With the minimum wage stagnant in many states, workers earning $17.50 per hour may wonder if this hourly pay allows them to live comfortably. While $17.50 per hour may seem like a decent wage, how much does it actually translate to annually? And after accounting for taxes and deductions, is $17.50 per hour still considered a livable pay rate?

In this article, we will calculate $17.50 per hour as a weekly, monthly, and yearly salary before and after typical taxes and deductions. We will examine whether $17.50 an hour provides a good salary by today’s standards and what lifestyle it can afford. To do this, we will create sample budgets to evaluate if $17.50 an hour allows workers to cover basic needs, buy a car, or purchase a home. We’ll look at the impact of inflation on $17.50 an hour and tips to increase your hourly pay. Understanding precisely what an hourly wage equals annually and after taxes is vital for anyone earning $17.50 per hour. With proper planning, even this hourly rate may be enough to live on.

Table of Contents

Convert $17.50 Per Hour to Weekly, Monthly, and Yearly Salary

Input your wage and hours per week to see how much you’ll make monthly, yearly and more.

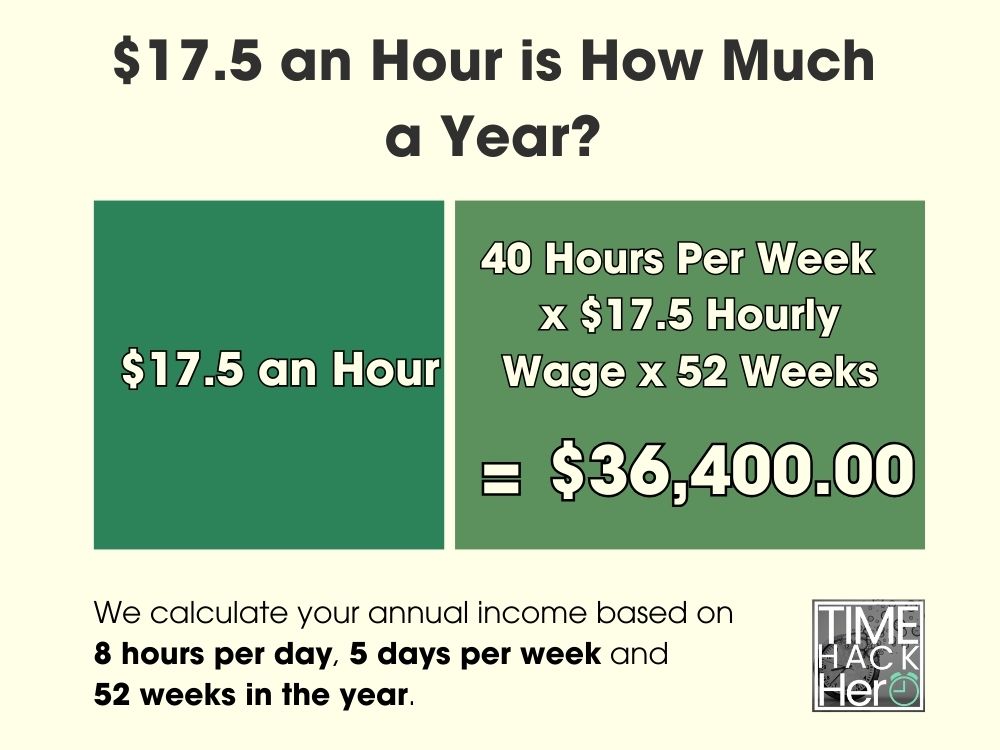

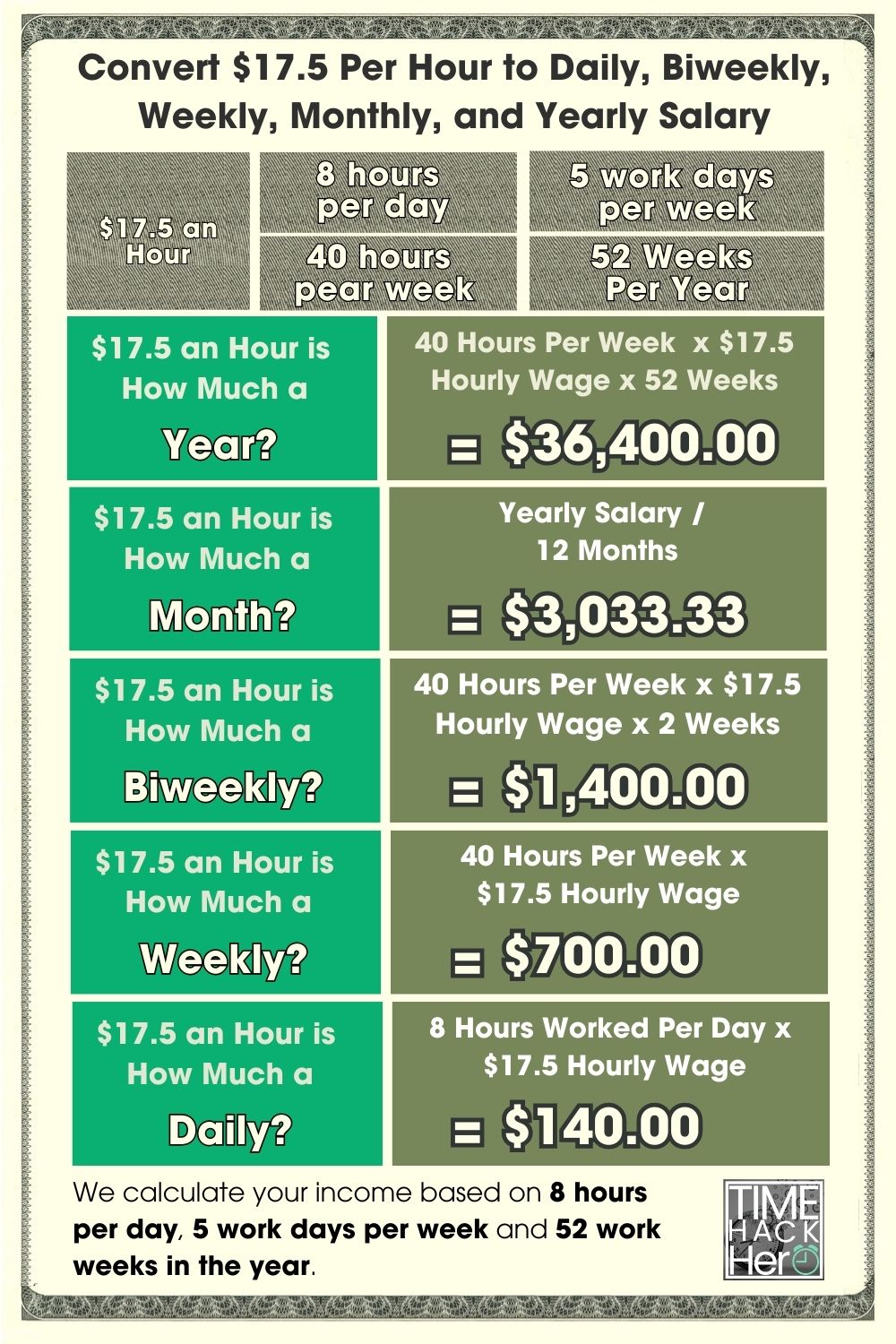

$17.50 an Hour is How Much a Year?

If you make $17.50 an hour, your yearly salary would be $36,400. We calculate your annual income based on 8 hours per day, 5 days per week and 52 weeks in the year.

Hours worked per week (40) x Hourly wage($17.50) x Weeks worked per year(52) = $36,400

$17.50 an Hour is How Much a Month?

If you make $17.50 an hour, your monthly salary would be $3,033.33. We calculated this number by dividing your annual income by 12 months.

