When you’re paid by the hour, it can be hard to figure out just how much your yearly income amounts to. After all, the number of hours you work each week and each year can vary quite a bit. But if you’re earning $20 an hour, there are some simple calculations you can do to estimate your potential annual earnings.

In this article, we’ll walk through the math step-by-step. We’ll look at how to calculate your income based on full-time and part-time work, and account for factors like overtime, holidays, and time off.

Whether you’re just starting a new job, considering a career change, or simply curious what your earning potential is, read on to find out the answer to the question: $20 an hour is how much a year?

Table of Contents

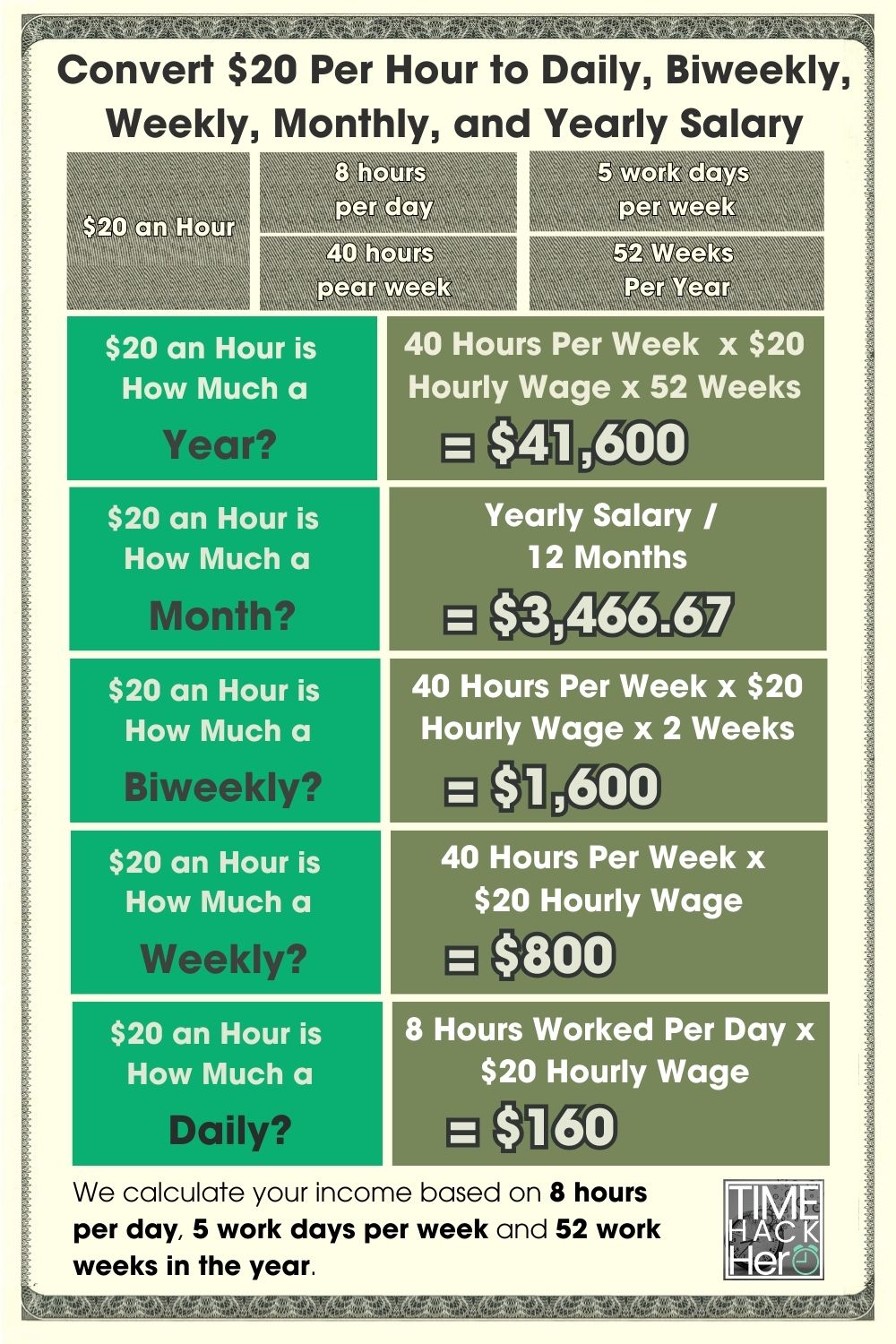

Convert $20 Per Hour to Weekly, Monthly, and Yearly Salary

Input your wage and hours per week to see how much you’ll make monthly, yearly and more.

