Have you recently started a new job that pays $20.19 per hour? Or are you considering a career change and want to know the earning potential of a $20.19 hourly wage? Calculating your approximate annual salary from an hourly rate is simple, but the total can vary quite a bit depending on factors like full-time vs part-time hours, overtime pay, and unpaid time off.

In this comprehensive guide, we’ll walk through exactly how to estimate your yearly earnings if you make $20.19 per hour. Whether you’re a new graduate, industry veteran, or just curious, read on to find out the answer to the question: How much money can I make annually if I earn $20.19 per hour?

Table of Contents

Convert $20.19 Per Hour to Estimated Weekly, Monthly, and Yearly Totals

Use this calculator to see your estimated earnings per week, month, and year based on your hourly wage and hours worked.

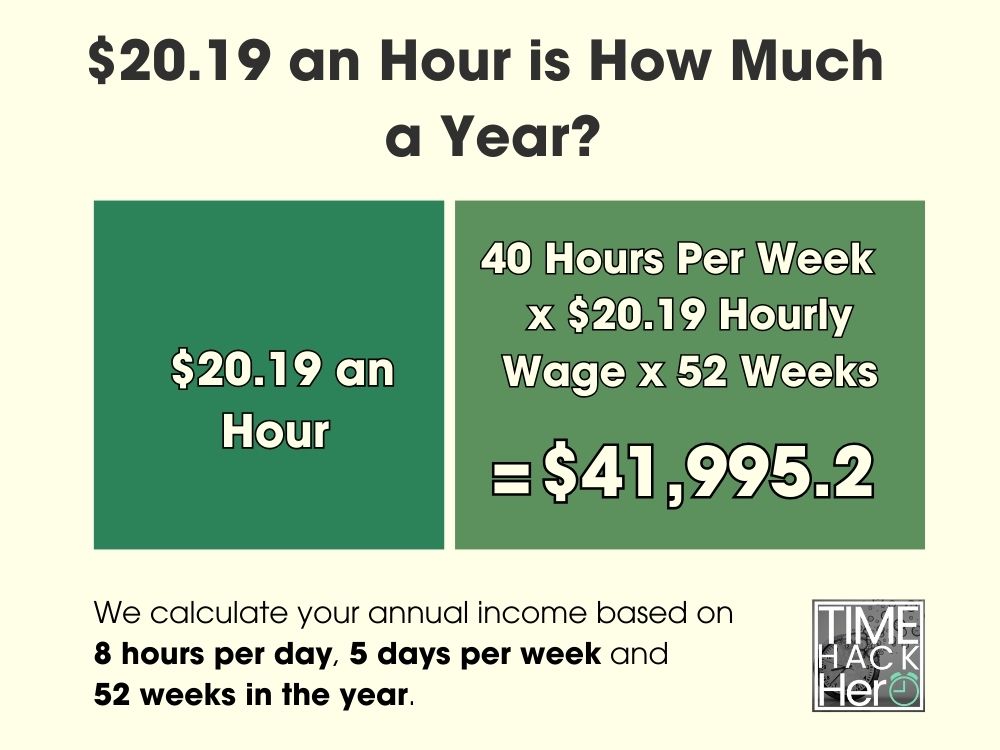

$20.19 an Hour is How Much Per Year?

If you earn $20.19 per hour and work full-time (40 hours per week) for all 52 weeks of the year, your estimated annual earnings would be $41,995.20.

This is calculated as:

Hours worked per week (40) x Hourly wage ($20.19) x Weeks per year (52) = $41,995.20

$20.19 an Hour is How Much Per Month?

Assuming 40 hours per week year-round, your estimated monthly earnings at $20.19/hour would be $3,499.60.

This is your yearly salary divided by 12 months:

$41,995.20 / 12 months = $3,499.60

$20.19 an Hour is How Much Biweekly?

If you get paid every 2 weeks, your biweekly earnings at $20.19/hour for 80 hours would be $1,615.20.

