Knowing your potential annual earnings from an hourly wage is essential for financial planning. In this article, we’ll break down the yearly salary for $15 per hour based on standard full-time and part-time schedules.

We’ll calculate the total pre-tax annual income that can be earned from $15/hour. We’ll also look at how overtime pay can boost yearly earnings. Since unpaid time off is common, we’ll factor in how it reduces actual annual pay at this rate.

In addition, we’ll determine the after-tax salary you can expect to take home from $15/hour after deductions. Understanding your net income is key for budgeting.

We’ll also evaluate whether $15/hour provides a livable wage in different areas of the country. With high inflation lately, we’ll discuss ways to increase earnings beyond $15/hour.

Knowing exactly how much you can potentially earn per year from $15 an hour is vital knowledge for your finances. Let’s explore this important question in detail.

Table of Contents

Convert $15 Per Hour to Weekly, Monthly, and Yearly Salary

Input your wage and hours per week to see how much you’ll make monthly, yearly and more.

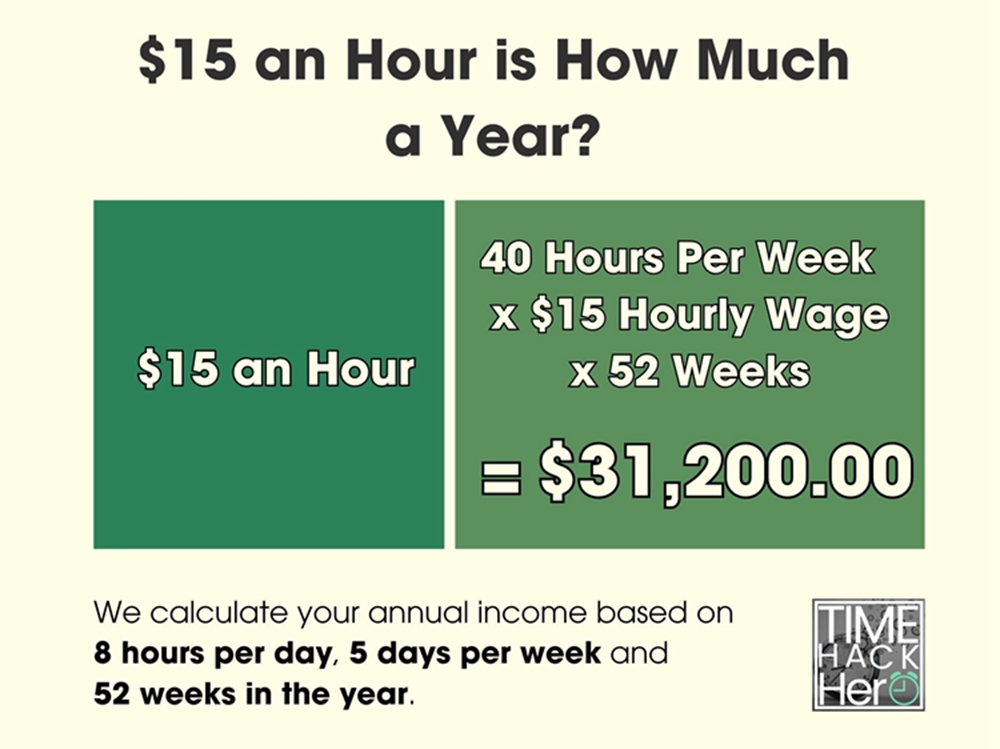

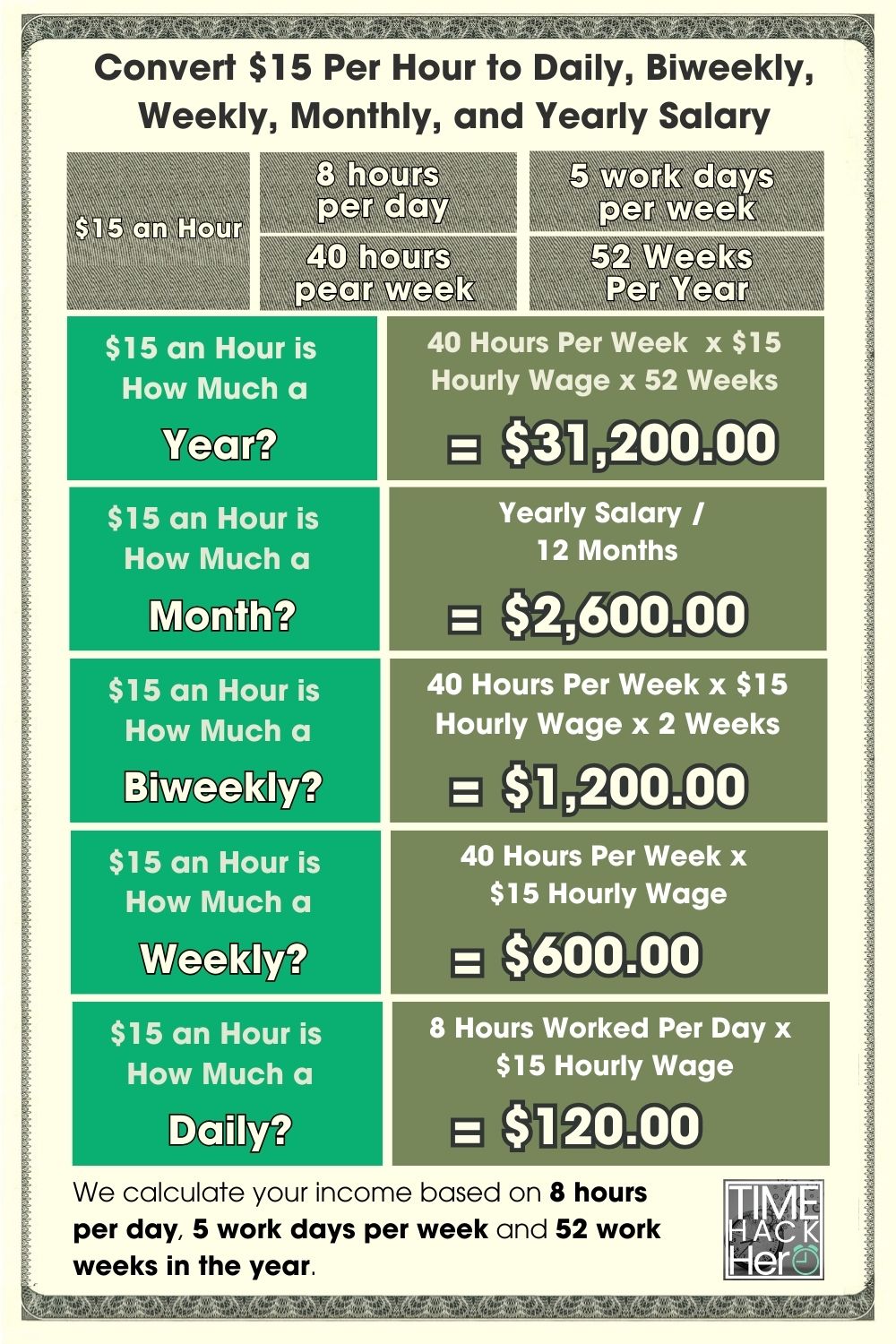

$15 an Hour is How Much a Year?

If you make $15 an hour, your yearly salary would be $31,200. We calculate your annual income based on 8 hours per day, 5 days per week and 52 weeks in the year.

Hours worked per week (40) x Hourly wage($15) x Weeks worked per year(52) = $31,200

$15 an Hour is How Much a Month?

If you make $15 an hour, your monthly salary would be $2,600. We calculated this number by dividing your annual income by 12 months.