$20 an Hour is How Much a Year?

If you make $20 an hour, your yearly salary would be $41,600. We calculate your annual income based on 8 hours per day, 5 days per week and 52 weeks in the year.

Hours worked per week (40) x Hourly wage($20) x Weeks worked per year(52) =$41,600

$20 an Hour is How Much a Month?

If you make $20 an hour, your monthly salary would be $3,466.67. We calculated this number by dividing your annual income by 12 months.

Hours worked per week (40) x Hourly wage($20) x Weeks worked per year(52) / Months per Year(12) =$3,466.67

$20 an Hour is How Much a Biweekly?

If you make $20 an hour, your monthly salary would be $1,600.

Hours worked per week (40) x Hourly wage($20) *2 =$1,600

$20 an Hour is How Much a Week?

If you make $20 an hour, your weekly salary would be $800. Calculating based on 5 days per week and 8 hours each day.

Hours worked per week (40) x Hourly wage($20) =$800

$20 an Hour is How Much a Day?

If you make $20 an hour, your daily salary would be $160. We calculated your daily income based on 8 hours per day.

Hours worked per day (8) x Hourly wage($20) =$160

$20 an Hour is How Much a Year?

The basic formula to calculate your annual salary from an hourly wage is:

Hourly Rate x Hours Worked per Week x Number of Weeks Worked per Year = Annual Salary

So for a $20 per hour job:

$20 per hour x 40 hours per week x 52 weeks per year = $41,600

However, this simple calculation makes some assumptions:

- You will work 40 hours every week of the year

- You will not get any paid time off

Therefore, it represents your earnings if you worked every week of the year, without any vacation, holidays, or sick days.

Accounting for Paid Time Off

The $41,600 base salary does not yet factor in paid time off (PTO). Let’s assume the job provides:

- 2 weeks (10 days) paid vacation

- 6 paid holidays

- 3 paid sick days

This totals 19 paid days off, or nearly 4 weeks of PTO.

Importantly, this paid time off should not be deducted from the annual salary, since you still get paid for those days.

So with 4 weeks PTO, the annual salary would remain $41,600.

Part time $20 an hour is How Much a Year?

Your annual income changes significantly if you work part-time and not full-time.

For example, let’s say you work 30 hours per week instead of 40. Here’s how you calculate your new yearly total:

$20 per hour x 30 hours per week x 52 weeks per year = $31,200

By working 10 fewer hours per week (30 instead of 40), your annual earnings at $20 an hour drop from $416,00 to $31,200.

That’s a $10,400 per year difference just by working part-time!

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $20 an hour:

| Hours Per Week | Earnings Per Week | Annual Earnings |

|---|---|---|

| 40 | $800 | $41,600 |

| 35 | $700 | $36,400 |

| 30 | $600 | $31,200 |

| 25 | $500 | $26,000 |

| 20 | $400 | $20,800 |

The more hours you work per week, the more you’ll earn per year when your hourly wage is fixed at $20.

Obviously, you need to consider other factors like benefits and work-life balance. But in terms of yearly income, hours matter!

$20 an Hour With Overtime is How Much a Year?

Now let’s look at how overtime can increase your annual earnings.

Overtime kicks in once you work more than 40 hours in a week. Typically, you earn 1.5x your regular hourly wage for overtime hours.

So if you make $20 per hour normally, you would make $30 per hour for any hours over 40 in a week.

Here’s an example:

- You work 45 hours in Week 1

- 40 regular hours paid at $20 per hour = $800

- 5 overtime hours paid at $30 per hour = $150

- Your total Week 1 earnings = $800 + $150 = $950

If you worked 45 hours each week for 52 weeks, here’s how your annual earnings increase thanks to overtime pay:

950 hours per week x 52 weeks per year = $49,400

That’s $7,500 more per year than you’d earn without overtime at the 40 hour per week base.

Overtime can add up significantly. But also keep in mind that working extra hours may result in higher taxes being withheld from your paycheck.