Hours worked per week (40) x Hourly wage($17.50) x Weeks worked per year(52) / Months per Year(12) = $3,033.33

$17.50 an Hour is How Much a Biweekly?

If you make $17.50 an hour, your biweekly salary would be $1,400.

Hours worked per week (40) x Hourly wage($17.50) x 2 = $1,400

$17.50 an Hour is How Much a Week?

If you make $17.50 an hour, your weekly salary would be $700. Calculating based on 5 days per week and 8 hours each day.

Hours worked per week (40) x Hourly wage($17.50) = $700

$17.50 an Hour is How Much a Day?

If you make $17.50 an hour, your daily salary would be $140. We calculated your daily income based on 8 hours per day.

Hours worked per day (8) x Hourly wage($17.50) = $140

$17.50 an Hour is How Much a Year?

The basic formula to calculate your annual salary from an hourly wage is:

Hourly Rate x Hours Worked per Week x Number of Weeks Worked per Year = Annual Salary

So for a $20 per hour job:

$17.50 per hour x 40 hours per week x 52 weeks per year = $36,400

However, this simple calculation makes some assumptions:

- You will work 40 hours every week of the year

- You will not get any paid time off

Therefore, it represents your earnings if you worked every week of the year, without any vacation, holidays, or sick days.

Accounting for Paid Time Off

The $36,400 base salary does not yet factor in paid time off (PTO). Let’s assume the job provides:

- 2 weeks (10 days) paid vacation

- 6 paid holidays

- 3 paid sick days

This totals 19 paid days off, or nearly 4 weeks of PTO.

Importantly, this paid time off should not be deducted from the annual salary, since you still get paid for those days.

So with 4 weeks PTO, the annual salary would remain $36,400 .

Part time $17.50 an hour is How Much a Year?

Your annual income changes significantly if you work part-time and not full-time.

