While $11 per hour is above the federal minimum wage, it still represents an entry-level income. In this article, we’ll break down the annual, monthly, biweekly, and weekly pay for jobs earning $11/hour. We’ll analyze whether $11/hour provides a livable wage, which occupations typically pay this rate, and what kind of lifestyle is realistic. Looking at factors like taxes, overtime eligibility, and unpaid time off, we’ll calculate the actual take-home earnings from $11/hour. We’ll also provide tips for budgeting and saving at this income level. While covering basic living expenses can be challenging, we’ll showcase ways to maximize limited funds. Planning for major purchases like cars or homes may not be feasible at $11/hour. By understanding the full earnings potential, individuals can better evaluate career options and money management strategies. Boosting skills to increase pay quickly is often essential. Calculating yearly salary projections empowers informed financial choices.

Table of Contents

Convert $11 Per Hour to Weekly, Monthly, and Yearly Salary

Input your wage and hours per week to see how much you’ll make monthly, yearly and more.

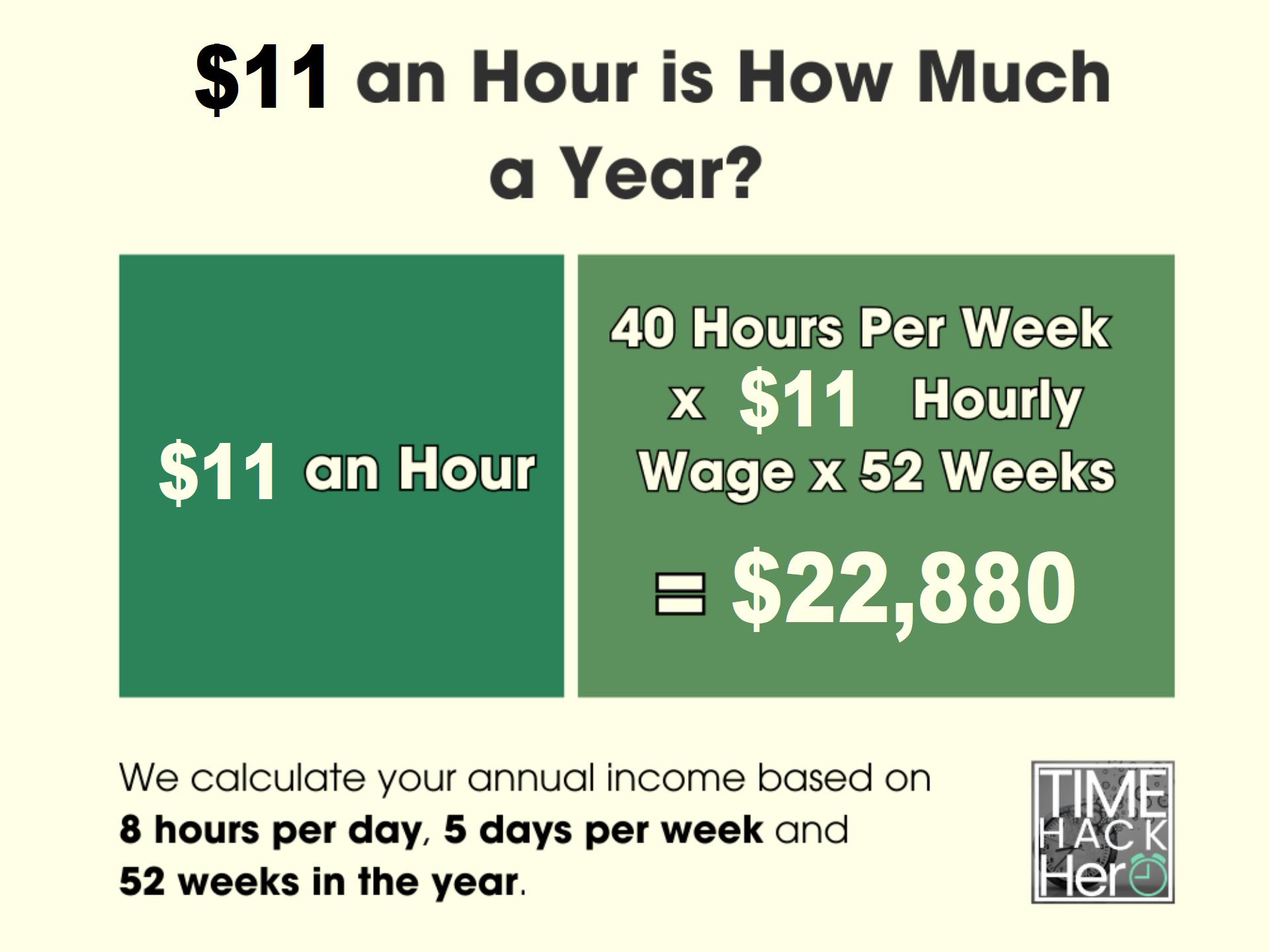

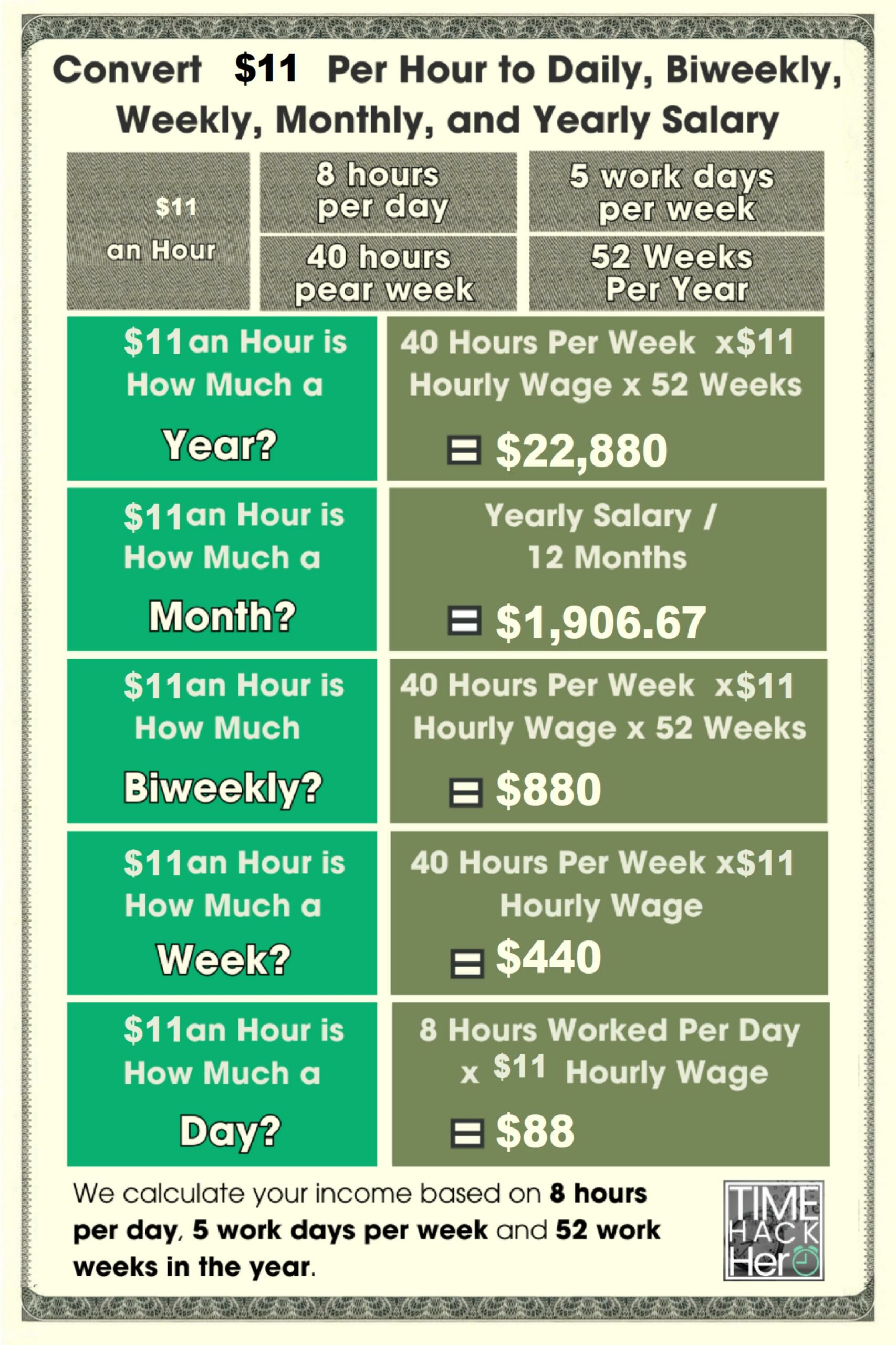

$11 an Hour is How Much a Year?

If you make $11 an hour, your yearly salary would be $22,880. We calculate your annual income based on 8 hours per day, 5 days per week and 52 weeks in the year.

Hours worked per week (40) x Hourly wage($11) x Weeks worked per year(52) = $22,880

$11 an Hour is How Much a Month?

If you make $11 an hour, your monthly salary would be $1,906.67. We calculated this number by dividing your annual income by 12 months.

Hours worked per week (40) x Hourly wage($11) x Weeks worked per year(52) / Months per Year(12) = $1,906.67

$11 an Hour is How Much Biweekly?

If you make $11 an hour, your biweekly salary would be $880.

