | 24.72% | $10,796.10 | $32,883.90 |

| Monthly Salary | $3,640 | 24.72% | $899.67 | $2,740.33 |

| BiWeekly Salary | $1,680 | 24.72% | $415.23 | $1,264.77 |

| Weekly Salary | $840 | 24.72% | $207.62 | $632.38 |

$21 an hour is how much a year after taxes

Here is the adjusted yearly salary after a 24.72% tax reduction:

-

- Yearly salary before taxes: $43,680

- Estimated tax rate: 24.72%

- Taxes owed (24.72% * $43,680 )= $10,796.10

- Yearly salary after taxes: $32,883.90

| Hourly Wage | Hours Worked Per Week | Weeks Worked Per Year | Total Yearly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Yearly Salary |

|---|---|---|---|---|---|---|

| $21 | 40 | 52 | $43,680 | 24.72% | $10,796.10 | $32,883.90 |

$21 an hour is how much a month after taxes

To calculate the monthly salary based on an hourly wage, you first need the yearly salary amount. Then divide by 12 months.

-

-

- Yearly salary before taxes at $21 per hour: $43,680

- Divided by 12 months per year: $43,680 / 12 = $3,640 per month

-

The monthly salary based on a 40 hour work week at $21 per hour is $3,640 before taxes.

After applying the estimated 24.72% tax rate, the monthly after-tax salary would be:

-

- Monthly before-tax salary: $3,640

- Estimated tax rate: 24.72%

- Taxes owed (24.72% * $3,640 )= $899.67

- Monthly after-tax salary: $2,740.33

Monthly Salary Based on $21 Per Hour

| Hourly Wage | Yearly Salary | Months Per Year | Before-Tax Monthly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Monthly Salary |

|---|---|---|---|---|---|---|

| $21 | $43,680 | 12 | $3,640 | 24.72% | $899.67 | $2,740.33 |

$21 an hour is how much biweekly after taxes

Many people are paid biweekly, meaning every other week. To calculate the biweekly pay at $21 per hour:

- Hourly wage: $21

- Hours worked per week: 40

- Weeks per biweekly pay period: 2

- $21 * 40 hours * 2 weeks = $1,680 biweekly

Applying the 24.72%estimated tax rate:

- Biweekly before-tax salary: $1,680

- Estimated tax rate: 24.72%

- Taxes owed (24.72% * $1,680 )= $415.23

- Biweekly after-tax salary: $1,264.77

Biweekly Salary at $21 Per Hour

| Hourly Wage | Hours Worked Per Week | Weeks Per Pay Period | Before-Tax Biweekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Biweekly Salary |

|---|---|---|---|---|---|---|

| $21 | 40 | 2 | $1,680 | 24.72% | $415.23 | $1,264.77 |

$21 an hour is how much weekly after taxes

To find the weekly salary based on an hourly wage, you need to know the number of hours worked per week. At 40 hours per week, the calculation is:

- Hourly wage: $21

- Hours worked per week: 40

- $21 * 40 hours = $840 per week

Accounting for the estimated 24.72% tax rate:

- Weekly before-tax salary: $840

- Estimated tax rate: 24.72%

- Taxes owed (24.72% * $840 )= $207.62

- Weekly after-tax salary: $632.38

Weekly Salary at $21 Per Hour

| Hourly Wage | Hours Worked Per Week | Before-Tax Weekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Weekly Salary |

|---|---|---|---|---|---|

| $21 | 40 | $840 | 24.72% | $207.62 | $632.38 |

Key Takeaways

- An hourly wage of $21 per hour equals a yearly salary of $43,680 before taxes, assuming a 40 hour work week.

- After accounting for an estimated 24.72% tax rate, the yearly after-tax salary is approximately $32,883.90 .

- On a monthly basis before taxes, $21 per hour equals $3,640 per month. After estimated taxes, the monthly take-home pay is about $2,740.33 .

- The before-tax weekly salary at $21 per hour is $840 . After taxes, the weekly take-home pay is approximately $632.38 .

- For biweekly pay, the pre-tax salary at $21 per hour is $1,680 . After estimated taxes, the biweekly take-home pay is around $1,264.77 .

Understanding annual, monthly, weekly, and biweekly salary equivalents based on an hourly wage is useful when budgeting and financial planning. Taxes make a significant difference in take-home pay, so be sure to account for them when making income conversions. Use this guide as a reference when making salary calculations.

What Is the Average Hourly Wage in the US?

Last Updated: Sep 1 2023

US Average Hourly Earnings is at a current level of $33.82, up from 33.74 last month and up from 32.43 one year ago. This is a change of 0.24% from last month and 4.29% from one year ago.

Average Hourly Earnings is the average dollars that a private employee makes per hour in the US. This metric is a part of one of the most important releases every month which includes unemployment numbers as well. This is normally released on the first Friday of every month. This metric is released by the Bureau of Labor Statistics (BLS).

What is the average salary in the U.S.?

