With rising inflation, an hourly wage of $12 leaves many wondering if it’s possible to earn a livable income. This article will break down exactly how much annual pay you can expect at $12 per hour based on full-time and part-time schedules. We will calculate gross yearly income and net salary after taxes. You’ll also learn how unpaid time off impacts actual yearly earnings, and whether $12 per hour provides enough to live on. If you currently earn $12 hourly or hope to someday, read on to see the annual, monthly, biweekly, and weekly pay $12 per hour equals before and after taxes. We will examine jobs paying $12 per hour, look at inflation’s impact, provide tips to increase income, and evaluate sample budgets to determine if home or car ownership is feasible. The goal is to give you a complete financial picture of what $12 an hour truly means.

Table of Contents

Convert $12 Per Hour to Weekly, Monthly, and Yearly Salary

Input your wage and hours per week to see how much you’ll make monthly, yearly and more.

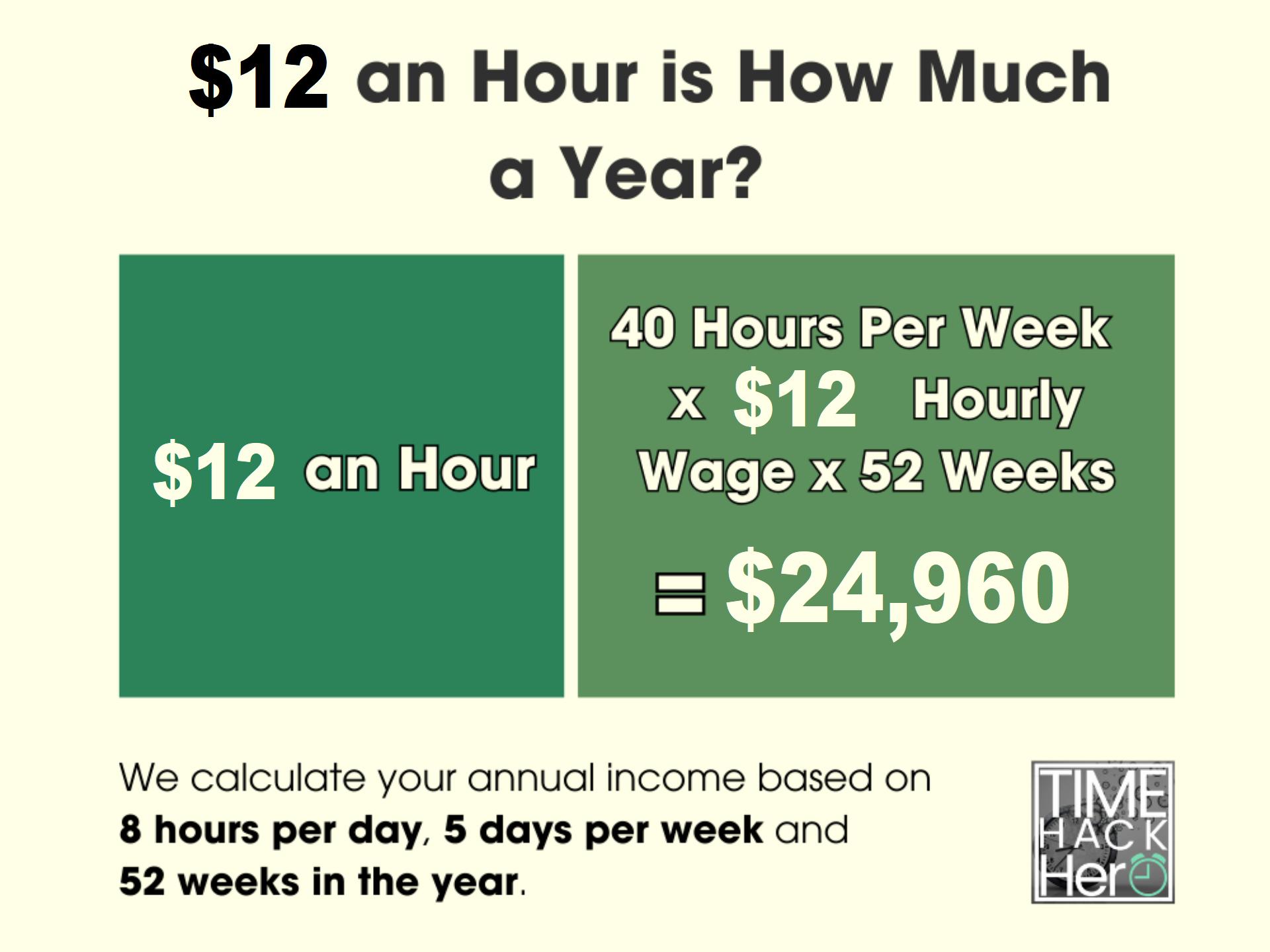

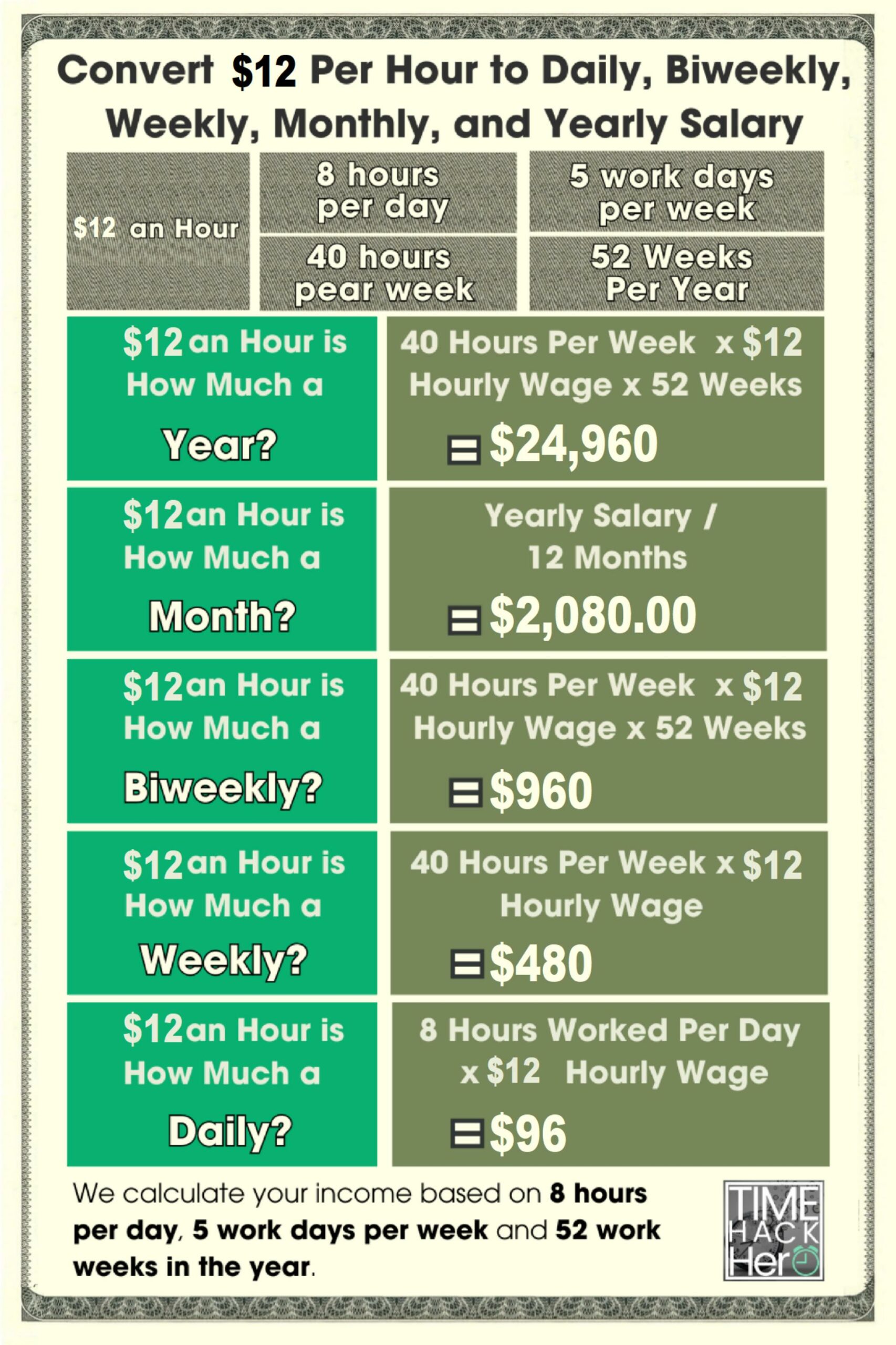

$12 an Hour is How Much a Year?

If you make $12 an hour, your yearly salary would be $24,960. We calculate your annual income based on 8 hours per day, 5 days per week and 52 weeks in the year.

Hours worked per week (40) x Hourly wage($12) x Weeks worked per year(52) = $24,960

$12 an Hour is How Much a Month?

If you make $12 an hour, your monthly salary would be $2,080. We calculated this number by dividing your annual income by 12 months.

Hours worked per week (40) x Hourly wage($12) x Weeks worked per year(52) / Months per Year(12) = $2,080

$12 an Hour is How Much a Biweekly?

If you make $12 an hour, your biweekly salary would be $960.