$20 an Hour With Unpaid Time off is How Much a Year?

The last factor that impacts your annual earnings is unpaid time off.

So far, we’ve assumed you work 52 weeks per year.

Let’s say you take extra unpaid time off for holidays, illness, or other reasons. How does that affect your annual total?

Here’s an example:

- You take 2 weeks off

- That leaves 50 paid weeks instead of 52 paid weeks

If you make $800 per week at a 40 hour full-time job, here’s the impact of 2 weeks off:

$800 per week x 50 paid weeks = $40,000

That’s $1,600 less than if you worked 52 weeks

The more unpaid time you take off, the lower your total annual earnings will be. Make sure to account for holidays, sick time, and vacation when estimating your annual salary at an hourly rate.

Putting It All Together

To summarize, here are the main factors that determine your yearly earnings when you’re paid hourly:

- Hours worked per week

- Hourly wage

- Overtime pay

- Unpaid time off

Based on a $20 per hour wage, here’s how your annual earnings change depending on whether you work full-time or part-time:

| Weeks Worked | Hours per week | Annual Earnings | |

| Full-Time | 52 weeks | 40 | $41,600 |

| Part-Time | 52 weeks | 30 | $31,200 |

| Overtime | 52 weeks | 45 | $49,400 |

| Unpaid Time off | 50 weeks | 40 | $40,000 |

As you can see, the amount of money you make in a year from an hourly wage can vary substantially depending on your hours and overtime. But it’s easy to calculate once you know your key numbers!

$20 An Hour Is How Much A Year After Taxes

Figuring out your actual annual earnings based on an hourly wage can be complicated once taxes are taken into account. In addition to federal, state, and local income taxes, 7.65% of your gross pay also goes to Social Security and Medicare through FICA payroll taxes. So how much does $20 an hour equal per year after FICA and income taxes are deducted from your gross pay?

Below we’ll walk through the steps to calculate your annual net take home pay if you make $20 per hour. This will factor in estimated federal, FICA, state, and local taxes so you know exactly what to expect.

Factoring in Federal Income Tax

Your federal income tax will be a big chunk out of your gross pay. Federal tax rates range from 10% to 37%, depending on your tax bracket.

To estimate your federal income tax rate and liability:

Look up your federal income tax bracket based on your gross pay.

2023 tax brackets: single filers

|

Tax rate |

Taxable income bracket |

Tax owed |

|---|---|---|

|

10% |

$0 to $11,000. |

10% of taxable income. |

|

12% |

$11,001 to $44,725. |

$1,100 plus 12% of the amount over $11,000. |

|

22% |

$44,726 to $95,375. |

$5,147 plus 22% of the amount over $44,725. |

|

24% |

$95,376 to $182,100. |

$16,290 plus 24% of the amount over $95,375. |

|

32% |

$182,101 to $231,250. |

$37,104 plus 32% of the amount over $182,100. |

|

35% |

$231,251 to $578,125. |

$52,832 plus 35% of the amount over $231,250. |

|

37% |

$578,126 or more. |

$174,238.25 plus 37% of the amount over $578,125. |

For example, if you are single with $41,600 gross annual pay, your federal tax bracket is 12%.

Your estimated federal tax would be:

$11,000 x 10% +($41,600 – $11,000) x 12% = $4,772

So at $20/hour with $41,600 gross pay, you would owe about $4,772 in federal income taxes.

Considering State Income Tax

In addition to federal tax, most states also charge a state income tax. State income tax rates range from about 1% to 13%, with most falling between 4% and 6%.

Key Takeaways

- California, Hawaii, New York, New Jersey, and Oregon have some of the highest state income tax rates in the country.

- Seven U.S. states charge no tax on earned income at all.

- Another 10 U.S states have a flat tax rate—everyone pays the same percentage regardless of how much they earn.

Look up your state income tax rate based on your gross income and filing status.

Top Income Tax Rates by State

Below, you’ll find the top 10 states with the highest income tax

| STATE | TOP INCOME TAX RATE |

|---|---|

| California | 13.3% |

| Hawaii | 11% |

| New York | 10.9% |

| New Jersey | 10.75% |

| Oregon | 9.9% |

| Minnesota | 9.85% |

| District of Columbia | 9.75% |

| Vermont | 8.75% |

| Iowa | 8.53% |

| Wisconsin | 7.65% |

Multiply your gross pay by your state tax rate. This gives your estimated state tax.