For example, let’s say you work 30 hours per week instead of 40. Here’s how you calculate your new yearly total:

$17.50 per hour x 30 hours per week x 52 weeks per year = $27,300

By working 10 fewer hours per week (30 instead of 40), your annual earnings at $18 an hour drop from $36,400 to $27,300.

That’s a $9,100 per year difference just by working part-time!

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $17.50 an hour:

| Hours Per Week | Earnings Per Week | Annual Earnings |

|---|---|---|

| 40 | $700 | $36,400 |

| 35 | $612.50 | $31,850 |

| 30 | $525 | $27,300 |

| 25 | $437.50 | $22,750 |

| 20 | $350 | $18,200 |

| 15 | $262.50 | $13,650 |

The more hours per week, the higher your total yearly earnings. But part-time work allows for more life balance if you don’t need the full salary.

$17.50 an Hour With Overtime is How Much a Year?

Now let’s look at how overtime can increase your annual earnings.

Overtime kicks in once you work more than 40 hours in a week. Typically, you earn 1.5x your regular hourly wage for overtime hours.

So if you make $17.50 per hour normally, you would make $26.25 per hour for any hours over 40 in a week.

Here’s an example:

- You work 45 hours in a Week

- 40 regular hours paid at $17.50 per hour = $700

- 5 overtime hours paid at $26.25 per hour = $131.25

- Your total one Week earnings =$700 + $131.25 = $831.25

If you worked 45 hours each week for 52 weeks, here’s how your annual earnings increase thanks to overtime pay:

$831.25 per week x 52 weeks per year = $43,225

That’s $6,825 more than you’d earn working just 40 hours per week at $17.50 an hour.

Overtime can add up! But also consider taxes and work-life balance when deciding on extra hours.

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $17.50 an hour:

| Overtime hours per work day | Hours Per Week | Earnings Per Week | Annual Earnings |

| 0 | 40 | $700 | $36,400 |

| 1 | 45 | $831.25 | $43,225 |

| 2 | 50 | $962.50 | $50,050 |

| 3 | 55 | $1,093.75 | $56,875 |

| 4 | 60 | $1,225 | $63,700 |

| 5 | 65 | $1,356.25 | $70,525 |

| 6 | 70 | $1,487.50 | $77,350 |

| 7 | 75 | $1,618.75 | $84,175 |

How Unpaid Time Off Impacts $17.50/Hour Yearly Earnings

So far we’ve assumed you work 52 paid weeks per year. Any unpaid time off will reduce your total income.

For example, let’s say you take 2 weeks of unpaid leave. That brings your paid weeks down to 50:

Hours worked per week (40) x Hourly wage($17.50) x Weeks worked per year(50) = $35,000 annual salary

With 2 weeks unpaid time off, your annual earnings at $17.50/hour would drop by $1,400.

The table below summarizes how your annual income changes depending on the number of weeks of unpaid leave.

| Weeks of unpaid leave | Paid weeks per year | Earnings Per Week | Annual Earnings |

| 0 | 52 | $700 | $36,400 |

| 1 | 51 | $700 | $35,700 |

| 2 | 50 | $700 | $35,000 |

| 3 | 49 | $700 | $34,300 |

| 4 | 48 | $700 | $33,600 |

| 5 | 47 | $700 | $32,900 |

| 6 | 46 | $700 | $32,200 |

| 7 | 45 | $700 | $31,500 |

Key Takeaways for $17.50 Hourly Wage

In summary, here are some key points on annual earnings when making $17.50 per hour:

- At 40 hours per week, you’ll earn $36,400 per year.

- Part-time of 30 hours/week results in $27,300 annual salary.

- Overtime pay can boost yearly earnings, e.g. $6,825 extra at 45 hours/week.

- Unpaid time off reduces your total income, around $1,400 less per 2 weeks off.

- Your specific situation and location impacts taxes and PTO.

Knowing your approximate annual salary and factors impacting it makes it easier to budget and plan your finances. The next step is calculating take-home pay after deductions like taxes.

$17.50 An Hour Is How Much A Year After Taxes

Figuring out your actual annual earnings based on an hourly wage can be complicated once taxes are taken into account. In addition to federal, state, and local income taxes, 7.65% of your gross pay also goes to Social Security and Medicare through FICA payroll taxes. So how much does $17.50 an hour equal per year after FICA and income taxes are deducted from your gross pay?

Below we’ll walk through the steps to calculate your annual net take home pay if you make $17.50 per hour. This will factor in estimated federal, FICA, state, and local taxes so you know exactly what to expect.

Factoring in Federal Income Tax

Your federal income tax will be a big chunk out of your gross pay. Federal tax rates range from 10% to 37%, depending on your tax bracket.

To estimate your federal income tax rate and liability:

Look up your federal income tax bracket based on your gross pay.

