With the rising cost of living, an hourly wage of $100 may seem high to some and just getting by to others. In this article, we will break down exactly how much annual income you can expect at $100 per hour based on full-time and part-time schedules. We will calculate gross yearly pay along with net salary after taxes. You’ll also learn how unpaid time off impacts actual annual earnings, and whether $100 per hour provides a comfortable living. If you currently earn $100 hourly or aspire to, read on to see the annual, monthly, biweekly, and weekly pay $100 per hour equals before and after taxes. We will examine jobs paying $100 per hour, look at inflation’s impact, provide tips to increase income, and evaluate sample budgets to determine if homeownership or car buying is possible. The goal is to give you a complete financial picture of what $100 an hour truly means.

Table of Contents

Convert $100 Per Hour to Weekly, Monthly, and Yearly Salary

Input your wage and hours per week to see how much you’ll make monthly, yearly and more.

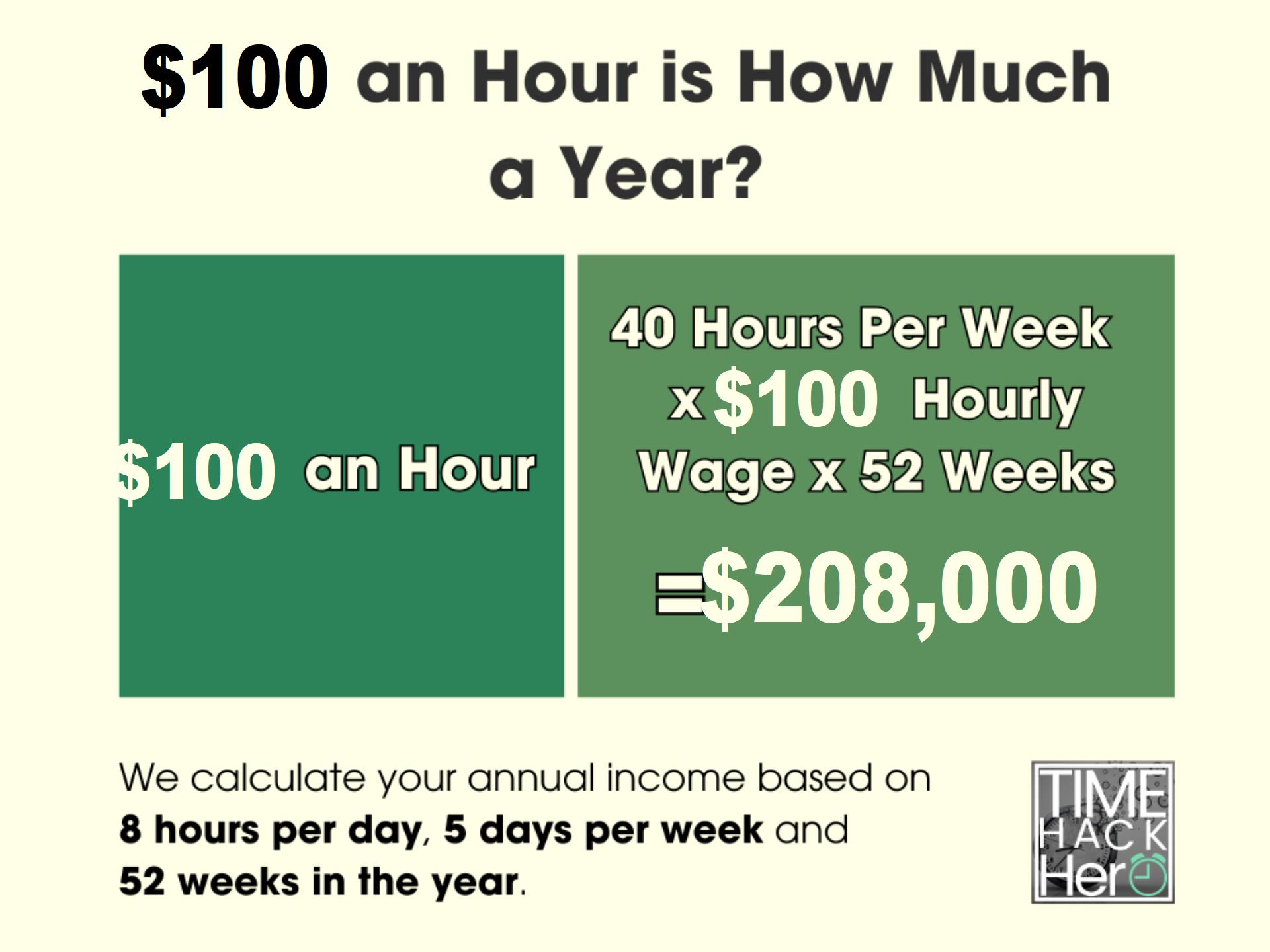

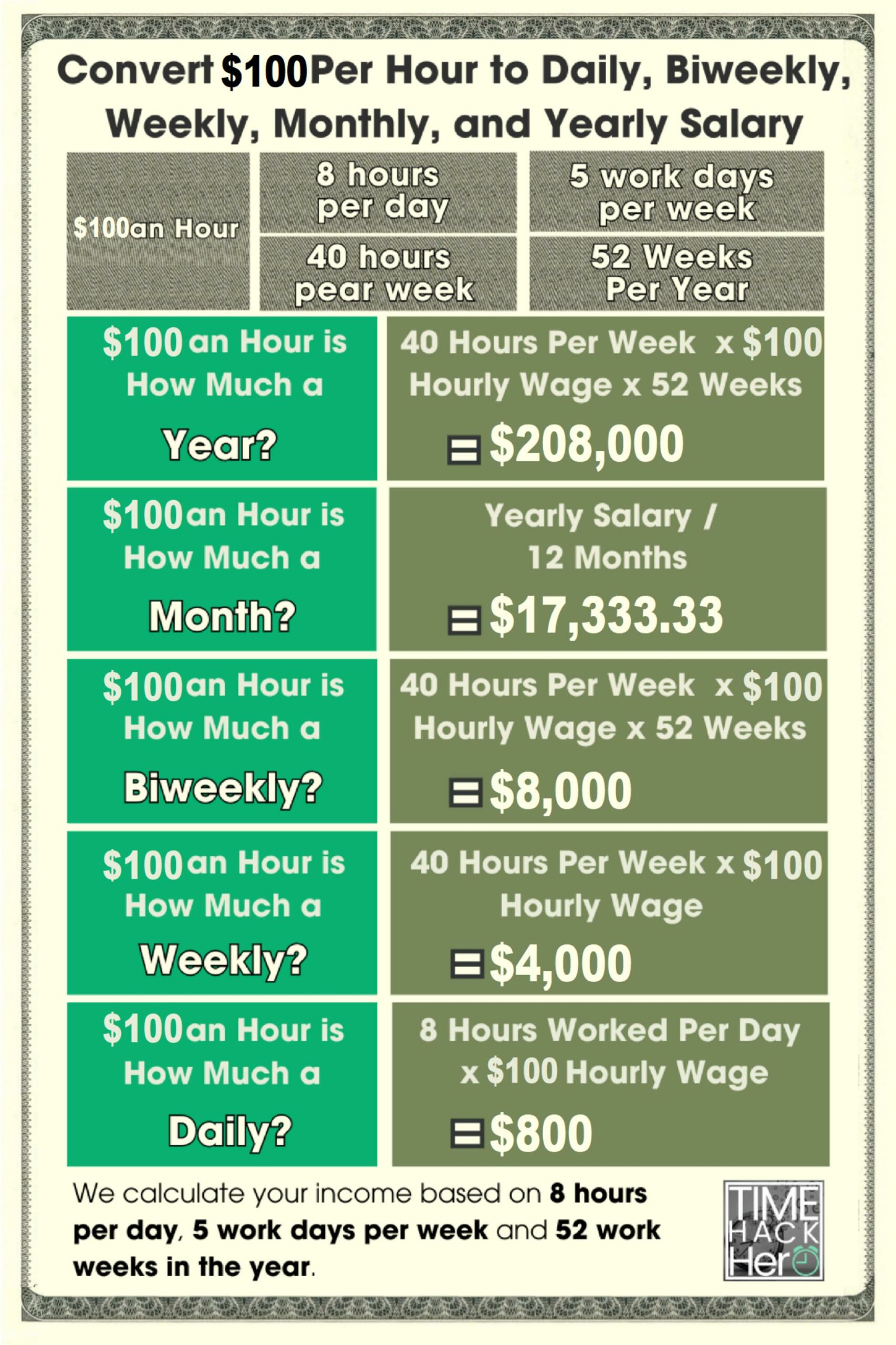

$100 an Hour is How Much a Year?

If you make $100 an hour, your yearly salary would be $208,000. We calculate your annual income based on 8 hours per day, 5 days per week and 52 weeks in the year.

Hours worked per week (40) x Hourly wage($100) x Weeks worked per year(52) = $208,000

$100 an Hour is How Much a Month?

If you make $100 an hour, your monthly salary would be $17,333.33. We calculated this number by dividing your annual income by 12 months.

Hours worked per week (40) x Hourly wage($100) x Weeks worked per year(52) / Months per Year(12) = $17,333.33

$100 an Hour is How Much a Biweekly?

If you make $100 an hour, your biweekly salary would be $8,000.