For example, say you live in North Carolina which has a 4.99% flat tax rate. Your estimated state income tax would be:

$41,600 gross pay x 4.99% state tax rate = $2,075.84 estimated state income tax

So with $41,600 gross annual pay, you would owe around $2,075.84 in North Carolina state income tax. Make sure to check your specific state’s rates.

Considering Local Taxes

Some cities and counties also charge local income taxes. These generally range from 1% to 3% of gross pay.

To estimate your potential local tax:

- See if your city or county charges a local income tax.

- If yes, look up the local income tax rate.

- Multiply your gross pay by the local tax rate to get your estimated local tax.

For example, if you lived in Columbus, Ohio which has a 2.5% local income tax, your estimated local tax would be:

$41,600 gross pay x 2.5% local tax rate = $1,040 estimated local income tax

So you may owe around $1,040 in local taxes in Columbus. Remember to check rates for your own city/county.

Accounting for FICA Taxes (Social Security & Medicare)

On top of income taxes, 7.65% of your gross pay will go to FICA taxes to fund Social Security and Medicare. This includes:

- 6.2% for Social Security

- 1.45% for Medicare

To estimate your FICA tax payment:

$41,600 gross pay x 7.65% FICA tax rate = $3,182

So you can expect to pay about $3,182 in Social Security and Medicare taxes out of your gross $41,600 in earnings.

Total Estimated Tax Payments

Based on the examples above, your total estimated tax payments would be:

Federal tax: $4,772

State tax: $2,075.84

Local tax: $1,040

FICA tax: $3,182

Total Estimated Tax: $11,069.84

$4,772 Federal tax + $2,075.84 State tax +$1,040 Local tax + $3,182 FICA tax = $11,069.84 Total Estimated Tax

Your total estimated tax payments would be around $11,069.84 per year.

Calculating Your Take Home Pay

To calculate your annual take home pay at $20/hour:

- Take your gross pay

- Subtract your estimated total tax payments

$41,600 gross pay – $11,069.84 Total Estimated Tax = $3,0530.16 Your Take Home Pay

In summary, if you make $20 per hour and work full-time, you would take home around $3,0530.16 per year after federal, state, local , FICA taxes.

Your actual net income may vary depending on your specific tax situation. But this gives you a general idea of what to expect.

Key Takeaways

Here are some key points on what $20 an hour equals annually after taxes:

- At $20/hour with full-time hours, you’ll earn about $41,600 gross pay.

- You’ll pay estimated federal income taxes of 12%, or around $4,772.

- State income taxes will take out another 4-6% or so, likely around $2,075.84.

- Local taxes could add another 1-3% depending on your city/county, potentially around $1,040.

- 7.65% of your gross pay will go to FICA taxes to fund Social Security and Medicare, around $3,182.

- Your total estimated tax payments will be roughly 30% of your gross pay, or about $11,069.84.

- That leaves annual take home pay of approximately $3,0530.16.

- Your actual net pay will depend on your specific tax situation and deductions.

- Use this as a general guide to estimate your annual earnings if you make $20 per hour.

Knowing your potential total earnings and tax liabilities can help when budgeting at an hourly wage. And remember, more take home pay is always better, so look into deductions and adjustments that can lower your taxable income.

Is $20 an Hour a Good Salary?

Whether $20 an hour is a good wage depends on where you live and your lifestyle.

Some key considerations:

- Cost of living: $20/hr goes further in some parts of the country than others. It may be a tight budget in high-cost cities like San Francisco or New York.

- Experience level: Entry-level roles tend to pay $15-$20 per hour, so $20 is decent for a first job. But more experienced workers can expect $25+ per hour.

- Job industry: Hourly pay can vary a lot across industries. $20/hr is above minimum wage but not high for skilled roles like tech or healthcare.

- Benefits: Jobs with good benefits like health insurance and retirement plans may pay slightly less hourly. But the total compensation package could still be favorable.

Overall, $20 an hour provides a livable wage for many Americans, especially in lower cost areas. But it may feel tight for experienced workers in expensive cities.

