The hourly wage a person earns has a direct impact on their annual salary and take-home pay. With inflation on the rise and the cost of living increasing, many people are left wondering if their current hourly pay allows them to earn a livable annual income. For those making $16 an hour, what does this equate to in terms of weekly, monthly, and yearly earnings? And after factoring in taxes, insurance, and other deductions, how much would $16 an hour really provide on an annual basis?

This article will break down exactly how much $16 per hour equals on a weekly, monthly, and yearly basis before and after taxes. We’ll discuss how elements like overtime pay and unpaid time off can impact total annual earnings at this pay rate. Additionally, we’ll explore whether $16 an hour is considered a good salary in today’s economic environment and what kind of lifestyle this wage can afford. If you or someone you know earns around $16 an hour, this article will provide insight into how far that pay can go over the course of a year.

Table of Contents

Convert $16 Per Hour to Weekly, Monthly, and Yearly Salary

Input your wage and hours per week to see how much you’ll make monthly, yearly and more.

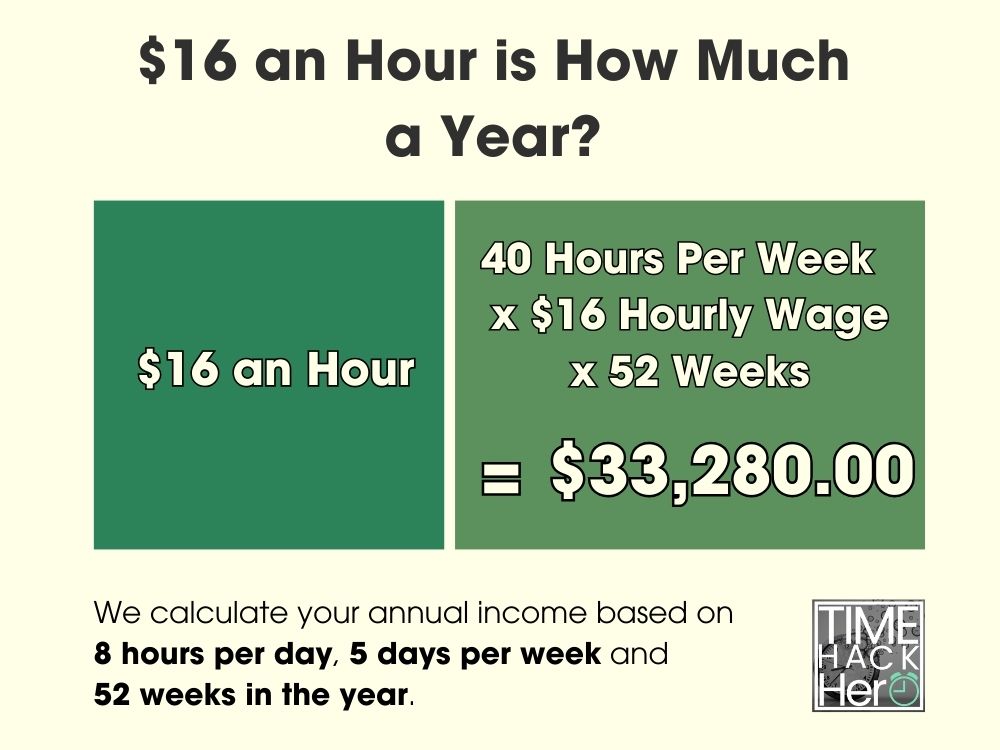

$16 an Hour is How Much a Year?

If you make $16 an hour, your yearly salary would be $33,280. We calculate your annual income based on 8 hours per day, 5 days per week and 52 weeks in the year.

Hours worked per week (40) x Hourly wage($16) x Weeks worked per year(52) = $33,280

$16 an Hour is How Much a Month?

If you make $16 an hour, your monthly salary would be $2,773.33. We calculated this number by dividing your annual income by 12 months.

Hours worked per week (40) x Hourly wage($16) x Weeks worked per year(52) / Months per Year(12) = $2,773.33

$16 an Hour is How Much a Biweekly?