Last Updated: July 18, 2023

The U.S. Bureau of Labor Statistics uses median salary data rather than averages to avoid skewed numbers from outlying high and low numbers. Median weekly earnings of the nation's 121.5 million full-time wage and salary workers were $1,100 in the second quarter of 2023, the U.S.

If a person works 52 weeks in the year, then this represents a national annual salary of $57,200.

Is $21 an Hour a Good Salary?

For a single person and even couples without children, $21 per hour provides a decent living wage in many parts of the country. However, for families with kids or those living in high cost urban areas, earning $21 an hour would mean an absolute struggle to get by. Overall, $21 an hour is a modest but livable income depending on your individual circumstances.

Full time annual earnings of $43,680 gross places an individual solidly in the lower middle class. However, after federal, state, and Social Security taxes, take-home pay will be around $36,000. The cost of living in your city and number of dependents you support has a huge impact on whether this take-home salary goes far enough.

In low cost cities and rural areas across the Midwest, South, and Southwest, $21 an hour can provide a simple but comfortable lifestyle. But if you’re trying to raise a family or pay big city rents on this income alone, you’ll face constant financial stress. Overall, $21 per hour meets the criteria for a minimum livable wage but does not afford much wiggle room. You’ll need to budget diligently and likely take on roommates or utilize public assistance if supporting kids.

Jobs that pay $21 an hour

While not extremely common, there are various jobs across numerous industries that pay hourly rates in the $21 per hour range. Here are some examples of jobs that offer wages close to $21 per hour:

- Radiologic Technologists – $28.73 per hour

- Dental Hygienists – $27.19 per hour

- Cardiovascular Technologists – $26.89 per hour

- Paralegals and Legal Assistants – $24.87 per hour

- Geological and Petroleum Technicians – $23.36 per hour

- Registered Nurses – $21.80 per hour

- Respiratory Therapists – $21.40 per hour

- Paramedics – $21.02 per hour

- Web Developers – $20.91 per hour

- Physical Therapist Assistants – $20.64 per hour

- Insurance Sales Agents – $20.23 per hour

- Legal Secretaries – $19.41 per hour

- Bookkeeping Clerks – $19.26 per hour

- HVAC Technicians – $19.01 per hour

These jobs span industries like healthcare, tech, legal services, sales, office administration, and the trades. Most require at least some post-secondary training, an associates degree, or industry-specific certification.

The key is finding roles that call for specialized technical skills or training, but not necessarily a full 4-year college degree. Jobs in booming sectors like healthcare and tech tend to pay above minimum wage, with hourly earnings approaching $21.

Can You Live Off $21 An Hour?

Living off $21 an hour is certainly doable, but requires diligent budgeting, especially if you’re supporting a family. Hourly pay of $21 equals about $43,680 per year for full time workers. After tax withholdings of roughly 25%, your annual take-home pay will be around $32,760.

For single adults living in areas with reasonable rents and housing prices, covering basic living costs on this salary is possible. Individuals without children who are comfortable living with roommates can potentially save a portion of their earnings. However, they will need to be prudent about spending and stick to a tight budget.

For married couples or those cohabitating, dual incomes totaling $40k-$45k annually creates a reasonably comfortable financial situation. Again, the individuals will need to watch their discretionary spending. But with two people splitting basic living costs, $21 per hour each provides a decent living in lower cost regions.

However, for single parents or those supporting multiple children, living on $21 an hour alone becomes extremely challenging. Reliable childcare alone can cost $600-$1000 or more per month per child. After paying for housing, childcare, food, medical and transportation, there would be little leftover in a single parent household making $21 hourly. Families would almost certainly need to supplement this income with child support, aid programs, and/or a second earner to get by.

One mitigating factor is that those earning $21 an hour or less would qualify for Medicaid, the Supplemental Nutrition Assistance Program (SNAP), the Earned Income Tax Credit, and other government poverty programs. Utilizing these resources is essential for parents and families to make $21 an hour livable. Overall, making $21 an hour work requires strict budgeting, lean spending, and subsidizing costs through aid programs if you have dependents.

The impact of inflation on the value of $21 an hour

With inflation recently reaching its highest level in over 40 years, the buying power of a fixed wage like $21 an hour steadily declines. What $21 could purchase in the year 2000 is significantly more than what it can purchase today.

For instance, the average new car in 2000 cost around $21,850. Today, the average new car costs $47,000. Housing, food costs, healthcare expenses, and most other goods and services have similarly risen faster than wages.

Going forward over the next 5-10 years, inflation is expected to further erode the buying power of flat earnings like $21 per hour. The Federal Reserve estimates that inflation will remain well above its 2% target through at least 2024. Most experts forecast inflation rising 3-4% annually in the near future.

What this means is that flat wages will lose value each year as the costs of goods and services march higher. So if you’re earning $21 per hour currently, that will likely equal only $18-19 in real purchasing power by 2030.

Boosting your earnings over time through raises, new jobs, training, and overtime is crucial just to maintain the status quo standard of living. If income doesn’t rise commensurate with inflation, you’ll notice your wages buy less and less each year.