2023 tax brackets: single filers

| Tax rate | Taxable income bracket | Tax owed |

|---|---|---|

| 10% | $0 to $11,000. | 10% of taxable income. |

| 12% | $11,001 to $44,725. | $1,100 plus 12% of the amount over $11,000. |

| 22% | $44,726 to $95,375. | $5,147 plus 22% of the amount over $44,725. |

| 24% | $95,376 to $182,100. | $16,290 plus 24% of the amount over $95,375. |

| 32% | $182,101 to $231,250. | $37,104 plus 32% of the amount over $182,100. |

| 35% | $231,251 to $578,125. | $52,832 plus 35% of the amount over $231,250. |

| 37% | $578,126 or more. | $174,238.25 plus 37% of the amount over $578,125. |

For example, if you are single with $36,400 gross annual pay, your federal tax bracket is 12%.

Your estimated federal tax would be:

$1,100 + ($36,400 – $11,000) x 12% = $4,148

So at $17.50/hour with $36,400 gross pay, you would owe about $4,148 in federal income taxes.

Considering State Income Tax

In addition to federal tax, most states also charge a state income tax. State income tax rates range from about 1% to 13%, with most falling between 4% and 6%.

Key Takeaways

-

- California, Hawaii, New York, New Jersey, and Oregon have some of the highest state income tax rates.

- Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming don’t impose an income tax at all.

- Another 10 U.S states have a flat tax rate—everyone pays the same percentage regardless of how much they earn.

A State-by-State Comparison of Income Tax Rates

| STATE | TAX RATES | LOWEST AND HIGHEST INCOME BRACKETS |

|---|---|---|

| Alaska | 0% | None |

| Florida | 0% | None |

| Nevada | 0% | None |

| South Dakota | 0% | None |

| Tennessee | 0% | None |

| Texas | 0% | None |

| Washington | 0% | None |

| Wyoming | 0% | None |

| Colorado | 4.55% | Flat rate applies to all incomes |

| Illinois | 4.95% | Flat rate applies to all incomes |

| Indiana | 3.23% | Flat rate applies to all incomes |

| Kentucky | 5% | Flat rate applies to all incomes |

| Massachusetts | 5% | Flat rate applies to all incomes |

| New Hampshire | 5% | Flat rate on interest and dividend income only |

| North Carolina | 4.99% | Flat rate applies to all incomes |

| Pennsylvania | 3.07% | Flat rate applies to all incomes |

| Utah | 4.95% | Flat rate applies to all incomes |

| Michigan | 4.25% | Flat rate applies to all incomes |

| Arizona | 2.59% to 4.5% | $27,806 and $166,843 |

| Arkansas | 2% to 5.5% | $4,300 and $8,501 |

| California | 1% to 13.3% | $9,325 and $1 million |

| Connecticut | 3% to 6.99% | $10,000 and $500,000 |

| Delaware | 0% to 6.6% | $2,000 and $60,001 |

| Alabama | 2% to 5% | $500 and $3,001 |

| Georgia | 1% to 5.75% | $750 and $7,001 |

| Hawaii | 1.4% to 11% | $2,400 and $200,000 |

| Idaho | 1.125% to 6.5% | $1,568 and $7,939 |

| Iowa | 0.33% to 8.53% | $1,743 and $78,435 |

| Kansas | 3.1% to 5.7% | $15,000 and $30,000 |

| Louisiana | 1.85% to 4.25% | $12,500 and $50,001 |

| Maine | 5.8% to 7.15% | $23,000 and $54,450 |

| Maryland | 2% to 5.75% | $1,000 and $250,000 |

| Minnesota | 5.35% to 9.85% | $28,080 and $171,221 |

| Mississippi | 0% to 5% | $5,000 and $10,001 |

| Missouri | 1.5% to 5.3% | $1,121 and $8,968 |

| Montana | 1% to 6.75% | $2,900and $17,400 |

| Nebraska | 2.46% to 6.84% | $3,340 and $32,210 |

| New Jersey | 1.4% to 10.75% | $20,000 and $1 million |

| New Mexico | 1.7% to 5.9% | $5,500 and $210,000 |

| New York | 4% to 10.9% | $8,500 and $25 million |

| North Dakota | 1.1% to 2.9% | $41,775 and $458,350 |

| Ohio | 0% to 3.99% | $25,000 and $110,650 |

| Oklahoma | 0.25% to 4.75% | $1,000 and $7,200 |

| Oregon | 4.75% to 9.9% | $3,750 and $125,000 |

| Rhode Island | 3.75% to 5.99% | $68,200 and $155,050 |

| South Carolina | 0% to 7% | $3,110 and $15,560 |

| Vermont | 3.35% to 8.75% | $42,150 and $213,150 |

| Virginia | 2% to 5.75% | $3,000 and $17,001 |

| Washington, D.C. | 4% to 9.75% | $10,000 and $1 million |

| West Virginia | 3% to 6.5% | $10,000 and $60,000 |

| Wisconsin | 3.54% to 7.65% | $12,760 and $280,950 |

To estimate your state income tax:

Look up your state income tax rate based on your gross pay and filing status.