Hours worked per week (40) x Hourly wage($11) x 2 = $880

$11 an Hour is How Much a Week?

If you make $11 an hour, your weekly salary would be $440. Calculating based on 5 days per week and 8 hours each day.

Hours worked per week (40) x Hourly wage($11) = $440

$11 an Hour is How Much a Day?

If you make $11 an hour, your daily salary would be $88. We calculated your daily income based on 8 hours per day.

Hours worked per day (8) x Hourly wage($11) = $88

$11 an Hour is How Much a Year?

The basic formula to calculate your annual salary from an hourly wage is:

Hourly Rate x Hours Worked per Week x Number of Weeks Worked per Year = Annual Salary

So for a $20 per hour job:

$11 per hour x 40 hours per week x 52 weeks per year = $22,880

However, this simple calculation makes some assumptions:

- You will work 40 hours every week of the year

- You will not get any paid time off

Therefore, it represents your earnings if you worked every week of the year, without any vacation, holidays, or sick days.

Accounting for Paid Time Off

The $22,880 base salary does not yet factor in paid time off (PTO). Let’s assume the job provides:

- 2 weeks (10 days) paid vacation

- 6 paid holidays

- 3 paid sick days

This totals 19 paid days off, or nearly 4 weeks of PTO.

Importantly, this paid time off should not be deducted from the annual salary, since you still get paid for those days.

So with 4 weeks PTO, the annual salary would remain $22,880 .

Part time $11 an hour is How Much a Year?

Your annual income changes significantly if you work part-time and not full-time.

For example, let’s say you work 20 hours per week instead of 40. Here’s how you calculate your new yearly total:

$11 per hour x 20 hours per week x 52 weeks per year = $11,440

By working 20 fewer hours per week (20 instead of 40), your annual earnings at $11 an hour drop from $22,880 to $11,440.

That’s a $11,440 per year difference just by working part-time!

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $11 an hour:

| Hours Per Week | Earnings Per Week | Annual Earnings |

|---|---|---|

| 40 | $440 | $22,880 |

| 35 | $385 | $20,020 |

| 30 | $330 | $17,160 |

| 25 | $275 | $14,300 |

| 20 | $220 | $11,440 |

| 15 | $165 | $8,580 |

The more hours per week, the higher your total yearly earnings. But part-time work allows for more life balance if you don’t need the full salary.

$11 an Hour With Overtime is How Much a Year?

Now let’s look at how overtime can increase your annual earnings.

Overtime kicks in once you work more than 40 hours in a week. Typically, you earn 1.5x your regular hourly wage for overtime hours.

So if you make $11 per hour normally, you would make $16.50 per hour for any hours over 40 in a week.

Here’s an example:

- You work 45 hours in a Week

- 40 regular hours paid at $11 per hour = $440

- 5 overtime hours paid at $16.50 per hour = $82.50

- Your total one Week earnings =$440 + $82.50 = $522.50

If you worked 45 hours each week for 52 weeks, here’s how your annual earnings increase thanks to overtime pay:

$522.50 per week x 52 weeks per year = $27,170

That’s $4,290 more than you’d earn working just 40 hours per week at $11 an hour.

Overtime can add up! But also consider taxes and work-life balance when deciding on extra hours.

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $11 an hour:

| Overtime hours per work day | Hours Per Week | Earnings Per Week | Annual Earnings |

| 0 | 40 | $440 | $22,880 |

| 1 | 45 | $522.50 | $27,170 |

| 2 | 50 | $605 | $31,460 |

| 3 | 55 | $687.50 | $35,750 |

| 4 | 60 | $770 | $40,040 |

| 5 | 65 | $852.50 | $44,330 |

| 6 | 70 | $935 | $48,620 |

| 7 | 75 | $1,017.50 | $52,910 |

How Unpaid Time Off Impacts $11/Hour Yearly Earnings

So far we’ve assumed you work 52 paid weeks per year. Any unpaid time off will reduce your total income.

For example, let’s say you take 2 weeks of unpaid leave. That brings your paid weeks down to 50:

Hours worked per week (40) x Hourly wage($11) x Weeks worked per year(50) = $22,000 annual salary

With 2 weeks unpaid time off, your annual earnings at $11/hour would drop by $880.

The table below summarizes how your annual income changes depending on the number of weeks of unpaid leave.

| Weeks of unpaid leave | Paid weeks per year | Earnings Per Week | Annual Earnings |

| 0 | 52 | $440 | $22,880 |

| 1 | 51 | $440 | $22,440 |

| 2 | 50 | $440 | $22,000 |

| 3 | 49 | $440 | $21,560 |

| 4 | 48 | $440 | $21,120 |

| 5 | 47 | $440 | $20,680 |

| 6 | 46 | $440 | $20,240 |

| 7 | 45 | $440 | $19,800 |

Key Takeaways for $11 Hourly Wage

In summary, here are some key points on annual earnings when making $11 per hour:

- At 40 hours per week, you’ll earn $22,880 per year.