Hours worked per week (40) x Hourly wage($100) x 2 = $8,000

$100 an Hour is How Much a Week?

If you make $100 an hour, your weekly salary would be $4,000. Calculating based on 5 days per week and 8 hours each day.

Hours worked per week (40) x Hourly wage($100) = $4,000

$100 an Hour is How Much a Day?

If you make $100 an hour, your daily salary would be $800. We calculated your daily income based on 8 hours per day.

Hours worked per day (8) x Hourly wage($100) = $800

$100 an Hour is How Much a Year?

The basic formula to calculate your annual salary from an hourly wage is:

Hourly Rate x Hours Worked per Week x Number of Weeks Worked per Year = Annual Salary

So for a $20 per hour job:

$100 per hour x 40 hours per week x 52 weeks per year = $208,000

However, this simple calculation makes some assumptions:

- You will work 40 hours every week of the year

- You will not get any paid time off

Therefore, it represents your earnings if you worked every week of the year, without any vacation, holidays, or sick days.

Accounting for Paid Time Off

The $208,000 base salary does not yet factor in paid time off (PTO). Let’s assume the job provides:

- 2 weeks (10 days) paid vacation

- 6 paid holidays

- 3 paid sick days

This totals 19 paid days off, or nearly 4 weeks of PTO.

Importantly, this paid time off should not be deducted from the annual salary, since you still get paid for those days.

So with 4 weeks PTO, the annual salary would remain $208,000 .

Part time $100 an hour is How Much a Year?

Your annual income changes significantly if you work part-time and not full-time.

For example, let’s say you work 25 hours per week instead of 40. Here’s how you calculate your new yearly total:

$100 per hour x 25 hours per week x 52 weeks per year = $130,000

By working 15 fewer hours per week (25 instead of 40), your annual earnings at $100 an hour drop from $208,000 to $130,000.

That’s a $78,000 per year difference just by working part-time!

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $100 an hour:

| Hours Per Week | Earnings Per Week | Annual Earnings |

|---|---|---|

| 40 | $4,000 | $208,000 |

| 35 | $3,500 | $182,000 |

| 30 | $3,000 | $156,000 |

| 25 | $2,500 | $130,000 |

| 20 | $2,000 | $104,000 |

| 15 | $1,500 | $78,000 |

The more hours per week, the higher your total yearly earnings. But part-time work allows for more life balance if you don’t need the full salary.

$100 an Hour With Overtime is How Much a Year?

Now let’s look at how overtime can increase your annual earnings.

Overtime kicks in once you work more than 40 hours in a week. Typically, you earn 1.5x your regular hourly wage for overtime hours.

So if you make $100 per hour normally, you would make $150 per hour for any hours over 40 in a week.

Here’s an example:

- You work 45 hours in a Week

- 40 regular hours paid at $100 per hour = $4,000

- 5 overtime hours paid at $150 per hour = $750

- Your total one Week earnings =$4,000 + $750 = $4,750

If you worked 45 hours each week for 52 weeks, here’s how your annual earnings increase thanks to overtime pay:

$4,750 per week x 52 weeks per year = $247,000

That’s $39,000 more than you’d earn working just 40 hours per week at $100 an hour.

Overtime can add up! But also consider taxes and work-life balance when deciding on extra hours.

Here’s a table summarizing how your annual earnings change depending on how many hours you work per week at $100 an hour:

| Overtime hours per work day | Hours Per Week | Earnings Per Week | Annual Earnings |

| 0 | 40 | $4,000 | $208,000 |

| 1 | 45 | $4,750 | $247,000 |

| 2 | 50 | $5,500 | $286,000 |

| 3 | 55 | $6,250 | $325,000 |

| 4 | 60 | $7,000 | $364,000 |

| 5 | 65 | $7,750 | $403,000 |

| 6 | 70 | $8,500 | $442,000 |

| 7 | 75 | $9,250 | $481,000 |

How Unpaid Time Off Impacts $100/Hour Yearly Earnings

So far we’ve assumed you work 52 paid weeks per year. Any unpaid time off will reduce your total income.

For example, let’s say you take 2 weeks of unpaid leave. That brings your paid weeks down to 50:

Hours worked per week (40) x Hourly wage($100) x Weeks worked per year(50) = $200,000 annual salary

With 2 weeks unpaid time off, your annual earnings at $100/hour would drop by $8,000.