What Is the Average Hourly Wage in the US?

Last Updated: Sep 1 2023

US Average Hourly Earnings is at a current level of $33.82, up from 33.74 last month and up from 32.43 one year ago. This is a change of 0.24% from last month and 4.29% from one year ago.

Average Hourly Earnings is the average dollars that a private employee makes per hour in the US. This metric is a part of one of the most important releases every month which includes unemployment numbers as well. This is normally released on the first Friday of every month. This metric is released by the Bureau of Labor Statistics (BLS).

What is the average salary in the U.S.?

Last Updated: July 18, 2023

The U.S. Bureau of Labor Statistics uses median salary data rather than averages to avoid skewed numbers from outlying high and low numbers. Median weekly earnings of the nation's 121.5 million full-time wage and salary workers were $1,100 in the second quarter of 2023, the U.S.

If a person works 52 weeks in the year, then this represents a national annual salary of $57,200.

10 Best Jobs That Pay $20 An Hour

Earning $20 an hour translates to an annual salary of around $41,600, assuming a standard 40-hour work week. While it may not seem like a huge amount, there are many decent jobs paying $20/hour that can provide a comfortable living, especially for singles or dual income households without children.

Below will explore some of the best jobs currently offering around $20 per hour that are attainable without a 4-year college degree. While compensation differs geographically, the following jobs represent careers that typically pay in the $15-$25 per hour range.

1. Administrative Assistant

Administrative assistants provide office support to managers and executives by handling clerical tasks, assisting with daily office needs, managing schedules and calendars, preparing reports and presentations, fielding calls and correspondence, organizing files and paperwork, and occasionally making travel and meeting arrangements.

While not the most glamorous profession, administrative assistants are vital for helping offices run efficiently. This is an accessible job for those with strong organizational, communication, and computer skills. Many employers provide on-the-job training as needed.

According to the Bureau of Labor Statistics, administrative assistants earn a median annual salary of $37,850, which translates to around $18 per hour.

2. Bookkeeping Clerk

Bookkeeping clerks handle financial transactions and other accounting duties for companies. This includes tasks like preparing financial reports and statements, reconciling bank accounts, tracking income and expenses, processing payroll, managing billing and invoices, performing audits, and preparing taxes.

Bookkeepers usually need to have some finance education or accounting experience. Certification can also be beneficial for advancement in this field. With the right credentials, bookkeeping can be a steady job with decent income potential without needing a 4-year degree.

The median annual pay for bookkeeping clerks is $40,240, or about $19 per hour.

3. Claims Adjuster

As an insurance claims adjuster, your job is to investigate insurance claims, assess damages, determine liability, and authorize payments. This involves tasks like interviewing claimants, corresponding with insurance customers, reviewing police reports, consulting with auto repair shops or contractors, estimating repair costs, submitting reports, and collaborating with appraisers.

Most major insurance companies provide training programs to teach the fundamentals of being a claims adjuster. Licensing or certification is mandatory in some states. This career path offers room for salary growth with experience.

According to the Bureau of Labor Statistics, the median annual wage for claims adjusters is $58,260, or roughly $28 per hour.

4. Commercial Driver

Commercial drivers operate large vehicles to transport materials over intercity, local, and often long distances. This includes careers as delivery drivers, truck drivers, bus drivers, and more. Responsibilities generally involve planning routes, loading/unloading cargo, verifying shipments, maintaining vehicles, and logging trip details according to transportation regulations.

A commercial driver’s license (CDL) is required and special endorsements may be needed for certain types of driving. Demand for delivery drivers and truck drivers is growing rapidly with the rise of e-commerce. Pay varies based on factors like experience and route distance.

The BLS reports a median annual salary of $47,130 for delivery truck drivers, which equates to around $22.50 per hour. Long-haul truckers typically earn much more.

5. Computer User Support Specialist

Also known as help desk technicians, computer user support specialists provide technical assistance to customers and employees using computer systems, software, and other technologies. Responsibilities include troubleshooting problems, diagnosing hardware/software issues, fixing computer errors, assisting with installations, and explaining how to use programs or equipment.

Many employers prefer candidates with some background in information technology, computer science, or a similar field. Certifications like CompTIA’s A+ credential are also beneficial. As technology evolves, skilled support technicians will continue to be in demand.