This is calculated as:

Hourly wage ($20.19) x Biweekly hours (80) = $1,615.20

$20.19 an Hour is How Much Per Week?

Working 40 hours per week at $20.19/hour results in weekly earnings of $807.60.

Hourly wage ($20.19) x Hours per week (40) = $807.60

$20.19 an Hour is How Much Per Day?

Assuming a standard 8 hour workday, your estimated daily pay at $20.19/hour would be $161.52.

Hourly wage ($20.19) x Hours per day (8) = $161.52

$20.19 an Hour is How Much Per Year?

The basic formula for calculating your annual earnings from an hourly wage is:

Hourly Rate x Hours Worked per Week x Number of Weeks Worked per Year = Annual Earnings

For $20.19 per hour:

$20.19/hour x 40 hours/week x 52 weeks/year = $41,995.20

However, this assumes you work 40 hours every week without any time off. Let’s factor in paid time off and other variables to get a more accurate estimate.

Accounting for Paid Time Off

The base calculation doesn’t yet account for paid holidays, vacation, sick days, etc. Let’s assume you get:

- 2 weeks (10 days) paid vacation

- 6 paid holidays

- 3 paid sick days

That’s 19 paid days off, equal to nearly 4 weeks PTO.

Importantly, this paid time off does not decrease your annual earnings, since you still get paid for those days.

So with 4 weeks PTO, your annual salary at $20.19/hour would remain $41,995.20.

Part Time $20.19 an Hour is How Much Per Year?

Your annual pay at $20.19/hour drops significantly if you work part-time instead of 40 hours full-time.

For example, at 30 hours per week:

$20.19/hour x 30 hours/week x 52 weeks/year = $31,491.40

That’s over $10,000 less per year than working 40 hour weeks.

Here’s how your annual earnings change at $20.19/hour based on hours worked per week:

| Hours Per Week | Annual Earnings |

|---|---|

| 40 | $41,995.20 |

| 35 | $36,746.60 |

| 30 | $31,491.40 |

| 25 | $26,247.00 |

| 20 | $20,998.40 |

When your hourly wage is fixed, hours worked directly impacts total annual pay.

$20.19 an Hour With Overtime is How Much Per Year?

Next let’s look at how overtime can increase your yearly earnings.

Overtime kicks in after 40 hours in a week, typically paid at 1.5x your regular wage.

For example:

- You work 45 hours in Week 1

- 40 regular hours at $20.19/hour = $807.60

- 5 overtime hours at 1.5 x $20.19 = $151.43

- Your total Week 1 earnings = $807.60 + $151.43 = $959.03

If you worked 45 overtime hours every week for a year at 1.5x pay, your estimated annual earnings would be:

$959.03 per week x 52 weeks = $49,869.56

That’s almost $8,000 more than without overtime pay.

Overtime can significantly increase your annual pay, but may also bump you into a higher tax bracket.

$20.19 an Hour With Unpaid Time Off is How Much Per Year?

The last factor that can reduce your annual earnings is unpaid time off.

Let’s say you take 2 weeks off without pay, leaving you with 50 paid weeks instead of 52.

At $807.60 per 40 hour week, 2 weeks unpaid time off would reduce your annual total to:

$807.60 per week x 50 paid weeks = $40,380

That’s $1,615.20 less than if you worked 52 paid weeks.

In general, more unpaid time off equals lower total annual pay at an hourly wage.

Putting It All Together

To summarize, the main factors determining your annual earnings from an hourly wage are:

- Hours worked per week

- Hourly wage rate

- Overtime pay

- Unpaid time off

Here’s how your annual earnings would change at $20.19/hour based on full-time vs part-time status:

| Weeks Worked | Hours Per Week | Annual Earnings | |

|---|---|---|---|

| Full-Time | 52 | 40 | $41,995.20 |

| Part-Time | 52 | 30 | $31,491.40 |

| Overtime | 52 | 45 | $49,869.56 |

| Unpaid Time Off | 50 | 40 | $40,380 |

In conclusion, calculating your approximate annual earnings from an hourly wage is straightforward once you account for key factors like hours worked, PTO, and overtime pay. The examples above illustrate how much variation is possible depending on your specific situation. Whether you are exploring a new job offer or forecasting a career change, this guide provides a helpful framework for estimating your potential yearly compensation from an hourly rate.