- Part-time of 30 hours/week results in $17,160 annual salary.

- Overtime pay can boost yearly earnings, e.g. $4,290 extra at 45 hours/week.

- Unpaid time off reduces your total income, around $880 less per 2 weeks off.

- Your specific situation and location impacts taxes and PTO.

Knowing your approximate annual salary and factors impacting it makes it easier to budget and plan your finances. The next step is calculating take-home pay after deductions like taxes.

$11 An Hour Is How Much A Year After Taxes

Figuring out your actual annual earnings based on an hourly wage can be complicated once taxes are taken into account. In addition to federal, state, and local income taxes, 7.65% of your gross pay also goes to Social Security and Medicare through FICA payroll taxes. So how much does $11 an hour equal per year after FICA and income taxes are deducted from your gross pay?

Below we’ll walk through the steps to calculate your annual net take home pay if you make $11 per hour. This will factor in estimated federal, FICA, state, and local taxes so you know exactly what to expect.

Factoring in Federal Income Tax

Your federal income tax will be a big chunk out of your gross pay. Federal tax rates range from 10% to 37%, depending on your tax bracket.

To estimate your federal income tax rate and liability:

Look up your federal income tax bracket based on your gross pay.

2023 tax brackets: single filers

| Tax rate | Taxable income bracket | Tax owed |

|---|---|---|

| 10% | $0 to $11,000. | 10% of taxable income. |

| 12% | $11,001 to $44,725. | $1,100 plus 12% of the amount over $11,000. |

| 22% | $44,726 to $95,375. | $5,147 plus 22% of the amount over $44,725. |

| 24% | $95,376 to $182,100. | $16,290 plus 24% of the amount over $95,375. |

| 32% | $182,101 to $231,250. | $37,104 plus 32% of the amount over $182,100. |

| 35% | $231,251 to $578,125. | $52,832 plus 35% of the amount over $231,250. |

| 37% | $578,126 or more. | $174,238.25 plus 37% of the amount over $578,125. |

For example, if you are single with $22,880 gross annual pay, your federal tax bracket is 12%.

Your estimated federal tax would be:

$1,100 + ($22,880 – $11,000) x 12% = $2,525.60

So at $11/hour with $22,880 gross pay, you would owe about $2,525.60 in federal income taxes.

Considering State Income Tax

In addition to federal tax, most states also charge a state income tax. State income tax rates range from about 1% to 13%, with most falling between 4% and 6%.

Key Takeaways

-

- California, Hawaii, New York, New Jersey, and Oregon have some of the highest state income tax rates.

- Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming don’t impose an income tax at all.

- Another 10 U.S states have a flat tax rate—everyone pays the same percentage regardless of how much they earn.