If you make $16 an hour, your biweekly salary would be $1,280.

Hours worked per week (40) x Hourly wage($16) x 2 = $1,280

$16 an Hour is How Much a Week?

If you make $16 an hour, your weekly salary would be $640. Calculating based on 5 days per week and 8 hours each day.

Hours worked per week (40) x Hourly wage($16) = $640

$16 an Hour is How Much a Day?

If you make $16 an hour, your daily salary would be $128. We calculated your daily income based on 8 hours per day.

Hours worked per day (8) x Hourly wage($16) = $128

$16 an Hour is How Much a Year?

The basic formula to calculate your annual salary from an hourly wage is:

Hourly Rate x Hours Worked per Week x Number of Weeks Worked per Year = Annual Salary

So for a $20 per hour job:

$16 per hour x 40 hours per week x 52 weeks per year = $33,280

However, this simple calculation makes some assumptions:

- You will work 40 hours every week of the year

- You will not get any paid time off

Therefore, it represents your earnings if you worked every week of the year, without any vacation, holidays, or sick days.

Accounting for Paid Time Off

The $33,280 base salary does not yet factor in paid time off (PTO). Let’s assume the job provides:

- 2 weeks (10 days) paid vacation

- 6 paid holidays

- 3 paid sick days

This totals 19 paid days off, or nearly 4 weeks of PTO.

Importantly, this paid time off should not be deducted from the annual salary, since you still get paid for those days.

So with 4 weeks PTO, the annual salary would remain $33,280 .

Part time $16 an hour is How Much a Year?

Your annual income changes significantly if you work part-time and not full-time.

For example, let’s say you work 20 hours per week instead of 40. Here’s how you calculate your new yearly total:

$16 per hour x 20 hours per week x 52 weeks per year = $16,640

By working 20 fewer hours per week (20 instead of 40), your annual earnings at $16 an hour drop from $33,280 to $16,640.

That’s a $16,640 per year difference just by working part-time!

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $16 an hour:

| Hours Per Week | Earnings Per Week | Annual Earnings |

|---|---|---|

| 40 | $640 | $33,280 |

| 35 | $560 | $29,120 |

| 30 | $480 | $24,960 |

| 25 | $400 | $20,800 |

| 20 | $320 | $16,640 |

| 15 | $240 | $12,480 |

The more hours per week, the higher your total yearly earnings. But part-time work allows for more life balance if you don’t need the full salary.

$16 an Hour With Overtime is How Much a Year?

Now let’s look at how overtime can increase your annual earnings.

Overtime kicks in once you work more than 40 hours in a week. Typically, you earn 1.5x your regular hourly wage for overtime hours.

So if you make $16 per hour normally, you would make $24 per hour for any hours over 40 in a week.

Here’s an example:

- You work 45 hours in a Week

- 40 regular hours paid at $16 per hour = $640

- 5 overtime hours paid at $24 per hour = $120

- Your total one Week earnings =$640 + $120 = $760

If you worked 45 hours each week for 52 weeks, here’s how your annual earnings increase thanks to overtime pay:

$760 per week x 52 weeks per year = $39,520

That’s $6,240 more than you’d earn working just 40 hours per week at $16 an hour.

Overtime can add up! But also consider taxes and work-life balance when deciding on extra hours.

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $16 an hour:

| Overtime hours per work day | Hours Per Week | Earnings Per Week | Annual Earnings |

| 0 | 40 | $640 | $33,280 |

| 1 | 45 | $760 | $39,520 |

| 2 | 50 | $880 | $45,760 |

| 3 | 55 | $1,000 | $52,000 |

| 4 | 60 | $1,120 | $58,240 |

| 5 | 65 | $1,240 | $64,480 |

| 6 | 70 | $1,360 | $70,720 |

| 7 | 75 | $1,480 | $76,960 |

How Unpaid Time Off Impacts $16/Hour Yearly Earnings

So far we’ve assumed you work 52 paid weeks per year. Any unpaid time off will reduce your total income.