$20.19 An Hour Is How Much A Year After Taxes

Calculating your actual annual earnings based on an hourly wage gets tricky once taxes enter the picture. On top of federal, state, and local income taxes, 7.65% of your gross pay goes to Social Security and Medicare through FICA payroll taxes. So how much does $20.19 per hour equal per year after FICA and income taxes are deducted from your gross pay?

Below we’ll go through the steps to estimate your yearly net take home salary if you make $20.19 per hour. This factors in approximated federal, FICA, state, and local taxes so you know precisely what to expect.

Factoring in Federal Income Tax

Your federal income tax will take a sizable chunk from your gross income. Federal tax rates range between 10% to 37%, based on your tax bracket.

To calculate your federal income tax rate and liability:

- Look up your federal income tax bracket using your gross income.

2023 tax brackets for single filers:

| Tax Rate | Taxable Income Bracket | Tax Owed |

|---|---|---|

| 10% | $0 to $11,000 | 10% of taxable income |

| 12% | $11,001 to $44,725 | $1,100 plus 12% of the amount over $11,000 |

| 22% | $44,726 to $95,375 | $5,147 plus 22% of the amount over $44,725 |

| 24% | $95,376 to $182,100 | $16,290 plus 24% of the amount over $95,375 |

| 32% | $182,101 to $231,250 | $37,104 plus 32% of the amount over $182,100 |

| 35% | $231,251 to $578,125 | $52,832 plus 35% of the amount over $231,250 |

| 37% | $578,126 or more | $174,238.25 plus 37% of the amount over $578,125 |

For example, if your gross annual income is $41,995.20 as a single filer, your federal tax bracket is 12%.

Your estimated federal tax would be:

$11,000 x 10% + ($41,995.20 – $11,000) x 12% = $4,819.42

So at $20.19/hour with $41,995.20 gross pay, you would owe about $4,819.42 in federal income tax.

Considering State Income Tax

On top of federal tax, most states charge state income tax. State income tax rates go from around 1% to 13%, with most between 4% to 6%.

Key Points

- California, Hawaii, New York, New Jersey, and Oregon have some of the highest state income tax rates.

- Seven U.S. states have no income tax.

- Ten other states have a flat tax rate, meaning everyone pays the same percentage regardless of income.

Look up your state income tax rate based on your gross pay and filing status.

Multiply your gross income by the state tax rate to get your estimated state tax amount.

For example, if you live in Pennsylvania with a 3.07% flat tax rate, your estimated state tax would be:

$41,995.20 gross income x 3.07% state tax rate = $1,289.25 estimated state tax

So with $41,995.20 gross annual income, you would owe about $1289.25 in Pennsylvania state income tax. Verify rates for your particular state.

Considering Local Taxes

Some cities and counties charge local income taxes ranging from 1% to 3% of gross income generally.

To estimate potential local taxes:

- Check if your city/county has a local income tax.

- If yes, look up the local income tax rate.

- Multiply your gross income by the local tax rate to estimate local tax.

For example, say you live in Columbus, OH which has a 2.5% local tax rate. Your estimated local tax would be:

$41,995.20 gross income x 2.5% local tax rate = $1,049.88 estimated local tax

So you may owe around $1,049.88 in Columbus local taxes. Verify rates for your specific area.

Accounting for FICA Taxes (Social Security & Medicare)

On top of income tax, 7.65% of your gross pay goes to FICA taxes for Social Security and Medicare:

- 6.2% for Social Security

- 1.45% for Medicare

To estimate FICA taxes:

$41,995.20 gross income x 7.65% FICA rate = $3,212.63

So expect to pay about $3,212.63 in Social Security and Medicare taxes from your $41,995.20 gross earnings.