Hours worked per week (40) x Hourly wage($12) x 2 = $960

$12 an Hour is How Much a Week?

If you make $12 an hour, your weekly salary would be $480. Calculating based on 5 days per week and 8 hours each day.

Hours worked per week (40) x Hourly wage($12) = $480

$12 an Hour is How Much a Day?

If you make $12 an hour, your daily salary would be $96. We calculated your daily income based on 8 hours per day.

Hours worked per day (8) x Hourly wage($12) = $96

$12 an Hour is How Much a Year?

The basic formula to calculate your annual salary from an hourly wage is:

Hourly Rate x Hours Worked per Week x Number of Weeks Worked per Year = Annual Salary

So for a $20 per hour job:

$12 per hour x 40 hours per week x 52 weeks per year = $24,960

However, this simple calculation makes some assumptions:

- You will work 40 hours every week of the year

- You will not get any paid time off

Therefore, it represents your earnings if you worked every week of the year, without any vacation, holidays, or sick days.

Accounting for Paid Time Off

The $24,960 base salary does not yet factor in paid time off (PTO). Let’s assume the job provides:

- 2 weeks (10 days) paid vacation

- 6 paid holidays

- 3 paid sick days

This totals 19 paid days off, or nearly 4 weeks of PTO.

Importantly, this paid time off should not be deducted from the annual salary, since you still get paid for those days.

So with 4 weeks PTO, the annual salary would remain $24,960 .

Part time $12 an hour is How Much a Year?

Your annual income changes significantly if you work part-time and not full-time.

For example, let’s say you work 25 hours per week instead of 40. Here’s how you calculate your new yearly total:

$12 per hour x 25 hours per week x 52 weeks per year = $15,600

By working 15 fewer hours per week (25 instead of 40), your annual earnings at $12 an hour drop from $24,960 to $15,600.

That’s a $9,360 per year difference just by working part-time!

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $12 an hour:

| Hours Per Week | Earnings Per Week | Annual Earnings |

|---|---|---|

| 40 | $480 | $24,960 |

| 35 | $420 | $21,840 |

| 30 | $360 | $18,720 |

| 25 | $300 | $15,600 |

| 20 | $240 | $12,480 |

| 15 | $180 | $9,360 |

The more hours per week, the higher your total yearly earnings. But part-time work allows for more life balance if you don’t need the full salary.

$12 an Hour With Overtime is How Much a Year?

Now let’s look at how overtime can increase your annual earnings.

Overtime kicks in once you work more than 40 hours in a week. Typically, you earn 1.5x your regular hourly wage for overtime hours.

So if you make $12 per hour normally, you would make $18 per hour for any hours over 40 in a week.

Here’s an example:

- You work 45 hours in a Week

- 40 regular hours paid at $12 per hour = $480

- 5 overtime hours paid at $18 per hour = $90

- Your total one Week earnings =$480 + $90 = $570

If you worked 45 hours each week for 52 weeks, here’s how your annual earnings increase thanks to overtime pay:

$570 per week x 52 weeks per year = $29,640

That’s $4,680 more than you’d earn working just 40 hours per week at $12 an hour.

Overtime can add up! But also consider taxes and work-life balance when deciding on extra hours.

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $12 an hour:

| Overtime hours per work day | Hours Per Week | Earnings Per Week | Annual Earnings |

| 0 | 40 | $480 | $24,960 |

| 1 | 45 | $570 | $29,640 |

| 2 | 50 | $660 | $34,320 |

| 3 | 55 | $750 | $39,000 |

| 4 | 60 | $840 | $43,680 |

| 5 | 65 | $930 | $48,360 |

| 6 | 70 | $1,020 | $53,040 |

| 7 | 75 | $1,110 | $57,720 |

How Unpaid Time Off Impacts $12/Hour Yearly Earnings

So far we’ve assumed you work 52 paid weeks per year. Any unpaid time off will reduce your total income.

For example, let’s say you take 2 weeks of unpaid leave. That brings your paid weeks down to 50:

Hours worked per week (40) x Hourly wage($12) x Weeks worked per year(50) = $24,000 annual salary

With 2 weeks unpaid time off, your annual earnings at $12/hour would drop by $960.

The table below summarizes how your annual income changes depending on the number of weeks of unpaid leave.

| Weeks of unpaid leave | Paid weeks per year | Earnings Per Week | Annual Earnings |

| 0 | 52 | $480 | $24,960 |

| 1 | 51 | $480 | $24,480 |

| 2 | 50 | $480 | $24,000 |

| 3 | 49 | $480 | $23,520 |

| 4 | 48 | $480 | $23,040 |

| 5 | 47 | $480 | $22,560 |

| 6 | 46 | $480 | $22,080 |

| 7 | 45 | $480 | $21,600 |

Key Takeaways for $12 Hourly Wage

In summary, here are some key points on annual earnings when making $12 per hour:

- At 40 hours per week, you’ll earn $24,960 per year.