The table below summarizes how your annual income changes depending on the number of weeks of unpaid leave.

| Weeks of unpaid leave | Paid weeks per year | Earnings Per Week | Annual Earnings |

| 0 | 52 | $4,000 | $208,000 |

| 1 | 51 | $4,000 | $204,000 |

| 2 | 50 | $4,000 | $200,000 |

| 3 | 49 | $4,000 | $196,000 |

| 4 | 48 | $4,000 | $192,000 |

| 5 | 47 | $4,000 | $188,000 |

| 6 | 46 | $4,000 | $184,000 |

| 7 | 45 | $4,000 | $180,000 |

Key Takeaways for $100 Hourly Wage

In summary, here are some key points on annual earnings when making $100 per hour:

- At 40 hours per week, you’ll earn $208,000 per year.

- Part-time of 30 hours/week results in $156,000 annual salary.

- Overtime pay can boost yearly earnings, e.g. $39,000 extra at 45 hours/week.

- Unpaid time off reduces your total income, around $8,000 less per 2 weeks off.

- Your specific situation and location impacts taxes and PTO.

Knowing your approximate annual salary and factors impacting it makes it easier to budget and plan your finances. The next step is calculating take-home pay after deductions like taxes.

$100 An Hour Is How Much A Year After Taxes

Figuring out your actual annual earnings based on an hourly wage can be complicated once taxes are taken into account. In addition to federal, state, and local income taxes, 7.65% of your gross pay also goes to Social Security and Medicare through FICA payroll taxes. So how much does $100 an hour equal per year after FICA and income taxes are deducted from your gross pay?

Below we’ll walk through the steps to calculate your annual net take home pay if you make $100 per hour. This will factor in estimated federal, FICA, state, and local taxes so you know exactly what to expect.

Factoring in Federal Income Tax

Your federal income tax will be a big chunk out of your gross pay. Federal tax rates range from 10% to 37%, depending on your tax bracket.

To estimate your federal income tax rate and liability:

Look up your federal income tax bracket based on your gross pay.

2023 tax brackets: single filers

| Tax rate | Taxable income bracket | Tax owed |

|---|---|---|

| 10% | $0 to $11,000. | 10% of taxable income. |

| 12% | $11,001 to $44,725. | $1,100 plus 12% of the amount over $11,000. |

| 22% | $44,726 to $95,375. | $5,147 plus 22% of the amount over $44,725. |

| 24% | $95,376 to $182,100. | $16,290 plus 24% of the amount over $95,375. |

| 32% | $182,101 to $231,250. | $37,104 plus 32% of the amount over $182,100. |

| 35% | $231,251 to $578,125. | $52,832 plus 35% of the amount over $231,250. |

| 37% | $578,126 or more. | $174,238.25 plus 37% of the amount over $578,125. |

For example, if you are single with $208,000 gross annual pay, your federal tax bracket is 32%.

Your estimated federal tax would be:

$37,104 + ($208,000 – $182,100) x 32% = $45,392

So at $100/hour with $208,000 gross pay, you would owe about $45,392 in federal income taxes.

Considering State Income Tax

In addition to federal tax, most states also charge a state income tax. State income tax rates range from about 1% to 13%, with most falling between 4% and 6%.

Key Takeaways

-

- California, Hawaii, New York, New Jersey, and Oregon have some of the highest state income tax rates.

- Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming don’t impose an income tax at all.

- Another 10 U.S states have a flat tax rate—everyone pays the same percentage regardless of how much they earn.