Total Estimated Tax Payments

Based on the examples above, your total estimated tax payments would be:

- Federal tax: $4,819.42

- State tax: $1,289.40

- Local tax: $1,049.88

- FICA tax: $3,212.63

Total Estimated Tax: $10,371.33

Your total estimated tax payments come out to around $10,371.33 per year.

Calculating Your Take Home Pay

To get your annual take home pay at $20.19/hour:

- Take your gross income

- Subtract your estimated total tax payments

$41,995.20 gross income – $10,371.33 Total Estimated Tax = $31,623.87 Your Take Home Pay

In summary, if you make $20.19 per hour and work full-time, you would take home about $31,623.87 per year after federal, state, local, and FICA taxes.

Your actual net income may vary based on your tax situation. But this provides a general estimate of what to expect annually.

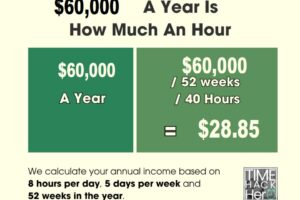

What Is the Average Hourly Wage in the US?

Last Updated: Sep 1 2023

US Average Hourly Earnings is at a current level of $33.82, up from 33.74 last month and up from 32.43 one year ago. This is a change of 0.24% from last month and 4.29% from one year ago.

Average Hourly Earnings is the average dollars that a private employee makes per hour in the US. This metric is a part of one of the most important releases every month which includes unemployment numbers as well. This is normally released on the first Friday of every month. This metric is released by the Bureau of Labor Statistics (BLS).

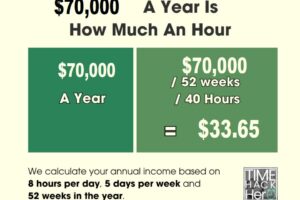

What is the average salary in the U.S.?

Last Updated: July 18, 2023

The U.S. Bureau of Labor Statistics uses median salary data rather than averages to avoid skewed numbers from outlying high and low numbers. Median weekly earnings of the nation's 121.5 million full-time wage and salary workers were $1,100 in the second quarter of 2023, the U.S.

If a person works 52 weeks in the year, then this represents a national annual salary of $57,200.

Is $20.19 an Hour a Good Salary?

Whether $20.19 an hour is a good wage largely depends on where you live and your personal circumstances. In low cost-of-living rural areas, $20 per hour can provide a relatively comfortable lifestyle. However, in expensive urban centers like New York and San Francisco, this hourly wage would make it difficult to afford market-rate housing and other costs.

According to the Bureau of Labor Statistics, the national median hourly wage for all occupations in the U.S. is $18.58 as of May 2020. So at $20.19 an hour, you’d be earning slightly above the median wage.

Here’s how $20.19 an hour stacks up against common benchmark incomes:

- Federal minimum wage: $7.25 per hour

- Federal poverty level (single individual): $12,880/year or $6.19/hour

- MIT Living Wage Calculator national living wage for 1 adult: $16.54/hour

- Median personal income: $35,805/year or $17.21/hour

While better than minimum wage and the poverty line, $20.19 is still close to the living wage level, suggesting it may be tough to afford major expenses in many areas. Overall, it’s a relatively low to moderate income that can provide a basic standard of living depending on your location and individual circumstances.

Jobs that pay $20.19 an hour

Many working-class jobs pay hourly rates in the $15 to $25 per hour range, which would include $20.19 an hour.

Here are some examples of jobs that typically pay around $20 per hour:

- Administrative assistants

- Retail supervisors

- Food service managers

- Entry-level construction jobs

- Security guards

- Medical assistants

- Customer service representatives

- Delivery drivers

- Veterinary technicians

Many of these occupations do not require extensive education or training beyond a high school diploma or some college. Vocational training programs can qualify you for higher-paying skilled jobs in healthcare, tech, and the trades that pay $20/hour or more. Overall, $20 an hour is a pretty typical wage for jobs that require less than a 4-year college degree.