Multiply your gross annual pay by the state tax rate.

For example, if you live in Pennsylvania which has a flat 3.07% tax rate, your estimated state tax would be:

$36,400 gross pay x 3.07% PA tax rate = $1,117.48 estimated state income tax

So with $36,400 gross annual income, you would owe around in $1,117.48 Pennsylvania state income tax. Verify your specific state’s income tax rates.

Factoring in Local Taxes

Some cities and counties levy local income taxes ranging from 1-3% of taxable income.

To estimate potential local taxes you may owe:

- Check if your city or county charges a local income tax.

- If yes, look up the local income tax rate.

- Multiply your gross annual pay by the local tax rate.

For example, say you live in Columbus, OH which has a 2.5% local income tax. Your estimated local tax would be:

$36,400 gross pay x 2.5% local tax rate = $910 estimated local tax

So with $36,400 in gross earnings, you may owe around $910 in Columbus local income taxes. Verify rates for your own city/county.

Accounting for FICA Taxes (Social Security & Medicare)

FICA taxes are a combination of Social Security and Medicare taxes that equal 15.3% of your earnings. You are responsible for half of the total bill (7.65%), which includes a 6.2% Social Security tax and 1.45% Medicare tax on your earnings.

In 2023, only the first $160,200 of your earnings are subject to the Social Security tax

There is an additional 0.9% surtax on top of the standard 1.45% Medicare tax for those who earn over $200,000 (single filers) or $250,000 (joint filers).

To estimate your FICA tax payment:

$36,400 x 6.2% + $36,400 x 1.45% = $2,784.60

So you can expect to pay about $2,784.60 in Social Security and Medicare taxes out of your gross $36,400 in earnings.

Total Estimated Tax Payments

Based on the examples above, your total estimated tax payments would be:

Federal tax: $4,148

State tax: $1,117.48

Local tax: $910

FICA tax: $2,784.60

Total Estimated Tax: $8,960.08

Calculating Your Take Home Pay

To calculate your annual take home pay at $17.50 /hour:

1. Take your gross pay

2. Subtract your estimated total tax payments

$36,400 gross pay – $8,960.08 Total Estimated Tax = $27,439.92 Your Take Home Pay

n summary, if you make $17.50 per hour and work full-time, you would take home around $27,439.92 per year after federal, state, local , FICA taxes.

Your actual net income may vary depending on your specific tax situation. But this gives you a general idea of what to expect.

Convert $17.50 Per Hour to Yearly, Monthly, Biweekly, and Weekly Salary After Taxes

If you make $17.50 an hour and work full-time (40 hours per week), your estimated yearly salary would be $36,400 .

The $36,400 per year salary does not account for taxes. Federal, state, and local taxes will reduce your take-home pay. The amount withheld depends on your location, filing status, dependents, and other factors.

Just now during our calculation of $17.50 An Hour Is How Much A Year After Taxes, we assumed the following conditions:

- You are single with $36,400 gross annual pay, your federal tax bracket is 12 %.

- You live in Pennsylvania which has a flat 3.07% tax rate

- You live in Columbus, OH which has a 2.5% local income tax.

In the end, we calculated your Total Estimated Tax is $8,960.08 , Your Take Home Pay is $27,439.92 , Total tax rate is 24.62%.

So next we’ll use 24.62% as the estimated tax rate to calculate your weekly, biweekly, and monthly after-tax income.

$17.50 Per Hour to Yearly, Monthly, Biweekly, Weekly,and Week Salary After Taxes Table

| Income before taxes | Estimated Tax Rate | Income Taxes | After Tax Income | |

| Yearly Salary | $36,400 | 24.62% | $8,960.08 | $27,439.92 |

| Monthly Salary | $3,033.33 | 24.62% | $746.67 | $2,286.66 |

| BiWeekly Salary | $1,400 | 24.62% | $344.62 | $1,055.38 |

| Weekly Salary | $700 | 24.62% | $172.31 | $527.69 |

$17.50 an hour is how much a year after taxes

Here is the adjusted yearly salary after a 24.62% tax reduction:

-

- Yearly salary before taxes: $36,400

- Estimated tax rate: 24.62%

- Taxes owed (24.62% * $36,400 )= $8,960.08

- Yearly salary after taxes: $27,439.92

| Hourly Wage | Hours Worked Per Week | Weeks Worked Per Year | Total Yearly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Yearly Salary |

|---|---|---|---|---|---|---|

| $17.50 | 40 | 52 | $36,400 | 24.62% | $8,960.08 | $27,439.92 |

$17.50 an hour is how much a month after taxes

To calculate the monthly salary based on an hourly wage, you first need the yearly salary amount. Then divide by 12 months.