According to the BLS, the median annual pay for computer support specialists is $55,510, or about $26.70 per hour.

6. Cosmetologist

A career as a cosmetologist involves providing beauty services like hair styling, hair coloring, makeup application, skincare, nail care, waxing, and other salon treatments. Cosmetologists may work at salons or spas, in theaters doing makeup for productions, as independent contractors, or even on cruise ships.

All states require licensure to work as a cosmetologist. Training programs are widely available through cosmetology schools and community colleges. Those tips make for good earning potential. According to PayScale, the average hourly pay for cosmetologists is $14.69, with wages ranging from $9 – $29 per hour.

7. Customer Service Representative

Customer service representatives interact with customers to address inquiries, troubleshoot problems, provide information, take orders, and offer assistance regarding products and services. This position, sometimes shortened to customer service rep (CSR), handles inbound calls, email, social media communications, live chats, and more.

CSRs are found in many types of companies and no specific education is required. Strong communication and problem-solving skills are essential. With substantial growth in e-commerce and online businesses, demand for CSRs continues increasing.

According to the BLS, customer service reps earn a median annual salary of $33,750, which equates to around $16 per hour.

8. Dental Assistant

Dental assistants help dentists examine and treat patients by handling routine tasks around the dental office. Daily duties include sterilizing instruments, preparing treatment rooms, assisting during procedures, taking x-rays, scheduling appointments, maintaining records and inventory, billing, and providing chairside patient care.

Formal training or education is generally required to become a dental assistant. Programs are widely available at community colleges, technical schools, and some dental offices. Licensing requirements vary by state. Demand should remain steady with the need for ongoing dental care.

According to the BLS, dental assistants earn a median annual salary of $41,180, which works out to around $19.80 per hour.

9. Medical Assistant

Medical assistants complete both clinical and administrative tasks at healthcare offices and facilities. Clinical duties include taking medical histories, recording vital signs, preparing patients for examinations, assisting physicians during exams, collecting and preparing laboratory specimens, sterilizing medical instruments, and more. Administrative tasks involve updating patient medical records, filling out insurance forms, scheduling appointments, arranging for hospital admission and laboratory services, and handling billing/bookkeeping.

Formal training or education, including externships, is typically required to become a medical assistant. Certification demonstrates competency and is required in some states. Job prospects should be excellent as demand for healthcare services grows.

According to the BLS, medical assistants earn a median annual salary of $34,800, equaling about $16.75 an hour.

10. Pharmacy Technician

Pharmacy technicians assist licensed pharmacists by performing routine tasks related to preparing and dispensing prescription drugs and medical devices. Responsibilities include receiving prescription requests, counting tablets, compounding medications like ointments, measuring medication amounts, filling vials, verifying patient information, preparing insurance claims, managing inventories, and sometimes administering immunizations.

Formal pharmacy tech training, certification, and registering with your state are typically required. Demand should remain strong due to the ongoing needs of an aging population. According to the BLS, the median annual pay for pharmacy technicians is $33,950, or about $16.50 per hour.

Can you live off $20 an hour?

It’s possible to live on $20 an hour depending on your lifestyle and expenses. Some key factors:

- Housing costs: If rent, mortgage, or utilities take up 50%+ of your monthly budget, $20/hr will be tough to live on. Roommates or living with family help.

- Debt payments: Student, car, and credit card debt can eat up $500+ per month, limiting funds for other expenses. Pay down debt to free up cash.

- Cost of living: Groceries, transportation, healthcare, and other costs vary hugely by location. $20/hr goes further in low cost Midwest cities than in coastal cities, for example.

- Family size: Single adults can potentially live on $20/hr. But supporting kids and a spouse on one income will be very difficult.

Overall, $20 an hour provides a basic but tight budget in many areas. You’ll need to watch expenses closely and likely supplement with a second income or side gig. But it is possible for single adults with low costs and debt.

Can You Buy a House on $20 An Hour?

Earning $20 per hour can provide a comfortable living in many parts of the country. But is this hourly wage enough to afford one of the biggest purchases – buying a home? While challenging in some high-cost areas, homeownership is possible on this salary if you choose the right location, follow key steps, and develop a smart financial plan.

How Much House Can You Afford?