- Part-time of 30 hours/week results in $18,720 annual salary.

- Overtime pay can boost yearly earnings, e.g. $4,680 extra at 45 hours/week.

- Unpaid time off reduces your total income, around $960 less per 2 weeks off.

- Your specific situation and location impacts taxes and PTO.

Knowing your approximate annual salary and factors impacting it makes it easier to budget and plan your finances. The next step is calculating take-home pay after deductions like taxes.

$12 An Hour Is How Much A Year After Taxes

Figuring out your actual annual earnings based on an hourly wage can be complicated once taxes are taken into account. In addition to federal, state, and local income taxes, 7.65% of your gross pay also goes to Social Security and Medicare through FICA payroll taxes. So how much does $12 an hour equal per year after FICA and income taxes are deducted from your gross pay?

Below we’ll walk through the steps to calculate your annual net take home pay if you make $12 per hour. This will factor in estimated federal, FICA, state, and local taxes so you know exactly what to expect.

Factoring in Federal Income Tax

Your federal income tax will be a big chunk out of your gross pay. Federal tax rates range from 10% to 37%, depending on your tax bracket.

To estimate your federal income tax rate and liability:

Look up your federal income tax bracket based on your gross pay.

2023 tax brackets: single filers

| Tax rate | Taxable income bracket | Tax owed |

|---|---|---|

| 10% | $0 to $11,000. | 10% of taxable income. |

| 12% | $11,001 to $44,725. | $1,100 plus 12% of the amount over $11,000. |

| 22% | $44,726 to $95,375. | $5,147 plus 22% of the amount over $44,725. |

| 24% | $95,376 to $182,100. | $16,290 plus 24% of the amount over $95,375. |

| 32% | $182,101 to $231,250. | $37,104 plus 32% of the amount over $182,100. |

| 35% | $231,251 to $578,125. | $52,832 plus 35% of the amount over $231,250. |

| 37% | $578,126 or more. | $174,238.25 plus 37% of the amount over $578,125. |

For example, if you are single with $24,960 gross annual pay, your federal tax bracket is 12%.

Your estimated federal tax would be:

$1,100 + ($24,960 – $11,000) x 12% = $2,775.20

So at $12/hour with $24,960 gross pay, you would owe about $2,775.20 in federal income taxes.

Considering State Income Tax

In addition to federal tax, most states also charge a state income tax. State income tax rates range from about 1% to 13%, with most falling between 4% and 6%.

Key Takeaways

-

- California, Hawaii, New York, New Jersey, and Oregon have some of the highest state income tax rates.

- Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming don’t impose an income tax at all.

- Another 10 U.S states have a flat tax rate—everyone pays the same percentage regardless of how much they earn.