Hours worked per week (40) x Hourly wage($15) x Weeks worked per year(52) / Months per Year(12) = $2,600

$15 an Hour is How Much a Biweekly?

If you make $15 an hour, your biweekly salary would be $1,200.

Hours worked per week (40) x Hourly wage($15) x 2 = $1,200

$15 an Hour is How Much a Week?

If you make $15 an hour, your weekly salary would be $600. Calculating based on 5 days per week and 8 hours each day.

Hours worked per week (40) x Hourly wage($15) = $600

$15 an Hour is How Much a Day?

If you make $15 an hour, your daily salary would be $120. We calculated your daily income based on 8 hours per day.

Hours worked per day (8) x Hourly wage($15) = $120

$15 an Hour is How Much a Year?

The basic formula to calculate your annual salary from an hourly wage is:

Hourly Rate x Hours Worked per Week x Number of Weeks Worked per Year = Annual Salary

So for a $20 per hour job:

$15 per hour x 40 hours per week x 52 weeks per year = $31,200

However, this simple calculation makes some assumptions:

- You will work 40 hours every week of the year

- You will not get any paid time off

Therefore, it represents your earnings if you worked every week of the year, without any vacation, holidays, or sick days.

Accounting for Paid Time Off

The $31,200 base salary does not yet factor in paid time off (PTO). Let’s assume the job provides:

- 2 weeks (10 days) paid vacation

- 6 paid holidays

- 3 paid sick days

This totals 19 paid days off, or nearly 4 weeks of PTO.

Importantly, this paid time off should not be deducted from the annual salary, since you still get paid for those days.

So with 4 weeks PTO, the annual salary would remain $31,200 .