When earning $20 per hour full-time, your annual pre-tax income would be around $41,600 (calculated at 40 hours per week for 52 weeks). As a general rule, you can afford a home 3 to 3.5 times your gross annual income. This means on $20 per hour, your maximum home budget would be:

- 3 x Annual Income = $124,800

- 3.5 x Annual Income = $145,600

This gives you an affordable price range of approximately $125,000 to $145,000.

Where you buy significantly impacts affordability at a $20 per hour income. Areas with lower costs of living and real estate prices will stretch your buying power further.

These cities and states offer relatively affordable median home values under $200,000, making them potentially within reach on $20 per hour:

| City | State | Median Home Value |

|---|---|---|

| Syracuse | NY | $143,400 |

| Tulsa | OK | $141,500 |

| Memphis | TN | $122,500 |

| Detroit | MI | $74,100 |

| Cleveland | OH | $67,100 |

Smaller Midwest and Southern cities like these allow income to go further. You may also find affordable suburbs or towns within commuting distance of pricier metro areas.

On the other hand, expensive coastal cities have extremely high real estate values, making buying prohibitive on this salary. For example:

| City | State | Median Home Value |

|---|---|---|

| San Francisco | CA | $1,310,000 |

| San Jose | CA | $1,125,000 |

| Los Angeles | CA | $799,400 |

| Seattle | WA | $757,600 |

| New York City | NY | $652,000 |

In lower-cost markets, $20 per hour makes homeownership possible with careful planning. In high-cost areas, it can be out of reach.

Example Budget For $20 Per Hour

Creating a budget is an important part of managing your finances. When you earn $20 per hour, you can potentially earn a decent living, but you need to be careful with how you allocate your income. Budgeting helps you understand where your money is going each month so you can make adjustments as needed.

This article provides an example budget for someone earning $20 per hour. It covers different budget categories like housing, transportation, food, utilities, and more. Read on for tips on creating a realistic budget that aligns with a $20 per hour income.

Calculating Your Monthly Take Home Pay

The first step in creating a budget is to calculate your monthly take home pay. This is the amount you actually receive in your paychecks after taxes and other deductions.

Here’s how to estimate your monthly take home pay when you earn $20 per hour:

- Hourly wage: $20

- Hours worked per week: 40

- Weeks worked per month: 4

- Monthly gross pay: $20 x 40 hours x 4 weeks = $3,200

Now you need to deduct taxes and other deductions like health insurance. A reasonable estimate is 30% for federal, state, and local taxes.

- Monthly gross pay: $3,200

- Estimated taxes (30%): $3,200 x 0.3 = $960

- Monthly take home pay: $3,200 – $960 = $2,240

So with an hourly wage of $20 and full time hours, you can expect around $2,240 per month in take home pay. This is the number you’ll use when building your budget.

Housing Costs

Housing is typically the biggest expense in any budget. As a general rule, housing costs should be 30% or less of your take home pay.

With $2,240 in monthly take home pay, you should budget $672 or less for housing. Here are some housing options to consider with this budget:

- Renting a room: $500/month

- Splitting an apartment: $600-$800/month

- Renting a studio apartment: $700-$900/month

Make sure to account for other housing costs like renters insurance, utilities, and internet when estimating your total housing costs. Getting a roommate can help save money on rent and utilities.

Transportation Expenses

After housing, transportation is the next biggest expense for most people. With $20 per hour income, here are some transportation options to consider:

Public Transportation

- Monthly bus or metro pass: $100

- Occasional Uber/Lyft rides: $50

- Total: $150/month

Using public transit is the most affordable transportation option if it’s convenient for your commute.

Owning a Used Car

- Used car payment: $200

- Gas: $80

- Insurance: $100

- Maintenance: $50

- Total: $430/month

Owning an older used car is the next cheapest option. Be sure to factor in gas, insurance, registration and maintenance costs.

Car Sharing Programs

- Zipcar membership: $10/month

- Usage fees: $100-$200/month

- Total: $110-$210/month

Car sharing programs like Zipcar allow you to rent cars by the hour without the costs of ownership. Usage fees add up though.

Aim to keep your transportation costs under $300-$500 per month based on your needs and commute. Public transit passes offer big savings.