A State-by-State Comparison of Income Tax Rates

| STATE | TAX RATES | LOWEST AND HIGHEST INCOME BRACKETS |

|---|---|---|

| Alaska | 0% | None |

| Florida | 0% | None |

| Nevada | 0% | None |

| South Dakota | 0% | None |

| Tennessee | 0% | None |

| Texas | 0% | None |

| Washington | 0% | None |

| Wyoming | 0% | None |

| Colorado | 4.55% | Flat rate applies to all incomes |

| Illinois | 4.95% | Flat rate applies to all incomes |

| Indiana | 3.23% | Flat rate applies to all incomes |

| Kentucky | 5% | Flat rate applies to all incomes |

| Massachusetts | 5% | Flat rate applies to all incomes |

| New Hampshire | 5% | Flat rate on interest and dividend income only |

| North Carolina | 4.99% | Flat rate applies to all incomes |

| Pennsylvania | 3.07% | Flat rate applies to all incomes |

| Utah | 4.95% | Flat rate applies to all incomes |

| Michigan | 4.25% | Flat rate applies to all incomes |

| Arizona | 2.59% to 4.5% | $27,806 and $166,843 |

| Arkansas | 2% to 5.5% | $4,300 and $8,501 |

| California | 1% to 13.3% | $9,325 and $1 million |

| Connecticut | 3% to 6.99% | $10,000 and $500,000 |

| Delaware | 0% to 6.6% | $2,000 and $60,001 |

| Alabama | 2% to 5% | $500 and $3,001 |

| Georgia | 1% to 5.75% | $750 and $7,001 |

| Hawaii | 1.4% to 11% | $2,400 and $200,000 |

| Idaho | 1.125% to 6.5% | $1,568 and $7,939 |

| Iowa | 0.33% to 8.53% | $1,743 and $78,435 |

| Kansas | 3.1% to 5.7% | $15,000 and $30,000 |

| Louisiana | 1.85% to 4.25% | $12,500 and $50,001 |

| Maine | 5.8% to 7.15% | $23,000 and $54,450 |

| Maryland | 2% to 5.75% | $1,000 and $250,000 |

| Minnesota | 5.35% to 9.85% | $28,080 and $171,221 |

| Mississippi | 0% to 5% | $5,000 and $10,001 |

| Missouri | 1.5% to 5.3% | $1,121 and $8,968 |

| Montana | 1% to 6.75% | $2,900and $17,400 |

| Nebraska | 2.46% to 6.84% | $3,340 and $32,210 |

| New Jersey | 1.4% to 10.75% | $20,000 and $1 million |

| New Mexico | 1.7% to 5.9% | $5,500 and $210,000 |

| New York | 4% to 10.9% | $8,500 and $25 million |

| North Dakota | 1.1% to 2.9% | $41,775 and $458,350 |

| Ohio | 0% to 3.99% | $25,000 and $110,650 |

| Oklahoma | 0.25% to 4.75% | $1,000 and $7,200 |

| Oregon | 4.75% to 9.9% | $3,750 and $125,000 |

| Rhode Island | 3.75% to 5.99% | $68,200 and $155,050 |

| South Carolina | 0% to 7% | $3,110 and $15,560 |

| Vermont | 3.35% to 8.75% | $42,150 and $213,150 |

| Virginia | 2% to 5.75% | $3,000 and $17,001 |

| Washington, D.C. | 4% to 9.75% | $10,000 and $1 million |

| West Virginia | 3% to 6.5% | $10,000 and $60,000 |

| Wisconsin | 3.54% to 7.65% | $12,760 and $280,950 |

To estimate your state income tax:

Look up your state income tax rate based on your gross pay and filing status.

Multiply your gross annual pay by the state tax rate.

For example, if you live in Pennsylvania which has a flat 3.07% tax rate, your estimated state tax would be:

$24,960 gross pay x 3.07% PA tax rate = $766.27 estimated state income tax

So with $24,960 gross annual income, you would owe around in $766.27 Pennsylvania state income tax. Verify your specific state’s income tax rates.

Factoring in Local Taxes

Some cities and counties levy local income taxes ranging from 1-3% of taxable income.

To estimate potential local taxes you may owe:

- Check if your city or county charges a local income tax.

- If yes, look up the local income tax rate.

- Multiply your gross annual pay by the local tax rate.

For example, say you live in Columbus, OH which has a 2.5% local income tax. Your estimated local tax would be:

$24,960 gross pay x 2.5% local tax rate = $624 estimated local tax

So with $24,960 in gross earnings, you may owe around $624 in Columbus local income taxes. Verify rates for your own city/county.

Accounting for FICA Taxes (Social Security & Medicare)

FICA taxes are a combination of Social Security and Medicare taxes that equal 15.3% of your earnings. You are responsible for half of the total bill (7.65%), which includes a 6.2% Social Security tax and 1.45% Medicare tax on your earnings.

In 2023, only the first $160,200 of your earnings are subject to the Social Security tax

There is an additional 0.9% surtax on top of the standard 1.45% Medicare tax for those who earn over $200,000 (single filers) or $250,000 (joint filers).

To estimate your FICA tax payment:

$24,960 x 6.2% + $24,960 x 1.45% = $1,909.44

So you can expect to pay about $1,909.44 in Social Security and Medicare taxes out of your gross $24,960 in earnings.

Total Estimated Tax Payments

Based on the examples above, your total estimated tax payments would be:

Federal tax: $2,775.20

State tax: $766.27

Local tax: $624

FICA tax: $1,909.44

Total Estimated Tax: $6,074.91

Calculating Your Take Home Pay

To calculate your annual take home pay at $12 /hour:

1. Take your gross pay

2. Subtract your estimated total tax payments

$24,960 gross pay – $6,074.91 Total Estimated Tax = $18,885.09 Your Take Home Pay

n summary, if you make $12 per hour and work full-time, you would take home around $18,885.09 per year after federal, state, local , FICA taxes.

Your actual net income may vary depending on your specific tax situation. But this gives you a general idea of what to expect.

Convert $12 Per Hour to Yearly, Monthly, Biweekly, and Weekly Salary After Taxes

If you make $12 an hour and work full-time (40 hours per week), your estimated yearly salary would be $24,960 .

The $24,960 per year salary does not account for taxes. Federal, state, and local taxes will reduce your take-home pay. The amount withheld depends on your location, filing status, dependents, and other factors.

Just now during our calculation of $12 An Hour Is How Much A Year After Taxes, we assumed the following conditions:

- You are single with $24,960 gross annual pay, your federal tax bracket is 12 %.