A State-by-State Comparison of Income Tax Rates

| STATE | TAX RATES | LOWEST AND HIGHEST INCOME BRACKETS |

|---|---|---|

| Alaska | 0% | None |

| Florida | 0% | None |

| Nevada | 0% | None |

| South Dakota | 0% | None |

| Tennessee | 0% | None |

| Texas | 0% | None |

| Washington | 0% | None |

| Wyoming | 0% | None |

| Colorado | 4.55% | Flat rate applies to all incomes |

| Illinois | 4.95% | Flat rate applies to all incomes |

| Indiana | 3.23% | Flat rate applies to all incomes |

| Kentucky | 5% | Flat rate applies to all incomes |

| Massachusetts | 5% | Flat rate applies to all incomes |

| New Hampshire | 5% | Flat rate on interest and dividend income only |

| North Carolina | 4.99% | Flat rate applies to all incomes |

| Pennsylvania | 3.07% | Flat rate applies to all incomes |

| Utah | 4.95% | Flat rate applies to all incomes |

| Michigan | 4.25% | Flat rate applies to all incomes |

| Arizona | 2.59% to 4.5% | $27,806 and $166,843 |

| Arkansas | 2% to 5.5% | $4,300 and $8,501 |

| California | 1% to 13.3% | $9,325 and $1 million |

| Connecticut | 3% to 6.99% | $10,000 and $500,000 |

| Delaware | 0% to 6.6% | $2,000 and $60,001 |

| Alabama | 2% to 5% | $500 and $3,001 |

| Georgia | 1% to 5.75% | $750 and $7,001 |

| Hawaii | 1.4% to 11% | $2,400 and $200,000 |

| Idaho | 1.125% to 6.5% | $1,568 and $7,939 |

| Iowa | 0.33% to 8.53% | $1,743 and $78,435 |

| Kansas | 3.1% to 5.7% | $15,000 and $30,000 |

| Louisiana | 1.85% to 4.25% | $12,500 and $50,001 |

| Maine | 5.8% to 7.15% | $23,000 and $54,450 |

| Maryland | 2% to 5.75% | $1,000 and $250,000 |

| Minnesota | 5.35% to 9.85% | $28,080 and $171,221 |

| Mississippi | 0% to 5% | $5,000 and $10,001 |

| Missouri | 1.5% to 5.3% | $1,121 and $8,968 |

| Montana | 1% to 6.75% | $2,900and $17,400 |

| Nebraska | 2.46% to 6.84% | $3,340 and $32,210 |

| New Jersey | 1.4% to 10.75% | $20,000 and $1 million |

| New Mexico | 1.7% to 5.9% | $5,500 and $210,000 |

| New York | 4% to 10.9% | $8,500 and $25 million |

| North Dakota | 1.1% to 2.9% | $41,775 and $458,350 |

| Ohio | 0% to 3.99% | $25,000 and $110,650 |

| Oklahoma | 0.25% to 4.75% | $1,000 and $7,200 |

| Oregon | 4.75% to 9.9% | $3,750 and $125,000 |

| Rhode Island | 3.75% to 5.99% | $68,200 and $155,050 |

| South Carolina | 0% to 7% | $3,110 and $15,560 |

| Vermont | 3.35% to 8.75% | $42,150 and $213,150 |

| Virginia | 2% to 5.75% | $3,000 and $17,001 |

| Washington, D.C. | 4% to 9.75% | $10,000 and $1 million |

| West Virginia | 3% to 6.5% | $10,000 and $60,000 |

| Wisconsin | 3.54% to 7.65% | $12,760 and $280,950 |

To estimate your state income tax:

Look up your state income tax rate based on your gross pay and filing status.

Multiply your gross annual pay by the state tax rate.

For example, if you live in Pennsylvania which has a flat 3.07% tax rate, your estimated state tax would be:

$22,880 gross pay x 3.07% PA tax rate = $702.42 estimated state income tax

So with $22,880 gross annual income, you would owe around in $702.42 Pennsylvania state income tax. Verify your specific state’s income tax rates.

Factoring in Local Taxes

Some cities and counties levy local income taxes ranging from 1-3% of taxable income.

To estimate potential local taxes you may owe:

- Check if your city or county charges a local income tax.

- If yes, look up the local income tax rate.

- Multiply your gross annual pay by the local tax rate.

For example, say you live in Columbus, OH which has a 2.5% local income tax. Your estimated local tax would be:

$22,880 gross pay x 2.5% local tax rate = $572 estimated local tax

So with $22,880 in gross earnings, you may owe around $572 in Columbus local income taxes. Verify rates for your own city/county.

Accounting for FICA Taxes (Social Security & Medicare)

FICA taxes are a combination of Social Security and Medicare taxes that equal 15.3% of your earnings. You are responsible for half of the total bill (7.65%), which includes a 6.2% Social Security tax and 1.45% Medicare tax on your earnings.

In 2023, only the first $160,200 of your earnings are subject to the Social Security tax

There is an additional 0.9% surtax on top of the standard 1.45% Medicare tax for those who earn over $200,000 (single filers) or $250,000 (joint filers).

To estimate your FICA tax payment:

$22,880 x 6.2% + $22,880 x 1.45% = $1,750.32

So you can expect to pay about $1,750.32 in Social Security and Medicare taxes out of your gross $22,880 in earnings.

Total Estimated Tax Payments

Based on the examples above, your total estimated tax payments would be:

Federal tax: $2,525.60

State tax: $702.42

Local tax: $572

FICA tax: $1,750.32

Total Estimated Tax: $5,550.34

Calculating Your Take Home Pay

To calculate your annual take home pay at $11 /hour:

1. Take your gross pay

2. Subtract your estimated total tax payments

$22,880 gross pay – $5,550.34 Total Estimated Tax = $17,329.66 Your Take Home Pay

n summary, if you make $11 per hour and work full-time, you would take home around $17,329.66 per year after federal, state, local , FICA taxes.

Your actual net income may vary depending on your specific tax situation. But this gives you a general idea of what to expect.

Convert $11 Per Hour to Yearly, Monthly, Biweekly, and Weekly Salary After Taxes

If you make $11 an hour and work full-time (40 hours per week), your estimated yearly salary would be $22,880 .

The $22,880 per year salary does not account for taxes. Federal, state, and local taxes will reduce your take-home pay. The amount withheld depends on your location, filing status, dependents, and other factors.

Just now during our calculation of $11 An Hour Is How Much A Year After Taxes, we assumed the following conditions:

- You are single with $22,880 gross annual pay, your federal tax bracket is 12 %.

- You live in Pennsylvania which has a flat 3.07% tax rate

- You live in Columbus, OH which has a 2.5% local income tax.