For example, let’s say you take 2 weeks of unpaid leave. That brings your paid weeks down to 50:

Hours worked per week (40) x Hourly wage($16) x Weeks worked per year(50) = $32,000 annual salary

With 2 weeks unpaid time off, your annual earnings at $16/hour would drop by $1,280.

The table below summarizes how your annual income changes depending on the number of weeks of unpaid leave.

| Weeks of unpaid leave | Paid weeks per year | Earnings Per Week | Annual Earnings |

| 0 | 52 | $640 | $33,280 |

| 1 | 51 | $640 | $32,640 |

| 2 | 50 | $640 | $32,000 |

| 3 | 49 | $640 | $31,360 |

| 4 | 48 | $640 | $30,720 |

| 5 | 47 | $640 | $30,080 |

| 6 | 46 | $640 | $29,440 |

| 7 | 45 | $640 | $28,800 |

Key Takeaways for $16 Hourly Wage

In summary, here are some key points on annual earnings when making $16 per hour:

- At 40 hours per week, you’ll earn $33,280 per year.

- Part-time of 30 hours/week results in $24,960 annual salary.

- Overtime pay can boost yearly earnings, e.g. $6,240 extra at 45 hours/week.

- Unpaid time off reduces your total income, around $1,280 less per 2 weeks off.

- Your specific situation and location impacts taxes and PTO.

Knowing your approximate annual salary and factors impacting it makes it easier to budget and plan your finances. The next step is calculating take-home pay after deductions like taxes.

$16 An Hour Is How Much A Year After Taxes

Figuring out your actual annual earnings based on an hourly wage can be complicated once taxes are taken into account. In addition to federal, state, and local income taxes, 7.65% of your gross pay also goes to Social Security and Medicare through FICA payroll taxes. So how much does $16 an hour equal per year after FICA and income taxes are deducted from your gross pay?

Below we’ll walk through the steps to calculate your annual net take home pay if you make $16 per hour. This will factor in estimated federal, FICA, state, and local taxes so you know exactly what to expect.

Factoring in Federal Income Tax

Your federal income tax will be a big chunk out of your gross pay. Federal tax rates range from 10% to 37%, depending on your tax bracket.

To estimate your federal income tax rate and liability:

Look up your federal income tax bracket based on your gross pay.

2023 tax brackets: single filers

| Tax rate | Taxable income bracket | Tax owed |

|---|---|---|

| 10% | $0 to $11,000. | 10% of taxable income. |

| 12% | $11,001 to $44,725. | $1,100 plus 12% of the amount over $11,000. |

| 22% | $44,726 to $95,375. | $5,147 plus 22% of the amount over $44,725. |

| 24% | $95,376 to $182,100. | $16,290 plus 24% of the amount over $95,375. |

| 32% | $182,101 to $231,250. | $37,104 plus 32% of the amount over $182,100. |

| 35% | $231,251 to $578,125. | $52,832 plus 35% of the amount over $231,250. |

| 37% | $578,126 or more. | $174,238.25 plus 37% of the amount over $578,125. |

For example, if you are single with $33,280 gross annual pay, your federal tax bracket is 12%.

Your estimated federal tax would be:

$1,100 + ($33,280 – $11,000) x 12% = $3,773.60

So at $16/hour with $33,280 gross pay, you would owe about $3,773.60 in federal income taxes.

Considering State Income Tax

In addition to federal tax, most states also charge a state income tax. State income tax rates range from about 1% to 13%, with most falling between 4% and 6%.

Key Takeaways

-

- California, Hawaii, New York, New Jersey, and Oregon have some of the highest state income tax rates.

- Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming don’t impose an income tax at all.

- Another 10 U.S states have a flat tax rate—everyone pays the same percentage regardless of how much they earn.