- You live in Pennsylvania which has a flat 3.07% tax rate

- You live in Columbus, OH which has a 2.5% local income tax.

In the end, we calculated your Total Estimated Tax is $6,074.91 , Your Take Home Pay is $18,885.09 , Total tax rate is 24.34%.

So next we’ll use 24.34% as the estimated tax rate to calculate your weekly, biweekly, and monthly after-tax income.

$12 Per Hour to Yearly, Monthly, Biweekly, Weekly,and Week Salary After Taxes Table

| Income before taxes | Estimated Tax Rate | Income Taxes | After Tax Income | |

| Yearly Salary | $24,960 | 24.34% | $6,074.91 | $18,885.09 |

| Monthly Salary | $2,080 | 24.34% | $506.24 | $1,573.76 |

| BiWeekly Salary | $960 | 24.34% | $233.65 | $726.35 |

| Weekly Salary | $480 | 24.34% | $116.83 | $363.17 |

$12 an hour is how much a year after taxes

Here is the adjusted yearly salary after a 24.34% tax reduction:

-

- Yearly salary before taxes: $24,960

- Estimated tax rate: 24.34%

- Taxes owed (24.34% * $24,960 )= $6,074.91

- Yearly salary after taxes: $18,885.09

| Hourly Wage | Hours Worked Per Week | Weeks Worked Per Year | Total Yearly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Yearly Salary |

|---|---|---|---|---|---|---|

| $12 | 40 | 52 | $24,960 | 24.34% | $6,074.91 | $18,885.09 |

$12 an hour is how much a month after taxes

To calculate the monthly salary based on an hourly wage, you first need the yearly salary amount. Then divide by 12 months.

-

-

- Yearly salary before taxes at $12 per hour: $24,960

- Divided by 12 months per year: $24,960 / 12 = $2,080 per month

-

The monthly salary based on a 40 hour work week at $12 per hour is $2,080 before taxes.

After applying the estimated 24.34% tax rate, the monthly after-tax salary would be:

-

- Monthly before-tax salary: $2,080

- Estimated tax rate: 24.34%

- Taxes owed (24.34% * $2,080 )= $506.24

- Monthly after-tax salary: $1,573.76

Monthly Salary Based on $12 Per Hour

| Hourly Wage | Yearly Salary | Months Per Year | Before-Tax Monthly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Monthly Salary |

|---|---|---|---|---|---|---|

| $12 | $24,960 | 12 | $2,080 | 24.34% | $506.24 | $1,573.76 |

$12 an hour is how much biweekly after taxes

Many people are paid biweekly, meaning every other week. To calculate the biweekly pay at $12 per hour:

- Hourly wage: $12

- Hours worked per week: 40

- Weeks per biweekly pay period: 2

- $12 * 40 hours * 2 weeks = $960 biweekly

Applying the 24.34%estimated tax rate:

- Biweekly before-tax salary: $960

- Estimated tax rate: 24.34%

- Taxes owed (24.34% * $960 )= $233.65

- Biweekly after-tax salary: $726.35

Biweekly Salary at $12 Per Hour

| Hourly Wage | Hours Worked Per Week | Weeks Per Pay Period | Before-Tax Biweekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Biweekly Salary |

|---|---|---|---|---|---|---|

| $12 | 40 | 2 | $960 | 24.34% | $233.65 | $726.35 |

$12 an hour is how much weekly after taxes

To find the weekly salary based on an hourly wage, you need to know the number of hours worked per week. At 40 hours per week, the calculation is:

- Hourly wage: $12

- Hours worked per week: 40

- $12 * 40 hours = $480 per week

Accounting for the estimated 24.34% tax rate:

- Weekly before-tax salary: $480

- Estimated tax rate: 24.34%

- Taxes owed (24.34% * $480 )= $116.83

- Weekly after-tax salary: $363.17

Weekly Salary at $12 Per Hour

| Hourly Wage | Hours Worked Per Week | Before-Tax Weekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Weekly Salary |

|---|---|---|---|---|---|

| $12 | 40 | $480 | 24.34% | $116.83 | $363.17 |

Key Takeaways

- An hourly wage of $12 per hour equals a yearly salary of $24,960 before taxes, assuming a 40 hour work week.

- After accounting for an estimated 24.34% tax rate, the yearly after-tax salary is approximately $18,885.09 .

- On a monthly basis before taxes, $12 per hour equals $2,080 per month. After estimated taxes, the monthly take-home pay is about $1,573.76 .

- The before-tax weekly salary at $12 per hour is $480 . After taxes, the weekly take-home pay is approximately $363.17 .