5 Ways To Increase Your Hourly Wage

If you currently earn less than $21 per hour, here are some potential strategies to boost your income over time:

- Learn new skills – Take classes and obtain certifications relevant to higher paying roles in your field. Expanding your knowledge and expertise leads to higher value.

- Negotiate raises – Demonstrate the value you bring to your employer and request higher compensation to match it. Know your worth and advocate.

- Work overtime – Occasional overtime is an easy way to immediately boost overall earnings. Time and a half on extra hours adds up quickly.

- Change companies – Switching employers every few years is an effective way to secure higher salaries through competition. Don’t get too comfortable.

- Explore side work – Consider part-time gigs or side businesses in evenings or weekends for extra cash flow. Bar tending, ride share driving, tutoring, and freelancing in a skill area are options.

- Enroll in classes – Attending community college or trade school courses in the evenings allows you to expand your skillset and credentials.

With persistence and continually developing new skills, steadily increasing your hourly pay is possible over time. The goal is gaining expertise that makes you more valuable and employable at higher rates.

Buying a car on $21 an hour

Buying a reliable used car is possible on $21 an hour, but financing an expensive vehicle would be extremely unwise. At this modest income level, transportation needs to be functional, affordable, and budget-conscious.

As a baseline, total monthly vehicle costs including payment, insurance, gas and maintenance should aim to stay under 10-15% of take-home income. Given take-home earnings of around $2,700 monthly at this wage, that translates to a car budget of around $250-$400.

Here are some tips for staying on track when buying a car on an hourly salary of $21:

- Shop used vehicles and aim for under 50k miles. Let someone else take the depreciation hit.

- Target purchase prices at $15,000 or less for the most financial flexibility.

- Get pre-approved financing from your bank or credit union so you know the rate and term you qualify for.

- Look at fuel efficient sedans or hatchbacks to minimize gas costs.

- If financing, put at least 20% down and keep the loan term no longer than 48 months.

- Have a mechanic inspect before purchasing to avoid lemons.

- Purchase from private sellers to avoid dealer fees and markups.

Owning a car on $21 an hour is certainly feasible. But it requires both discipline and clever shopping to find optimal transportation without breaking the bank. Patience and persistence finding deals pays off.

Can You Buy a House on $21 An Hour?

Buying a house on a single income of $21 an hour would be incredibly challenging and generally not financially advisable. However, for a dual income couple each making $21 per hour, home ownership may be possible in some metro areas.

The primary obstacle is saving up enough for a down payment while also maintaining enough income left over to cover a mortgage. On $43k per year, saving 20% down on a median priced home is unrealistic in most housing markets. However, programs like FHA loans allow down payments as low as 3.5%. There are also down payment assistance programs for qualified buyers.

For dual income couples jointly earning $80k-90k, buying a modest starter home in lower cost regions like the Midwest, South, and Southwest is feasible. With one spouse able to care for kids at home, the single income can stretch further. You’d likely be looking at purchasing an older home between $150k-$200k, depending on location. This keeps the mortgage payment around 25% of take-home income.

Overall, buying a house on a single income of $21 an hour will face major hurdles. But for committed couples able to combine incomes and save up small down payments, home ownership may be possible. Just stick to your price range and stay modest in your expectations.

Example Budget For $21 Per Hour

Creating a detailed monthly budget is crucial for living on $21 per hour. You’ll need to watch discretionary costs closely while ensuring you contribute to savings. Here is a sample budget at this income level:

- Gross Monthly Income (@ $21/hour x 40 hours/week x 4 weeks): $3,360

- Taxes and Deductions at 25%: $840

- Take Home Pay: $2,520

- Rent (with roommates or studio): $800

- Used Car Payment: $220

- Gas: $80

- Car Insurance: $100

- Groceries: $250

- Health Insurance: $150

- Cell Phone: $40

- Utilities: $150

- Dining Out: $80

- Entertainment: $50

- Retirement Savings: $100

- Emergency Savings: $100

- Total Monthly Expenses: $2,220

- Money Remaining: $300

This allows $300 left per month for added savings, debt repayment, or discretionary purchases. While doable, there is little wiggle room. Any emergency costs or surprise bills would require cutting back extra spending. For families supporting kids on this salary alone, expenses would need to be reduced drastically in all areas and subsidized through government aid programs.

Overall, individuals or couples with dual incomes can potentially live on $21 an hour with strict budgeting. But supporting a family on this salary alone is unrealistic without major lifestyle sacrifices.

In Summary

While possible for single adults, living comfortably on $21 an hour would prove very difficult for families, especially in higher cost metropolitan areas. Diligent budgeting and lean spending are necessities at this income level.

For couples with dual $21 per hour incomes, a basic but decent lifestyle is certainly achievable. But single parents or those with multiple dependents would struggle without supplemental income via government assistance, child support, etc.

Much depends on whether you’re realistically able to cut discretionary costs and the prevailing costs of living in your city. Overall, $21 per hour provides a survivable but very modest income. Roommates, aids programs, and dual incomes are near necessities for sustainable living at this hourly rate in today’s economy. But for childless adults or couples in low cost regions, $21 an hour can absolutely be made livable.