Can You Live Off $20.19 An Hour?

Living solely on $20.19 an hour is possible depending on your location, lifestyle, and expenses. However, it will likely require budgeting and making some trade-offs.

Assuming full-time work, you would earn $3,031 per month or $36,372 per year before taxes on this wage. After accounting for taxes, healthcare, and other payroll deductions, your take-home pay would be approximately $2,500 per month or $30,000 per year.

While certainly livable in lower cost areas, this take-home pay could make it challenging to afford housing, transportation, healthcare, and other basic necessities in higher cost metropolitan regions like Los Angeles, New York, San Francisco, Seattle, and Honolulu.

To determine if $20.19 an hour is enough to live on in your area, it’s helpful to calculate your total monthly expenses. These may include:

- Rent or mortgage

- Groceries

- Utilities

- Transportation

- Insurance

- Medical expenses

- Personal care

- Entertainment

- Debt payments

- Retirement and savings

Ideally, your total monthly expenses would be 50% or less of your take-home income. If your expenses exceed this threshold on an income of $20 an hour, you may need to make cuts in your budget, find ways to earn additional income, or move to a lower cost area.

Overall, while $20.19 an hour provides a livable wage for some, it would likely require careful budgeting and limited discretionary spending in many parts of the country.

The impact of inflation on the value of $20.19 an hour

Inflation steadily erodes the purchasing power of your earnings over time. While you may be making $20.19 an hour today, that money will likely buy less and less in the future as prices rise.

For example, at an average annual inflation rate of 3%, $20.19 today would be equivalent to just $17.80 in 10 years due to declining purchasing power. And at a higher 5% annual inflation rate, your $20.19 wage would only have the buying power of $15.43 in a decade.

This illustrates why cost of living increases and periodic raises are necessary just to maintain your current standard of living. If you are only earning $20 per hour in ten years, you will need to budget more carefully and cut back spending as your money won’t go as far.

The table below shows the effect of inflation on the future value of $20.19 per hour:

| Years From Now | Value of $20.19/hour at 3% Inflation | Value of $20.19/hour at 5% Inflation |

|---|---|---|

| 5 years | $18.59 | $17.24 |

| 10 years | $17.08 | $15.43 |

| 15 years | $15.71 | $13.92 |

| 20 years | $14.47 | $12.64 |

To keep up with rising costs, you’ll need to seek pay raises, promotions, or change jobs to increase your earnings over time. Finding additional sources of income can also offset the impacts of inflation.

5 Ways To Increase Your Hourly Wage

If you find that living on $20.19 an hour is not enough, there are several strategies you can use to boost your hourly pay:

1. Ask for a raise at your current job

If you’ve gained new skills or taken on more responsibilities, request a wage increase from your manager. Come prepared with research on fair market wages for your position and how your contributions have grown.

2. Change jobs or companies

Look for open roles that pay more per hour, either within your same field or at other employers. Changing companies is one of the fastest ways to increase earnings.

3. Pick up overtime or extra shifts

Working additional hours is an easy way to immediately boost your overall weekly and monthly income.

4. Develop new skills through education/training

Enroll in courses or training programs to gain certifications and skills that qualify you for higher-paying work.

5. Take on a side gig or freelancing

Moonlighting with a side job or freelance work during nights and weekends can provide additional income streams.

Being proactive about increasing your earnings will ensure your wage keeps pace with expenses over time. Don’t let inflation eat away at the value of your money.

Buying a car on $20.19 an hour

Buying a car is a major expense, so it requires careful budgeting when earning $20 an hour. While possible, you will need to target an affordable used car and factor in all ownership costs.