- For biweekly pay, the pre-tax salary at $12 per hour is $960 . After estimated taxes, the biweekly take-home pay is around $726.35 .

Understanding annual, monthly, weekly, and biweekly salary equivalents based on an hourly wage is useful when budgeting and financial planning. Taxes make a significant difference in take-home pay, so be sure to account for them when making income conversions. Use this guide as a reference when making salary calculations.

What Is the Average Hourly Wage in the US?

Last Updated: Sep 1 2023

US Average Hourly Earnings is at a current level of $33.82, up from 33.74 last month and up from 32.43 one year ago. This is a change of 0.24% from last month and 4.29% from one year ago.

Average Hourly Earnings is the average dollars that a private employee makes per hour in the US. This metric is a part of one of the most important releases every month which includes unemployment numbers as well. This is normally released on the first Friday of every month. This metric is released by the Bureau of Labor Statistics (BLS).

What is the average salary in the U.S.?

Last Updated: July 18, 2023

The U.S. Bureau of Labor Statistics uses median salary data rather than averages to avoid skewed numbers from outlying high and low numbers. Median weekly earnings of the nation's 121.5 million full-time wage and salary workers were $1,100 in the second quarter of 2023, the U.S.

If a person works 52 weeks in the year, then this represents a national annual salary of $57,200.

Is $12 an Hour a Good Salary?

Very few Americans would consider $12 an hour a “good salary” in 2023. At $12 per hour, your annual gross income assuming 40 hour work weeks is only $24,960. That’s just above the 2022 federal poverty line for a family of four, and barely halfway to the median household income of around $70,000.

Compared to typical incomes, an hourly wage of $12 puts you solidly in the bottom 30% of all wage earners nationally. It’s a low-income level by any measure, and would make affording basic needs a constant struggle for most small families.

While $12 an hour goes slightly further in rural areas or small towns versus big cities, it’s below a living wage nearly everywhere. The minimum salary required to meet basic needs across each US state ranges from around $25,000 to $40,000 according to most cost of living calculators.

Overall, it’s difficult for all but the most minimal lifestyles to be sustained long term on $12 per hour or less. Supplementing earned income with government assistance becomes essential at this wage level.

Jobs That Pay $12 Per Hour

The largest employers of workers earning around $12 per hour or less are as follows:

- Fast food and counter workers

- Waiters / waitresses

- Dishwashers

- Food preparation workers

- Janitors and cleaners

- Farm laborers

- Retail salespersons and cashiers

- Stock clerks and order fillers

- Childcare workers

- Home health aides

Jobs paying $12 an hour or under generally require no formal education or experience requirements. Most fall under the food services, agriculture, retail, hospitality, or domestic services sectors. Part time roles also make up a substantial share.

Unless you advance to managerial positions, skilled trades, or obtain higher education, escaping low hourly wages of $12 or less can be very challenging in many of these occupations. Changing industries or employers is often necessary to boost earning capacity substantively.

Can You Live Off $12 An Hour?

Attempting to live independently on $12 an hour is extremely difficult, if not impossible outright for larger families. Even single adults working full time at $12 per hour face constant financial stress.

At $12 per hour, your maximum recommended housing budget is only $600 per month to avoid being cost-burdened. Finding safe, decent quality housing at that price point is challenging in nearly any location.

After housing, you’d only have around $1,000 left in a $12 per hour budget to cover all other costs – food, transport, healthcare, clothing, utilities, childcare if needed, and any savings. Realistically, all it takes is one moderate emergency like a car repair or medical bill to jeopardize finances.

Making matters worse, inflation has caused costs of rent, food, gasoline, vehicles and healthcare to rise substantially faster than $12 per hour wages in recent years. Thus the actual buying power of $12 per hour has steadily declined, even as nominal pay has increased mildly.

To afford basic but tight budgets, individuals or couples without kids may turn to extremes like eliminating auto ownership, buying only used clothes and furniture, and utilizing food banks. But families with children have few options beyond seeking public or family assistance when relying on $12 per hour or less.

The Impact of Inflation on $12 per Hour

Inflation – the persistent, general upward trend in prices over time – has seriously eroded the purchasing power of $12 per hour over the past several decades. Looking at historical data shows just how much farther $12 per hour used to stretch:

- In 1990, $12 per hour would equal nearly $24 per hour in today’s money after adjusting for inflation – twice its current buying power.

- By 2000, inflation had cut the real value of $12 per hour to around $18 in today’s dollars – still 50% higher than now.

- In 2010, $12 per hour translated to over $15 per hour in 2022 when adjusted for inflation – 25% more purchasing power.

- Today’s $12 per hour has the same buying power as approximately $10 per hour did back in 2000 – a loss of close to 20%.