A State-by-State Comparison of Income Tax Rates

| STATE | TAX RATES | LOWEST AND HIGHEST INCOME BRACKETS |

|---|---|---|

| Alaska | 0% | None |

| Florida | 0% | None |

| Nevada | 0% | None |

| South Dakota | 0% | None |

| Tennessee | 0% | None |

| Texas | 0% | None |

| Washington | 0% | None |

| Wyoming | 0% | None |

| Colorado | 4.55% | Flat rate applies to all incomes |

| Illinois | 4.95% | Flat rate applies to all incomes |

| Indiana | 3.23% | Flat rate applies to all incomes |

| Kentucky | 5% | Flat rate applies to all incomes |

| Massachusetts | 5% | Flat rate applies to all incomes |

| New Hampshire | 5% | Flat rate on interest and dividend income only |

| North Carolina | 4.99% | Flat rate applies to all incomes |

| Pennsylvania | 3.07% | Flat rate applies to all incomes |

| Utah | 4.95% | Flat rate applies to all incomes |

| Michigan | 4.25% | Flat rate applies to all incomes |

| Arizona | 2.59% to 4.5% | $27,806 and $166,843 |

| Arkansas | 2% to 5.5% | $4,300 and $8,501 |

| California | 1% to 13.3% | $9,325 and $1 million |

| Connecticut | 3% to 6.99% | $10,000 and $500,000 |

| Delaware | 0% to 6.6% | $2,000 and $60,001 |

| Alabama | 2% to 5% | $500 and $3,001 |

| Georgia | 1% to 5.75% | $750 and $7,001 |

| Hawaii | 1.4% to 11% | $2,400 and $200,000 |

| Idaho | 1.125% to 6.5% | $1,568 and $7,939 |

| Iowa | 0.33% to 8.53% | $1,743 and $78,435 |

| Kansas | 3.1% to 5.7% | $15,000 and $30,000 |

| Louisiana | 1.85% to 4.25% | $12,500 and $50,001 |

| Maine | 5.8% to 7.15% | $23,000 and $54,450 |

| Maryland | 2% to 5.75% | $1,000 and $250,000 |

| Minnesota | 5.35% to 9.85% | $28,080 and $171,221 |

| Mississippi | 0% to 5% | $5,000 and $10,001 |

| Missouri | 1.5% to 5.3% | $1,121 and $8,968 |

| Montana | 1% to 6.75% | $2,900and $17,400 |

| Nebraska | 2.46% to 6.84% | $3,340 and $32,210 |

| New Jersey | 1.4% to 10.75% | $20,000 and $1 million |

| New Mexico | 1.7% to 5.9% | $5,500 and $210,000 |

| New York | 4% to 10.9% | $8,500 and $25 million |

| North Dakota | 1.1% to 2.9% | $41,775 and $458,350 |

| Ohio | 0% to 3.99% | $25,000 and $110,650 |

| Oklahoma | 0.25% to 4.75% | $1,000 and $7,200 |

| Oregon | 4.75% to 9.9% | $3,750 and $125,000 |

| Rhode Island | 3.75% to 5.99% | $68,200 and $155,050 |

| South Carolina | 0% to 7% | $3,110 and $15,560 |

| Vermont | 3.35% to 8.75% | $42,150 and $213,150 |

| Virginia | 2% to 5.75% | $3,000 and $17,001 |

| Washington, D.C. | 4% to 9.75% | $10,000 and $1 million |

| West Virginia | 3% to 6.5% | $10,000 and $60,000 |

| Wisconsin | 3.54% to 7.65% | $12,760 and $280,950 |

To estimate your state income tax:

Look up your state income tax rate based on your gross pay and filing status.

Multiply your gross annual pay by the state tax rate.

For example, if you live in Pennsylvania which has a flat 3.07% tax rate, your estimated state tax would be:

$208,000 gross pay x 3.07% PA tax rate = $6,385.60 estimated state income tax

So with $208,000 gross annual income, you would owe around in $6,385.60 Pennsylvania state income tax. Verify your specific state’s income tax rates.

Factoring in Local Taxes

Some cities and counties levy local income taxes ranging from 1-3% of taxable income.

To estimate potential local taxes you may owe:

- Check if your city or county charges a local income tax.

- If yes, look up the local income tax rate.

- Multiply your gross annual pay by the local tax rate.

For example, say you live in Columbus, OH which has a 2.5% local income tax. Your estimated local tax would be:

$208,000 gross pay x 2.5% local tax rate = $5,200 estimated local tax

So with $208,000 in gross earnings, you may owe around $5,200 in Columbus local income taxes. Verify rates for your own city/county.

Accounting for FICA Taxes (Social Security & Medicare)

FICA taxes are a combination of Social Security and Medicare taxes that equal 15.3% of your earnings. You are responsible for half of the total bill (7.65%), which includes a 6.2% Social Security tax and 1.45% Medicare tax on your earnings.

In 2023, only the first $160,200 of your earnings are subject to the Social Security tax

There is an additional 0.9% surtax on top of the standard 1.45% Medicare tax for those who earn over $200,000 (single filers) or $250,000 (joint filers).

To estimate your FICA tax payment:

$160,200 x 6.2% + $200,000 x 1.45% + $8,000 x 0.9% = $12,904.40

So you can expect to pay about $12,904.40 in Social Security and Medicare taxes out of your gross $208,000 in earnings.

Total Estimated Tax Payments

Based on the examples above, your total estimated tax payments would be:

Federal tax: $45,392

State tax: $6,385.60

Local tax: $5,200

FICA tax: $12,904.40

Total Estimated Tax: $69,882

Calculating Your Take Home Pay

To calculate your annual take home pay at $100 /hour:

1. Take your gross pay

2. Subtract your estimated total tax payments

$208,000 gross pay – $69,882 Total Estimated Tax = $138,118 Your Take Home Pay

n summary, if you make $100 per hour and work full-time, you would take home around $138,118 per year after federal, state, local , FICA taxes.

Your actual net income may vary depending on your specific tax situation. But this gives you a general idea of what to expect.

Convert $100 Per Hour to Yearly, Monthly, Biweekly, and Weekly Salary After Taxes

If you make $100 an hour and work full-time (40 hours per week), your estimated yearly salary would be $208,000 .