A State-by-State Comparison of Income Tax Rates

| STATE | TAX RATES | LOWEST AND HIGHEST INCOME BRACKETS |

|---|---|---|

| Alaska | 0% | None |

| Florida | 0% | None |

| Nevada | 0% | None |

| South Dakota | 0% | None |

| Tennessee | 0% | None |

| Texas | 0% | None |

| Washington | 0% | None |

| Wyoming | 0% | None |

| Colorado | 4.55% | Flat rate applies to all incomes |

| Illinois | 4.95% | Flat rate applies to all incomes |

| Indiana | 3.23% | Flat rate applies to all incomes |

| Kentucky | 5% | Flat rate applies to all incomes |

| Massachusetts | 5% | Flat rate applies to all incomes |

| New Hampshire | 5% | Flat rate on interest and dividend income only |

| North Carolina | 4.99% | Flat rate applies to all incomes |

| Pennsylvania | 3.07% | Flat rate applies to all incomes |

| Utah | 4.95% | Flat rate applies to all incomes |

| Michigan | 4.25% | Flat rate applies to all incomes |

| Arizona | 2.59% to 4.5% | $27,806 and $166,843 |

| Arkansas | 2% to 5.5% | $4,300 and $8,501 |

| California | 1% to 13.3% | $9,325 and $1 million |

| Connecticut | 3% to 6.99% | $10,000 and $500,000 |

| Delaware | 0% to 6.6% | $2,000 and $60,001 |

| Alabama | 2% to 5% | $500 and $3,001 |

| Georgia | 1% to 5.75% | $750 and $7,001 |

| Hawaii | 1.4% to 11% | $2,400 and $200,000 |

| Idaho | 1.125% to 6.5% | $1,568 and $7,939 |

| Iowa | 0.33% to 8.53% | $1,743 and $78,435 |

| Kansas | 3.1% to 5.7% | $15,000 and $30,000 |

| Louisiana | 1.85% to 4.25% | $12,500 and $50,001 |

| Maine | 5.8% to 7.15% | $23,000 and $54,450 |

| Maryland | 2% to 5.75% | $1,000 and $250,000 |

| Minnesota | 5.35% to 9.85% | $28,080 and $171,221 |

| Mississippi | 0% to 5% | $5,000 and $10,001 |

| Missouri | 1.5% to 5.3% | $1,121 and $8,968 |

| Montana | 1% to 6.75% | $2,900and $17,400 |

| Nebraska | 2.46% to 6.84% | $3,340 and $32,210 |

| New Jersey | 1.4% to 10.75% | $20,000 and $1 million |

| New Mexico | 1.7% to 5.9% | $5,500 and $210,000 |

| New York | 4% to 10.9% | $8,500 and $25 million |

| North Dakota | 1.1% to 2.9% | $41,775 and $458,350 |

| Ohio | 0% to 3.99% | $25,000 and $110,650 |

| Oklahoma | 0.25% to 4.75% | $1,000 and $7,200 |

| Oregon | 4.75% to 9.9% | $3,750 and $125,000 |

| Rhode Island | 3.75% to 5.99% | $68,200 and $155,050 |

| South Carolina | 0% to 7% | $3,110 and $15,560 |

| Vermont | 3.35% to 8.75% | $42,150 and $213,150 |

| Virginia | 2% to 5.75% | $3,000 and $17,001 |

| Washington, D.C. | 4% to 9.75% | $10,000 and $1 million |

| West Virginia | 3% to 6.5% | $10,000 and $60,000 |

| Wisconsin | 3.54% to 7.65% | $12,760 and $280,950 |

To estimate your state income tax:

Look up your state income tax rate based on your gross pay and filing status.

Multiply your gross annual pay by the state tax rate.

For example, if you live in Pennsylvania which has a flat 3.07% tax rate, your estimated state tax would be:

$33,280 gross pay x 3.07% PA tax rate = $1,021.70 estimated state income tax

So with $33,280 gross annual income, you would owe around in $1,021.70 Pennsylvania state income tax. Verify your specific state’s income tax rates.

Factoring in Local Taxes

Some cities and counties levy local income taxes ranging from 1-3% of taxable income.

To estimate potential local taxes you may owe:

- Check if your city or county charges a local income tax.

- If yes, look up the local income tax rate.

- Multiply your gross annual pay by the local tax rate.