-

-

- Yearly salary before taxes at $17.50 per hour: $36,400

- Divided by 12 months per year: $36,400 / 12 = $3,033.33 per month

-

The monthly salary based on a 40 hour work week at $17.50 per hour is $3,033.33 before taxes.

After applying the estimated 24.62% tax rate, the monthly after-tax salary would be:

-

- Monthly before-tax salary: $3,033.33

- Estimated tax rate: 24.62%

- Taxes owed (24.62% * $3,033.33 )= $746.67

- Monthly after-tax salary: $2,286.66

Monthly Salary Based on $17.50 Per Hour

| Hourly Wage | Yearly Salary | Months Per Year | Before-Tax Monthly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Monthly Salary |

|---|---|---|---|---|---|---|

| $17.50 | $36,400 | 12 | $3,033.33 | 24.62% | $746.67 | $2,286.66 |

$17.50 an hour is how much biweekly after taxes

Many people are paid biweekly, meaning every other week. To calculate the biweekly pay at $17.50 per hour:

- Hourly wage: $17.50

- Hours worked per week: 40

- Weeks per biweekly pay period: 2

- $17.50 * 40 hours * 2 weeks = $1,400 biweekly

Applying the 24.62%estimated tax rate:

- Biweekly before-tax salary: $1,400

- Estimated tax rate: 24.62%

- Taxes owed (24.62% * $1,400 )= $344.62

- Biweekly after-tax salary: $1,055.38

Biweekly Salary at $17.50 Per Hour

| Hourly Wage | Hours Worked Per Week | Weeks Per Pay Period | Before-Tax Biweekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Biweekly Salary |

|---|---|---|---|---|---|---|

| $17.50 | 40 | 2 | $1,400 | 24.62% | $344.62 | $1,055.38 |

$17.50 an hour is how much weekly after taxes

To find the weekly salary based on an hourly wage, you need to know the number of hours worked per week. At 40 hours per week, the calculation is:

- Hourly wage: $17.50

- Hours worked per week: 40

- $17.50 * 40 hours = $700 per week

Accounting for the estimated 24.62% tax rate:

- Weekly before-tax salary: $700

- Estimated tax rate: 24.62%

- Taxes owed (24.62% * $700 )= $172.31

- Weekly after-tax salary: $527.69

Weekly Salary at $17.50 Per Hour

| Hourly Wage | Hours Worked Per Week | Before-Tax Weekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Weekly Salary |

|---|---|---|---|---|---|

| $17.50 | 40 | $700 | 24.62% | $172.31 | $527.69 |

Key Takeaways

- An hourly wage of $17.50 per hour equals a yearly salary of $36,400 before taxes, assuming a 40 hour work week.

- After accounting for an estimated 24.62% tax rate, the yearly after-tax salary is approximately $27,439.92 .

- On a monthly basis before taxes, $17.50 per hour equals $3,033.33 per month. After estimated taxes, the monthly take-home pay is about $2,286.66 .

- The before-tax weekly salary at $17.50 per hour is $700 . After taxes, the weekly take-home pay is approximately $527.69 .

- For biweekly pay, the pre-tax salary at $17.50 per hour is $1,400 . After estimated taxes, the biweekly take-home pay is around $1,055.38 .

Understanding annual, monthly, weekly, and biweekly salary equivalents based on an hourly wage is useful when budgeting and financial planning. Taxes make a significant difference in take-home pay, so be sure to account for them when making income conversions. Use this guide as a reference when making salary calculations.

What Is the Average Hourly Wage in the US?

Last Updated: Sep 1 2023

US Average Hourly Earnings is at a current level of $33.82, up from 33.74 last month and up from 32.43 one year ago. This is a change of 0.24% from last month and 4.29% from one year ago.

Average Hourly Earnings is the average dollars that a private employee makes per hour in the US. This metric is a part of one of the most important releases every month which includes unemployment numbers as well. This is normally released on the first Friday of every month. This metric is released by the Bureau of Labor Statistics (BLS).

What is the average salary in the U.S.?

Last Updated: July 18, 2023

The U.S. Bureau of Labor Statistics uses median salary data rather than averages to avoid skewed numbers from outlying high and low numbers. Median weekly earnings of the nation's 121.5 million full-time wage and salary workers were $1,100 in the second quarter of 2023, the U.S.

If a person works 52 weeks in the year, then this represents a national annual salary of $57,200.

Is $17.5 an Hour a Good Salary?

Whether $17.5 an hour is considered a good salary depends on your location, expenses, debt levels and career field. It also depends on your expectations and financial goals. Here are some key considerations:

- On a full-time basis (40 hours a week), $17.5 an hour translates to an annual salary of around $36,400 per year. This exceeds the federal poverty level for a family of four which is $27,750 in 2023.