The $208,000 per year salary does not account for taxes. Federal, state, and local taxes will reduce your take-home pay. The amount withheld depends on your location, filing status, dependents, and other factors.

Just now during our calculation of $100 An Hour Is How Much A Year After Taxes, we assumed the following conditions:

- You are single with $208,000 gross annual pay, your federal tax bracket is 32 %.

- You live in Pennsylvania which has a flat 3.07% tax rate

- You live in Columbus, OH which has a 2.5% local income tax.

In the end, we calculated your Total Estimated Tax is $69,882 , Your Take Home Pay is $138,118 , Total tax rate is 33.60%.

So next we’ll use 33.60% as the estimated tax rate to calculate your weekly, biweekly, and monthly after-tax income.

$100 Per Hour to Yearly, Monthly, Biweekly, Weekly,and Week Salary After Taxes Table

| Income before taxes | Estimated Tax Rate | Income Taxes | After Tax Income | |

| Yearly Salary | $208,000 | 33.60% | $69,882 | $138,118 |

| Monthly Salary | $17,333.33 | 33.60% | $5,823.50 | $11,509.83 |

| BiWeekly Salary | $8,000 | 33.60% | $2,687.77 | $5,312.23 |

| Weekly Salary | $4,000 | 33.60% | $1,343.88 | $2,656.12 |

$100 an hour is how much a year after taxes

Here is the adjusted yearly salary after a 33.60% tax reduction:

-

- Yearly salary before taxes: $208,000

- Estimated tax rate: 33.60%

- Taxes owed (33.60% * $208,000 )= $69,882

- Yearly salary after taxes: $138,118

| Hourly Wage | Hours Worked Per Week | Weeks Worked Per Year | Total Yearly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Yearly Salary |

|---|---|---|---|---|---|---|

| $100 | 40 | 52 | $208,000 | 33.60% | $69,882 | $138,118 |

$100 an hour is how much a month after taxes

To calculate the monthly salary based on an hourly wage, you first need the yearly salary amount. Then divide by 12 months.

-

-

- Yearly salary before taxes at $100 per hour: $208,000

- Divided by 12 months per year: $208,000 / 12 = $17,333.33 per month

-

The monthly salary based on a 40 hour work week at $100 per hour is $17,333.33 before taxes.

After applying the estimated 33.60% tax rate, the monthly after-tax salary would be:

-

- Monthly before-tax salary: $17,333.33

- Estimated tax rate: 33.60%

- Taxes owed (33.60% * $17,333.33 )= $5,823.50

- Monthly after-tax salary: $11,509.83

Monthly Salary Based on $100 Per Hour

| Hourly Wage | Yearly Salary | Months Per Year | Before-Tax Monthly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Monthly Salary |

|---|---|---|---|---|---|---|

| $100 | $208,000 | 12 | $17,333.33 | 33.60% | $5,823.50 | $11,509.83 |

$100 an hour is how much biweekly after taxes

Many people are paid biweekly, meaning every other week. To calculate the biweekly pay at $100 per hour:

- Hourly wage: $100

- Hours worked per week: 40

- Weeks per biweekly pay period: 2

- $100 * 40 hours * 2 weeks = $8,000 biweekly

Applying the 33.60%estimated tax rate:

- Biweekly before-tax salary: $8,000

- Estimated tax rate: 33.60%

- Taxes owed (33.60% * $8,000 )= $2,687.77

- Biweekly after-tax salary: $5,312.23

Biweekly Salary at $100 Per Hour

| Hourly Wage | Hours Worked Per Week | Weeks Per Pay Period | Before-Tax Biweekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Biweekly Salary |

|---|---|---|---|---|---|---|

| $100 | 40 | 2 | $8,000 | 33.60% | $2,687.77 | $5,312.23 |

$100 an hour is how much weekly after taxes

To find the weekly salary based on an hourly wage, you need to know the number of hours worked per week. At 40 hours per week, the calculation is:

- Hourly wage: $100

- Hours worked per week: 40

- $100 * 40 hours = $4,000 per week

Accounting for the estimated 33.60% tax rate:

- Weekly before-tax salary: $4,000

- Estimated tax rate: 33.60%

- Taxes owed (33.60% * $4,000 )= $1,343.88

- Weekly after-tax salary: $2,656.12

Weekly Salary at $100 Per Hour

| Hourly Wage | Hours Worked Per Week | Before-Tax Weekly Salary | Estimated Tax Rate | Taxes Owed | After-Tax Weekly Salary |

|---|---|---|---|---|---|

| $100 | 40 | $4,000 | 33.60% | $1,343.88 | $2,656.12 |

Key Takeaways

- An hourly wage of $100 per hour equals a yearly salary of $208,000 before taxes, assuming a 40 hour work week.