Part time $15 an hour is How Much a Year?

Your annual income changes significantly if you work part-time and not full-time.

For example, let’s say you work 30 hours per week instead of 40. Here’s how you calculate your new yearly total:

$15 per hour x 30 hours per week x 52 weeks per year = $23,400

By working 10 fewer hours per week (30 instead of 40), your annual earnings at $15 an hour drop from $31,200 to $23,400.

That’s a $7,800 per year difference just by working part-time!

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $15 an hour:

| Hours Per Week | Earnings Per Week | Annual Earnings |

|---|---|---|

| 40 | $600 | $31,200 |

| 35 | $525 | $27,300 |

| 30 | $450 | $23,400 |

| 25 | $375 | $19,500 |

| 20 | $300 | $15,600 |

| 15 | $225 | $11,700 |

The more hours per week, the higher your total yearly earnings. But part-time work allows for more life balance if you don’t need the full salary.

$15 an Hour With Overtime is How Much a Year?

Now let’s look at how overtime can increase your annual earnings.

Overtime kicks in once you work more than 40 hours in a week. Typically, you earn 1.5x your regular hourly wage for overtime hours.

So if you make $15 per hour normally, you would make $22.50 per hour for any hours over 40 in a week.

Here’s an example:

- You work 45 hours in a Week

- 40 regular hours paid at $15 per hour = $600

- 5 overtime hours paid at $22.50 per hour = $112.50

- Your total one Week earnings =$600 + $112.50 = $712.50

If you worked 45 hours each week for 52 weeks, here’s how your annual earnings increase thanks to overtime pay:

$712.50 per week x 52 weeks per year = $37,050

That’s $5,850 more than you’d earn working just 40 hours per week at $15 an hour.

Overtime can add up! But also consider taxes and work-life balance when deciding on extra hours.

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $15 an hour:

| Overtime hours per work day | Hours Per Week | Earnings Per Week | Annual Earnings |

| 0 | 40 | $600 | $31,200 |

| 1 | 45 | $712.50 | $37,050 |

| 2 | 50 | $825 | $42,900 |

| 3 | 55 | $937.50 | $48,750 |

| 4 | 60 | $1,050 | $54,600 |

| 5 | 65 | $1,162.50 | $60,450 |

| 6 | 70 | $1,275 | $66,300 |

| 7 | 75 | $1,387.50 | $72,150 |

How Unpaid Time Off Impacts $15/Hour Yearly Earnings

So far we’ve assumed you work 52 paid weeks per year. Any unpaid time off will reduce your total income.

For example, let’s say you take 2 weeks of unpaid leave. That brings your paid weeks down to 50:

Hours worked per week (40) x Hourly wage($15) x Weeks worked per year(50) = $30,000 annual salary

With 2 weeks unpaid time off, your annual earnings at $15/hour would drop by $1,200.

The table below summarizes how your annual income changes depending on the number of weeks of unpaid leave.

| Weeks of unpaid leave | Paid weeks per year | Earnings Per Week | Annual Earnings |

| 0 | 52 | $600 | $31,200 |

| 1 | 51 | $600 | $30,600 |

| 2 | 50 | $600 | $30,000 |

| 3 | 49 | $600 | $29,400 |

| 4 | 48 | $600 | $28,800 |

| 5 | 47 | $600 | $28,200 |

| 6 | 46 | $600 | $27,600 |

| 7 | 45 | $600 | $27,000 |

Key Takeaways for $15 Hourly Wage

In summary, here are some key points on annual earnings when making $15 per hour:

- At 40 hours per week, you’ll earn $31,200 per year.

- Part-time of 30 hours/week results in $23,400 annual salary.

- Overtime pay can boost yearly earnings, e.g. $5,850 extra at 45 hours/week.

- Unpaid time off reduces your total income, around $1,200 less per 2 weeks off.

- Your specific situation and location impacts taxes and PTO.

Knowing your approximate annual salary and factors impacting it makes it easier to budget and plan your finances. The next step is calculating take-home pay after deductions like taxes.

$15 An Hour Is How Much A Year After Taxes

Figuring out your actual annual earnings based on an hourly wage can be complicated once taxes are taken into account. In addition to federal, state, and local income taxes, 7.65% of your gross pay also goes to Social Security and Medicare through FICA payroll taxes. So how much does $15 an hour equal per year after FICA and income taxes are deducted from your gross pay?

Below we’ll walk through the steps to calculate your annual net take home pay if you make $15 per hour. This will factor in estimated federal, FICA, state, and local taxes so you know exactly what to expect.

Factoring in Federal Income Tax

Your federal income tax will be a big chunk out of your gross pay. Federal tax rates range from 10% to 37%, depending on your tax bracket.