For example, say you live in Columbus, OH which has a 2.5% local income tax. Your estimated local tax would be:

$33,280 gross pay x 2.5% local tax rate = $832 estimated local tax

So with $33,280 in gross earnings, you may owe around $832 in Columbus local income taxes. Verify rates for your own city/county.

Accounting for FICA Taxes (Social Security & Medicare)

FICA taxes are a combination of Social Security and Medicare taxes that equal 15.3% of your earnings. You are responsible for half of the total bill (7.65%), which includes a 6.2% Social Security tax and 1.45% Medicare tax on your earnings.

In 2023, only the first $160,200 of your earnings are subject to the Social Security tax

There is an additional 0.9% surtax on top of the standard 1.45% Medicare tax for those who earn over $200,000 (single filers) or $250,000 (joint filers).

To estimate your FICA tax payment:

$33,280 x 6.2% + $33,280 x 1.45% = $2,545.92

So you can expect to pay about $2,545.92 in Social Security and Medicare taxes out of your gross $33,280 in earnings.

Total Estimated Tax Payments

Based on the examples above, your total estimated tax payments would be:

Federal tax: $3,773.60

State tax: $1,021.70

Local tax: $832

FICA tax: $2,545.92

Total Estimated Tax: $8,173.22

Calculating Your Take Home Pay

To calculate your annual take home pay at $16 /hour:

1. Take your gross pay

2. Subtract your estimated total tax payments

$33,280 gross pay – $8,173.22 Total Estimated Tax = $25,106.78 Your Take Home Pay

n summary, if you make $16 per hour and work full-time, you would take home around $25,106.78 per year after federal, state, local , FICA taxes.

Your actual net income may vary depending on your specific tax situation. But this gives you a general idea of what to expect.

Convert $16 Per Hour to Yearly, Monthly, Biweekly, and Weekly Salary After Taxes

If you make $16 an hour and work full-time (40 hours per week), your estimated yearly salary would be $33,280 .

The $33,280 per year salary does not account for taxes. Federal, state, and local taxes will reduce your take-home pay. The amount withheld depends on your location, filing status, dependents, and other factors.

Just now during our calculation of $16 An Hour Is How Much A Year After Taxes, we assumed the following conditions:

- You are single with $33,280 gross annual pay, your federal tax bracket is 12 %.

- You live in Pennsylvania which has a flat 3.07% tax rate

- You live in Columbus, OH which has a 2.5% local income tax.

In the end, we calculated your Total Estimated Tax is $8,173.22 , Your Take Home Pay is $25,106.78 , Total tax rate is 24.56%.

So next we’ll use 24.56% as the estimated tax rate to calculate your weekly, biweekly, and monthly after-tax income.

$16 Per Hour to Yearly, Monthly, Biweekly, Weekly,and Week Salary After Taxes Table

| Income before taxes | Estimated Tax Rate | Income Taxes | After Tax Income | |

| Yearly Salary | $33,280 | 24.56% | $8,173.22 | $25,106.78 |

| Monthly Salary | $2,773.33 | 24.56% | $681.10 | $2,092.23 |

| BiWeekly Salary | $1,280 | 24.56% | $314.35 | $965.65 |

| Weekly Salary | $640 | 24.56% | $157.18 | $482.82 |

$16 an hour is how much a year after taxes

Here is the adjusted yearly salary after a 24.56% tax reduction:

-

- Yearly salary before taxes: $33,280

- Estimated tax rate: 24.56%

- Taxes owed (24.56% * $33,280 )= $8,173.22

- Yearly salary after taxes: $25,106.78

| Hourly Wage | Hours Worked Per Week | Weeks Worked Per Year | Total Yearly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Yearly Salary |

|---|---|---|---|---|---|---|

| $16 | 40 | 52 | $33,280 | 24.56% | $8,173.22 | $25,106.78 |

$16 an hour is how much a month after taxes

To calculate the monthly salary based on an hourly wage, you first need the yearly salary amount. Then divide by 12 months.

-

-

- Yearly salary before taxes at $16 per hour: $33,280

- Divided by 12 months per year: $33,280 / 12 = $2,773.33 per month

-

The monthly salary based on a 40 hour work week at $16 per hour is $2,773.33 before taxes.