- After accounting for an estimated 33.60% tax rate, the yearly after-tax salary is approximately $138,118 .

- On a monthly basis before taxes, $100 per hour equals $17,333.33 per month. After estimated taxes, the monthly take-home pay is about $11,509.83 .

- The before-tax weekly salary at $100 per hour is $4,000 . After taxes, the weekly take-home pay is approximately $2,656.12 .

- For biweekly pay, the pre-tax salary at $100 per hour is $8,000 . After estimated taxes, the biweekly take-home pay is around $5,312.23 .

Understanding annual, monthly, weekly, and biweekly salary equivalents based on an hourly wage is useful when budgeting and financial planning. Taxes make a significant difference in take-home pay, so be sure to account for them when making income conversions. Use this guide as a reference when making salary calculations.

What Is the Average Hourly Wage in the US?

Last Updated: Sep 1 2023

US Average Hourly Earnings is at a current level of $33.82, up from 33.74 last month and up from 32.43 one year ago. This is a change of 0.24% from last month and 4.29% from one year ago.

Average Hourly Earnings is the average dollars that a private employee makes per hour in the US. This metric is a part of one of the most important releases every month which includes unemployment numbers as well. This is normally released on the first Friday of every month. This metric is released by the Bureau of Labor Statistics (BLS).

What is the average salary in the U.S.?

Last Updated: July 18, 2023

The U.S. Bureau of Labor Statistics uses median salary data rather than averages to avoid skewed numbers from outlying high and low numbers. Median weekly earnings of the nation's 121.5 million full-time wage and salary workers were $1,100 in the second quarter of 2023, the U.S.

If a person works 52 weeks in the year, then this represents a national annual salary of $57,200.

Is $100 an Hour a Good Salary?

For most Americans, $100 per hour would be an incredible, life-changing income. It puts you solidly in the upper-middle class and top 10-15% of all wage earners nationally.

The median hourly wage in the U.S. is around $27 per hour. So at $100/hr, you’re earning nearly 4 times the national median. Even in high-cost states like California or New York, this income affords an exceptionally comfortable standard of living.

At this wage level, you can truly begin maximizing quality of life – nicer housing, travel, good schools, ample savings. Many dreams become instantly more achievable on this salary.

Of course “good” is subjective. Those earning far more may not consider $100/hr to be well-off. But relative to average Americans, this income provides tremendous advantages and financial flexibility. It’s life-changing money for most.

Jobs that pay $100 an hour

While not common, there are a select number of high-earning professions that pay over $100 per hour:

- Lawyers – Corporate attorneys or partners at major law firms can bill $100-300+ per hour. Requires a law degree and passing the bar exam.

- Doctors – Experienced specialists like surgeons, anesthesiologists, radiologists typically earn $100-$200+ per hour. Requires medical degree and residency.

- Dentists – General dentists and specialists like orthodontists average $100-$150 per hour. Requires a DDS/DMD degree.

- Consultants – Self-employed consultants in IT, business, marketing, HR, and other fields charge $100-250/hr typically. Years of experience required.

- Executives – Higher level corporate executives like VPs or C-suite earn equivalent salaries of $100/hr or much more.

- Air traffic controllers – Earning $100-$120/hr is common for these highly trained professionals.

- Pilots/captains – Senior pilots and captains at major airlines can earn $100-$300/hr on average.

- Specialty trades – Some plumbers, electricians, and contractors earn $100+ per hour for complex projects.

As you can see, high earnings of $100/hr are achievable but require extensive education, training, experience, skills, and demand for your services. Medicine, law, and business consulting are perhaps the most realistic paths if your goal is to consistently earn this wage.

Can You Live Off $100 An Hour?

Absolutely! At $100 per hour full-time, your annual pre-tax income would be roughly $208,000. After taxes, you would bring home around $140,000-$160,000 depending on location, family size, etc. This puts you solidly in the upper-middle class lifestyle.

While inflation will eat into some of that buying power, this level of income still affords tremendous flexibility:

- Housing – You could easily afford a $400-$700k+ home, finance it comfortably, and pay higher property taxes.

- Autos – Buying luxury, premium, or specialty vehicles becomes realistic. Save for a large downpayment.

- Travel – Taking exotic vacations and trips several times a year is feasible within reason.

- Savings – Maxing out retirement accounts and building substantial non-retirement savings is achievable.

- Kids – Paying for top tier private schools, family activities, college funds etc. is attainable.

- Misc – Can afford more discretionary spending on dining out, entertainment, hobbies, charity.

Of course, reasonable budgeting is still prudent. Those earning $100/hr who live beyond their means can still face money issues. But the earning potential provides tremendous financial flexibility.