To estimate your federal income tax rate and liability:

Look up your federal income tax bracket based on your gross pay.

2023 tax brackets: single filers

| Tax rate | Taxable income bracket | Tax owed |

|---|---|---|

| 10% | $0 to $11,000. | 10% of taxable income. |

| 12% | $11,001 to $44,725. | $1,100 plus 12% of the amount over $11,000. |

| 22% | $44,726 to $95,375. | $5,147 plus 22% of the amount over $44,725. |

| 24% | $95,376 to $182,100. | $16,290 plus 24% of the amount over $95,375. |

| 32% | $182,101 to $231,250. | $37,104 plus 32% of the amount over $182,100. |

| 35% | $231,251 to $578,125. | $52,832 plus 35% of the amount over $231,250. |

| 37% | $578,126 or more. | $174,238.25 plus 37% of the amount over $578,125. |

For example, if you are single with $31,200 gross annual pay, your federal tax bracket is 12%.

Your estimated federal tax would be:

$1,100 + ($31,200 – $11,000) x 12% = $3,524

So at $15/hour with $31,200 gross pay, you would owe about $3,524 in federal income taxes.

Considering State Income Tax

In addition to federal tax, most states also charge a state income tax. State income tax rates range from about 1% to 13%, with most falling between 4% and 6%.

Key Takeaways

-

- California, Hawaii, New York, New Jersey, and Oregon have some of the highest state income tax rates.

- Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming don’t impose an income tax at all.

- Another 10 U.S states have a flat tax rate—everyone pays the same percentage regardless of how much they earn.

A State-by-State Comparison of Income Tax Rates

| STATE | TAX RATES | LOWEST AND HIGHEST INCOME BRACKETS |

|---|---|---|

| Alaska | 0% | None |

| Florida | 0% | None |

| Nevada | 0% | None |

| South Dakota | 0% | None |

| Tennessee | 0% | None |

| Texas | 0% | None |

| Washington | 0% | None |

| Wyoming | 0% | None |

| Colorado | 4.55% | Flat rate applies to all incomes |

| Illinois | 4.95% | Flat rate applies to all incomes |

| Indiana | 3.23% | Flat rate applies to all incomes |

| Kentucky | 5% | Flat rate applies to all incomes |

| Massachusetts | 5% | Flat rate applies to all incomes |

| New Hampshire | 5% | Flat rate on interest and dividend income only |

| North Carolina | 4.99% | Flat rate applies to all incomes |

| Pennsylvania | 3.07% | Flat rate applies to all incomes |

| Utah | 4.95% | Flat rate applies to all incomes |

| Michigan | 4.25% | Flat rate applies to all incomes |

| Arizona | 2.59% to 4.5% | $27,806 and $166,843 |

| Arkansas | 2% to 5.5% | $4,300 and $8,501 |

| California | 1% to 13.3% | $9,325 and $1 million |

| Connecticut | 3% to 6.99% | $10,000 and $500,000 |

| Delaware | 0% to 6.6% | $2,000 and $60,001 |

| Alabama | 2% to 5% | $500 and $3,001 |

| Georgia | 1% to 5.75% | $750 and $7,001 |

| Hawaii | 1.4% to 11% | $2,400 and $200,000 |

| Idaho | 1.125% to 6.5% | $1,568 and $7,939 |

| Iowa | 0.33% to 8.53% | $1,743 and $78,435 |

| Kansas | 3.1% to 5.7% | $15,000 and $30,000 |

| Louisiana | 1.85% to 4.25% | $12,500 and $50,001 |

| Maine | 5.8% to 7.15% | $23,000 and $54,450 |

| Maryland | 2% to 5.75% | $1,000 and $250,000 |

| Minnesota | 5.35% to 9.85% | $28,080 and $171,221 |

| Mississippi | 0% to 5% | $5,000 and $10,001 |

| Missouri | 1.5% to 5.3% | $1,121 and $8,968 |

| Montana | 1% to 6.75% | $2,900and $17,400 |

| Nebraska | 2.46% to 6.84% | $3,340 and $32,210 |

| New Jersey | 1.4% to 10.75% | $20,000 and $1 million |

| New Mexico | 1.7% to 5.9% | $5,500 and $210,000 |

| New York | 4% to 10.9% | $8,500 and $25 million |

| North Dakota | 1.1% to 2.9% | $41,775 and $458,350 |

| Ohio | 0% to 3.99% | $25,000 and $110,650 |

| Oklahoma | 0.25% to 4.75% | $1,000 and $7,200 |

| Oregon | 4.75% to 9.9% | $3,750 and $125,000 |

| Rhode Island | 3.75% to 5.99% | $68,200 and $155,050 |

| South Carolina | 0% to 7% | $3,110 and $15,560 |

| Vermont | 3.35% to 8.75% | $42,150 and $213,150 |

| Virginia | 2% to 5.75% | $3,000 and $17,001 |

| Washington, D.C. | 4% to 9.75% | $10,000 and $1 million |

| West Virginia | 3% to 6.5% | $10,000 and $60,000 |

| Wisconsin | 3.54% to 7.65% | $12,760 and $280,950 |

To estimate your state income tax:

Look up your state income tax rate based on your gross pay and filing status.