In the end, we calculated your Total Estimated Tax is $5,550.34 , Your Take Home Pay is $17,329.66 , Total tax rate is 24.26%.

So next we’ll use 24.26% as the estimated tax rate to calculate your weekly, biweekly, and monthly after-tax income.

$11 Per Hour to Yearly, Monthly, Biweekly, Weekly,and Week Salary After Taxes Table

| Income before taxes | Estimated Tax Rate | Income Taxes | After Tax Income | |

| Yearly Salary | $22,880 | 24.26% | $5,550.34 | $17,329.66 |

| Monthly Salary | $1,906.67 | 24.26% | $462.53 | $1,444.14 |

| BiWeekly Salary | $880 | 24.26% | $213.47 | $666.53 |

| Weekly Salary | $440 | 24.26% | $106.74 | $333.26 |

$11 an hour is how much a year after taxes

Here is the adjusted yearly salary after a 24.26% tax reduction:

-

- Yearly salary before taxes: $22,880

- Estimated tax rate: 24.26%

- Taxes owed (24.26% * $22,880 )= $5,550.34

- Yearly salary after taxes: $17,329.66

| Hourly Wage | Hours Worked Per Week | Weeks Worked Per Year | Total Yearly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Yearly Salary |

|---|---|---|---|---|---|---|

| $11 | 40 | 52 | $22,880 | 24.26% | $5,550.34 | $17,329.66 |

$11 an hour is how much a month after taxes

To calculate the monthly salary based on an hourly wage, you first need the yearly salary amount. Then divide by 12 months.

-

-

- Yearly salary before taxes at $11 per hour: $22,880

- Divided by 12 months per year: $22,880 / 12 = $1,906.67 per month

-

The monthly salary based on a 40 hour work week at $11 per hour is $1,906.67 before taxes.

After applying the estimated 24.26% tax rate, the monthly after-tax salary would be:

-

- Monthly before-tax salary: $1,906.67

- Estimated tax rate: 24.26%

- Taxes owed (24.26% * $1,906.67 )= $462.53

- Monthly after-tax salary: $1,444.14

Monthly Salary Based on $11 Per Hour

| Hourly Wage | Yearly Salary | Months Per Year | Before-Tax Monthly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Monthly Salary |

|---|---|---|---|---|---|---|

| $11 | $22,880 | 12 | $1,906.67 | 24.26% | $462.53 | $1,444.14 |

$11 an hour is how much biweekly after taxes

Many people are paid biweekly, meaning every other week. To calculate the biweekly pay at $11 per hour:

- Hourly wage: $11

- Hours worked per week: 40

- Weeks per biweekly pay period: 2

- $11 * 40 hours * 2 weeks = $880 biweekly

Applying the 24.26%estimated tax rate:

- Biweekly before-tax salary: $880

- Estimated tax rate: 24.26%

- Taxes owed (24.26% * $880 )= $213.47

- Biweekly after-tax salary: $666.53

Biweekly Salary at $11 Per Hour

| Hourly Wage | Hours Worked Per Week | Weeks Per Pay Period | Before-Tax Biweekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Biweekly Salary |

|---|---|---|---|---|---|---|

| $11 | 40 | 2 | $880 | 24.26% | $213.47 | $666.53 |

$11 an hour is how much weekly after taxes

To find the weekly salary based on an hourly wage, you need to know the number of hours worked per week. At 40 hours per week, the calculation is:

- Hourly wage: $11

- Hours worked per week: 40

- $11 * 40 hours = $440 per week

Accounting for the estimated 24.26% tax rate:

- Weekly before-tax salary: $440

- Estimated tax rate: 24.26%

- Taxes owed (24.26% * $440 )= $106.74

- Weekly after-tax salary: $333.26

Weekly Salary at $11 Per Hour

| Hourly Wage | Hours Worked Per Week | Before-Tax Weekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Weekly Salary |

|---|---|---|---|---|---|

| $11 | 40 | $440 | 24.26% | $106.74 | $333.26 |

Key Takeaways

- An hourly wage of $11 per hour equals a yearly salary of $22,880 before taxes, assuming a 40 hour work week.

- After accounting for an estimated 24.26% tax rate, the yearly after-tax salary is approximately $17,329.66 .

- On a monthly basis before taxes, $11 per hour equals $1,906.67 per month. After estimated taxes, the monthly take-home pay is about $1,444.14 .

- The before-tax weekly salary at $11 per hour is $440 . After taxes, the weekly take-home pay is approximately $333.26 .

- For biweekly pay, the pre-tax salary at $11 per hour is $880 . After estimated taxes, the biweekly take-home pay is around $666.53 .

Understanding annual, monthly, weekly, and biweekly salary equivalents based on an hourly wage is useful when budgeting and financial planning. Taxes make a significant difference in take-home pay, so be sure to account for them when making income conversions. Use this guide as a reference when making salary calculations.