- According to the U.S. Census Bureau, the median personal income in the United States is around $35,805. So $17.5 per hour puts you close to the middle of U.S. earners. However, median incomes vary significantly by state and region. Large coastal cities tend to have higher wages and costs of living compared to middle America.

- The average hourly wage for all occupations in May 2022 was $32.36, according to the Bureau of Labor Statistics (BLS). So $17.5 per hour is considerably below the national average.

- Minimum wage workers have long argued that $15 an hour should be the new minimum. From that perspective, $17.50 is better than minimum wage but still quite low for many households, especially in higher cost-of-living areas.

Overall, whether $17.50 per hour is considered a good wage depends hugely on your individual circumstances. It can provide a decent living in some areas but may mean perpetual financial struggles in high-cost cities.

Jobs that Pay $17.5 Per Hour

Certain jobs tend to pay right around $17.50 per hour. Here are some examples of occupations that often pay near this rate:

- Retail jobs. Retail salespersons, cashiers, stock clerks and related roles often pay between $15-$18 per hour depending on experience and location. Retail giant Costco starts employees at $17 per hour.

- Food service jobs. Cooks, dishwashers, hosts, baristas and other food service roles frequently pay around $15-$18 per hour depending on the restaurant. Some fast casual chains like Shake Shack start employees around $16-$18 per hour.

- Call center roles. Customer service representatives, telemarketers and other call center jobs often pay $16-$20 per hour. Some companies such as Discover Card start representatives at $17-$18 per hour.

- Transportation jobs. Some school bus drivers, taxi drivers, chauffeurs and package delivery drivers make $16-$20 per hour depending on experience and employer.

- Warehouse jobs. Forklift operators, loaders, order pickers and inventory clerks are often paid $15-$20 per hour based on skills and experience. Amazon starts fulfillment center workers at around $18 per hour.

- Nursing assistants. Certified nursing assistants who work in nursing homes, hospitals and other healthcare settings are typically paid $14-$18 per hour.

- Factory jobs. Assemblers, machine operators, welders, and other manufacturing roles frequently pay between $15-$20 per hour based on industry and location.

So while not extremely common, jobs paying right around $17.50 per hour can be found, particularly within industries like retail, food service, call centers, transportation and manufacturing.

Can You Live Off $17.5 An Hour?

Whether or not it’s possible to live on $17.5 an hour depends on your lifestyle expectations, location, and household situation. For a single person living in an average cost-of-living area, it would generally require discipline and budgeting to cover basic necessities. For families supporting children or living in high-cost metropolitan areas, it would be extremely challenging to live comfortably at this wage level.

Some key considerations on living off $17.5 per hour:

- Assuming 40 hours per week and 50 weeks per year, $17.5 per hour equals $35,000 pre-tax annual earnings. After taxes, this might equate to around $28,000 in take-home pay.

- The average monthly rent for a 1-bedroom apartment nationally is around $1,100. At $17.5 per hour, your pre-tax monthly earnings would be around $3,000. So more than a third of your earnings could go just toward housing costs.

- Living in a high-rent metro area like New York City or San Francisco at $17.5 per hour would likely require sharing a multi-bedroom apartment and relying on public transportation.

- Earning $17.5 per hour would make it challenging to afford roomy housing, reliable transportation, ample food/clothing, entertainment expenses and savings contributions without financial sacrifices in at least some areas.

- Supporting a family on $17.5 per hour would require very careful budgeting, low-cost housing, and likely government assistance programs to afford basics like healthcare, childcare and sufficient nutrition.

Overall, while possible in some areas for single adults, living comfortably on $17.5 per hour would be quite difficult for most households, especially families. You’d likely need supplemental income sources or a very low cost of living.

The Impact of Inflation on $17.5 An Hour

With inflation recently reaching its highest level in 40 years, the rising costs of housing, food, transportation and other living expenses make it increasingly difficult to get by on hourly wages under $20 per hour. Here’s how inflation has impacted someone earning $17.5 per hour:

- Inflation averaged 8.6% in 2022. So assuming a 40-hour work week, inflation caused the real purchasing power of $17.5 per hour to decline by around $1.50 over the course of 2022.

- Consumer prices have continued rising in 2023, further eroding real wages. The real value of $17.5 per hour has likely declined by around $2 per hour or more since early 2020.

- Key living expenses like food and rent have been rising even faster than overall inflation, squeezing household budgets further. Average rents rose 12% nationally in 2022.

- To maintain the same purchasing power as two years ago, $17.5 per hour in 2023 would have to rise to around $19.5 per hour or more.

- Without meaningful wage increases, inflation eats away at earnings. Someone earning $17.5 per hour in 2022 or 2023 is worse off in real terms than the same hourly wage before inflation spiked.

Overall, with living costs rising, $17.50 buys significantly less today than it did even a year or two ago. Those earning this hourly rate are falling behind inflation without pay increases.