After applying the estimated 24.56% tax rate, the monthly after-tax salary would be:

-

- Monthly before-tax salary: $2,773.33

- Estimated tax rate: 24.56%

- Taxes owed (24.56% * $2,773.33 )= $681.10

- Monthly after-tax salary: $2,092.23

Monthly Salary Based on $16 Per Hour

| Hourly Wage | Yearly Salary | Months Per Year | Before-Tax Monthly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Monthly Salary |

|---|---|---|---|---|---|---|

| $16 | $33,280 | 12 | $2,773.33 | 24.56% | $681.10 | $2,092.23 |

$16 an hour is how much biweekly after taxes

Many people are paid biweekly, meaning every other week. To calculate the biweekly pay at $16 per hour:

- Hourly wage: $16

- Hours worked per week: 40

- Weeks per biweekly pay period: 2

- $16 * 40 hours * 2 weeks = $1,280 biweekly

Applying the 24.56%estimated tax rate:

- Biweekly before-tax salary: $1,280

- Estimated tax rate: 24.56%

- Taxes owed (24.56% * $1,280 )= $314.35

- Biweekly after-tax salary: $965.65

Biweekly Salary at $16 Per Hour

| Hourly Wage | Hours Worked Per Week | Weeks Per Pay Period | Before-Tax Biweekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Biweekly Salary |

|---|---|---|---|---|---|---|

| $16 | 40 | 2 | $1,280 | 24.56% | $314.35 | $965.65 |

$16 an hour is how much weekly after taxes

To find the weekly salary based on an hourly wage, you need to know the number of hours worked per week. At 40 hours per week, the calculation is:

- Hourly wage: $16

- Hours worked per week: 40

- $16 * 40 hours = $640 per week

Accounting for the estimated 24.56% tax rate:

- Weekly before-tax salary: $640

- Estimated tax rate: 24.56%

- Taxes owed (24.56% * $640 )= $157.18

- Weekly after-tax salary: $482.82

Weekly Salary at $16 Per Hour

| Hourly Wage | Hours Worked Per Week | Before-Tax Weekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Weekly Salary |

|---|---|---|---|---|---|

| $16 | 40 | $640 | 24.56% | $157.18 | $482.82 |

Key Takeaways

- An hourly wage of $16 per hour equals a yearly salary of $33,280 before taxes, assuming a 40 hour work week.

- After accounting for an estimated 24.56% tax rate, the yearly after-tax salary is approximately $25,106.78 .

- On a monthly basis before taxes, $16 per hour equals $2,773.33 per month. After estimated taxes, the monthly take-home pay is about $2,092.23 .

- The before-tax weekly salary at $16 per hour is $640 . After taxes, the weekly take-home pay is approximately $482.82 .

- For biweekly pay, the pre-tax salary at $16 per hour is $1,280 . After estimated taxes, the biweekly take-home pay is around $965.65 .

Understanding annual, monthly, weekly, and biweekly salary equivalents based on an hourly wage is useful when budgeting and financial planning. Taxes make a significant difference in take-home pay, so be sure to account for them when making income conversions. Use this guide as a reference when making salary calculations.

What Is the Average Hourly Wage in the US?

Last Updated: Sep 1 2023

US Average Hourly Earnings is at a current level of $33.82, up from 33.74 last month and up from 32.43 one year ago. This is a change of 0.24% from last month and 4.29% from one year ago.

Average Hourly Earnings is the average dollars that a private employee makes per hour in the US. This metric is a part of one of the most important releases every month which includes unemployment numbers as well. This is normally released on the first Friday of every month. This metric is released by the Bureau of Labor Statistics (BLS).

What is the average salary in the U.S.?

Last Updated: July 18, 2023

The U.S. Bureau of Labor Statistics uses median salary data rather than averages to avoid skewed numbers from outlying high and low numbers. Median weekly earnings of the nation's 121.5 million full-time wage and salary workers were $1,100 in the second quarter of 2023, the U.S.