As inflation consistently outpaces wage growth for many minimum and low-wage workers, the same $12 buys fewer and fewer necessary goods each year. Closing this gap requires proactive career moves rather than waiting and hoping for rises in base pay rates.

5 Ways To Increase Your Hourly Wage

For those stuck earning $12 per hour or less, simply waiting on periodic raises from employers is rarely enough to substantively improve living standards. Following are 5 proactive steps workers can take to boost their income and earnings potential above subsistence levels:

- Pursue career-specific certifications – Obtain training and certifications that qualify you for better pay in high-demand fields like healthcare, technology, skilled trades, and finance.

- Transition into supervisory roles – Moving into team lead or shift manager positions can provide a meaningful pay bump while building management skills.

- Change companies strategically – Job hopping increases income faster for many. Seek offers at firms known for above-average compensation.

- Develop specialized niche skills – Become invaluable by mastering skills in short supply like equipment repair, welding, coding, or key foreign languages.

- Start a side business – A successful side venture or freelancing brings extra income and flexibility.

In most instances, systemic changes from policymakers will be essential to truly transform low-wage work. But driven individuals can absolutely create better futures through focused career planning and development.

Buying a Car on $12 per Hour

Owning a reliable vehicle while earning just $12 per hour requires very careful selection and tight budgeting. You’ll be limited to older used models purchased upfront rather than financing.

Experts recommend limiting total transportation costs to 10-15% of pretax income for low wage earners. At $24,960 per year, that’s $208 to $312 per month max for car payment, gas, insurance, repairs and maintenance combined.

With such constraints, buying newer or specialized vehicles is unrealistic. Private sales of basic sedans or hatchbacks over 10 years old with 100k+ miles offer the most transportation for the money upfront. Mainstream brands like Toyota, Honda, and Ford have lower cost used parts, insurance, and repairs.

Expect to spend $3,000-5,000 for reasonable vehicles if paying cash. Have a mechanic inspect any private-party vehicle before purchasing. Keep minimum liability-only insurance to control costs.

While safety and reliability concerns exist for these older cars, they provide the mostrealistic mobility option alongside public transportation for workers at $12 per hour or less. Just be diligent with maintenance and research to find functional deals.

Can You Buy a House at $12 per Hour?

Home ownership on an income of $12 per hour is essentially impossible without major outside financial assistance. Even subsidized programs have income requirements well exceeding full-time earnings of $24,960 per year.

At $12 per hour, a maximum of $600 per month is recommended toward housing to avoid being cost-burdened. But median home prices nationally are around $300,000 – requiring roughly $1,500 per month with taxes and insurance.

Even if you could somehow save a 5% down payment of $15,000, mortgage approvals factor in your income. Lenders generally require your total debt payments stay under 40% of gross monthly income. On $24,960 annually, that allows just over $800 total for a mortgage payment, taxes, insurance, and all other debts combined.

Qualifying for a $900 monthly mortgage alone on that income is nearly impossible, let alone affording another $500 or more per month in taxes and insurance on a median priced home.

The bottom line is home ownership simply isn’t a realistic possibility for full-time employees earning $12 per hour or less without other major sources of income. Renting modest accommodations, or sharing housing costs with others, remains the only feasible path.

Example Budget on $12 Per Hour

To illustrate the financial realities of living on $12 per hour, here is an example monthly budget for an individual with no children earning this wage:

Monthly Net Income

- $12/hour x 40 hours/week x 4 weeks = $1,920

Expenses:

- Rent – $600 (shared apartment)

- Groceries – $250

- Used car payment – $200

- Car insurance – $100

- Gas – $80

- Cell phone – $40

- Internet – $20

- Health insurance – $150 (ACA exchange)

- Entertainment – $50

- Dining out – $40

- Emergency savings – $50

Total Expenses = $1,580

Remaining = $340

This very lean budget leaves little room for clothing, medications, car repairs or any other financial surprises without going into debt. And saving for future needs like education, retirement or a home is essentially impossible.

While technically “survivable”, lifestyles for those earning $12 per hour require major tradeoffs and severely limited opportunities for building financial security. Prospects for advancement must be seized for meaningful improvement.

In Summary

Attempting to live and support a family on $12 per hour is a significant struggle bordering on impossibility for many. Housing, transportation, healthcare and other costs quickly consume an income of less than $25,000 per year. Saving and investing at this wage level is extremely difficult.

Inflation has seriously eroded the buying power of $12 per hour over the decades as well. Vehicles, housing, and education require a far higher percentage of income compared to decades past.

Subsidized housing, government assistance, family support and strict budgeting are necessary to meet basic needs. Significant skills development, training, or career changes into higher paying roles provide the only paths toward economic security. Until livable minimum wages arrive, $12 per hour leaves workers stuck with few options.