5 Ways To Increase Your Hourly Wage

For those earning $17.5 per hour or less, getting a raise or finding higher paying work can provide relief from inflation and improve overall finances. Here are 5 potential ways to boost your hourly earnings:

- Ask for a raise – If you’ve been with your employer for a year or more and have a positive track record, request a wage increase to keep pace with living expenses. Come armed with data on your contributions and inflationary impacts.

- Find a higher paying job – Explore job listings in your field to see if more lucrative opportunities exist. Switching companies can often provide a 10-20% pay bump.

- Develop new skills – Take courses or training to expand your skill-set. Learn specialized equipment or software to make yourself more valuable and open doors to better-paying roles.

- Negotiate starting wages – When applying for roles, research typical wages and negotiate your starting pay during the hiring process. Employers often have flexibility.

- Work overtime – Taking on extra shifts or overtime hours can significantly boost weekly earnings. Even 5-10 extra hours per week can make a difference.

Putting in the effort to increase your earnings can help protect against inflation erosion. A few more dollars per hour makes housing, transportation and savings more attainable.

Buying a Car on $17.5 Per Hour

Trying to buy a car while earning $17.5 an hour would be quite challenging for most people. Here are some key considerations on affording an auto purchase at this wage:

- The average new car transaction price recently exceeded $48,000. After taxes and living expenses, it would be nearly impossible for someone earning $17.5 per hour to manage payments on a new car.

- However, buying a used car would be more realistic. Used car prices increased during the pandemic but have been dropping in 2022 and 2023. The current average used car price is around $28,000.

- For a used car costing $20,000, a 5-year loan at 6% interest would equate to a monthly payment around $380. This would consume a significant chunk of monthly take-home pay at $17.5 per hour.

- To keep costs down, buying an older used car (8-10 years old) in the $10k-$15k range makes more financial sense. This reduces monthly payments to around $200-$300, much more feasible on this income.

- Minimum full coverage insurance will cost $100+ per month for most used car purchases, further cutting into limited budgets. Shopping around for discounts can help.

- Fuel, maintenance and unexpected repairs on an older used car may still strain monthly finances. Careful budgeting for ownership costs is essential.

Overall, buying any car while earning $17.5 an hour requires careful selection of affordable, reliable used models. New cars and many late-model used cars would be out of reach for most on this tight budget.

Can You Buy a House at $17.5 Per Hour?

For most people and places, buying a house while earning $17.5 per hour would be extremely difficult, if not impossible. Some key home buying considerations at this wage:

- The current median home price nationally is around $370,000. Putting just a 3.5% down payment on a median home would require saving $13,000+. Attainable on this hourly wage? Unlikely for most.

- During mortgage approval, lenders generally want your total monthly debts to be less than 36% of your gross monthly income. On $17.5 per hour with average taxes, your take-home pay is around $2,800 per month. So your max monthly mortgage payment would be about $1,000 to get approved.

- Even with a 3.5% FHA loan on a $200,000 home (much cheaper than the median), monthly mortgage payments would exceed $1,200, blowing past the recommended 36% debt ratio at this income level. You’d be rejected.

- While $1,000 per month could theoretically cover rent for some one-bedroom apartments in lower cost areas, it would not be enough for even a modest starter home in most housing markets.

- Saving up the required 3.5% down payment ($7,000 on a $200,000 home) while making $17.5 per hour would likely take several years for most buyers.

The bottom line is buying a home at this wage would only be feasible in the most affordable real estate markets or with a hefty down payment from family. Or opting for an unusually tiny or dilapidated property. But home ownership is largely out of reach for $17.5 hourly earners.

Example Budget at $17.5 Per Hour

Here is an example monthly budget for someone earning $17.5 per hour while working full-time:

Gross Monthly Income: $3,000 Net Monthly Income: $2,450

Rent: $800 Utilities: $200 Food: $300 Health Insurance: $200 Phone: $100 Internet: $50 Car Payment: $300 Car Insurance: $100 Gas: $120 Entertainment: $100 Clothing: $50 Misc. Expenses: $100 Total: $2,420

This tight budget shows how closely expenses would match earnings each month for many at this wage level. There is little room for savings, vacations, big purchases, eating out, or entertainment. Any emergency costs or spikes in gas or food prices could blow the budget. It requires discipline and likely sacrifice in some areas (small living space, older car, limited fun spending, etc.). Financial stress would be significant.

In Summary

In today’s economy, $17.5 per hour provides a wage higher than minimum pay but lower than the national average. Careful budgeting could allow a single adult to cover basic needs in some areas, but supporting families would be very difficult at this earnings level. High-cost cities would be particularly challenging. With rising inflation, the buying power of $17.5 per hour is falling. Major purchases like cars and homes would be mostly out of reach on this salary. Boosting earnings through raises, skills training, or higher paying jobs provides the best path toward improving one’s standard of living. But in many parts of the country today, $17.5 per hour only provides a very modest living with little ability to get ahead.