What Is the Average Hourly Wage in the US?

Last Updated: Sep 1 2023

US Average Hourly Earnings is at a current level of $33.82, up from 33.74 last month and up from 32.43 one year ago. This is a change of 0.24% from last month and 4.29% from one year ago.

Average Hourly Earnings is the average dollars that a private employee makes per hour in the US. This metric is a part of one of the most important releases every month which includes unemployment numbers as well. This is normally released on the first Friday of every month. This metric is released by the Bureau of Labor Statistics (BLS).

What is the average salary in the U.S.?

Last Updated: July 18, 2023

The U.S. Bureau of Labor Statistics uses median salary data rather than averages to avoid skewed numbers from outlying high and low numbers. Median weekly earnings of the nation's 121.5 million full-time wage and salary workers were $1,100 in the second quarter of 2023, the U.S.

If a person works 52 weeks in the year, then this represents a national annual salary of $57,200.

Is $11 an Hour a Good Salary?

To determine if $11 per hour is a good wage, we’ll compare it to nationwide salary averages. According to the Bureau of Labor Statistics, the median hourly wage for all occupations in the United States was $20.17 as of May 2021. This means half of all workers earned less than this amount, while the other half earned more.

At $11 per hour, this wage is nearly half of the national median wage. On an annual basis, $11 per hour equates to an annual income of $22,880 if working 40 hours per week, 52 weeks per year. The median annual salary for all occupations was $44,225 in May 2021.

Considering these nationwide salary benchmarks, $11 per hour is a quite low wage. It is less than half the median annual salary. However, pay varies substantially by state and by metropolitan area. $11 an hour will go further in some regions than others.

Jobs that Pay $11 Per Hour Given its low earning level, $11 per hour is common among entry-level, low-skill occupations. Some examples of jobs that often pay around $11 per hour include:

- Fast food workers – Fast food cooks, cashiers, and customer service representatives often start around minimum wage, which ranges from $7.25 to $11 per hour depending on the state.

- Retail salespersons – Retail store jobs like cashiers, stock clerks, and sales floor associates typically pay $11 per hour or less.

- Dishwashers – Dishwashers in restaurants and cafeterias usually earn under $12 per hour.

- Hotel housekeepers – Those cleaning rooms in hotels and resorts average $11 to $12 per hour.

- Food preparation workers – Preparing meals in cafeterias, schools, hospitals, and catering businesses pays around $11 per hour.

- Parking lot attendants – Parking lot attendants who park cars for customers average around $11 per hour in wages.

- Hosts/Hostesses – Restaurant hosts earning $11 per hour greet customers, manage wait lists, seat patrons, and organize reservations.

The majority of jobs paying around $11 per hour require minimal formal education or on-the-job training. They involve routine tasks that most people can learn in a short period of time.

Can You Live Off $11 An Hour?

Surviving on $11 an hour is possible but challenging across much of the country. At this wage, housing will likely consume over 30% of your pretax income. The Department of Housing and Urban Development defines affordable housing costs as less than 30% of income.

To break even on housing alone at $11 per hour, monthly rent payments would need to be under $600. The average one bedroom apartment in the U.S. costs nearly double that at around $1,100 per month. Living alone while earning $11 per hour may require relying on roommates, subsidies, or public housing programs in most areas.

Adding in other typical monthly costs like food, transportation, utilities, healthcare and taxes can quickly exhaust an $11 per hour paycheck:

- National average rent for 1-bedroom apartment – $1,100

- Groceries – $300 per month

- Used car payment – $200

- Auto insurance – $100

- Gasoline – $100

- Health insurance – $400

- Cell phone – $40

- Utilities – $200

- Transportation – $100

- This totals $2,540 in basic monthly expenses at $11 an hour, leaving little room for savings or discretionary spending.

To live off $11 an hour, extreme frugality through minimalist living, strict budgeting, buying used goods, and avoiding debt are often necessary. Public assistance and charity can also help fill gaps. Overall, it is very challenging to independently support a family on this wage.

The Impact of Inflation on the Value of $11 Per Hour

With inflation surpassing 8% in 2022, the purchasing power of an $11 per hour salary is rapidly declining. At this wage, your real earnings are falling as the costs of housing, food, transportation and other goods outpace income growth.

Just to maintain the same buying power year-over-year, hourly wages would need to increase by 8%. Instead, with typical annual raises of 3% or less, real wages are declining.

For example, in five years with 5% average inflation annually, $11 per hour today would need to rise to $13.86 just to equal the same purchasing power. That means your standard of living is falling each year your wage does not keep pace with inflation.