Multiply your gross annual pay by the state tax rate.

For example, if you live in Pennsylvania which has a flat 3.07% tax rate, your estimated state tax would be:

$31,200 gross pay x 3.07% PA tax rate = $957.84 estimated state income tax

So with $31,200 gross annual income, you would owe around in $957.84 Pennsylvania state income tax. Verify your specific state’s income tax rates.

Factoring in Local Taxes

Some cities and counties levy local income taxes ranging from 1-3% of taxable income.

To estimate potential local taxes you may owe:

- Check if your city or county charges a local income tax.

- If yes, look up the local income tax rate.

- Multiply your gross annual pay by the local tax rate.

For example, say you live in Columbus, OH which has a 2.5% local income tax. Your estimated local tax would be:

$31,200 gross pay x 2.5% local tax rate = $780 estimated local tax

So with $31,200 in gross earnings, you may owe around $780 in Columbus local income taxes. Verify rates for your own city/county.

Accounting for FICA Taxes (Social Security & Medicare)

FICA taxes are a combination of Social Security and Medicare taxes that equal 15.3% of your earnings. You are responsible for half of the total bill (7.65%), which includes a 6.2% Social Security tax and 1.45% Medicare tax on your earnings.

In 2023, only the first $160,200 of your earnings are subject to the Social Security tax

There is an additional 0.9% surtax on top of the standard 1.45% Medicare tax for those who earn over $200,000 (single filers) or $250,000 (joint filers).

To estimate your FICA tax payment:

$31,200 x 6.2% + $31,200 x 1.45% = $2,386.80

So you can expect to pay about $2,386.80 in Social Security and Medicare taxes out of your gross $31,200 in earnings.

Total Estimated Tax Payments

Based on the examples above, your total estimated tax payments would be:

Federal tax: $3,524

State tax: $957.84

Local tax: $780

FICA tax: $2,386.80

Total Estimated Tax: $7,648.64

Calculating Your Take Home Pay

To calculate your annual take home pay at $15 /hour:

1. Take your gross pay

2. Subtract your estimated total tax payments

$31,200 gross pay – $7,648.64 Total Estimated Tax = $23,551.36 Your Take Home Pay

n summary, if you make $15 per hour and work full-time, you would take home around $23,551.36 per year after federal, state, local , FICA taxes.

Your actual net income may vary depending on your specific tax situation. But this gives you a general idea of what to expect.

Convert $15 Per Hour to Yearly, Monthly, Biweekly, and Weekly Salary After Taxes

If you make $15 an hour and work full-time (40 hours per week), your estimated yearly salary would be $31,200 .

The $31,200 per year salary does not account for taxes. Federal, state, and local taxes will reduce your take-home pay. The amount withheld depends on your location, filing status, dependents, and other factors.

Just now during our calculation of $15 An Hour Is How Much A Year After Taxes, we assumed the following conditions:

- You are single with $31,200 gross annual pay, your federal tax bracket is 12 %.

- You live in Pennsylvania which has a flat 3.07% tax rate

- You live in Columbus, OH which has a 2.5% local income tax.

In the end, we calculated your Total Estimated Tax is $7,648.64 , Your Take Home Pay is $23,551.36 , Total tax rate is 24.51%.

So next we’ll use 24.51% as the estimated tax rate to calculate your weekly, biweekly, and monthly after-tax income.

$15 Per Hour to Yearly, Monthly, Biweekly, Weekly,and Week Salary After Taxes Table

| Income before taxes | Estimated Tax Rate | Income Taxes | After Tax Income | |

| Yearly Salary | $31,200 | 24.51% | $7,648.64 | $23,551.36 |

| Monthly Salary | $2,600 | 24.51% | $637.39 | $1,962.61 |

| BiWeekly Salary | $1,200 | 24.51% | $294.18 | $905.82 |

| Weekly Salary | $600 | 24.51% | $147.09 | $452.91 |

$15 an hour is how much a year after taxes

Here is the adjusted yearly salary after a 24.51% tax reduction:

-

- Yearly salary before taxes: $31,200

- Estimated tax rate: 24.51%

- Taxes owed (24.51% * $31,200 )= $7,648.64

- Yearly salary after taxes: $23,551.36

| Hourly Wage | Hours Worked Per Week | Weeks Worked Per Year | Total Yearly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Yearly Salary |

|---|---|---|---|---|---|---|

| $15 | 40 | 52 | $31,200 | 24.51% | $7,648.64 | $23,551.36 |

$15 an hour is how much a month after taxes

To calculate the monthly salary based on an hourly wage, you first need the yearly salary amount. Then divide by 12 months.