Food Budget

Food costs vary based on your grocery shopping and dining out habits. With a $20 per hour income, here are some typical food budgets to consider:

Groceries

- $150 per month: Very tight grocery budget buying generics and basics

- $250 per month: Modest grocery budget with some brand names and more variety

- $350 per month: Grocery budget with more organic and specialty items

Dining Out

- $100 per month: Eating out 1-2 times per week

- $200 per month: Dining out 3-5 times per week

- $300+ per month: Frequent dining out and takeout

Total food budgets:

- $250-$400 per month: Cooks at home frequently and occasional takeout

- $400-$600 per month: Enjoys more dining out and takeout

- $600-$700+ per month: Frequent dining out and food delivery

Look for ways to save on groceries like buying store brands, shopping sales, and cooking at home. Meal planning and batch cooking helps reduce food waste and costs.

Utilities

Utility costs include expenses like:

- Electricity

- Gas for heating

- Water and sewer

- Trash removal

- Internet

- Cell phone

Actual utility costs depend on factors like apartment size, energy efficiency, and your usage. On average, plan to budget $150-$300 per month for utilities. Ways to save include:

- Using energy efficient lights and appliances

- Adjusting your thermostat

- Comparing internet and cell phone plans to find cheap options

- Using your cell phone’s WiFi instead of data

Having roommates can reduce costs since utility bills are split. A smaller apartment will also usually have lower utility expenses than a larger one.

Insurance

Insurance provides important financial protection in case of illness, accidents, or other losses. With a $20 per hour income, here are some typical insurance expenses:

- Health insurance: $0 to $500 per month

- Covered by employer or parents: $0

- ACA exchange health plan: $150-$500/month depending on income

- Renters insurance: $15-$30 per month

- Auto insurance: $100-$250 per month

- Insurance costs depend on factors like your age, vehicle, and driving record

- Life insurance: $25-$50 per month

- A basic term life policy if you have dependents

Shop around when choosing insurance plans to help minimize monthly costs. Overall plan to budget $100-$500 per month for insurance expenses.

Savings Goals

It’s important to make room for savings in your budget even with a modest income. Here are some tips for savings goals to work towards:

- Emergency fund: Aim to save $25-$100 per month until you have 3-6 months of living expenses set aside

- Retirement savings: Put $50-$200 per month towards an IRA or other retirement account. Take advantage of any employer matching funds.

- Down payment on a home: Save $100-$300 per month in a separate account if home ownership is a goal

- Car down payment: Save $50-$150 per month for a future used car purchase

- Education: Save $50-$150 per month in a 529 account if further education is planned

Include savings goals in your budget as fixed expenses so you pay yourself first each month. Start small if needed but aim to increase your savings rate over time.

Sample Budgets

Here are two sample budgets for someone earning $20 per hour:

Sample Frugal Monthly Budget

| Expense | Amount |

|---|---|

| Housing (shared apartment) | $600 |

| Utilities | $150 |

| Groceries | $250 |

| Dining Out | $50 |

| Public Transportation | $100 |

| Cell Phone | $40 |

| Insurance | $100 |

| Savings | $200 |

| Total | $1,490 |

This leaves $750 for other discretionary spending like entertainment, clothing, personal care, gifts, etc.

Sample Comfortable Monthly Budget

| Expense | Amount |

|---|---|

| Housing (1 bedroom apartment) | $800 |

| Utilities | $200 |

| Groceries | $300 |

| Dining Out | $200 |

| Used Car Payment | $200 |

| Car Insurance | $100 |

| Gas | $80 |

| Cell Phone | $40 |

| Insurance | $200 |

| Savings | $300 |

| Total | $2,420 |

This leaves $180 for discretionary spending each month. Less room for extras but includes more housing space and a car.

Summary

A full-time job paying $20 per hour provides an annual salary of approximately $41,600. This wage is slightly below the overall US median income. Whether this salary provides a comfortable living standard depends heavily on location, household size, and fixed expenses. It is likely sufficient for a single adult in a low-cost area but quite difficult for a family in a major metro. Those struggling to get by on $41,600 have options like second jobs, room rentals, expense cutting, and government assistance to supplement their income. The ability to live comfortably on this salary comes down to managing cost of living and adding income where possible.

What’s next, remember to save our diagram to your Pinterest board for further checking.