The impact of inflation on the value of $100 an hour

While inflation impacts lower wage earners more, even those earning $100+ per hour feel the pinch of rising prices.

For example, inflation is up about 8% in 2022. If your earnings stayed flat at $100/hr, your real buying power would drop by 8%. Things you could afford in 2021 would suddenly get 8% more expensive.

This example further illustrates why cost of living adjustments and merit raises are important to keep up. Even those earning $100/hr must budget smarter when inflation persists.

And inflation has a larger impact on your savings. Someone with $100,000 in cash savings is losing nearly $8,000 per year to 8% inflation. This emphasizes the need to invest savings wisely.

Overall, inflation should still be top of mind even for high wage earners. Managing lifestyle inflation and being cost conscious remains important.

5 Ways To Increase Your Hourly Wage

Even if you earn over $100/hr already, boosting your earning ability even higher is always beneficial. Here are some tips:

- Ask for raises – If you’re an employee, negotiate your true worth in salary reviews. Consider changing jobs if needed.

- Build skills – Obtain advanced certifications and training to command higher billing rates as a consultant or contractor.

- Expand services – As a consultant or business owner, offer higher value services or serve more clients. Hire staff to scale.

- Adjust rates – Review your hourly or project rates yearly and adjust for inflation and rising experience. Don’t undercharge.

- Leverage opportunities – Take on limited side projects for extra income. Teach or speak at conferences for fees.

The more value you can consistently deliver, the higher your income potential becomes over time. Keep growing your skills.

Buying a car on $100 an hour

Buying a luxury or specialty vehicle becomes much more feasible at $100 per hour income. Here are some tips for affordability:

- Set a budget – Don’t let lifestyle inflation get out of control. Keep car purchases under $60-$80k for financial prudence. Buy used for further discounts.

- Downpayment – Put at least 20% down on financing to secure the best rates and keep payments manageable.

- Check insurance – Insure a luxury/sports car wisely. Expect higher premiums. Weigh options and shop around.

- Assess costs – Determine total costs of ownership including higher gas, maintenance, taxes, etc. Factor these in.

- Negotiate price – Use buying services to negotiate the best price from dealers. Improve your leverage.

- Protect resale value – Maintain the car meticulously. Keep mileage low to retain resale value. Consider extended warranties.

With a $100/hr income, you can truly enjoy the cars you love while still making wise financial decisions. Balance splurges with budgeting.

Can You Buy a House on $100 An Hour?

Absolutely! With a $100/hr full-time income, buying an expensive house is very feasible. Here are some tips for home buyers:

- Get pre-approved – Talk to lenders and get pre-approved for a mortgage up to $1 million or more based on your income and debts. Lock in rates.

- Shop in your price range – Target homes priced from $400k up to $2 million on this salary. Hire a knowledgeable real estate agent.

- Maximize downpayment – Put down 20-30% or more on a home purchase for the best rates/terms and immediate equity.

- Mind closing costs – Account for thousands in closing fees, inspection costs, taxes etc. Factor these in.

- Consider jumbo loans – For million-dollar homes, jumbo loans often make sense. Weigh options.

- Account for higher costs – Budget for higher utility bills, property taxes, insurance, maintenance etc on a larger/nicer home.

On $100 per hour, you can comfortably afford your dream home in most markets while still following smart money principles.

Example Budget For $100 Per Hour

Let’s look at an example monthly budget for a single person earning $100/hr full-time:

- Mortgage/Rent – $2,000

- Vehicle Costs – $1,000

- Utilities – $500

- Groceries – $600

- Dining Out – $500

- Travel – $1,000

- Insurance – $500

- Smartphone/Internet – $200

- Subscriptions – $100

- Retirement Savings – $2,500

- Taxes (30%) – $5,000

- Total Costs – $14,000

This leaves around $6,000 per month for additional savings, discretionary spending, etc. A very comfortable budget.

For a family earning $200,000 ($100/hr x 2 incomes), a $20,000 total monthly budget is reasonable. Save aggressively and limit lifestyle inflation.

In Summary

Earning $100 per hour affords a top tier salary and lifestyle well beyond the average American. At this income level, you can truly begin maximizing housing, automobiles, travel, and quality of life.

However, some money best practices still apply: Budget wisely, save/invest diligently, limit debt, watch for lifestyle inflation. Even at high incomes, reckless spending can lead to financial issues.

Maximizing earnings is also still crucial to fighting inflation and building long-term wealth. Those earning $100/hr should constantly work to increase their skills and serve higher value clients.

Overall, $100 an hour provides tremendous opportunities for the lifestyle most only dream of – with smart financial habits. Earning well requires hard work and in demand skills, but opens doors to true financial comfort and flexibility.