If a person works 52 weeks in the year, then this represents a national annual salary of $57,200.

Is $16 an Hour a Good Salary?

Whether or not $16 an hour is considered a good salary depends largely on where you live and your overall household budget. In some rural parts of the country, this wage may allow you to live fairly comfortably. However, if you’re located in a major metropolitan area, this hourly rate makes it tough to make ends meet.

According to the MIT Living Wage Calculator, the minimum livable wage for a single adult with no children is $16.54 per hour. However, this livable wage amount varies significantly across different states and cities. For example, the living wage is $22.01/hour in New York City but just $13.34/hour in Puerto Rico.

So while $16 an hour reaches the minimum livable wage threshold, it doesn’t provide much wiggle room in higher cost-of-living areas. You’ll likely need to budget carefully and look for ways to supplement your income.

Jobs that Pay $16 An Hour

Certain entry-level jobs or jobs that require some specialized training but not a full college degree typically pay around $16 per hour. Some of the most common professions that offer $16/hour wages include:

- Administrative assistants – Scheduling, bookkeeping, word processing

- Medical assistants – Helping doctors with patient care, paperwork, medical procedures

- Bookkeepers – Recording financial transactions, preparing statements

- Preschool teachers – Educating and supervising young children

- Paralegals – Researching laws, preparing legal documents

- Phlebotomists – Drawing blood from patients and donors

- Emergency dispatchers – Receiving 911 calls and dispatching emergency responders

- Retail supervisors – Overseeing staff and operations in stores

- Line cooks – Preparing food in restaurants and institutional kitchens

The level of education and training required for these roles varies. However, many are accessible with just a high school diploma plus some vocational courses or on-the-job training. Overall, service sector and healthcare jobs represent many of the common positions paying around $16/hour.

Can You Live Off $16 An Hour?

While $16 an hour is doable in lower cost areas, it presents some clear budgeting challenges in pricier cities. Assuming you work 40 hours per week year-round at $16/hour, you would earn around $33,280 per year before taxes. After federal, state, and payroll tax deductions, your take-home pay is closer to $26,600.

While individuals’ living expenses vary greatly, here is an approximate monthly budget for someone earning $16/hour:

- Rent (studio apartment): $1,000

- Utilities: $150

- Groceries: $400

- Car payment + insurance: $450

- Gas: $120

- Cell phone: $75

- Internet/cable: $100

- Entertainment/miscellaneous: $250

Total: $2,545

Based on this budget, costs quickly add up and exceed monthly take-home income. Rent alone consumes nearly 50% of gross income at this wage level. And higher costs like an emergency medical expense or car repair could be crushing.

To live comfortably at $16/hour, you would likely need to save on housing by getting roommates or living farther from urban centers. Working a second job, earning side income, or relying on a partner’s earnings may be necessary in higher cost regions. Overall, $16 an hour is livable but requires mindful budgeting and spending optimization.

The Impact of Inflation on the Value of $16 An Hour

With inflation currently over 8%, the real value of a $16 hourly wage is decreasing each year. $16 an hour in 2023 has less purchasing power than just a couple years ago.

For example, if inflation averages 5% per year, in five years that $16 will only be worth around $13.78 in today’s dollars. And the actual goods and services you could purchase with it would decline by that amount. This steady decline in real wages makes it harder for $16/hour to cover expenses over time.

To maintain purchasing power, hourly wages must increase at the same general rate as inflation. If not, everyday costs like food, rent, and gas will consume a greater share of income. On fixed wages, standard of living slowly declines each year.

This emphasizes the importance of seeking out pay raises, higher paying jobs, side incomes, and labor unions to boost wages. Relying solely on $16/hour will leave you increasingly stretched thin due to inflationary forces.

5 Ways To Increase Your Hourly Wage

If you’re currently earning $16 or less per hour, here are some options to increase your income:

- Ask for a raise – If you’ve been at your job for awhile and have a positive track record, request a wage increase from your manager. Come armed with data on your contributions and current market rates for your role.

- Seek promotions – Taking on more responsibilities and moving up the ladder is key for larger salary bumps. Ask about promotion opportunities and training that can set you up for advancement.