-

-

- Yearly salary before taxes at $15 per hour: $31,200

- Divided by 12 months per year: $31,200 / 12 = $2,600 per month

-

The monthly salary based on a 40 hour work week at $15 per hour is $2,600 before taxes.

After applying the estimated 24.51% tax rate, the monthly after-tax salary would be:

-

- Monthly before-tax salary: $2,600

- Estimated tax rate: 24.51%

- Taxes owed (24.51% * $2,600 )= $637.39

- Monthly after-tax salary: $1,962.61

Monthly Salary Based on $15 Per Hour

| Hourly Wage | Yearly Salary | Months Per Year | Before-Tax Monthly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Monthly Salary |

|---|---|---|---|---|---|---|

| $15 | $31,200 | 12 | $2,600 | 24.51% | $637.39 | $1,962.61 |

$15 an hour is how much biweekly after taxes

Many people are paid biweekly, meaning every other week. To calculate the biweekly pay at $15 per hour:

- Hourly wage: $15

- Hours worked per week: 40

- Weeks per biweekly pay period: 2

- $15 * 40 hours * 2 weeks = $1,200 biweekly

Applying the 24.51%estimated tax rate:

- Biweekly before-tax salary: $1,200

- Estimated tax rate: 24.51%

- Taxes owed (24.51% * $1,200 )= $294.18

- Biweekly after-tax salary: $905.82

Biweekly Salary at $15 Per Hour

| Hourly Wage | Hours Worked Per Week | Weeks Per Pay Period | Before-Tax Biweekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Biweekly Salary |

|---|---|---|---|---|---|---|

| $15 | 40 | 2 | $1,200 | 24.51% | $294.18 | $905.82 |

$15 an hour is how much weekly after taxes

To find the weekly salary based on an hourly wage, you need to know the number of hours worked per week. At 40 hours per week, the calculation is:

- Hourly wage: $15

- Hours worked per week: 40

- $15 * 40 hours = $600 per week

Accounting for the estimated 24.51% tax rate:

- Weekly before-tax salary: $600

- Estimated tax rate: 24.51%

- Taxes owed (24.51% * $600 )= $147.09

- Weekly after-tax salary: $452.91

Weekly Salary at $15 Per Hour

| Hourly Wage | Hours Worked Per Week | Before-Tax Weekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Weekly Salary |

|---|---|---|---|---|---|

| $15 | 40 | $600 | 24.51% | $147.09 | $452.91 |

Key Takeaways

- An hourly wage of $15 per hour equals a yearly salary of $31,200 before taxes, assuming a 40 hour work week.

- After accounting for an estimated 24.51% tax rate, the yearly after-tax salary is approximately $23,551.36 .

- On a monthly basis before taxes, $15 per hour equals $2,600 per month. After estimated taxes, the monthly take-home pay is about $1,962.61 .

- The before-tax weekly salary at $15 per hour is $600 . After taxes, the weekly take-home pay is approximately $452.91 .

- For biweekly pay, the pre-tax salary at $15 per hour is $1,200 . After estimated taxes, the biweekly take-home pay is around $905.82 .

Understanding annual, monthly, weekly, and biweekly salary equivalents based on an hourly wage is useful when budgeting and financial planning. Taxes make a significant difference in take-home pay, so be sure to account for them when making income conversions. Use this guide as a reference when making salary calculations.

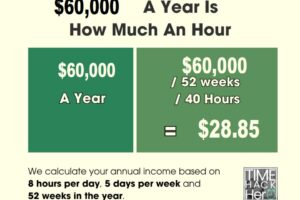

What Is the Average Hourly Wage in the US?

Last Updated: Sep 1 2023

US Average Hourly Earnings is at a current level of $33.82, up from 33.74 last month and up from 32.43 one year ago. This is a change of 0.24% from last month and 4.29% from one year ago.

Average Hourly Earnings is the average dollars that a private employee makes per hour in the US. This metric is a part of one of the most important releases every month which includes unemployment numbers as well. This is normally released on the first Friday of every month. This metric is released by the Bureau of Labor Statistics (BLS).