Those on fixed incomes like social security, disability and retirement savings face similar issues. Even at higher wage levels, inflation can quickly erode real income. Proactively seeking raises, bonuses, promotions or higher-paying jobs is key.

5 Ways To Increase Your Hourly Wage

For those earning $11 per hour or less, increasing income is crucial to improving living standards. Here are some strategies:

- Get More Education – Complete a diploma or degree program in a growing, high-paying field like healthcare, technology, or the skilled trades.

- Develop In-Demand Skills – Take classes to gain skills like computer programming, digital marketing, bookkeeping, commercial driving licenses, or mechanic certifications that pay more.

- Work Overtime – Maximize hours with overtime at your current job while working towards a better one long-term.

- Find an Entry-Level Job To Gain Experience – Work at a staffing agency or intern to get a foot in the door in higher paying industries like finance, tech, healthcare.

- Ask For Raises Frequently – Request raises every 6 months from your employer highlighting your contributions. Inflation alone merits increases.

- Search Opportunities At Other Companies – Leverage skills gained at your current job to move up the pay scale by applying elsewhere. Don’t get stuck at one employer.

Improving your skill set, gaining experience, and aggressively pursuing higher compensation are the most effective ways to boost income over time.

Buying a Car on $11 An Hour

Is buying a car realistic on an $11 per hour income? In short, financing any vehicle while earning $11 an hour would be extremely difficult. However, some options may exist in certain scenarios.

As a general rule, your total monthly vehicle expenses – car payment, insurance, gas and maintenance – should not exceed 10-15% of your pretax monthly income. At $11 per hour or $1,915 in gross monthly pay, that means keeping total car costs under $200 to $300.

Here are the limitations:

- Car payments at typical interest rates would be unaffordable. You may need significant cash savings from another source for a reasonable down payment to get reasonable monthly payments.

- Auto insurance for a 16 or 18 year old on a newer car would likely exceed $150 per month alone. Going without full coverage poses financial risks.

- Budgeting $100 for gasoline and $50 for maintenance is reasonable, but leaves only $100 or less for a car payment.

- An older used car bought outright with cash could avoid a payment. But maintenance costs rise on older vehicles.

For most people, earning $11 an hour will require buying an inexpensive used car with cash or using public transportation. Financing a vehicle at this income level is extremely difficult unless a family member co-signs and helps with the down payment. Save up rather than taking on debt.

Can You Buy A House on $11 An Hour?

Is buying a house realistic on $11 an hour? Unfortunately, home ownership is highly unlikely at this income level in most markets across the country.

As a general rule, you can afford a house worth 2 to 3 times your gross annual income. On a full-time $11 per hour job paying $22,880 per year, that means affording a home valued between roughly $45,000 to $70,000. Only in the most rural and distressed housing markets are livable homes available at those prices.

In addition, lenders want your total monthly debts including a mortgage payment to be below 43% of your gross monthly income. On $11 an hour, that allows for a total mortgage payment of around $700 per month. This is well below the monthly payment on a median priced home almost anywhere in America.

While creative financing options like USDA loans exist in some rural areas, home ownership will be very difficult for most households until annual incomes rise well above $22,880 per year. Improving your income potential through education and career growth is key to eventually buying a home.

Renting plus making extra mortgage principal payments later in life is a reasonable alternative on lower incomes. The security and forced savings effect of home ownership has appeal, but the costs are simply out of reach for $11 per hour earners in most markets.

Example Budget on $11 Per Hour

Creating a detailed budget is essential to maximize limited funds earned at $11 an hour. Below is an example budget for an individual earning $11 an hour working 40 hours per week:

- Gross Monthly Income at $11/hour: $1,920

- Federal and State Taxes: $230

- Rent for One Bedroom Apartment: $800

- Used Car Payment: $150

- Auto Insurance: $100

- Gasoline: $80

- Groceries: $300

- Health Insurance Premiums: $200

- Cell Phone: $40

- Electricity: $60

- Transportation: $80

- Total Monthly Expenses: $2,040

This bare bones budget leaves just $120 at the end of the month. And that’s before accounting for any dining out, hobbies, healthcare copays, clothing, or emergency costs. Running a surplus most months would be extremely difficult.

To live on an $11 per hour salary, you must find very cheap housing with roommates, minimize transportation costs, have no debt payments, and receive healthcare subsidies or Medicaid. Every dollar must be stretched to try making ends meet.

In Summary

Earning $11 per hour is considered quite low by national standards – it’s less than half the median wage across the entire U.S. workforce. Successfully living independently on this income alone is nearly impossible in most areas due to high housing costs. Individuals or families relying solely on $11 per hour face very difficult financial circumstances unless heavily subsidized through public benefits or charity. Significant supplementation through a working spouse/partner, second job, government income supplements, or shared housing is often necessary. Boosting skills, education, and income should be top priorities for those earning $11 per hour or less.