- Change companies – Leaving for a new job offer tends to produce the biggest compensation gains. Polish your resume and interview skills and benchmark pay at other employers.

- Gain new skills – Taking classes, online training courses, workshops, or seminars can all expand your skillset. Learn in-demand abilities that translate to higher pay.

- Start a side hustle – Driving for a rideshare app, tutoring, deliveries, or monetizing a hobby on weekends is a straightforward way to supplement $16/hour.

Prioritizing professional development and seeking higher incomes categories are key to moving beyond $16/hour. With time and effort, you can progressively work your way toward higher rates of pay.

Buying a Car on $16 An Hour

Is buying a car realistic if you earn $16 an hour? With careful planning, it may be possible depending on the vehicle. The first step is to understand how much you can reasonably afford to spend.

As a general rule, your total car costs – including the loan payment, insurance, gas and maintenance – should be less than 10-15% of your gross monthly income. At $16 an hour or ~$2,660 per month, that means keeping total car costs under $266-$400 per month.

For a used vehicle with a 5-year loan term and strong credit (5% APR), this means you can likely afford a car valued around $10,000- $15,000. You’ll want to target private party/Craigslist sales or low-priced dealers to find cars in this budget range.

When shopping, look for makes and models with reputations for value retention and reliability, like Toyota Corollas and Civics. Avoid high-cost repairs by getting a pre-purchase inspection and reviewing vehicle history reports. And keep insurance costs down with a high deductible policy.

While buying new or financing expensive cars is unrealistic on $16/hour, a quality used vehicle is obtainable with smart budgeting. Just be sure to factor in all ownership costs before committing to a purchase.

Can You Buy a House on $16 An Hour?

Owning a home on a $16 hourly wage is challenging but potentially feasible depending on your location. The primary hurdle is saving up enough for a down payment while making monthly mortgage payments affordable.

On a single $16/hour income, purchasing a median priced U.S. home at around $355,000 is likely out of reach. However, buying a lower cost home in your area may be possible. Different factors to consider include:

- Minimum down payment – You’ll typically need at least 3-5% down. At 5%, that’s $17,750 for a $355,000 home. On $16/hour, saving this much takes disciplined budgeting.

- Monthly mortgage – To keep payments under 30% of your monthly income, you can afford roughly $800 per month on a mortgage. This covers a home valued around $150,000.

- Location – Consider lower-priced markets and less urban areas where home prices are below national levels. Expand your search radius.

- Assistance programs – First time buyer grants, USDA loans, and down payment assistance programs can help ease budget constraints.

- Preparation – Before buying, pay off other debts and build your credit score to secure better mortgage rates.

While difficult, home ownership is possible on this salary if expectations align with budget realities. Partnering with a co-buyer can also help make a low priced home accessible. Overall, thoughtful preparation is key.

Example Budget For $16 Per Hour

To summarize, here is an example monthly budget for someone earning $16 per hour while working full-time:

Monthly Take Home Pay: $2,660

- Rent: $800 (studio or shared apartment)

- Utilities: $150

- Car Payment: $200

- Car Insurance: $100

- Gas: $120

- Groceries: $250

- Phone: $75

- Internet: $50

- Health Insurance: $150

- Entertainment: $100

- Dining Out: $50

- Clothing: $50

- To Savings: $200

Total Spent: $2,295

This allows for a moderate savings contribution while covering essentials. Discretionary spending is kept to a minimum. With this type of careful budget, $16 an hour may support a single person if housing costs are low. Those supporting families or living in high expense areas will struggle.

In Summary

While $16 an hour reaches the minimum “livable wage” level, it provides a tight budget in many areas due to rising costs. Carefully monitoring spending and cutting discretionary costs is crucial. Some supplementary income sources may be needed to live comfortably.

This hourly rate allows for basic needs but little financial flexibility. Seeking out promotions, developing new skills, or changing employers can be pathways to move beyond $16/hour. With proper planning, home ownership and used vehicle purchases are achievable long-term goals, even on this modest salary.