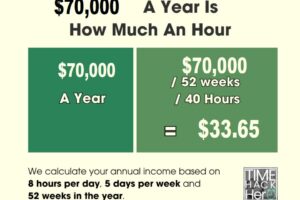

What is the average salary in the U.S.?

Last Updated: July 18, 2023

The U.S. Bureau of Labor Statistics uses median salary data rather than averages to avoid skewed numbers from outlying high and low numbers. Median weekly earnings of the nation's 121.5 million full-time wage and salary workers were $1,100 in the second quarter of 2023, the U.S.

If a person works 52 weeks in the year, then this represents a national annual salary of $57,200.

Is $15 an Hour a Good Salary?

Whether or not $15 per hour is considered a “good” wage depends heavily on where you live, household size, and lifestyle expectations.

For a single individual without children living in a small town or rural area, $15 an hour can potentially provide a basic but decent quality of life. However, for expensive coastal cities like Los Angeles, New York, Seattle, Miami, and others, it would be extremely difficult for one person to live comfortably on $15 an hour.

Let’s examine some data from the MIT Living Wage Calculator:

- New York City: $21.24 per hour

- Chicago: $15.69 per hour

- Houston: $15.93 per hour

- Sioux Falls, SD: $12.07 per hour

- Augusta, GA: $12.07 per hour

In lower cost areas of the country, $15 per hour meets or comes close to living wage estimates. But for larger metropolitan areas, it falls well below the minimum comfortable standard, especially for households with 2 or more members.

For families with children, a sole earner making $15 an hour would find it nearly impossible to provide for all expenses without relying heavily on government assistance programs. As household size grows, the challenges multiply quickly.

Jobs that pay $15 an hour

There are a range of entry-level and low-skill occupations that typically pay around $15 per hour:

- Retail associates – Assist customers, process transactions, stock shelves, and perform other duties in retail stores. Many employers provide on-the-job training.

- Food service workers – Prepare and serve food, clean facilities, and perform other basic tasks in restaurants and dining establishments.

- Home health aides – Provide routine healthcare and daily assistance to elderly, disabled, or chronically ill persons in their homes. Typically require a high school diploma and brief training program.

- Landscaping & groundskeeping – Perform a variety of tasks such as mowing, trimming, planting, watering to maintain parks, golf courses, gardens, and other grounds. Usually require no formal education.

- Call center representatives – Interact with customers by phone, email, or online chat to address inquiries, complaints, provide support, and process transactions. Most employers provide short-term on-site training.

- Teacher assistants – Provide classroom and instructional assistance to lead teachers in K-12 school settings. Typically need some college coursework but no bachelor’s degree.

- Security guards – Protect property, assets, and individuals by monitoring premises and controlling access points. Generally require a high school diploma or GED.

These examples demonstrate the array of basic entry-level jobs across fields like retail, food service, administrative work, and assisted living that pay $15 or slightly above per hour. Formal education requirements are minimal.

Can You Live Off $15 An Hour?

Whether it’s possible to live comfortably on $15 an hour largely depends on where you reside and your overall budget and lifestyle. For single adults without children in areas with low living costs, it is certainly achievable to live on this salary. However, those supporting families or living in major metropolitan areas would struggle without relying on government assistance programs or supplemental income sources.

To determine if $15/hour meets your needs, start by breaking down monthly expenses:

- Housing costs (rent/mortgage, utilities, taxes, insurance)

- Transportation (car payment, insurance, gas, maintenance)

- Food

- Medical (health insurance premiums, prescriptions, co-pays)

- Debt payments

- Basic necessities (clothing, phone bill, hygiene items)

- Leisure & entertainment

Experts recommend allocating a maximum of 30% of pretax income to housing. At $15/hour or $2,600 per month, that’s $780 for housing. While finding rent at or below that level may be possible depending on location, owning a home would be extremely difficult.

Overall, strict budgeting, minimizing any non-essential costs, having roommates, and avoiding high housing costs is critical to living on $15 an hour. Relying on government subsidies, charity, and cost assistance programs could become necessary depending on circumstances.

The impact of inflation on the value of $15 an hour

With inflation reaching its highest level in 40 years, the real value and purchasing power of $15 an hour has plummeted substantially. While nominal minimum wage rates have increased slightly in recent years, they have not kept pace with inflation.

In 2021, $15 per hour provided an annual income of around $31,200. But with inflation now over 8% annually, real wages have declined dramatically when accounting for huge rises in the cost of living. From food and fuel to housing, healthcare, and other basics, expenses have skyrocketed.

This means workers are able to purchase far fewer goods and services with their earnings compared to previous years. Unless wages start rising faster than inflation, this decline in real incomes will persist and economic hardship will deepen – especially for lower income households.

For those earning $15 an hour or similar wages, maintaining even a basic standard of living has become extremely difficult in the face of heightened inflation. Supplemental income sources are increasingly vital.