Some tips for buying a car on $20/hour income:

- Aim to spend no more than 10-15% of your gross monthly income on transportation costs. At $20 an hour, this puts your monthly car budget at around $300 to $450.

- Shop for used vehicles and look for a reliable model 3-6 years old. This provides the best value and lower payments.

- Get pre-approved for financing to know your price range and score better loan terms.

- Choose a longer loan term like 6 years to lower your monthly payment to fit your budget. But avoid loans over 5-6 years to prevent being underwater.

- Buy from private sellers to avoid dealer fees, but have the car inspected first.

- Factor in insurance, gas, maintenance and repairs in your budget. Owning a car costs more than just the monthly payment.

With reasonable expectations and smart budgeting, you can probably buy a solid used car in the $10,000 to $15,000 range making $20 an hour. Just be wary of overextending yourself.

Can You Buy a House on $20.19 An Hour?

On an hourly wage of $20.19, buying a house is challenging unless you live in a very low cost real estate market or have substantial savings. While home ownership may be possible, it will require discipline and making trade-offs.

Some tips for buying a home on around $20 per hour:

- Aim to spend no more than 28% of gross monthly income on housing. At $20/hour this allows a budget of around $900 per month for mortgage principal, interest, taxes and insurance.

- Save for at least a 10-20% downpayment. This will lower your monthly costs and allow you to qualify for better mortgage rates. At $20/hour, saving up $10,000-20,000 can take 1-2 years if you’re disciplined.

- Consider moving farther from job centers to find affordable housing markets with median home prices between $75,000 to $150,000. This may require a longer commute.

- Buy a small, older home or condo to keep the purchase price low. Opt for a 1-2 bedroom unit with under 1,000 sq ft.

- Get pre-approved and shop around for the best mortgage rates. Compare multiple lenders to find the lowest rates for your situation. Consider an FHA loan.

- Avoid house poor situations by buying well below your maximum budget. Don’t spend more than 2.5-3x your gross annual income on a home.

While owning a home on $20 an hour is possible with diligent saving and budgeting, it may require trade-offs like a longer commute or modest home. Renting may be a better option if you want to live closer to job centers.

Example Budget For $20.19 Per Hour

Here is an example monthly budget for living on $20.19 an hour or approximately $30,000 per year after taxes:

| Expense | Amount | % of Income |

|---|---|---|

| Rent | $800 | 27% |

| Groceries | $250 | 8% |

| Car payment | $200 | 7% |

| Car insurance | $100 | 3% |

| Gasoline | $80 | 3% |

| Utilities | $150 | 5% |

| Cell phone | $80 | 3% |

| Internet/cable | $100 | 3% |

| Entertainment | $150 | 5% |

| Dining out | $100 | 3% |

| Clothing | $50 | 2% |

| Personal care | $30 | 1% |

| Gym membership | $30 | 1% |

| Total expenses | $2,120 | 71% |

This leaves $380 per month for savings, retirement, and discretionary spending. While certainly doable, this budget doesn’t leave much room for major unexpected expenses or costs beyond the basics. You would need to live with roommates and be mindful about discretionary purchases.

Some ways to further reduce costs include:

- Live with family or roommates

- Reduce entertainment, dining out and discretionary purchases

- Buy used clothing and household items

- Avoid car payments by buying an economical used car in cash

- Reduce commute time and transportation costs by living close to work

- Take advantage of government assistance programs as needed

Overall, this illustrates $20 an hour provides a basic but modest standard of living. You’ll need to budget wisely, spend less on discretionary items, and use cost-cutting strategies.

In Summary

In most areas, $20.19 per hour provides a relatively low to moderate income. While living solely on this wage is certainly possible, it will require mindful budgeting, especially in higher cost regions. To live more comfortably, you’ll likely need to take steps to control expenses, increase earnings, and reduce major costs like housing. With prudent money management, however, it is possible to achieve a basic but modest standard of living on $20 an hour.

What’s next, remember to save our diagram to your Pinterest board for further checking.