5 Ways To Increase Your Hourly Wage

If you currently earn around $15 per hour but are struggling to get by, here are some options to boost your income:

- Ask for a raise – If you’ve been in your job awhile and have a good record, request a wage increase to keep pace with living costs. Prepare a persuasive case.

- Find a higher paying job – Browse job boards and sites like Indeed and Glassdoor to find openings that pay more for your skill level. Update your resume.

- Develop new skills – Take classes or training to gain skills that qualify you for better-paying roles. A credential or certification can expand opportunities.

- Work overtime – Take on extra shifts or hours above your normal schedule when possible to earn more.

- Start a side business – Offer services like on-demand delivery, virtual assistance, housecleaning, etc. to generate supplemental income.

- Adjust tax withholding – Claim fewer allowances to reduce tax withholding and increase your regular take-home pay. (But avoid penalties!)

Exploring every avenue to boost income is crucial when living on $15 an hour. Combining several strategies above can help create a path to greater financial stability.

Buying a car on $15 an hour

Reliable transportation is essential for most working adults. But cars come with a hefty price tag. Is buying a car realistic if you earn $15 an hour?

The short answer – it’s very difficult unless you pay a large portion of the cost upfront or receive family assistance. The average monthly car payment now exceeds $600. For someone earning $15 an hour or ~$2,600 per month before taxes, a $600 car payment equates to over 23% of pretax income – far above recommended limits.

That said, here are some tips for making car ownership POSSIBLE on a $15/hour budget:

- Pay a large down payment – Putting 30-50% down substantially reduces the financed amount so you have a lower monthly payment. Save aggressively.

- Buy used – Opt for an older used vehicle with lower sticker price. Search private sellers for the best deals.

- Secure a co-signer – Having a co-signer with good credit helps qualify and lowers payments.

- Extend your loan term – Choosing a 72-month or longer term drops the monthly payment but increases total interest paid.

- Find a fuel efficient model – Prioritize vehicles with great gas mileage to minimize this ownership cost. Avoid gas guzzlers.

- Get quotes from multiple insurers – Compare rates across companies. Ask about discounts available for your situation.

Owning a vehicle on $15 an hour requires sacrifice, discipline, and likely help from family or friends. But with the right planning, it can be possible on a tight budget.

Can You Buy a House on $15 An Hour?

On an hourly income of $15, owning a home is highly unrealistic in most housing markets. Some key factors demonstrating why home ownership is exceptionally difficult at this wage level:

- Required downpayments of 10-20% are difficult to accumulate when living paycheck to paycheck. Saving $10,000+ takes years on this income.

- Monthly mortgage payments, insurance, taxes, and homeowner fees would consume 50% or more of take-home pay.

- Unexpected maintenance and repair costs become financial emergencies. Budgeting for surprise expenses isn’t feasible.

- It’s near impossible to qualify for a mortgage. Lenders look for stable employment history, good credit, and debt-to-income ratios no higher than 36%.

The bottom line – buying a house solely on a $15 per hour income simply isn’t plausible for most people without substantial and ongoing family assistance. Renting is the only realistic housing option.

That said, home ownership could be possible WAY down the road through strict saving over many years, advancement to higher income roles, prudent financial choices, and partnership with a dual income spouse or partner. But achieving home ownership directly from $15 an hour wages isn’t feasible.

Example Budget For $15 Per Hour

To illustrate the reality of living on $15 an hour, let’s look at an example monthly budget:

Income

- Monthly Take Home Pay (after taxes): $1,968

Housing

- Rent (with roommate): $600

- Utilities: $150

Transportation

- Used Car Payment: $250

- Insurance: $100

- Gas: $80

Food & Essentials

- Groceries: $240

- Cell Phone: $40

- Miscellaneous: $75

Healthcare

- Insurance Premium: $50

- Prescriptions: $25

- Doctor Co-Pays: $20

Remaining

- $338 left per month

This tight budget shows that covering just the bare essentials is difficult on $15 an hour, even with a roommate in a low cost region. Saving money is near impossible and any surprise expenses result in falling behind on bills. Supplemental assistance and income may be required for sustainability.

In Summary

For single adults with no children living in areas with a very low cost of living, $15 an hour can potentially provide a subsistence lifestyle, but leaves little room for error or financial surprises. However, those supporting families or residing in medium to high cost areas will find it incredibly difficult to make ends meet solely on this wage.

Strict budgeting, assistance programs, and supplemental income sources become essential. But the significant erosion of purchasing power caused by high inflation makes getting by on $15 an hour more untenable than ever. Without wages rising commensurate with living costs, economic hardship deepens for lower income households.